Bitfarms: Gloomy Mining Economics But AI Trading Opportunity Exists

Summary

- Cryptocurrency miners are diversifying into the artificial intelligence market to compensate for lower margins caused by plummeting Bitcoin prices.

- Bitfarms executives have also mentioned the possibility of entering the AI market during their Q2 earnings call.

- The upcoming Bitcoin halving event and mining economics pose challenges for Bitfarms' profitability, but the company's balance sheet remains strong.

- In these conditions, the stock is a Hold, but there are trading opportunities.

spawns

According to some analysts, cryptocurrency miners are diversifying into the artificial intelligence market in order to try to compensate for lower margins resulting from Bitcoin (BTC-USD) prices plummeting to less than half of the November 2021 peak. This possibility was also evoked by Bitfarms' (NASDAQ:BITF) executives during the second quarter 2023 (Q2) earnings call on August 8 as I will further elaborate later.

Now, offering AI computing services at a time when Nvidia’s (NASDAQ:NVDA) GPUs are in high demand would surely alleviate the supply issues some enterprises are facing and also generate windfall gains for the miners but it is important to assess whether transiting from blockchain's hashrates to Generative AI's large language models is feasible.

In the meantime, given more pressing concerns like the effects of inflation and mining difficulty on crypto production costs as well as the upcoming bitcoin halving event, the aim of this thesis is to assess whether the company's finances are healthy enough to navigate the current crypto bear market.

I start with Bitcoin halving which has a direct impact on its supply.

Bitcoin Halving and Mining Economics

This fourth Bitcoin halving event is estimated for April 26, 2024, which means that the reward for producing the coin will go down from 6.25 BTC to 3.125 BTC or a 50% drop. The objective is to reduce the supply and contribute to Bitcoin scarcity, in turn increasing its value. However, this key aspect of Bitcoin’s foundational policy has not worked to sustainably raise the cryptocurrency's value, as in addition to the demand-supply equation, there are also other market forces that determine its price.

One of them is volatility which grappled the cryptocurrency world in November last year after Sam Bankman-Fried’s cryptocurrency exchange FTX collapsed also impacting Genesis Global which paused client withdrawals amid the unprecedented market turmoil that followed.

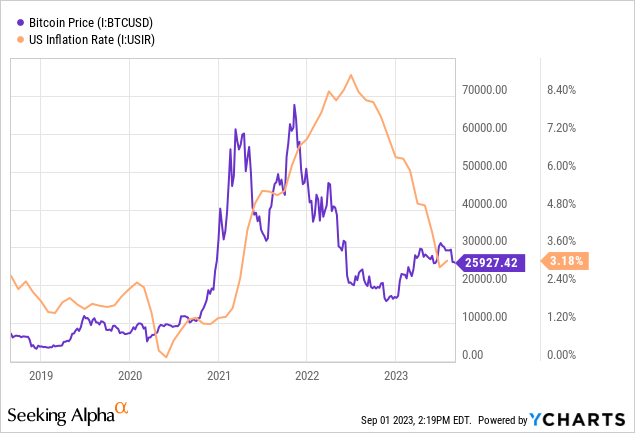

Another factor that has an effect on Bitcoin’s value is inflation as shown in the orange chart below.

Now, fiat currencies such as the dollar or the euro can be printed at will by each country's central bank at times of economic turmoil as part of monetary policy loosening, but on the flip side causes high inflation as was the case on both sides of the Atlantic Ocean in 2021. In sharp contrast, not controlled by any central bank, the amount of bitcoin created is limited which explains why its price surged as inflation accelerated as shown in the blue chart above.

Coming back to the effect of Bitcoin halving on Bitfarms, for the same amount of computational work its mining operations contribute to the network, fewer bitcoins will be obtained in return. This means that the management will have to exercise cost control in order not to go bankrupt like the weakest players in the industry.

Network Difficulty and Finances

Now, one of the ways the miner has optimized costs is by using the energy-efficient Bitmain S19Jpro, which allows for higher hashrates or computational power at lower costs. For powering its mining farm, Bitfarms' energy mix consists of over 85% hydroelectric power which, unlike fossil fuel sources, is subject to less variable costs. Additionally, capex intensity has been lowered through the use of equipment lines of credit.

Still, mining economics have been exceptionally unfavorable in Q2, namely because of an inflation-driven 6.5% hike by utilities in Quebec which accounts for about 75% of energy needs.

Another factor that adversely affect revenue was mining network difficulty increasing by 24% sequentially which resulted in only 1,223 Bitcoin being mined compared to 1,297 in the first quarter (Q1). This difficulty pertains to finding a block in the blockchain and increased considerably in Q2, by 67% YoY as more mining pools participated in minting coins, adding to cryptocurrency energy production costs. Thus, the cost to produce one Bitcoin climbed to $15,700, from only $12,500 in the first quarter.

Looking at the industry, this figure was still lower than HIVE Digital's (HIVE) average cost of production $18,687, and Hut 8 Mining’s (NASDAQ:HUT) $21,766 (or CAD$ 29,600).

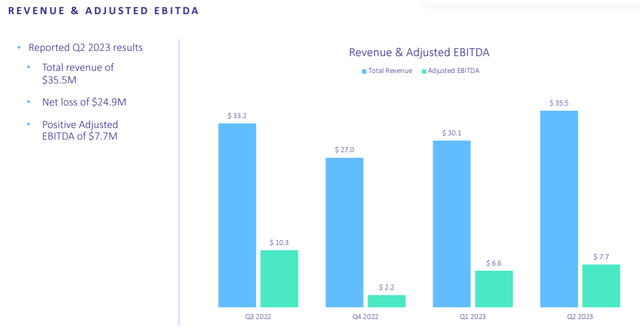

Furthermore, despite the higher cost of production, adjusted EBITDA has improved to $7.7 million mostly as a result of higher revenue of $35.5 million due to an increase in the price of bitcoin in Q2, but, still, the income statement showed a $24.9 million net loss.

