Weekly Closed-End Fund Roundup: Tortoise Tender Offers Announced (August 27, 2023)

Summary

- 9 out of 22 CEF sectors positive on price and 12 out of 22 sectors positive on NAV.

- Tortoise tender offers are announced.

- Tender offers are part of the funds' discount management program.

your_photo

The Weekly Closed-End Fund Roundup will be put out at the start of each week to summarize recent price movements in closed-end fund [CEF] sectors in the last week, as well as to highlight recently concluded or upcoming corporate actions on CEFs, such as tender offers. Data is taken from the close of August 25th, 2023.

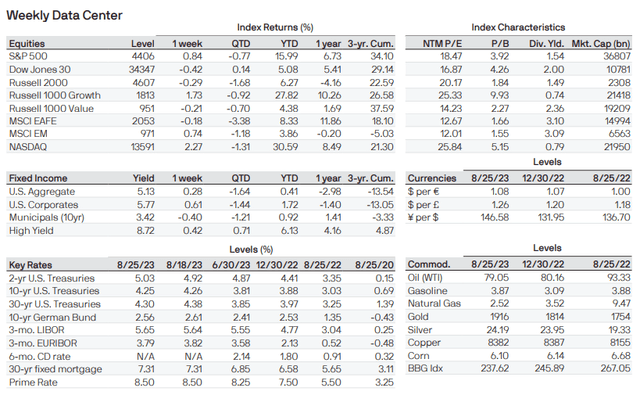

JPMorgan releases a nice Weekly Market Recap every week. These are the key index levels this week for equities:

Weekly performance roundup

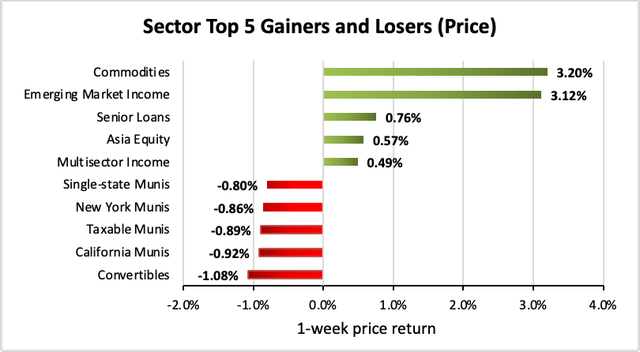

For CEFs, 9 out of 22 sectors were positive on price (up from 0 last week) and the average price return was +0.15% (down from -2.30% last week). The lead gainer was Commodities (+3.20%) while Convertibles lagged (-1.08%).

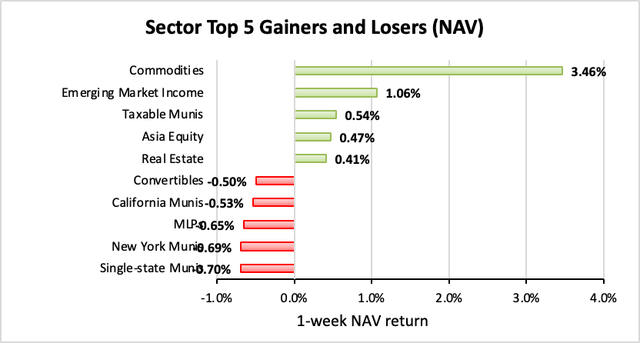

12 out of 22 sectors were positive on NAV (up from 0 last week), while the average NAV return was +0.16% (up from -0.07% last week). The top sector by NAV was Commodities (+3.46%) while the weakest sector by NAV was Single-state Munis (-0.70%).

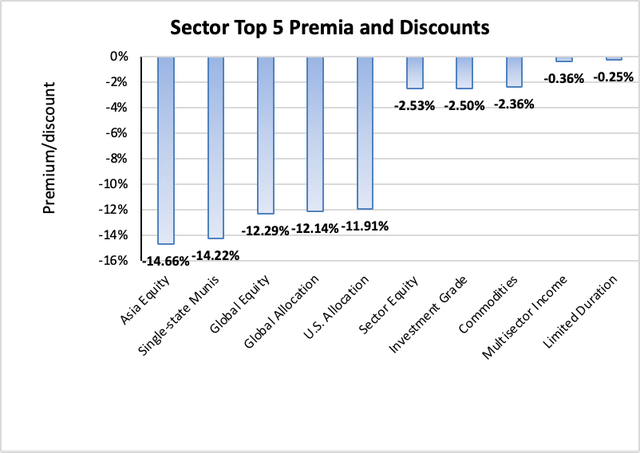

The sector with the highest premium was Limited Duration (-0.25%), while the sector with the widest discount is Asia Equity (-14.66%). The average sector discount is -7.70% (down from -1.90% last week).

