PointsBet: Even At Its Size, Its Presence Will Ignite Fanatics Stock Whenever Its IPO Debuts

Summary

- US-based online betting operator PointsBet Holdings Ltd. has sold its Australian unit to Fanatics for $250 million.

- PointsBet cited the high costs and low margins of the sports betting business as the reason for the sale.

- Fanatics plans to enter the sports betting market and aims to become the #1 sports betting platform in the future.

basketboy/iStock via Getty Images

As the sports betting sector rounds the corner spinning off marginal platforms one after another, an intriguing round-trip play is hovering above the fray. It involves the US-based online betting operator PointsBet Holdings Ltd. (OTCQX:PBTHF). A unit of its Australian parent (PBH:ASX) has been sold for US$250m to privately held Fanatics, the giant merchandiser of authorized sports team wearables and memorabilia.

From the early post-legalization days in 2018 through 2021's rocket ride, reality has set in across sector stocks. Valuations have come down to earth, sheep have been separated from goats and the outline of the sports betting business that will be is beginning to come clear to investors.

At this point, such stalwarts in their own fields as Churchill Downs (CHDN) have left the sports betting business and returned to their legacy Twin Spires online unit for horse racing only. CHDN management has cited the same story as others who have left or who may be leaving the online space: Costs too high, margins too low, taxes punitive in too many states. Wynn Resorts Ltd. (WYNN) had put their online sports betting site on sale for $500m citing similar concerns. It has since decided to hang in for its WynnBET site to await what is clearly coming-consolidation of market shares for the survivors of the ongoing dilemmas of the business.

Among the more recent companies waving bye bye to sports betting is PointsBet Holdings Ltd., the US unit of the Australian online operator. The business has been sold to privately held Fanatics for the same reason other platforms have left the business: Commenting on the sale, its CEO said it could no longer endure the massive outlays of marketing spend to achieve scale and diversion of resources required to stay competitive. He said that PB's business in Australia and Canada were healthy and will stay competitive in the years ahead.

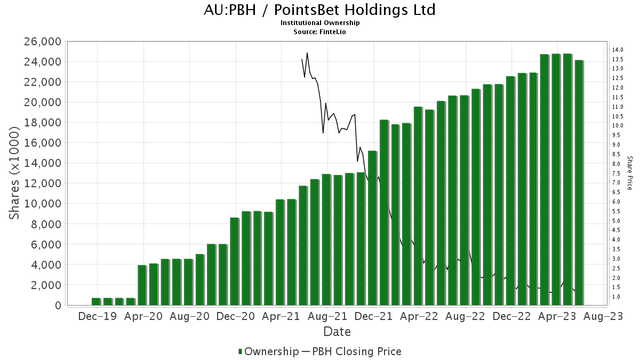

Above: The dilemma and the intrigue of a stock that tanked big time vs. a growing institutional holder base.

Fanatics had originally bid $150m for the business but DraftKings (DKNG) came in with a competitive offer so Fanatics upped the ante and now has closed at $250m.

The stock has tanked 80% under pressure as the losses have piled up despite PBTH's presence in 14 states. It had reached a high during the frenetic upside trading phase for sector stocks at $11.3000 a share. NBCUniversal's 4.9% equity piece acquired during 2020 will remain with the Aussie parent (PBH:ASX).

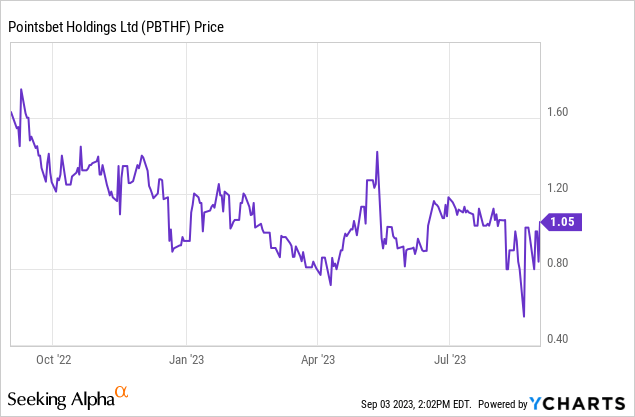

The stock's US market cap at writing is $340m. At writing its balance sheet noted it had more cash per share than the value of the trade at $1.77. Its book value shows at $1.63 a share.

Shareholders will be paid ~US$1.44 a share. The stock is now trading ~$1.05 at virtual zero volume as holders await developments now expected to move faster. There are 311.6m shares outstanding with institutional holders here still hanging on to ~33% of the outstanding. That group contains some impressive names like: TIAA CREF, Roundhill ETF, Vanguard, and a unit of Schwab.