Company Presentation (investor.bitfarms.com)

However, the balance sheet remains strong, with cash of $31 million and the Bitcoins in the treasury totaling around $17 million, signifying about $48 million in liquidity, widely offsetting approximately $31.7 million of debt at the end of Q2. Another aspect of the finances is the relatively high operating cash flow with $36.3 million for fiscal year 2022.

Valuations, Potential AI Revenues and Risks

As a result, Bitfarms' trailing Price/Cash Flow of 7x is more than 60% undervalued relative to peers in the IT industry. Despite this favorable valuation, I consider the stock to be a hold and, there are three reasons for this.

First, there are still uncertainties as to the effects of lingering inflation and mining difficulty on profitability as I touched upon earlier. Second, with its lower production costs, Bitfarms has a better chance of "surviving" the halving effect. Still, in addition to being advantageous in terms of supply-driven price dynamics, halving also poses challenges, as it entails the use of more electrical power for producing the same number of bitcoins.

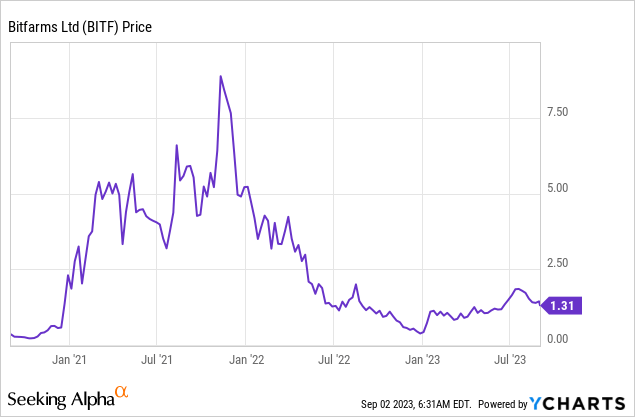

Third, its current price of $1.3 is not far from the $1.00 minimum closing bid price requirement by the Nasdaq Stock Exchange. In this case, the risk is that there may be a high level of volatility in case the stock falls below the one-dollar level for a specific time period especially when the Stock Exchange sends a compliance notice to the miner.

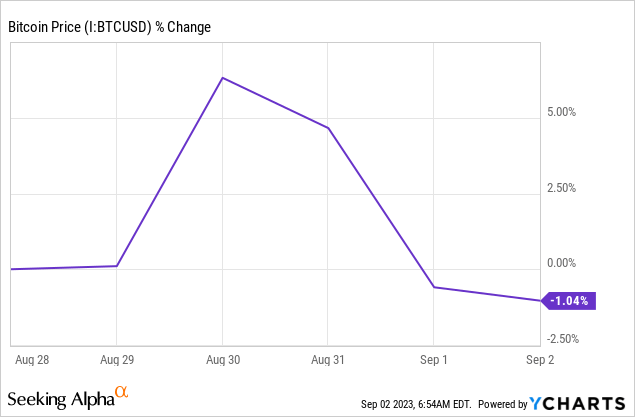

Shifting to a positive tone, lower profitability could be offset by an improvement in revenue levels in case the price of the cryptocurrency increases. Well, this may become a possibility after a U.S. court overturned a decision by the Securities and Exchange Commission to deny Grayscale’s application to convert its existing Grayscale Bitcoin Trust (OTC:GBTC) into a spot ETF. Now, with assets under management of $13.8 billion, this does not mean that this large OTC-traded Bitcoin fund will now automatically be traded as a SPOT ETF, but Bitcoin gaining more than 5% when the news hit the markets as shown below suggests that there are reasons for being optimistic.

Looking at the possibility of initiating a new AI-led revenue stream, this is unlikely to be that straightforward, as the S19JPro mining equipment used by Bitfarms makes use of ASIC chips for calculating the hashrate while AI makes use of GPUs or graphics processing units. Still, given that there is currently a shortage of data center space in North America, the company can reallocate some of its facilities towards AI but this will require investments in terms of generators and UPS (uninterruptible power supply). In this case, conventional data centers consume less power but it first needs to be stabilized, in contrast with crypto mining rigs which can run directly on utility power.

Noteworthily, the management is evaluating the AI diversification path very closely while also paying attention to metrics like margins and longevity.

Concluding with the Trading Potential

In conclusion, the company's balance sheet is healthy and could benefit from higher bitcoin prices as asset managers push further for the approval of a spot ETF, but unfavorable mining economics could further deteriorate the net loss in the balance of 2023 and next year as the halving event looms.

On a different note, as seen for two other Bitcoin mining plays which saw their share prices jump by over 17% when they announced deals covering cloud and AI, this could also favorably impact Bitfarms' stock in case it also makes a similar move. In this respect, the price could surge to $1.53 based on the current share price of $1.31 and a 17% upside depending on the veracity of the news update. Even more gains could be made in case there are further developments as to the process of launching a Bitcoin spot ETF, as Grayscale is not alone since giant asset manager BlackRock (BLK) and other Wall Street investment banks have also made similar moves. Finally, during trading, the stock should be held for only a limited time period, and if the targeted gains have not been attained, it is preferable to exit with a stop loss rather than holding on to the stock as is normally the case during investing.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This is an investment thesis and is intended for informational purposes. Investors are kindly requested to do additional research before investing.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.