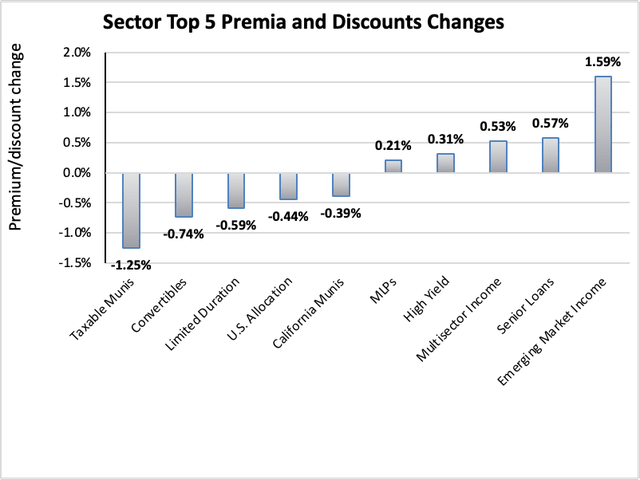

The sector with the highest premium/discount increase was Emerging Market Income (+1.59%), while Taxable Munis (-1.25%) showed the lowest premium/discount decline. The average change in premium/discount was -0.09% (up from -0.44% last week).

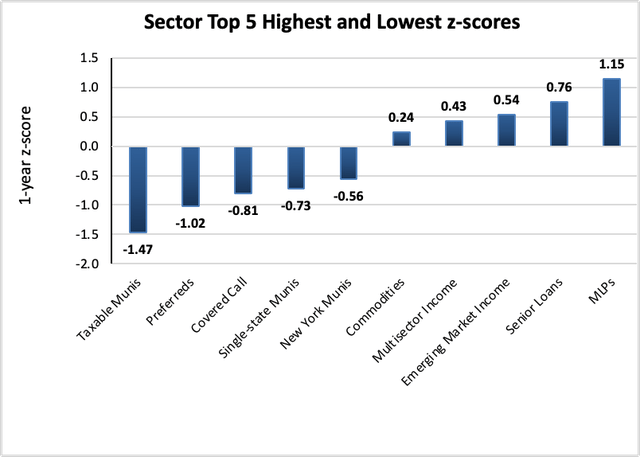

The sector with the highest average 1-year z-score is MLPs (+1.15), while the sector with the lowest average 1-year z-score is Taxable Munis (-1.47). The average z-score is -0.18 (down from -0.14 last week).

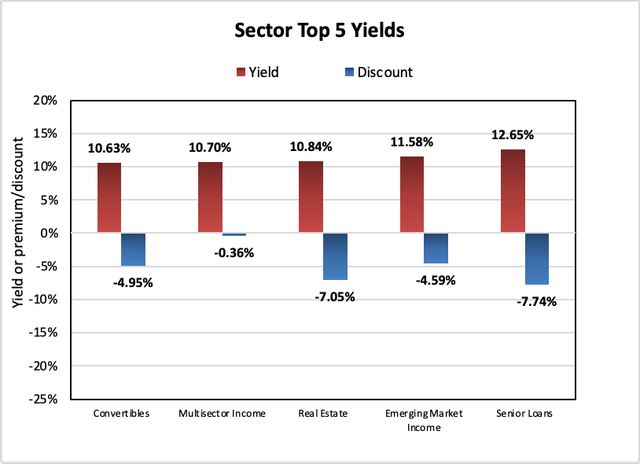

The sectors with the highest yields are Senior Loans (+12.65%), Emerging Market Income (+11.58%), and Real Estate (+10.84%). Discounts are included for comparison. The average sector yield is +8.30% (down from +8.37% last week).

