Citigroup: Dirt Cheap For A Reason

Summary

- Citigroup's recent earnings beat estimates but still showed weakness in many of its businesses, leading to a drop in stock price.

- The bank's major divisions, including Institutional Clients Group, experienced shaky performance compared to the prior year.

- Citigroup has growth opportunities in its Asia family office business and its Commercial Banking division, but faces challenges such as potential Fitch downgrades and surging operating expenses.

Ceri Breeze

Thesis

In recent history, Citigroup, Inc. (NYSE:C) has been a relatively under performer among the big banks. Its valuation clearly reflects that as its valuation metrics consistently trail peer stocks by quite a margin. Its most recent earnings, reported in July, were a mixed bag as they beat estimates but still showed weakness in many of its businesses. That said, Citi does have growth opportunities as it is investing in areas such as Commercial Banking with its launch of CitiDirect. Challenges also remain for Citi as potential Fitch downgrades could cause higher costs of borrowing and surging operating expenses are hitting their bottom line. In my view, the current future outlook for Citi remains quite uncertain as it has internal and external challenges and its low valuation is justified. Therefore, I initiate Citi at a Hold rating with a price target of $43.

Earnings

Overview

In July, CNBC reported that Citi's earnings beat on both the top and bottom lines but the stock still dropped 4% post-earnings. They reported EPS of $1.33 versus an Refinitiv estimate of $1.30 and reported revenue of $19.44 billion versus $19.29 billion. Their results were pressured as markets revenues were negatively impacted by low volatility and the investment banking revenues were weighed on by the uncertain macro-environment. CEO Jane Fraser stated "In Banking, the long-awaited rebound in Investment Banking has yet to materialize, making for a disappointing quarter." There were also reportedly higher expenses and higher costs of credit. In my view, even though earnings beat estimates, they were far from smooth sailing.

Firm-Wide Performance

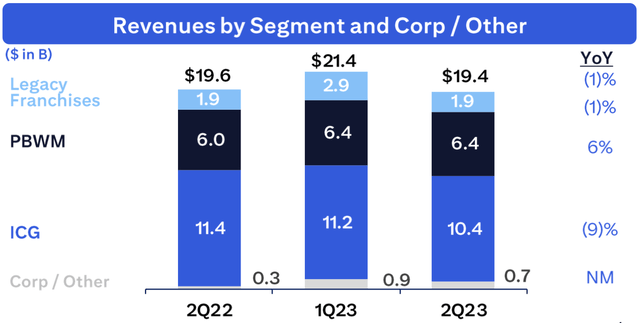

Citigroup Q2 Earnings Presentation

Citi reported weak results when compared to the prior year quarter. Revenue was $19.4 billion which is down slightly from $19.6 billion. This is mainly the result of growth in Services revenues and US Personal Banking being more than offset by declines in Markets, Investment Banking, and Global Wealth Management revenue. Legacy Franchise revenues were also down as exits and wind-downs continue for that division. As a result net income was down from $4.5 billion in 2Q22 to only $2.9 billion. In my view, ROE and ROTCE also showed unfavourable developments as they dropped from 9.7% to 5.6% and from 11.2% to 6.4% respectively. The company remains quite conservative with allowances for credit losses up from $16.0 billion to $17.5 billion. Lastly, deposits remain mainly unchanged while loans were up 1% YoY on an increase in US Personal Banking. From my analysis, Citi's Q2 earnings were sub-par as most metrics deteriorated from the prior year quarter. I believe Citi's relatively poor returns could continue if the macro-environment does not improve.

