Verona Pharma: De-Risked COPD Biotech Play, Approval Likely Coming Soon

Summary

- Verona Pharma has submitted a New Drug Application (NDA) for ensifentrine, a potential treatment for COPD, to the FDA.

- The FDA has a 60-day window to accept or reject the filing, with a potential approval date as early as January 2024.

- Verona Pharma's commercial strategy includes a swift launch in 1H24, building a sales team, and planning an EU launch by late 2024.

- We reiterate our buy rating moving into the Ensifentrine launch.

greenbutterfly

Reason for update: regulatory update and catalyst date

FDA Acceptance of Ensifentrine's NDA Filing

Verona Pharma (NASDAQ:VRNA) has recently completed its New Drug Application (NDA) submission for ensifentrine, a potential treatment for COPD. The U.S. Food and Drug Administration (FDA) has a 60-day clock to accept or reject this filing. Given the robust data and de-risked endpoints (FEV) used during the two Phase III ENHANCE trials, there is a high likelihood of the FDA accepting ensifentrine’s NDA. Acceptance would lead to the assignment of a PDUFA (Prescription Drug User Fee Act) date. We anticipate this to be in April 2024, following a regular review process. Should ensifentrine receive a Priority Review, this could fast-track the PDUFA date (potential approval date) to as early as January 2024.

| Date/Time frame | Event/Stage | Description |

|---|---|---|

| Present | NDA Submission | Verona Pharma completed its New Drug Application (NDA) submission to the FDA for ensifentrine as a treatment for COPD. |

| 60 days post submission | FDA Decision on NDA | The FDA will either accept or reject ensifentrine's NDA filing. Based on solid data from Phase III ENHANCE trials, acceptance is highly likely. |

| January 2024 (if Priority Review) | Potential PDUFA Date | If ensifentrine receives a Priority Review, the PDUFA date could be as early as January 2024. |

| April 2024 (if Regular Review) | Anticipated PDUFA Date | If ensifentrine goes through a regular review process, the expected PDUFA date is in April 2024. |

| TBD | AdCom Meeting | It's still uncertain if there will be an AdCom meeting before the PDUFA date. If it happens, the FDA will seek expert opinions on ensifentrine due to its unique mechanism. |

| 1H24 | US Launch | If approved, Verona Pharma plans a swift US launch of ensifentrine in the first half of 2024. |

| Late 2024 | EU Launch | The company is planning for the launch of ensifentrine in the European Union by the end of 2024. |

Note: This timeline is constructed based on the information provided and is subject to change as the FDA review progresses and as more details emerge regarding the EU regulatory process.

We remind readers that Ensifentrine, the company's flagship product, uniquely combines a long-acting muscarinic antagonist and a phosphodiesterase-4 inhibitor, aiming to enhance lung function and reduce COPD exacerbations. With its novel mechanism targeting airway smooth muscles and inflammatory cells, Ensifentrine offers a potential therapeutic breakthrough for those unresponsive to standard-of-care treatments that have been approved for decades. For a more detailed analysis of ensifentrine and the current market landscape, please read our previous article.

Company's pipeline overview (Company source )

AdCom Considerations

The AdCom (Advisory Committee) plays a crucial role in the FDA's decision-making process. It is still unclear whether there will be an AdCom meeting prior to the PDUFA date. The novelty of ensifentrine’s mechanism – being a PDE3 and PDE4 dual inhibitor – might prompt the agency to seek expert opinions. However, Verona's management remains optimistic about a smooth review process, possibly without an AdCom meeting. Based on previous interactions with the agency and the company, we believe the likelihood of an AdCom is relatively low, and even with the AdCom, considering the robustness of the available data on hand (size, endpoint selection, efficacy and safety data, and clear value proposition addressing the space), there is limited risk of any negative surprises.

Commercial Strategy and Launch of Ensifentrine

Should ensifentrine receive approval, a swift launch is anticipated in 1H24 based on what the company has been signaling around launch preparedness; for example, the company has expressed confidence in its manufacturing capacity to meet commercial-scale supply demands. Verona's commercial strategy includes building a sales team comprising 100 representatives to cater to the 14k specialists nationally, akin to strategies seen in asthma therapy launches. Of note, the company is planning an EU launch by late 2024.