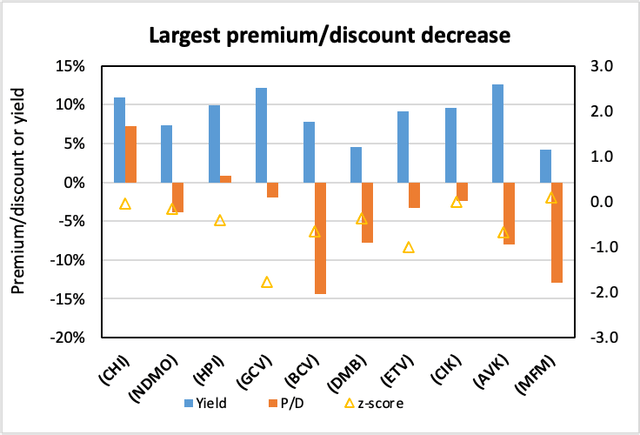

Individual CEFs that have undergone a significant decrease in premium/discount value over the past week, coupled optionally with an increasing NAV trend, a negative z-score, and/or are trading at a discount, are potential buy candidates.

| Fund | Ticker | P/D decrease | Yield | P/D | z-score | Price change | NAV change |

| Calamos Convertible Opp Inc | (CHI) | -3.70% | 10.94% | 7.20% | -0.1 | -4.23% | -2.46% |

| Nuveen Dynamic Municipal Opportunities | (NDMO) | -3.12% | 7.32% | -3.88% | -0.2 | -3.69% | 2.44% |

| JHancock Preferred Income | (HPI) | -2.82% | 9.90% | 0.81% | -0.4 | -2.67% | 0.87% |

| Gabelli Conv Inc Secs | (GCV) | -2.64% | 12.11% | -1.90% | -1.8 | -2.86% | -0.45% |

| Bancroft Fund | (BCV) | -2.61% | 7.76% | -14.43% | -0.7 | -2.83% | -0.94% |

| BNY Mellon Muni Bond Infrastructure Fund | (DMB) | -2.57% | 4.57% | -7.81% | -0.4 | -3.49% | 0.00% |

| Eaton Vance Tax-Managed Buy-Write Opp | (ETV) | -2.56% | 9.16% | -3.27% | -1.0 | -2.28% | -1.88% |

| Credit Suisse Asset Mgmt Income | (CIK) | -2.45% | 9.54% | -2.45% | 0.0 | -0.35% | -1.28% |

| Advent Convertible & Income Fund | (AVK) | -2.44% | 12.61% | -8.00% | -0.7 | -2.28% | -0.36% |

| MFS Municipal Income | (MFM) | -2.32% | 4.20% | -12.89% | 0.1 | -3.10% | 1.49% |

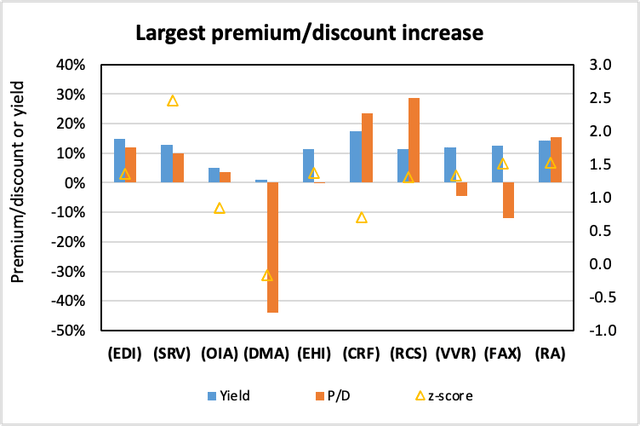

Conversely, individual CEFs that have undergone a significant increase in premium/discount value in the past week, coupled optionally with a decreasing NAV trend, a positive z-score, and/or are trading at a premium, are potential sell candidates.

