Palantir: Morgan Stanley Downgrade Presents A Buying Opportunity (Rating Upgrade)

Summary

- Palantir shares dropped over 8% following a downgrade from Morgan Stanley, citing overvaluation and uncertainty about monetizing AI.

- Despite the downgrade, Morgan Stanley actually increased its position in Palantir by nearly 60% in Q2 2023.

- Palantir's recent $1 billion buyback program and strong support in the $14 to $15 range provide reasons to negate the downgrade.

Michael Vi

Palantir Technologies Inc. (NYSE:PLTR) shares shed more than 8% on Thursday, August 31st to close out a rough month where it lost 25% from its all-time highs. Thursday's price action was triggered by a downgrade from Morgan Stanley, citing general overvaluation and lack of clarity about the company's ability to monetize AI.

While in my recent article I urged investors not to get too excited about a potential S&P inclusion, I also acknowledged that the company and stock have many things in their favor over the long-term. A 25% pullback in general and 8% on a single day on the back of a downgrade presented a compelling enough opportunity for me to initiate a position again in Palantir. In this article, I present 5 reasons to negate the Morgan Stanley downgrade. Let us get into the details.

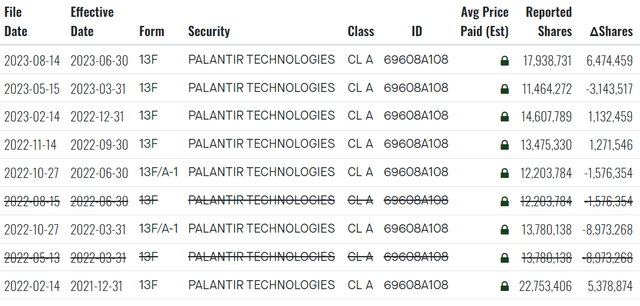

#1 Watch What They Do And Not What They Say

While the Morgan Stanley downgrade made headlines, the fact that they increased their position in Palantir by nearly 60% in the second (calendar) quarter of 2023 went largely unnoticed. Morgan Stanley's current (June 30th, 2023) position of nearly 18 million Palantir shares is its 2nd highest exposure to the stock since the end of 2021. While it is possible that Morgan Stanley may have offloaded some shares in the ongoing quarter, I'd still expect them to hold a sizeable position in the stock coming out of this quarter.

In short, Morgan Stanley's action makes it hard for me to believe that even they believe in their own price target pf $9 (previously $8).

#2 Buyback

Palantir recently surprised the market with a $1 billion buyback announcement. At the current price of ~$15, the total authorized amount could retire nearly 66 million shares, which is 3% of the total shares outstanding. Obviously, the company is unlikely to execute the entire buyback at any single price point but knowing that the company has our backs with an approved buyback program ready to go is reassuring and should help the stock find a base in case the sell-off intensifies. Considering the age of the company as a public entity (about 3 years), I'd argue that Palantir has been fairly disciplined in not diluting shareholders away.

#3 AI, Government and Monetization

Outside of valuation and the stock's general run, Morgan Stanley cited lack of visibility into monetization of Palantir's Artificial Intelligence Platform [AIP] and the Government sector being unlikely to provide an offset. As a curveball, I do agree monetization is a little murky, not just for Palantir but for almost all companies bar a few exceptions like NVIDIA Corporation (NVDA) and Microsoft Corporation (MSFT). AI, as a money-maker, is still in its infancy undeniably but Palantir has got many things in its favor for the long-term.

- Palantir's AI prospects is not just a "future story" but a current reality as well. Palantir was already ranked #1 in a 2022 study (when AI crazy did not take over the market) analyzing 2021 market share and revenue in AI software platforms. Personally, I don't see AIP as the company's 4th platform but rather one that blends with its three existing solutions (Foundry, Gotham, Apollo) to offer better decision-making capabilities to its defense and business clients.

- Even if you don't believe AI has increased the Total Addressable Market [TAM], the original estimate of $119 billion is still lucrative enough for many years to come. As a reminder, Palantir generated just about $2 billion in 2022 revenue.

- Government or Public Sector in general, is well-known for being a little bit behind the technology curve. Add layers of security and regulatory pressure on top of it, not many companies can establish a presence in Government sector. Palantir has not only been successful in establishing a presence but also differentiating itself from the competition. It is not a coincidence that Palantir keeps reporting winning multi-year government contracts worth 100s of millions. Finally, it is believed that Governments globally can gain (basically save) up to $1 trillion from using data analytics but very few have resources to do so efficiently. Enter, Palantir and the likes.

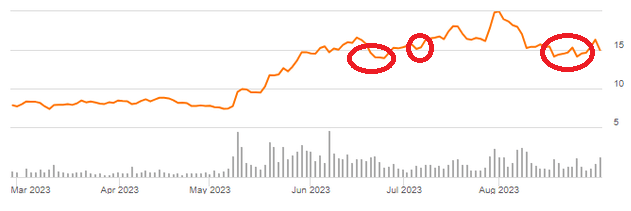

#4 Strong Support in the $14 to $15 Area

In the last three months, Palantir's stock has found strong support in the $14 to $15 area, right where the stock is right now.

PLTR Chart (Seekingalpha.com)

In my Q2 preview, I had raised the concern that the stock had gone too far, too fast by pointing out that the then-200-Day moving average was half of the then-trading price of $18, thereby creating unfilled technical gaps. Thanks to the general uptrend in the stock price and the recent sell-off, the current 200-Day average is less than 30% away from the current share price. This means the potential downside (before reaching stronger support) is far more limited now than it was just a few short weeks ago.

PLTR Moving Avgs (Barchart.com)

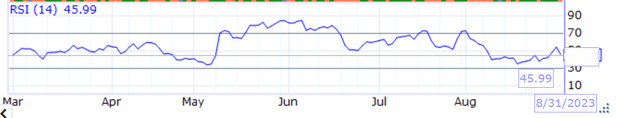

#5 Technically Oversold, Almost

It wasn't long ago that Palantir stock was way overbought technically, as indicated by the Relative Strength Index [RSI] chart below, with the stock almost breaching 90 a few times between May and June. RSI has been on a downtrend since then, with the stock establishing a stronger base as discussed above. However, thanks to the sell-off in the last month and more specifically, yesterday, Palantir's RSI is now in the mid 40s. This is not in the textbook oversold level (of <30) yet but a couple of more weak price action days is likely to send the stock close to the oversold levels.

Conclusion

"Don't listen to what people say, watch what they do" has often been used in politics. I believe it holds true for businesses and the lucrative world of investments. In addition to the points presented above, Palantir's cash on hand represents nearly 10% of the company's market-cap and the company has a pristine balance sheet with no debt.

I believe the downgrade has presented long-term Palantir believes a nice opportunity to add to/initiate a position. And in a nod to "watch what they do", I initiated a position again in Palantir yesterday. I am looking forward to a run to at least $18 before evaluating my position.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT, PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.