BND: Why Bonds May Crash Soon - A Deep Dive Into Inflation

Summary

- Summer saw increased volatility in financial markets, with stocks and bonds declining while commodities rose.

- If BND breaks below its $70 support level, stocks and bonds may crash together as the market enters further stagflation.

- Services inflation is around 6.1%, indicating inflation has only declined due to lower commodity prices.

- Based on services inflation, the US economy has consistently stagnated since Q3 of 2021, better reflecting the economic attitudes of most households and small businesses.

- Assuming commodity prices stagnate or rise, the official CPI inflation level should increase over the coming months, creating a critical bearish catalyst for BND.

Torsten Asmus

August saw an increase in volatility across asset classes in the financial market. The general trend was similar to during the drawdowns in early 2022; stocks and bonds declined while commodities rose. The uncommon positive correlation between stocks and bonds has continued to persist, as both are weighed down by the inflationary and interest rate impacts caused by higher commodity prices.

In my view, one of the most telling signals for financial markets will likely be actions in the bond market, as seen in the broad low-risk bond ETF, Vanguard Total Bond Market Index Fund ETF (NASDAQ:BND). I have held a bearish view on BND since mid-2020, covering the ETF last in June following the debt ceiling deal. Since then, the bond market has seen slight declines, with BND pushing against its support level of around $70 as long-term interest rates break to new highs. While I have been expecting another increase in long-term rates, the trend's rebound shocked many, creating increased strain on stocks - particularly those impacted by mortgage rates.

The last two weeks of August saw a reversal of this bearish trend, with stocks and bonds bouncing up and crude oil seeing a slight retracement. In my view, this situation creates a significant opportunity, either signifying a general end to the "interest-rate & inflation" issue or its ill-timed return. This return is "ill-timed" because interest rates and inflation usually fall as the economic outlook slows. It is, to me, a fact that the economy is slowing (however, the extent to which can be debated); should inflation and long-term interest rates rise despite the slowing economy, there could be tremendous implications for financial markets. In other words, if BND breaks below the $70 level and continues lower, I expect a rapid unwind in stocks and bonds. Conversely, if the bond market rebounds from its low level, I believe stocks and bonds may remain safe or positive for some time.

"True" Inflation is Around 6.1% Today

Firstly, we must consider that the economy is not operating in a standard paradigm due to the enormous volatility created in 2020. During that year, the economy slowed exceptionally quickly. Still, it rebounded fast due to the "back and forth" switching from mandated lockdowns, generally leading to much lower production levels that have only recently normalized. Further, extreme money-supply creation and stimulus have added to the supply-side inflationary pressures, artificially creating economic demand through temporary but significant increases in personal income levels. Today, all of that stimulus is coming out of the economy as the Federal Reserve slowly allows its balance sheet to decline. Short-term borrowing costs are also much higher than usual to slow inflation created in 2020-2021.

In the future, inflation will be essential for BND's performance because long-term interest rates are susceptible to inflation expectations. BND's yield-to-maturity is 4.8%, with a weighted average maturity of 8.9 years and a third of its holdings in corporate bonds (two-thirds in Treasuries). Mostly, these securities are not priced for high inflation levels. The current 10-year Treasury "inflation breakeven" rate is 2.24%, meaning the bond market is pricing for 2.24% average inflation over the next ten years. The typical level is 2% (the Fed inflation target), so bonds are fundamentally not expecting inflation to remain abnormally high for long. This measure strongly correlates to oil prices because that commodity is outside the Federal Reserve's control. See below:

The reality is that most inflationary factors are susceptible to oil prices. One of the most significant components of the CPI is energy itself; however, prices for food, clothes, and virtually all goods are also tied directly to oil prices because transportation costs are the greatest total production cost for almost all manufactured goods today. When human labor was more of a necessity in the past, oil (and natural gas) may not have been as essential, but today, oil and other energy costs are the primary supply-chain input costs.