| Fund | Ticker | P/D increase | Yield | P/D | z-score | Price change | NAV change |

| Virtus Stone Harbor Emg Mkts Total Inc | (EDI) | 5.49% | 14.95% | 11.93% | 1.4 | 6.44% | -1.69% |

| NXG Cushing Midstream Energy Fund | (SRV) | 5.28% | 12.79% | 9.86% | 2.5 | 4.77% | -3.84% |

| Invesco Municipal Inc Opp I | (OIA) | 4.11% | 5.05% | 3.45% | 0.8 | 3.62% | -1.77% |

| Destra Multi-Alternative | (DMA) | 3.83% | 0.90% | -43.99% | -0.2 | 7.31% | -1.04% |

| Western Asset Global High Income | (EHI) | 3.04% | 11.28% | -0.28% | 1.4 | 1.57% | -3.81% |

| Cornerstone Total Return Fund | (CRF) | 2.58% | 17.55% | 23.57% | 0.7 | 3.08% | -1.26% |

| PIMCO Strategic Income Fund | (RCS) | 2.57% | 11.31% | 28.81% | 1.3 | 2.27% | 0.00% |

| Invesco Senior Income | (VVR) | 2.46% | 11.88% | -4.37% | 1.3 | 3.14% | -0.27% |

| abrdn Asia-Pacific Income Fund Inc | (FAX) | 2.23% | 12.45% | -11.96% | 1.5 | 1.92% | -0.92% |

| Brookfield Real Assets Income Fund Inc. | (RA) | 2.18% | 14.19% | 15.27% | 1.5 | 2.12% | -1.02% |

New!

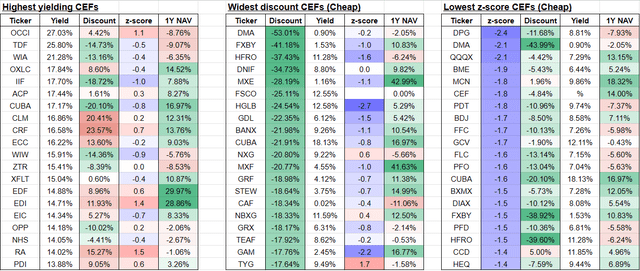

From our screener, here are the CEFs with the highest yields, widest discounts, and lowest 1-year z-scores:

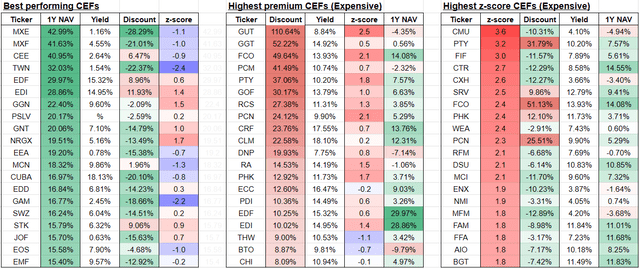

From our screener, here are the CEFs with the best 1-year performance, highest premiums, and highest 1-year z-scores:

Recent corporate actions

These are from the past month. Any new news in the past week has a bolded date:

July 31, 2023 | Nuveen Floating Rate Income Fund Announces Completion of Mergers and Distribution Increase. The mergers of Nuveen Senior Income Fund (Nuveen Senior Income Fund (NSL) Stock Price Today, Quote & News), Nuveen Floating Rate Income Opportunity Fund (Nuveen Floating Rate Income Opportunity Fund (JRO) Stock Price Today, Quote & News), and Nuveen Short Duration Credit Opportunities Fund (Nuveen Short Duration Credit Opportunity Fund (JSD) Stock Price Today, Quote & News) into Nuveen Floating Rate Income Fund (Nuveen Floating Rate Income Fund (JFR) Stock Price Today, Quote & News) Stock Price Today, Quote & News) Stock Price Today, Quote & News) were successfully completed prior to the opening of the New York Stock Exchange on July 31, 2023. The fund's newly consolidated portfolio contains approximately $2 billion in investments-the largest among listed senior loan closed-end funds. Through the mergers, a wholly-owned subsidiary of JFR acquired approximately all of the assets and liabilities of NSL, JRO, and JSD in tax-free transactions, and common shares of NSL, JRO, and JSD were converted to newly-issued common shares of JFR in an aggregate amount equal to the value of the net assets of NSL, JRO, and JSD. The transactions took place based upon NSL's, JRO's, JSD's, and JFR's closing net asset values on July 28, 2023. The exchange ratios at which common shares of NSL, JRO, and JSD were converted to common shares of JFR are listed below:

