Comerica's Interest Rate Exposure Makes Shares Unattractive

Summary

- Comerica has experienced significant deposit flight and shrinking net interest margins due to aggressive deposit pricing and the failure of Silicon Valley Bank.

- The bank has stabilized deposits by raising interest rates, but this has compressed net interest margins and may require further increases.

- Comerica's earnings are at risk from changes in interest rates, and the stock is viewed as having a poor risk/reward profile.

JHVEPhoto/iStock Editorial via Getty Images

Back in October, I recommended investors in Comerica (NYSE:CMA) look to rotate out of the bank’s shares given the risk of deposit attrition. Indeed, the carnage in regional banks since the failure of Silicon Valley Bank earlier this year has hit Comerica hard with the bank seeing meaningful deposit flight, requiring it to raise interest rates on deposits. This has led to shrinking net interest margins (NIM).

While shares have bounced off their lows, they are down by over 25% since my piece and nearly 40% over the past year. Unfortunately, in my view, the company is still poorly positioned to deal with the volatile interest rate regime we are experiencing. Consequently, I would continue to avoid the stock.

Seeking Alpha

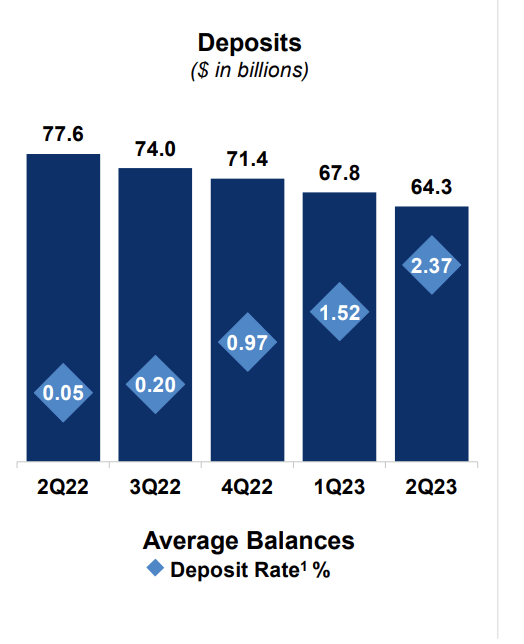

The core challenge facing Comerica can be seen in their second quarter earnings results and accompanying presentation materials. Comerica was extremely aggressive in its deposit pricing, meaning that it did not pass on much of the Federal Reserve’s interest rate hikes to depositors. In the third quarter of 2022, the Fed raised rates above 3%, and Comerica was still paying just 0.2% to depositors on average.

Comerica

Accordingly, Comerica began to see deposits decline as customers moved funds to higher-earning alternatives. The failure of Silicon Valley Bank this year brought into sharper focus low-deposit pricing, particularly among depositors with balances above the FDIC’s $250,000 insurance limit, causing deposit flight. As the above chart shows, CMA has lost about $13 billion in deposits (about 17%) over the past year.

Unsurprisingly, much of this flight has come from those uninsured deposits, and those deposits now make up 48% of total deposits, down from 64% at year-end 2022. Now, management has reported that while deposits fell by $3.5 billion in Q2, most of those losses happened in April with deposits stabilizing in the “second half of the quarter.”

However, this stabilization is coming at a cost—CMA raised deposits rates by 85bp on average in Q2 to 2.37%. CMA is able to stem deposit losses by paying depositors more to keep their funds at Comerica. This meaningful increase in funding costs is compressing the bank’s net interest margins. NIM has declined to 2.93% from 3.74% in Q4 2022 as higher deposit costs weigh.

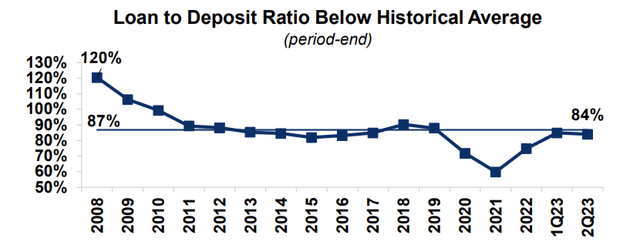

A reason last year why Comerica paid so little to depositors was that the bank was awash in excess liquidity. As deposits soared after COVID, its loan to deposit ratio plunged. Money was coming in more quickly than it could be lent out. Because CMA did not need all these deposits, it kept rates low, happy to see some deposits leave.

Comerica

My concern with this strategy was that it can be difficult to gauge how quickly deposits will leave, and an unforeseen crisis like the one started by Silicon Valley led to a much quicker drop in deposits than could have been reasonably expected. Accordingly, Comerica is not carrying the excess liquidity it once did with its loan to deposits up to 84% from 75% at year-end 2022. This is still a bit below the 88% in 2019.

