Evaluating Marinus: Ztalmy's Growth And Upcoming Trial Insights

Summary

- Marinus Pharmaceuticals received FDA approval for Ztalmy to treat seizures; aims to broaden its application.

- Marinus has strong financial standing with a cash runway until late 2024; ongoing trials on Ztalmy show potential.

- Recommendation: Maintain a "Buy" stance on Marinus, monitoring trial results and developments to mitigate investment risks.

fmajor/E+ via Getty Images

Introduction

Marinus Pharmaceuticals (NASDAQ:MRNS), focusing on seizure disorders, got FDA approval in 2022 for Ztalmy (ganaxolone) to treat seizures in CDD patients over two. Ganaxolone, affecting GABAA receptors, shows anti-seizure effects. Marinus aims to expand its use and application methods.

In my most recent analysis of Marinus, I highlighted their strategic shift from postpartum depression to rare genetic epilepsies, a move that proved beneficial with the FDA approval of Ztalmy for CDD. Although still unprofitable, their increased R&D expenses signal dedication to broadening Ztalmy's reach. While optimistic about ganaxolone's potential for TSC, I'm skeptical about its role for status epilepticus. Despite challenges, I recommended a 'Buy' due to its promising trajectory, especially if TSC data is positive.

Recent Developments: Oppenheimer downgraded Marinus due to concerns over a phase 3 trial of IV ganaxolone. Price target reduced to $9; shares dropped ~13%. Delays in RAISE trial results and slower enrollment added to the concerns.

In this article, we'll dive deep into Marinus' latest strides in the medical field, how they've performed financially, and the ongoing trials surrounding their seizure medication, Ztalmy.

Q2 Earnings Report

Looking at Marinus' most recent earnings report, net product revenues from Ztalmy sales were $4.2M and $7.6M for the three and six months ended June 30, 2023. BARDA federal contract revenue rose significantly to $8.9M in the first half of 2023 due to the API onshoring initiative. R&D expenses increased to $49.3M in six months, while SG&A expenses reached $30.9M mainly because of Ztalmy's US launch. Despite a net loss of $66.7M in six months, the firm held $175.3M in cash and short-term investments as of June 2023, expected to sustain operations into late 2024.

Cash Runway & Liquidity

Turning to Marinus' balance sheet, as of June 30, 2023, the company reported assets including 'Cash and cash equivalents' at $127.8M, and 'Short-term investments' at $47.5M, aggregating to a combined total of $175.3M. The company used $65.8M in operating activities over the six months ending June 30, 2023. This suggests a monthly cash burn of approximately $11M. By dividing the total assets from the aforementioned details ($175.3M) by the monthly cash burn ($11M), we get a cash runway of roughly 16 months. However, it's prudent to mention that these values and estimates are based on past data and might not directly predict future performance.

Regarding the company's liquidity, the presence of significant current assets, primarily cash and its equivalents, indicates a relatively strong short-term liquidity position. On the liability side, there's a noticeable 'Notes payable' amounting to $68.1M, hinting at the company's reliance on external financing. Given the company's sizable assets and current financial stance, securing additional financing in the future could be feasible, if required. These are my personal observations, and other analysts might interpret the data differently.

Valuation, Growth, & Momentum

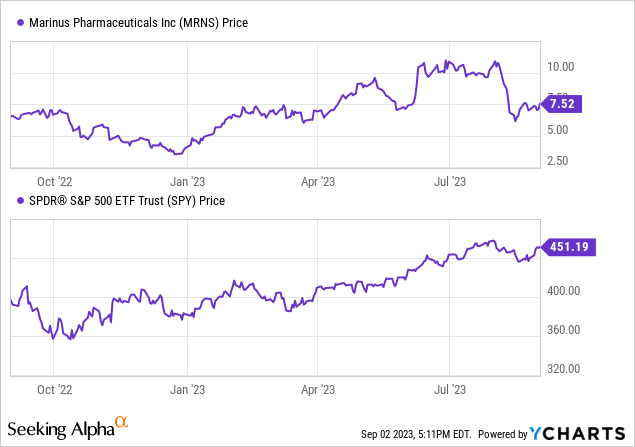

According to Seeking Alpha data, Marinus exhibits a moderate capital structure with an enterprise value of $312.42M. While currently unprofitable, there's evident growth in sales and a promising trajectory for their main product, Ztalmy. Given the recent FDA approval and strategic shifts, there's potential for significant future earnings as they further their R&D efforts. The stock's momentum has been positive overall, outpacing the S&P500 over the 9-month period.