Ticker

Fund Name

Exchange

Ratio

NSL

Nuveen Senior Income Fund

0.58066176

JRO

Nuveen Floating Rate Income Opportunity Fund

0.98666856

JSD

Nuveen Short Duration Credit Opportunities Fund

1.45917932

In addition, JFR has declared the following monthly distribution. The distribution represents an increase over the previous month of 14%. [Initial merger proposal] [Shareholder approval announcement]

Upcoming corporate actions

These are from the past month. Any new news in the past week has a bolded date:

August 16, 2023 | Tortoise Announces Tender Offers for its Closed-End Funds.

August 14, 2023 | Western Asset Managed Municipals Fund Inc., Western Asset Municipal Partners Fund Inc., Western Asset Intermediate Muni Fund Inc. Announce Results of Stockholder Votes at Special Meeting of Stockholders Relating to Proposed Mergers.

July 10, 2023 | Virtus Stone Harbor Emerging Markets Total Income Fund Announces Distributions; Provides Update on Pending Merger.

June 20, 2023 | Tekla Capital Management LLC Announces Proposed Transaction.

April 24, 2023 | Kayne Anderson Energy Infrastructure Fund and Kayne Anderson NextGen Energy & Infrastructure Announce Updated Terms for Proposed Merger.

April 13, 2023 | Nuveen Preferred Closed-End Funds Announce Proposed Mergers.

March 22, 2023 | Board of First Trust Dynamic Europe Equity Income Fund Approves Conversion into an ETF.

Recent activist or other CEF news

These are from the past month. Any new news in the past week has a bolded date:

July 17, 2023 | Vertical Capital Income Fund Announces Appointment of Carlyle as Investment Manager and Rebrand to Carlyle Credit Income Fund.

------------------------------------

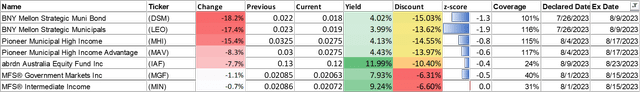

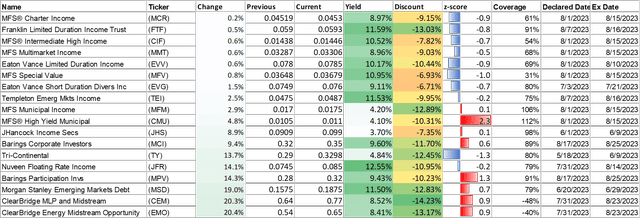

Distribution changes announced this month

These are sorted in ascending order of distribution change percentage. Funds with distribution changes announced this month are included. Any distribution declarations made this week are in bold. I've also added monthly/quarterly information as well as yield, coverage (after the boost/cut), discount and 1-year z-score information. I've separated the funds into two sub-categories, cutters and boosters.

Cutters

Boosters

Commentary

1. Tortoise Tender Offers

Tortoise has announced the final set of tender offers as part of its discount management program for their set of CEFs. The funds are:

- Tortoise Energy Infrastructure Corp. (TYG)

- Tortoise Midstream Energy Fund, Inc. (NTG)

- Tortoise Pipeline & Energy Fund, Inc. (TTP)

- Tortoise Energy Independence Fund, Inc. (NDP)

- Tortoise Power and Energy Infrastructure Fund, Inc. (TPZ)

Tender offers are beneficial to investors is because they allow cashing out of a CEF close to NAV. With all of these midstream/infrastructure funds trading at deep discounts, this represents an instant profit on part of one's holdings. Moreover, since the shares are being repurchased at a slight discount to NAV, there is a small accretive effect to the NAV/share as well.

The reason that CEF managers usually don't willingly conduct tender offers is because they reduce AUM and hence fee income. Thus, the fact that Tortoise is conducting these offers voluntarily, rather than being strong-armed into doing in reaction to activist pressure, is a sign of management alignment with shareholders, in my opinion. (This is notwithstanding the fact that some of the Tortoise funds are now being targeted by Saba, but the discount management program was established before then).