Now to be clear, I am not arguing Comerica has a liquidity shortfall. The bank’s loan to deposit ratio is now back in keeping with its post-financial crisis norm. Comerica can safely operate its business with its current liquidity position. However, while a year ago, CMA could let deposits leave and keep rates low because it had more than enough liquidity, it now does need to maintain deposits around current levels. That is why it is raising rates paid to depositors. Given its deposit base still materially under-yields fed funds, further increases that squeeze margins may be needed.

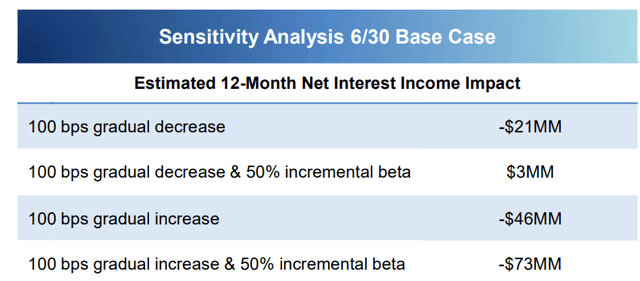

Indeed, CMA is in a unique position where it projects that is net interest income would fall if rates rise or fall another 100bp. Typically, banks are seen as having a net interest benefit when rates rise, and lose when they fall. CMA sees income falling either way, but it actually does worse as rates rise.

Comerica

This is because it now is passing on more interest increases to depositors, and because much of its asset base is fixed-rate. Its securities portfolio is substantial at $20.4, even though that is down from $22.8 billion one year ago. This portfolio yields just 2.1%, less than it is currently paying on deposits to fund it, hence the net interest margin squeeze. It has $2.2 billion in unrealized losses on its securities portfolio and $1 billion on its swap portfolio.

Fortunately, due to maturities, the securities portfolio will decline by about $900 million by the end of the year and a further $2 billion next year. This creates liquidity and the opportunity to invest at a higher yield. But this portfolio will weigh on results for some time.

Predicting interest rates is very difficult, but given the bank’s own sensitivity analysis, there is earnings risk from either higher or lower rates. This adds to the likelihood we have seen CMA report peak profits this cycle. With earnings likely due to decline due to interest rates over time, I struggle to see a positive catalyst for the stock.

Now, while interest rate risk concerns me, one area where CMA is solid is credit quality. The bank has proactively taken steps to guard against a recession impacting the quality of its loan portfolio. It now has reserved $728 million for loan losses, or 1.3% of its loan portfolio, up from $609 million a year ago. Right now, though, loan quality remains quite strong. Nonperforming loans are just $186 million, or 0.33% of its portfolio. Its common equity tier one ratio (CET1) increased by 19bp to 10.31% in the quarter. This is well above the 7% regulatory minimum. CMA’s loan quality is strong and well-reserved for, and the bank is amply capitalized.

For the full year, management is expecting net interest income to rise by 1-2%, or be about $2.48 billion. Year to date, net interest income is $1.33 billion. This implies a second half run-rate of $575 million, down from $621 million in Q2 as the full quarter impact of Q2’s deposit rate increases are felt. Holding credit costs and all else constant would reduce the EPS run-rate to $1.88.

Ultimately, I see risks skewed to the downside from this level of earnings. As noted above, CMA will see headwinds from changes, in either direction, in interest rates. Perhaps, rates stay rangebound for a prolonged period of time, but given all of the uncertainties around the economy and inflation, I believe this positions CMA as having a poor risk/reward. Additionally, 48% of deposits are still above the FDIC insurance limit. As such, risks are skewed to more deposit attrition and/or further deposit rate increases that further compress NIM.

Shares now trade at a 20% premium to tangible equity per share of $39.48. They are still at a discount to the $63.11 book value excluding accumulated other comprehensive losses, on its loan portfolio. However, with loan to deposit ratios rising, there is a risk some of the losses are made permanent as CMA manages liquidity, as such it is not appropriate to entirely ignore these mark-to-market losses, in my view.

With earnings poised to decline at least another 6% sequentially in H2 2023 and potentially closer to 25% (or about $1.50 in quarterly EPS) if deposit rates have to rise another 15bp to stem outflows, CMA shares appear fairly valued at a 20% premium to tangible book value. I would view tangible equity of $39.5 as a good level to buy shares as that fully discounts its securities portfolio losses whereas I would actively short shares around $60, which would largely ignore its security portfolio losses.

At about $48, shares appear to be stuck, but with earnings declining and the risk that higher interest rates degrade earnings further, catalyst risk appears skewed to the downside. As such, I would look to rotate out of CMA and into banks with a more favorable deposit mix or better exposure to interest rate risk, like Citizens Financial (CFG) or Charles Schwab (SCHW).

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.