Institutional Clients Group

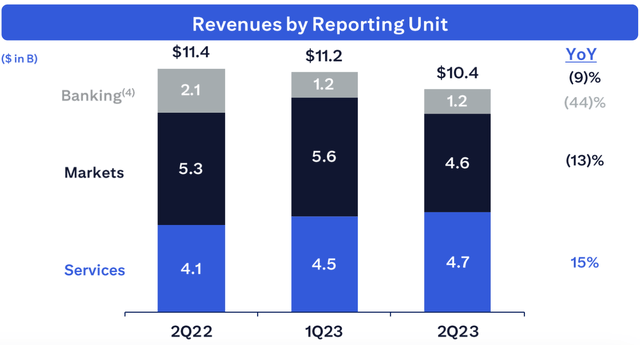

Citigroup Q2 Earnings Presentation

For this division, net revenues were down from $11.419 billion to $10.441 billion. To break it down, Services revenues were up from $4.050 billion in 2Q22 to $4.655 billion. This is a result of growth in Treasury and Trade Solutions revenues on higher rates and growth in cross border transaction value and commercial card spend volumes. In addition, Security Services revenue also showed growth as a result of higher rates across currencies. For the Markets unit, revenues were down from $5.292 billion to $4.619 billion and that comes as a result of weakness in Fixed Income, due to strength in rates but weakness in currencies and commodities, and Equities due to a decline in equity derivatives revenues. Lastly for the Banking unit, revenues were down from $1.583 billion to $1.233 billion as there were lower investment banking revenues and corporate lending revenue due to macro uncertainty and lower volumes, respectively. Operating expenses also had a YoY increase as they are up 13% on investments in Treasury and Trade Solutions, investments in Risk and Control, and severance costs in Markets and Investment Banking. As a whole, this division showed $2.190 billion in net income which is significantly down from the prior year's $3.961 billion. Overall, from my analysis, this major division showed a lack of resilience as results showed weakness across the board. Other than the increase in Service revenues, I believe there were no other strengths to be seen.

Personal Banking & Wealth Management

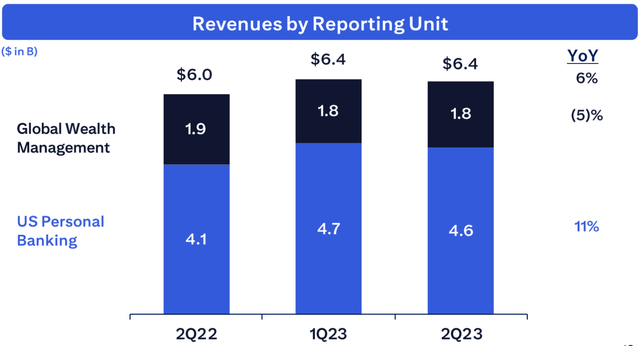

Citigroup Q2 Earnings Presentation

For this division, net revenues were up from $6.029 billion in 2Q22 to $6.395 billion. Digging deeper, US Personal Banking revenues were up from $4.124 billion in 2Q22 to $4.592 billion. The US Personal Banking Unit had Branded Cards revenue growth as there was higher net interest income, and higher Retail Services Revenue also due to higher net interest income and lower partner payments. Retail Banking revenues were down but mainly due to the transfer of associated deposit balances to Global Wealth Management. For the Global Wealth Management unit, revenues were down from $1.905 billion in 2Q22 to $1.803 billion. Within this unit, they had investment fee headwinds and had to pay higher interest rates on deposits. I believe the main positive in this unit was that client assets increased from $730 billion to $764 billion YoY. Overall operating expenses were up 5% YoY as they made investments in risk and control. Net income for the division comes to $494 million down from the prior year's $553 million. From my analysis, this division's results were very mixed for the quarter. In my view, these results have been close to satisfactory as the various drops of net income or revenue in this unit have been relatively moderate.

Legacy Franchises

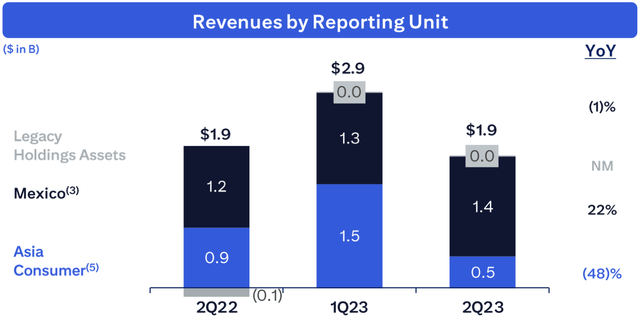

Citigroup Q2 Earnings Presentation

For this division, net revenue was reported to be $1.923 billion down from the prior year's $1.935 billion. Breaking it down, Asia Consumer revenue was down from $880 million in 2Q22 to only $454 million while Mexico Consumer/Small Business and Middle Market revenues were up from $1.184 billion in 2Q22 to $1.449 billion. Lastly, Legacy Holding Assets revenues were $20 million compared to a $129 million loss in 2Q22. Overall revenues in the division were down as Mexico's strong results on higher rates and volume being more than offset by Citi's revenue reductions from exited markets and continued wind downs. Operating expenses dropped 2% YoY but mainly only because of the exit markets and continued wind downs. As a whole, the division had a net loss of $125 million versus a $17 million loss in 2Q22. Again, I believe this division showed mixed results as the very strong Mexico results were more than offset by the Asia weakness. In my view, results for the division as a whole were near satisfactory but the inconsistency in revenue growth can be potentially concerning.