In the last round of tenders, the pro-ration factors ranged from between -8.98% to -11.45%. We own NTG in our Tactical Income-100 portfolio, and intend to fully tender our shares. The tender offers are for 5% of outstanding shares at 98% of NAV. If more than 5% of shareholders tender their shares, the proportion of shares accepted will be pro-rated. This means that if one elects to tender all of their shares, a minimum of 5% of shares will be accepted, but possibly more depending on how many other shareholders tender. For example, if 50% of shareholders tender, then 10% of an investor's shares will be accepted for repurchase.

The tender offers are expected to commence on or around October 2, 2023. Our recommendation for anyone holding any of the Tortoise funds is to tender all of your shares. Remember to inform your broker of your decision to tender (preferably a few days in advance of the expiry date as some brokers may have earlier internal deadlines), as the default action is to not tender.

Moreover, in the unlikely event that NTG or the other CEFs trade higher than a -2% discount (i.e., narrower than a -2% discount or at a premium), then one should not tender as you would get a better price by selling on the open market.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Don't know what to do about CEF corporate actions?

Closed-end funds news and recommendations are now exclusive to members of CEF/ETF Income Laboratory. We also manage closed-end fund (CEF) and exchange-traded fund (ETF) portfolios targeting safe and reliable ~8% yields to make income investing easy for you. Check out what our members have to say about our service.

To see all that our exclusive membership has to offer, sign up for a free trial by clicking on the button below!

This article was written by

CEF/ETF Income Laboratory is a premium newsletter on Seeking Alpha that is focused on researching profitable income and arbitrage ideas with closed-end funds (CEFs) and exchange-traded funds (ETFs). We manage model safe and reliable 8%-yielding fund portfolios that have beaten the market in order to make income investing easy for you. Check us out to see why one subscriber calls us a "one-stop shop for CEF research.”

Click here to learn more about how we can help your income investing!

The CEF/ETF Income Laboratory is a top-ranked newsletter service that boasts a community of over 1000 serious income investors dedicated to sharing the best CEF and ETF ideas and strategies.

Our team includes:

1) Stanford Chemist: I am a scientific researcher by training who has taken up a passionate interest in investing. I provide fresh, agenda-free insight and analysis that you won't find on Wall Street! My ultimate goal is to provide analysis, research and evidence-based ways of generating profitable investing outcomes with CEFs and ETFs. My guiding philosophy is to help teach members not "what to think", but "how to think".

2) Nick Ackerman: Nick is a former Financial Advisor and has previously qualified for holding Series 7 and Series 66 licenses. These licenses also specifically qualified him for the role of Registered Investment Adviser (RIA), i.e., he was registered as a fiduciary and could manage assets for a fee and give advice. Since then he has continued with his passion for investing through writing for Seeking Alpha, providing his knowledge, opinions, and insights of the investing world. His specific focus is on closed-end funds as an attractive way to achieve income as well as general financial planning strategies towards achieving one’s long term financial goals.

3) Juan de la Hoz: Juan has previously worked as a fixed income trader, financial analyst, operations analyst, and economics professor in Canada and Colombia. He has hands-on experience analyzing, trading, and negotiating fixed-income securities, including bonds, money markets, and interbank trade financing, across markets and currencies. He is the "ETF Expert" of the CEF/ETF Income Laboratory, and enjoys researching strategies for income investors to increase their returns while lowering risk.

4) Dividend Seeker: Dividend Seeker began investing, as well as his career in Financial Services, in 2008, at the height of the market crash. This experience gave him a lot of perspective in a short period of time, and has helped shape his investment strategy today. He follows the markets passionately, investing mostly in sector ETFs, fixed-income CEFs, gold, and municipal bonds. He has worked in the Insurance industry in Funds Management, helping to direct conservative investments for claims reserves. After a few years, he moved in to the Banking industry, where he worked as a junior equity and currency analyst. Most recently, he took on an Audit role, supervising BSA/AML Compliance teams for one of the largest banks in the world. He has both a Bachelors and MBA in Finance. He is the "Macro Expert" of the CEF/ETF Income Laboratory.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NTG, RA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (3)

Here: www.google.com/...RA is 80% bonds that’s not infrastructure, MLPA is infrastructure.