Although optimistic about Ztalmy's potential expansion, the company's prospects hinge on the forthcoming trial results and broader product application success.

Marinus Progresses with Ganaxolone in RSE and TSC Treatments

Marinus is progressing its clinical studies on ganaxolone. According to the company, interim findings from the Phase 3 RAISE trial for refractory status epilepticus [RSE] are expected in Q1 2024. Moreover, RAISE sites are receiving a new IV ganaxolone formulation. Significant strides have been made in addressing super refractory status epilepticus [SRSE] with 18 emergency-treated patients, indicating positive initial results. The Phase 3 RAISE II trial, targeting European approval, will commence patient enrollment in late 2023. Meanwhile, the Phase 2 RESET trial for established status epilepticus [ESE] is on track to finish its primary group by 2023's close. The U.S. Department of Health and Human Services is partly funding the RAISE trial.

In the context of tuberous sclerosis complex (TSC), the international Phase 3 TrustTSC study of oral ganaxolone is in progress, with findings projected for mid-2024. A recent patent extends ganaxolone's use for TSC to 2040.

For newer product initiatives, the multiple ascending dose [MAD] study is ongoing, with results due by 2023 end. Post-MAD trial results, plans to finalize the Lennox-Gastaut syndrome clinical study are set for early 2024. Furthermore, a top oral candidate's IND application is slated for Q4 2024 submission.

My Analysis & Recommendation

In summary, Marinus continues to be a focal point within the rare genetic epilepsy sector. The company's dedication to expanding the usage of Ztalmy is evident through its heightened R&D efforts. With a reasonable cash runway until late 2024, Marinus appears to be well-fortified for its ongoing and planned clinical trials.

However, there are valid reservations. While the prospects in TSC appear promising-especially with the recent patent securing ganaxolone usage until 2040-I harbor doubts regarding its prospects in treating RSE. RSE is a particularly challenging condition to address in terms of efficacy. A potential misstep or failure in this trial could introduce significant volatility into Marinus' stock in the coming months. Investors would be wise to closely monitor these developments, keeping an eye out for interim results from the Phase 3 RAISE trial slated for Q1 2024.

Yet, despite these concerns, I maintain an optimistic outlook for Marinus, primarily driven by its strategic growth trajectory. While setbacks in the RSE trial would indeed be significant, the company's wider product portfolio, combined with promising indications in areas like TSC, provides a certain level of risk mitigation. Given the company's evident growth in sales and the positive momentum of Ztalmy, combined with the potential expansion opportunities, the underlying strengths of Marinus cannot be disregarded.

Therefore, on balance, I maintain a "Buy" recommendation for Marinus. The rationale for this stance hinges on the growth potential of Ztalmy, especially if the TSC data pans out positively, as well as the company's ability to navigate its clinical trials effectively. That said, investors should adopt a proactive approach, staying informed on trial results and any company developments, to manage the potential risks associated with their investment.

Risks to Thesis

Risks that could contradict my investment recommendation for Marinus include:

Overestimation of Product Potential: I may have been overly optimistic about Ztalmy's potential, especially in treating TSC. If trials don't yield positive results, this optimism could be misplaced.

Underestimation of Challenges: RSE is challenging to treat. While I have reservations, a failure in this domain could be more impactful than I've predicted.

R&D Expenses: Increased R&D spending might not necessarily translate into product successes. My optimism may have overemphasized this spending as an indicator of future potential.

Financial Health: Although their cash reserves appear solid now, unforeseen circumstances or unsuccessful trials could accelerate cash burn.

Biases: I might harbor cognitive biases, including confirmation bias, having seen FDA approval for one of Marinus's products, and this might cloud my judgment.

External Factors: Oppenheimer's downgrade and the 13% share price drop could indicate deeper issues that I've overlooked.

Market Dynamics: The rare genetic epilepsy sector may evolve, with new entrants or innovations potentially overshadowing Marinus's products.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article aims to offer informational content and is not meant to be a comprehensive analysis of the company. It should not be interpreted as personalized investment advice with regard to "Buy/Sell/Hold/Short/Long" recommendations. The predictions and opinions expressed herein about clinical, regulatory, and market outcomes are those of the author and are rooted in probabilities rather than certainties. While efforts are made to ensure the accuracy of the information, there might be inadvertent errors. Therefore, readers are encouraged to independently verify the information. Investing in biotech comes with inherent volatility, risk, and speculation. Before making any investment decisions, readers should undertake their own research and evaluate their financial position. The author disclaims any liability for financial losses stemming from the use or reliance on the content of this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.