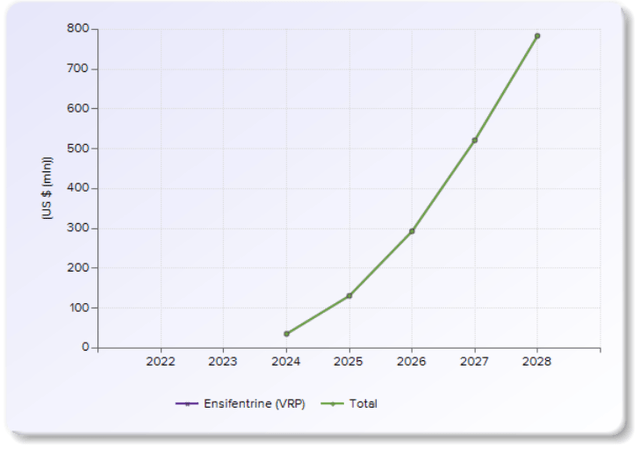

Evaluate consensus projection (Ensifentrine)

Based on the consensus numbers, the market seems to be valuing the drug's sales to reach close to $800m by 2028. Assuming that the drug reaches this, using a conservative peak sales multiple of 3 (conservative biotech multiple used across the industry), we see the target valuation should be >$2.4Bn just using this peak sales number, and the current valuation (~$1.3Bn EV) has a meaningful upside close to 100%.

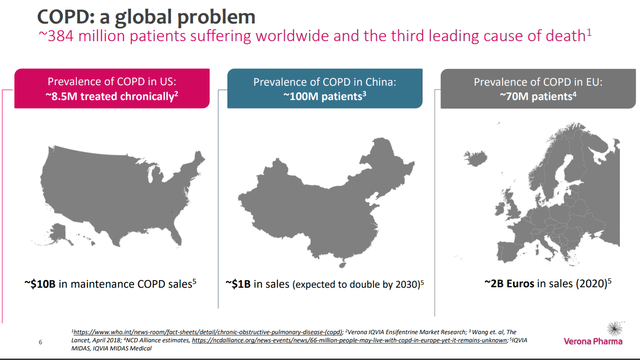

COPD Market size (Company source)

Robust Financials

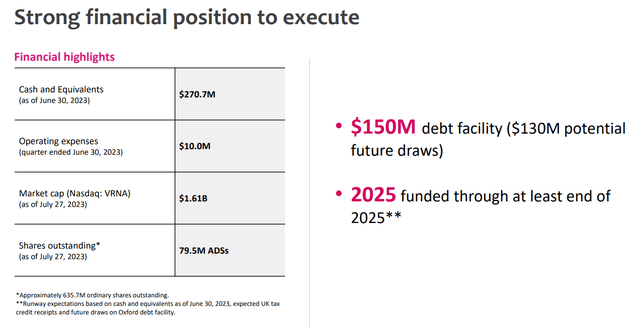

Verona - Financial q2 (Verona - Financial q2)

The company is guiding the cash runway until 2025, which is around two years of buffer, and would be after the drug launch, which is highly reassuring. Unless the approval gets delayed in the US, which we do not think is a likely scenario considering the clinical data on hand, we do believe the risk of potential near-term dilution remains low.

Risk Factors

While the prospects for ensifentrine seem promising, investors must consider potential risks. The FDA's decision, while anticipated to be positive, remains uncertain until the announcement. The potential for unforeseen adverse effects, production complications, and market acceptance are inherent risks in pharmaceutical ventures.

Conclusion

Verona Pharma presents a compelling investment opportunity, given the clear upcoming catalyst - the FDA's decision on ensifentrine's NDA filing. The robust data from the two pivotal trials and the potentially massive unmet need in the $10Bn COPD market (need for a novel target as the current standard of care drugs lose efficacy and patients usually rotate around different agents until they get refractory to all of them) that ensifentrine addresses suggest a high chance of approval. This, combined with a well-strategized commercial launch and robust cash runway, sets the stage for significant de-risked growth potential for VRNA. The risk/reward balance, especially given the recent stock pullback, seems favorable, positioning VRNA as a buy.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Biotechvalley Insights (BTVI) is not a registered investment advisor, and articles are not targeted toward retail investors. The content is for informational purposes only; you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained in our articles or comments constitutes a solicitation, recommendation, endorsement, or offer by Biotechvalley Insights or any third-party service provider to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction. The research and reports made available by BTVI reflect and express the opinion of the applicable BTVI entity as of the time of the report only. Reports are based on generally-available information, field research, inferences, and deductions through the applicable due diligence and analytical process. BTVI may use resources from brokerage reports, corporate IR, and KOL/expert interviews that may have a conflict of interest with the company/assets that BTVI covers. To the best of the applicable BTVI's ability and belief, all information contained herein is accurate and reliable, is not material non-public information, and has been obtained from public sources that the applicable BTVI entity believes to be accurate and reliable. However, such information is presented “as is” without warranty of any kind, whether express or implied. With respect to their respective research reports, BTVI makes no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results to be obtained from its use. Further, any analysis/comment contains a very large measure of analysis and opinion. All expressions of opinion are subject to change without notice, and BTVI does not undertake to update or supplement any reports or any of the information, analysis, and opinion contained in them.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)