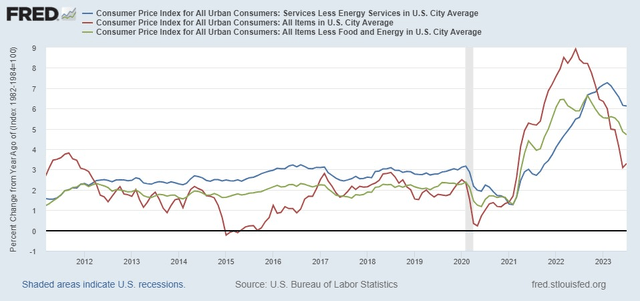

Thus, "official" CPI inflation is around 3.3%, not far above the Fed's 2% target and the 2.24% target in the bond market. However, core inflation, which excludes food and energy, is still much higher at ~4.85%. To me, even core inflation is too oil-sensitive because manufactured goods primarily use energy (oil or electricity) to manufacture and transport raw materials to the end buyer. With that in mind, I believe the "most accurate" inflation measure is "services inflation excluding energy services" because that is primarily focused on human labor costs, which are far less correlated to energy prices. See below:

Consumer Price Indices (Federal Reserve Economic Database)

In my view, services inflation is "true" inflation, as a measure of fundamental economic trends, because it is the least exposed to changes in commodity prices. Of course, higher food and fuel costs slowly push wages higher, creating higher service prices; however, the relationship is a few steps removed and indirect compared to goods-centric inflation measures. Based on services prices, inflation is still around 6.1% today, only 1% below its peak level and not falling as nearly as quickly as the commodity-sensitive inflation measures.

Significantly, services prices consistently rose faster than others throughout most of the 2010s. Commodity prices were extremely low during this period due to overproduction, leading to very low inflation. However, as services, such as rent, healthcare, and other costs, rose faster than inflation, most households have had to spend far more on services than goods, potentially explaining why people "feel" inflation is higher than the official numbers suggest.

Investors, analysts, and most people would benefit from understanding services inflation because it fills the gap on many disconnects in the economic data today. For example, the "real GDP" (i.e., "the economy") contracted in 2022 is enough to signify a recession typically. Still, it may grow as fast as 5.6% today - an extremely high real economic growth level. Of course, most working Americans probably do not feel the economy is booming, likely because "services-based real GDP" has been consistently stagnating since Q3 of 2021. In other words, the economy appears to be increasing because commodity prices have fallen considerably since early 2022. This GDP measure is not falling fast but signifies a prolonged, gentle, but prolonged "recession-like" trend experienced by many households and small businesses today.

Inflation Will Spike If Oil Rebounds

BND's price trend will fundamentally depend on official CPI inflation, so if commodity prices fall further, we can expect bond yields will not rise. Given the inflation breakeven rate, CPI inflation must consistently fall to around 2-3% for BND to be reasonably priced. If CPI inflation fails to fall that far, BND will likely fall further as long-term rates adjust for prolonged higher inflation. Based on non-commodity inflation (services inflation), fundamental inflation is still around 6.1% today and has hardly budged despite the Federal Reserve's efforts. Thus, if commodity prices remain flat or rise, then I believe it is likely that the broader consumer price index will see a sharp rebound.

