With student loan payments set to start again in October after a three-year break, experts have warned that the U.S. housing market might take a hit and mortgages could become even more unaffordable—especially for first-time homebuyers.

The U.S. housing sector has been hit by an ongoing affordability crisis, as home prices skyrocketed during the pandemic when demand was high, mortgages were relatively low and supply was limited. The situation reached a crisis point when mortgage rates surged last year because of the Federal Reserve's aggressive rate hikes campaign to lower inflation.

Though prices have come down slightly since last summer, following a temporary drop in demand and sales, prices for homes in the U.S. remain high—as do mortgage rates.

According to Zillow's latest data, as of July 31, the average home price in the U.S. was $348,126—1 percent higher than this time last year. The most popular home loan in the U.S., the 30-year fixed-rate mortgage, dropped for the first time in five weeks at the end of August, but mortgages remain higher than in 2022.

Student loan payments restarting on October 1 might deepen the ongoing unaffordability crisis, according to experts.

A recent survey by independent research and index product development firm Pulsenomics found that 58 percent of economists think restarting student loan payments this fall will impact mortgage affordability.

The survey was conducted among over 100 economists, investment strategists, and housing market analysts between July 31 and August 14.

Some 35 percent of economists polled in the Pulsenomics' survey believed that restarting student loan payments will hit the U.S. homeownership rate, and 26 percent think that it could increase the mortgage delinquency rate. The total delinquency rate for a group of the country's 30 largest servicers was 3.16 percent at the end of June, according to Inside Mortgage Finance.

The U.S. homeownership rate has already tumbled to 65.9 percent over the second quarter, according to data from St. Louis Fed. In the second quarter of 2020, it was 67.9 percent.

Student loan payments were first paused by then-President Donald Trump in March 2020, as a relief measure for borrowers struggling during the pandemic. It was then extended for a total of nine times—until now.

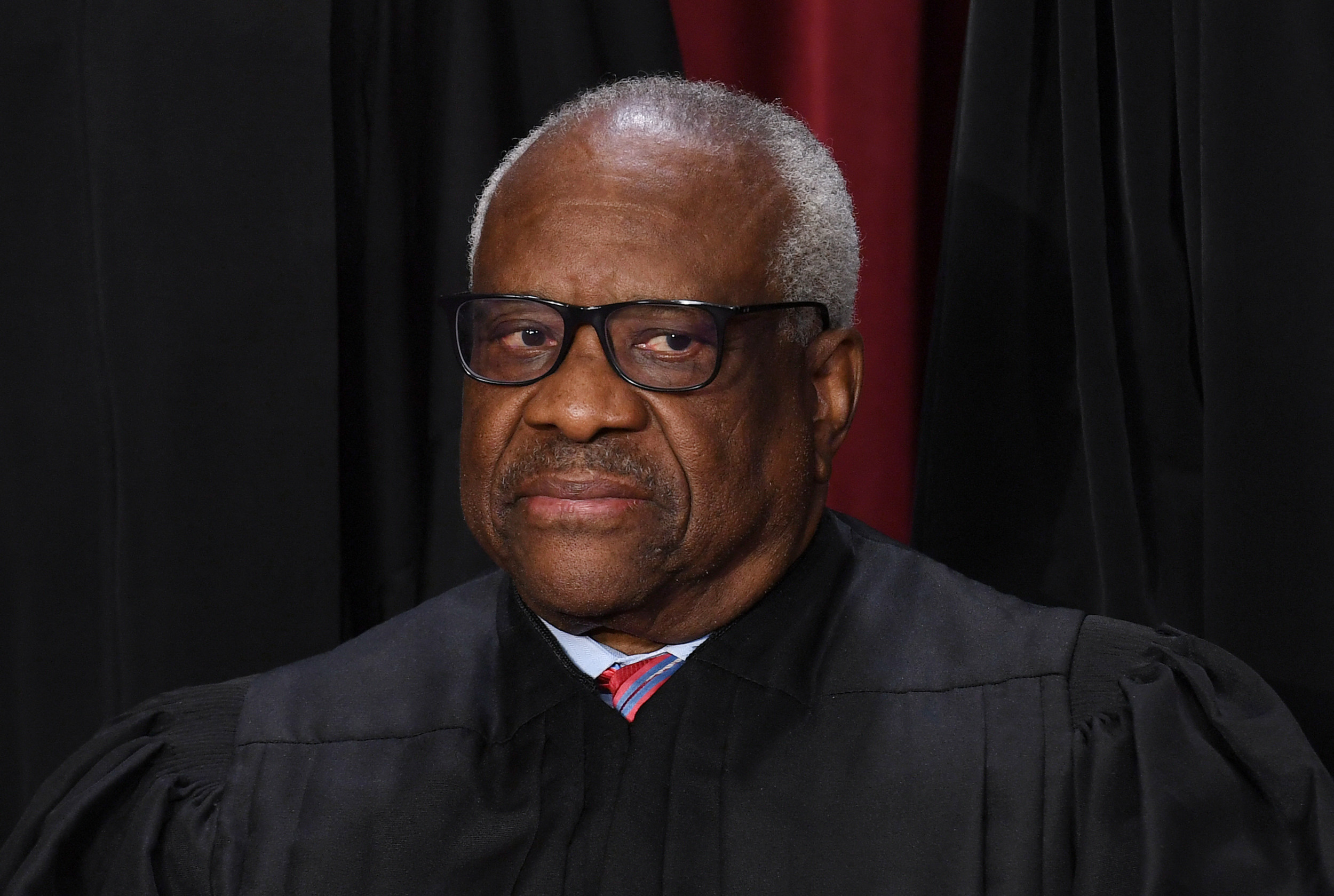

The Biden administration had tried to cancel student loan payments altogether, but the move was struck by the Supreme Court earlier this year. President Joe Biden agreed to end the three-year pause on payments in a deal with Republicans to lift the debt ceiling in May.

Interest on loans started accruing again on September 1. Some 43 million Americans, who hold a combined $1.75 trillion in student debt, will be affected by the resuming of payments.

According to the Consumer Financial Protection Bureau (CFPB), more than one in thirteen student loan borrowers is currently behind on their other payment obligations, while about one in five student loan borrowers has risk factors that suggest they could struggle when scheduled payments resume.