Baytex Energy: Strong Oil Prices Push Projected H2 2023 FCF Above US$400 Million

Summary

- Baytex Energy is projected to generate US$426 million in 2H 2023 free cash flow.

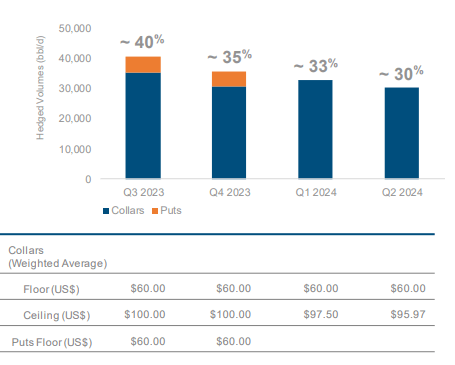

- It benefits from strong oil prices and narrower WCS differentials and has wide WTI oil collars with a ceiling of US$100.

- BTE may be able to put US$200 million towards share repurchases in 2H 2023.

- The estimated value has improved to US$5.50 at long-term $75 WTI oil, assuming narrower WCS differentials continue.

- Looking for more investing ideas like this one? Get them exclusively at Distressed Value Investing. Learn More »

zhengzaishuru

Baytex Energy (NYSE:BTE) closed on its acquisition of Ranger Oil in late June, resulting in increased production of approximately 155,000 BOEPD in 2H 2023. At current strip prices Baytex is now expected to generate US$426 million in free cash flow during the second half of 2023, benefiting from higher oil prices and reduced heavy oil differentials.

I now estimate Baytex's value at around CAD$7.45 (US$5.50) per share at long-term $75 WTI oil. This also assumes a US$15 WCS differential. Stronger near-term oil prices plus the improved heavy oil differentials have resulted in a 13% increase in my estimate of Baytex's value compared to March 2023.

This report uses US dollars unless otherwise indicated, as well as an exchange rate of US$1.00 to CAD$1.35.

Baytex's Assets And Capital Allocation

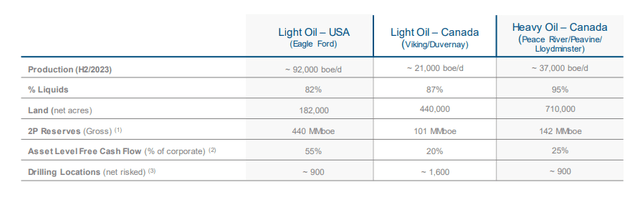

Baytex now has approximately 59% of its production and 55% of its asset level free cash flow coming from the Eagle Ford. The remaining 41% of Baytex's production and 45% of its asset level free cash flow comes from its Canadian operations. Baytex's Heavy Oil assets account for the majority of its Canadian production, although the margins are typically lower than its Light Oil assets due to the heavy oil differentials.

Baytex's Business Units (baytexenergy.com)

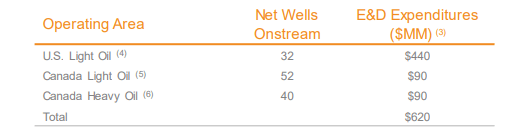

Baytex is currently putting approximately 70% of its 2H 2023 capex budget towards the Eagle Ford, with the remainder split between its Canadian Light Oil and Heavy Oil assets.

Baytex's Capex (baytexenergy.com)

Outlook For 2H 2023

Baytex expects production to average approximately 155,000 BOEPD in the second half of 2023. This includes full contribution from the Ranger Oil acquisition that closed late in Q2 2023.

Baytex's production mix during this period is expected to be 50% light oil, 22% heavy oil, 12% NGLs and 16% natural gas.

At current strip (including roughly $83 WTI oil) for the second half of 2023, Baytex is expected to generate $1.684 billion in revenues, inclusive of hedges. Baytex's oil collars are quite wide, so they won't affect Baytex's results unless oil prices move significantly from current levels.

Baytex's Hedges (baytexenergy.com)

Baytex is benefiting from relatively strong oil prices (with 72% of its production being oil) as well as relatively narrow heavy oil differentials. Baytex's heavy oil production may realize around $59 per barrel for 2H 2023, while its light oil production should realize over $80 per barrel.