Corporate/Other

For this division, net revenues were up from $255 million in 2Q22 to $677 million. This is a result of higher net revenues from investment portfolio due to higher rates. Total operating expenses were up sharply as they increased 89% YoY to $302 million mainly due to inflation and severance within the division. Income from continuing operations was $361 million (including a reserve release) up from the prior year's $273 million. I believe it was a resilient division for the quarter but it also had a relatively small contribution to Citi's earnings.

Concluding Remarks

Q2 was not a walk in the park for Citi. From my analysis, Citi had a challenging quarter as their major divisions showed performance declines from the prior year quarter amid a tough macro-environment and geopolitical headwinds. Digging deeper reveals a mixed bag for many units as results were not consistent even within divisions. In my view, the overall weakness in their results overshadows the relatively small number of strong results in their earnings. As a whole, I believe Citi's Q2 results were sub-par and disappointing but not flat-out terrible.

Opportunities

In early August, Reuters reported that Citigroup's Asia family office business had a strong growth in client numbers. It was reported that they had a 25% increase in clients this year which builds off of an even better 50% YoY increase in Asia clients in 2022. In Asia, demand is reportedly surging as people are looking to set up private investment vehicles and plan for business succession. According to Reuters, in 2020, Citi had transformed its Asia family office in to a full-fledged unit. Ong of Citigroup stated that "We have seen great interest from China, Hong Kong, the Philippines, India, and Indonesia in settling their family offices here (Hong Kong)." Reuters also mentioned that there was an increase in interest in these services in the Middle East. In my view, this is a great opportunity to expand this area of the business. Many of the developing countries in Asia are growing in importance on the world stage and I believe Citi's focus on this market could be key in unlocking growth in this business.

Another opportunity for Citi could be in its Commercial Banking business. In July, Zacks reported that Citi launched a single-entry point digital platform called CitiDirect Commercial Banking. They reportedly launched this platform in attempt to meet the growing global needs of clients and helps to bring all their global products and services to a single platform. According to Zacks, the platform was created with clients so that the experience can be seamless and features include data driven insights and digitally opening accounts among many others. Zacks reports that it is currently being used in the US and in 2H23, they will expand to Hong Kong, India, Singapore, and the UK. In my view, this is another growth opportunity as they can potentially attract more clients with a good user experience. I believe expanding to international markets will also potentially accelerate growth in this division.