Above: The stock has tanked for many reasons but mostly because holders thought it would fetch a much fatter price than it did. Also because of losses on revenues with overspend on promotions.

What's ahead as Fanatics officially takes over the transition and final operations of PointsBet?

Google

The platform's full revenue year in 2022 hit $248m, putting it in the lowest volume tier of US competitors, but it reflected a 7% YoY increase in revenue so Fanatics will essentially be starting at ground zero.

We have to consider that most data and metrics relative to the pre-sale shares are in fact of little use in appraising the value of a PointsBet business as a unit of Fanatics. To get a better handle on what may lie just ahead for PB holders who decide to buy into what could be a kind of special situation for the sector, we look at Fanatics.

Fanatics has long planned an IPO when it reached a valuation as a private company last year of $31b, just after a $700m financing. The timing of the public issue had been delayed by the stated goals of management to enter the sports betting business and that when it did, it would proceed full steam to an IPO. We are now at that point. Our sources believe that with financing in place and with PB under the Fanatics tent, events could begin to move that would bring a Fanatics IPO to market by early next year. Clearly market conditions ahead are unknowable in terms of the size and pricing of a proposed stock issue.

Fanatics 2022 revenue is estimated at $6b, with a forward forecast of $8b for this year. The company said it would primarily use its money for M&A, which of course means PBTHF. The company said its goals will be to evolve into a $10b company organically, with sports betting as a spearhead. CEO Mitchell Rubin has done a bit of bloviating on where he expects Fanatics sports betting platforms to be. Marketed under various brands (Fanatics Sportsbook, PointsBet, Fan Experiences, PointsBet Casino) he says he expects Fanatics to emerge as #1 in sports betting in the years ahead.

Clearly considering that now, the combined share of market of the two sector leaders, (DKNG) and (OTCPK:PDYPY) (FanDuel), is above 75% it would be something of a stretch here. The combined head start and marketing heft of the leaders and just their casino giant tier two competitors (CZR), (MGM), (PENN) will provide big time pot holes on the road ahead for Fanatics to #1. FanDuel's UK parent, Flutter Entertainment is also planning a US IPO for FanDuel.

BetMGM sits right beneath the two leaders as the only competitor with a double-digit market share (~10%). But the top operators are all near, at, or well past the $1b annual revenue levels and moving ahead as they all slowly reduce their marketing spend and begin to turn profitable.

Fanatics has hired Matt King, former operating head at DraftKings to oversee its entry into the sports betting market who has a more realistic take on what's ahead,

"This is a ten year journey," he recently told investors. "We are going to move very methodically through a ten year journey. And by doing that and taking that approach, it allows you to be a bit more considered in your decisions. You can kind of move slower, slightly slower today, in order to move faster later."

That is a fair assessment of what lies ahead for Fanatics and specifically, opens a shaft of light for investors in the space to come shortly when the IPO becomes a reality.

So the question here is this: Just how critical a piece will a nascent sports betting unit be of the forward valuation of a publicly traded Fanatics? At this point with the size and pricing of such an issue it is of course impossible to know. But it is not impossible to suggest this:

As dominant revenue wise as the Fanatics sports merchandise business is, it is pretty clear that as the stock debuts it will mostly trade on prospects for its sports betting unit. It is the way of the world. Everyone understands that the sports merchandise business is solid. But the sale of team jerseys, caps, warm up jackets and their forward prospects aren't what will motivate investors. Sports betting will.

Instead, even though clearly, Fanatics sports betting business will start out tiny, it will be the engine that ignites the stock if and when the parameters of the public issue hit investors. Beginning with a $31b valuation pre-public issue, add the possibilities that under a Fanatics branding with its marketing power. Mix in the presumed 82m sports gear customers and the existing PB database bettors and, you get the elixir magic of a stock that could ignite quickly out of the box.

What's a realistic estimate of a Fanatics brand debut year?

Using our own data archives and projections joined with those of the American Gaming Association and Morgan Stanley, we are forecasting a CAGR of the sector of ~18.5% through to 2030. With variances input for black swan events, macroeconomic downturns, etc., we see a $20b market emerging by the end of the decade.

We know that sometime by mid-year next or before, the deal made between Disney's ESPN unit (DIS) and PENN Entertainment (PENN) to convert Penn's Barstool Sports Book brand customer base into an ESPN-branded platform is about to start. Fueled by an annual $150m marketing package, PENN will pay for ESPN advertising, editorial and overall brand presence will help scale the current Barstool revenue at a much faster pace than it did under its prior identity. It will be no magic leap, but it will complicate Fanatics' job at hand.

2023 projected sports betting online win: $7.62b. Nearly $6b of that amount will be won by the two market leaders with all other competitors fighting for what is left. In 2024, our best estimate now is hitting a range of ~$9b assuming a normalized annual hold in the long proven 7% range.