Units | $ Per Unit | $ Million USD | |

Heavy Oil | 6,274,400 | $59.00 | $370 |

Light Oil | 14,260,000 | $82.00 | $1,169 |

NGLs | 3,422,400 | $22.00 | $75 |

Natural Gas | 27,379,200 | $2.60 | $71 |

Hedge Value | -$1 | ||

Total | $1,684 |

Baytex's royalty rate during the second half of the year may end up around 22.5% due to higher commodity prices and the higher royalty rates with the Ranger assets (compared to Baytex's Canadian assets). One of Ranger's presentations indicated a roughly 23% royalty rate.

Post-acquisition, Baytex's operating expenses may average around US$8.50 per BOE, while its 2H 2023 capital expenditures are expected to be around US$460 million.

$ Million USD | |

Royalties | $379 |

Operating Expenses | $242 |

Transportation | $44 |

General And Admin | $40 |

Cash Interest | $75 |

Capital Expenditures | $460 |

Leasing Expenditures | $7 |

Asset Retirement Obligations | $11 |

Total Expenses | $1,258 |

This leads to a projection of US$426 million in free cash flow for Baytex in 2H 2023. Baytex had mentioned expectations for around US$300 million in 2H 2023 free cash flow before, but that was at $75 WTI oil for the second half of the year.

Debt And Dividends

Baytex had 862.2 million common shares outstanding at the end of Q2 2023, and then repurchased 4.7 million common shares between July 1st to July 26th at an average price of CAD$4.59 (US$3.40) per share. This would have cost Baytex approximately US$16 million.

Baytex is paying a quarterly dividend of CAD$0.0225 (US$0.0167) per share on October 2 to shareholders of record on September 15, 2023. This is Baytex's first dividend since 2015 and currently adds up to around US$14 million per quarter.

Baytex reported having approximately US$2.11 billion in net debt at the end of Q2 2023. It may be able to reduce its net debt to US$1.9 billion by the end of 2023 if it puts 50% of its free cash flow towards its base dividend plus share repurchases.

Estimated Value

I am maintaining my view on long-term WTI oil prices at $75, but Baytex is benefiting from both improved near-term oil prices and narrower heavy oil differentials.

If WCS differentials can average US$15.00, then I'd now value Baytex at approximately CAD$7.45 (US$5.50) per share in a long-term $75 WTI oil scenario. This also assumes that commodity prices follow the current strip (including $80 WTI oil) for 2024, before returning back to long-term commodity prices.

Conclusion

Baytex Energy is now expected to generate over US$400 million in free cash flow in the second half of 2023 as its production has increased to 155,000 BOEPD after its acquisition of Ranger Oil. Baytex also has wide collars for oil hedges and thus is fully benefiting from improved near-term oil prices, while WCS differentials have also narrowed.

I now estimate Baytex's value at CAD$7.45 (US$5.50) per share at long-term $75 WTI oil, also assuming that WCS differentials can average US$15 going forward.

Free Trial Offer

We are currently offering a free two-week trial to Distressed Value Investing. Join our community to receive exclusive research about various energy companies and other opportunities along with full access to my portfolio of historic research that now includes over 1,000 reports on over 100 companies.

This article was written by

Elephant Analytics has also achieved a top 50 score on the Bloomberg Aptitude Test measuring financial aptitude (out of nearly 200,000 test takers). He has also achieved a score (153) in the 99.98th percentile on the WAIS-III IQ test and has led multiple teams that have won awards during business and strategy competitions involving numerical analysis. In one such competition, he captained his team to become North American champions, finishing ahead of top Ivy League MBA teams, and represented North America in the Paris finals.

Elephant Analytics co-founded a company that was selected as one of 20 companies to participate in an start-up incubator program that spawned several companies with $100+ million valuations (Lyft, Life360, Wildfire). He also co-founded a mobile gaming company and designed the in-game economic models for two mobile apps (Absolute Bingo and Bingo Abradoodle) with over 30 million in combined installs.

Legal Disclaimer: Elephant Analytics' reports, premium research service and other writings are personal opinions only and should not be considered as investment advice. Only registered investment advisors can provide personalized investment advice. While Elephant Analytics attempts to provide reports that include accurate facts, investors should do their own diligence and fact checking prior to making their own decisions.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in BTE, BTE:CA over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.