Valuation

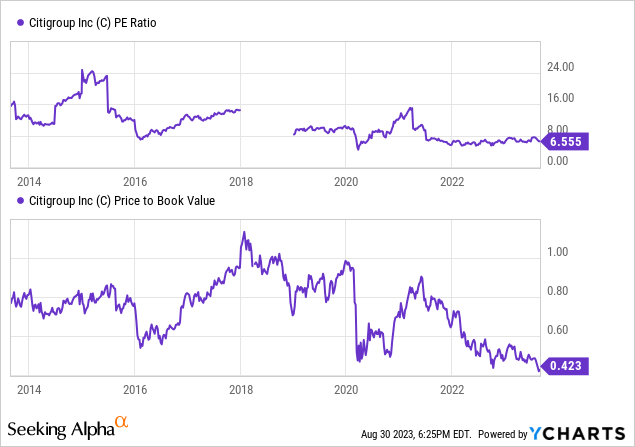

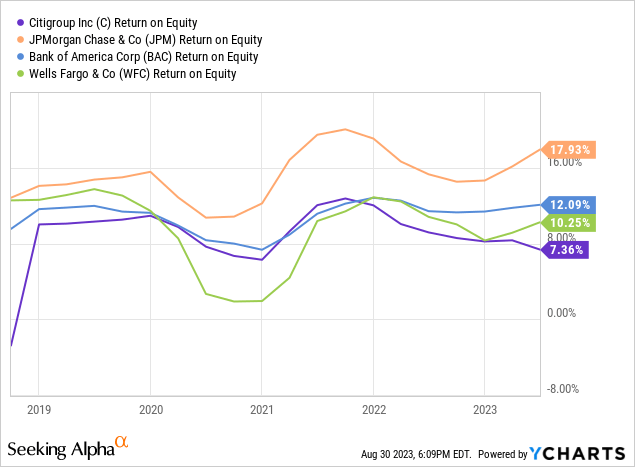

Citi's P/E ratio currently sits at around 6.5 which is a low level relative to the previous ten years. Its P/B ratio is also at multi-year lows of around 0.4. Both of these ratio indicates that Citi's valuation is extremely depressed. However, I believe with the current internal challenges, the disappointing earnings that Citi reported, and a highly uncertain macro backdrop, multiple expansion could be difficult in the near term. As shown below, Citi's ROE has trailed that of rivals since late 2021. Recently, the margin has widened as Citi is delivering relatively poor performance compared to that of rival big banks. While rivals have seen improvements in their ROE in 2023 from the late 2022 trough, Citi is still seeing declines in its ROE which is a deeply concerning sign. From my analysis, it is clear that Citi is trading at a very low valuation but that does not make it necessarily a bargain. Thus, I believe that despite the depressed valuation, Citi is correctly valued with its current P/E ratio, all things considered.

Citi has a TTM EPS of $6.02. With the investment banking market showing signs of thawing, with the ARM IPO coming soon, Citi's investment banking revenue may rebound in the NTM. Furthermore, probabilities of a soft landing have increased which could support Citi's earnings as potential higher loan volumes and less credit losses could add to earnings. Therefore, I believe it is reasonable to estimate that Citi's EPS could potentially show a 10% increase in the NTM versus the TTM. Thus, there is potential that there will be EPS of around $6.60 for the NTM. With a P/E ratio of 6.555 and an expected EPS of $6.60 (Price Target = P/E X Expected EPS), I arrive at a price target of approximately $43. Therefore, I initiate Citi at a Hold rating.

Risks

There are a few risks that could cause Citi's stock valuation to become even more depressed than it is at current levels. On August 24th, Zacks reported Citigroup was working on streamlining its business as it is suffering from cost woes. Citi is reportedly suffering from escalating costs as they spend on business-led investments on tech and transformation. According to Zacks, Citi has had expenses rising over the years as it revamps underlying tech, risk management and internal controls. Operating expenses have had a 5.2% CAGR for a 4 year period ended 2022 and Zacks projects that 2023 will show another 5.1% YoY gain in expenses for Citi. Citi is also trying to streamline their international operations. For example, they are closing retail banking in the UK and instead expanding Personal Banking and Wealth Management there. Another example is their exit from consumer banking from 13 markets across Asia and the EMEA. My primary concern here is whether expenses have any end in sight and when shareholders can expect to see returns from investments in areas like risk management and internal controls. Of course, Citi making improvements is an opportunity for them to turn the business around but making these investments is creating soaring costs which can be a significant risk as well. Therefore, I believe there is a degree of risk that Citi is taking by making these bets on transformation since these costs are taking significantly away from the bottom line.

In mid-August, CNBC reported that Fitch is warning that it might downgrade the banking industry's credit rating from AA- to A+. The agency had already cut assessment of the industry health from AA to AA- in June. It is reported that banks like JPMorgan Chase may have to be downgraded since JPMorgan currently sits at an AA- rating and individual bank ratings cannot be higher than the industry rating. Because JPMorgan may be downgraded, peer banks may also be downgraded to reflect the difference. Citi currently sits at an A rating and could potentially see that slip to an A- rating. In my view, that could cause an increase in borrowing costs for Citi and could further bring up overall costs and trim down their profit margins. I believe that this is a significant risk for Citi as they are already struggling with surging costs.

Conclusion

There is no denying that Citi is sitting at a rock-bottom valuation with P/E and P/B ratios at multi-year lows. However, it is there for a reason. While the bank has some growth opportunities internationally, it is also suffering from weakness in its earnings and a tough macro-environment. Its operating costs are also surging as it attempts a transformation, which could make its stock a risky proposition. In addition, Fitch downgrades could further pressure its earnings as borrowing costs could add to the already large expenses. Its ROE is also significantly trailing peers and it seems like it is continuing to lose ground to the other big banks. As a result, I believe the valuation is justified at current levels as internal and external factors do not seem to be in Citi's favour. Therefore, I initiate Citi at a Hold rating with a price target of $43.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (10)

C will most likely be heading below $40 in the next several months. Rate hikes will continue to badger bank earnings, lack of new mortgages and refinancing will hurt earnings. Add a slowing economy and coming elections C won’t be heading north anytime soon imo.