We think that assuming Fanatics can plant its brands in 17 states inside the existing PB landscape (including four new entries anticipated by next year) it can set a year one goal of a range of 4.5% to 5% share of market next year or ~$450m in revenue. While this would be crumb on the revenue table of the Fanatics sports gear business, it will have a big resonating impact on the perception of valuation of the stock.

The in and out strategy play

Investors can contemplate that the offering will project several scenarios that fall within a range of what the company will realistically expect to achieve over a span of out years for its sports betting business. We expect a well thought out series of scenarios here with revenue sprung from existing PB bettors plus the potential of converting a projected percentage of Fanatics wearable buyers to active punters. The company will benefit even as a late entry from the experience since 2018, both positive and negative for existing players in the space.

We don't expect anywhere near the level of marketing and promotional spend existing entities made during the early years of legalization when state after state was coming on board at a breakneck speed relative to past gaming legislation. They know how to avoid overspend, how to exploit existing databases. The most successful transformation of customers had been achieved by the two leaders who attacked their daily fantasy sports players immediately.

We can expect Fanatics marketing to first focus on its wearable customers. We'll see combined deals of signups with wearable awards across a vast database. We will also see initial measured media spend and team/league partnerships ramp quickly. Nobody ever suggests that there is any limit on the insatiable greed of leagues and teams for free money from sports betting apps. We can see how the proven merchandising skills of the sports wearable business can be adapted here.

And we can also see how, as it was since 2018, sports betting platforms can vastly chop up market shares from one great maw as they sign up and later on confront churn. It is here that the recruited teams at Fanatics will have to earn their pay. If as COO King has said, getting the company up to any leadership market share in sports betting will be a long journey.

That being said, we believe the IPO shares will take a similar trajectory of feeding into the pom-pom twirling side of investors in the space and as a result, get the stock on an early run. It won't be hard logic to present. Take a proven marketer with an immense sports mad customer base, give them a site built with cutting-edge features and watch the fast run-up of revenues begin to rise.

And in the wake of that, up will go the public issue until it comes down for air. At that point the idea is to get out at a preordained price target and wait for events to play out.

In other words, use the DKNG history: In at the open, ride it during the early skyrocket with early results, then take the money and run. Afterward, when the dust settles, decide if you want to come back in at a price reflecting a truer value based on a ceiling target that reflects real-world growth.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

For in-depth and deep dive research on the casino and gaming sector, subscribe to The House Edge. New: Free excerpts from our book in progress "The Smartest ever Guide to Gaming Stocks" - free to existing members and new subscribers.

This article was written by

For 30 years I held senior vp and exec VP positions in major casino hotel operations among them Caesars, Ballys, Trump Taj Mahal and have done extensive consulting assignments for many others in the US, including the native American property Mohegan Sun, in Connecticut. I have also done special projects for Caesars Palace in Las Vegas. I was the founder and publisher of Gaming Business Magazine, first ever publication covering the gaming industry and have written extensively about the industry.

MY INVESTMENT STRATEGY: Due to the necessities of my casino consulting business which encompasses many top gaming companies, I have placed my own gaming portfolio into a blind trust over ten years ago. At that time I instructed my money manager(who is a former industry colleague herself as well as a corporate lawyer and money manager) to follow my gaming investment strategy along these lines.

1. I am a value investor first. Knowing the industry in depth I am able to plumb opportunities and problems others cannot see. Mostly I like to identify price ranges over given periods where I believe the market is asleep and I can buy in at the lowest possible risk. 2. I am a strong believer in management quality. Knowing so many top people in the industry allows me to evaluate which ones I believe have the "right stuff" to move a stock and which are populated by corporate drones. 3. I have instructed my manager never to trade on sugar high spikes in earnings or news per se but use the "string theory" I have developed which in brief, follows a skein of news and earnings releases over set periods of time for each stock and then move in or out. 4. I have instructed her to keep the portfolio diverse with holdings in four basic areas: Casino stocks in Las Vegas, Macau and the regionals, gaming tech stocks with real moats not just cute apps.

I am pleased to announce that as of September 1, 2022 I am expanding my coverage to include entertainment stocks, a sector undergoing a massive revolution on many fronts. This has sprung loose many investment ideas in the space I expect to share with members. The coverage is added at no extra cost.

I have been involved in the entertainment sector as well for decades involved in overseeing show and events in my properties as well as independent productions. I currently sit on the board of privately held Atlas Media Corporation, one of America;s premium non-fiction producers of tv and film programming.

Overall I have done immensely well and share my views with SA readers and more specifically with strong recommendations and gaming stock strategy analysis based on my network of industry contacts for subscribers to my SA Premium Site: THE HOUSE EDGE.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.