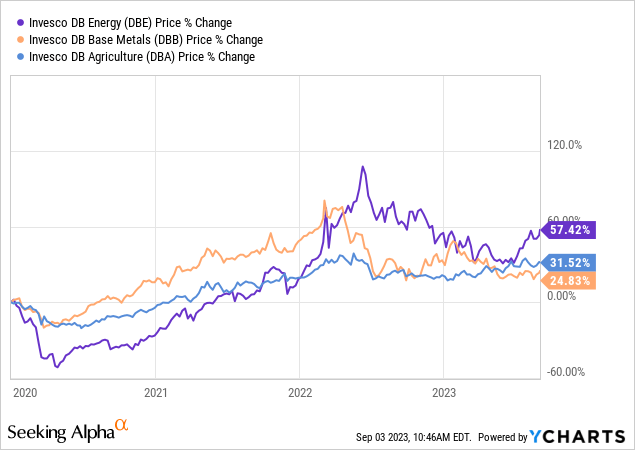

For the most part, commodity prices are floating around late 2021 levels, near "support" zones held since then. Energy commodities have recently seen a sharp upward rebound, almost certainly promoting a rise in inflation measures over the coming months (note: there is some lag between energy futures and realized consumer prices). Base metals are around support levels and probably will not rise significantly due to China's property market woes. Agricultural commodity prices are always a wildcard due to their relationship with the weather but may increase due to the Ukraine-Russia grain deal fiasco. See below:

Of these commodities, energy prices have the most significant impact on inflation, with agricultural commodities being a material secondary factor. As detailed in "USO: The Next Oil Bull Market May Have Begun," many supply-side factors could cause energy commodities to rebound even if economic demand slows - mainly due to the end of the Strategic Petroleum Reserve release. Obviously, that could create a huge positive factor for inflation levels. However, inflation may still rebound even if oil and gas remain flat because CPI inflation is being heavily weighed down by ~17% YoY deflation in consumer energy prices. As long as energy prices do not continue to fall, that level will return to 0% YoY, likely causing overall CPI inflation to rise toward services inflation of ~6%.

While my discussion may seem to be nitpicking on how the CPI is measured, I believe this specific issue will significantly impact BND's performance over the coming year. By and large, investors expect inflation to continue to decline due to the Fed's measures. However, the data suggests that inflation is only low due to the decline in commodity prices, led by improved supplies, much of which was from a release of stored "emergency" oil. As investors realize that inflation should rebound as that beneficial factor ends, I expect the long-term bonds in BND will re-price lower to account for higher inflation levels. BND's "duration" is 6.5X, so a 1% increase in its long-term inflation outlook should cause it to lose around 6.5% in value.

Credit Spreads Likely Underpriced

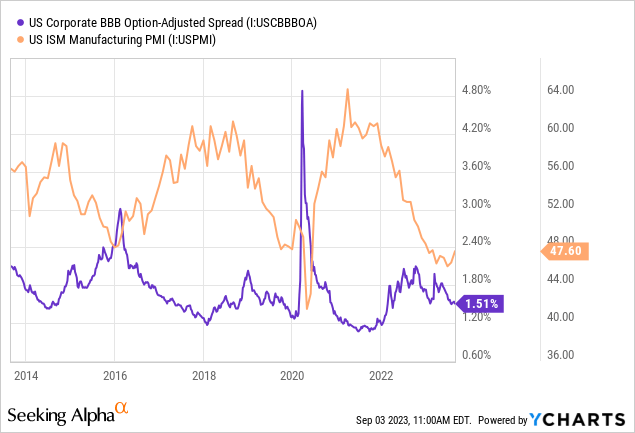

Two-thirds of BND is in Treasuries while a third is in corporate bonds, all of which are investment grade, with most having A to BBB credit ratings near the "bottom of the top" of the corporate credit risk ladder. These bonds typically pay a 1-3% premium to Treasuries of an equivalent maturity. That "spread" usually rises with economic risk since that causes corporate bond downgrades. A decent correlation exists between the manufacturing PMI (an economic growth indicator) and corporate credit spreads. However, corporate credit spreads are very low today compared to the negative PMI growth outlook. See below:

If the PMI is below 50, US manufacturing companies are seeing a slowdown in business activity. The current measure is around the lowest level since 2008, excluding the lockdown-generated crash in 2020. The corporate credit spread did rise as the PMI began to fall, but spreads are still below normal despite a fundamentally negative manufacturing outlook. To me, this indicates that corporate bonds are overpriced due to excess demand for investment products, failing to account for the economic risks in those bonds. In my view, this is a secondary negative factor that could harm BND's value over the coming year.

Beware The Yield Curve "Re-Steepening"

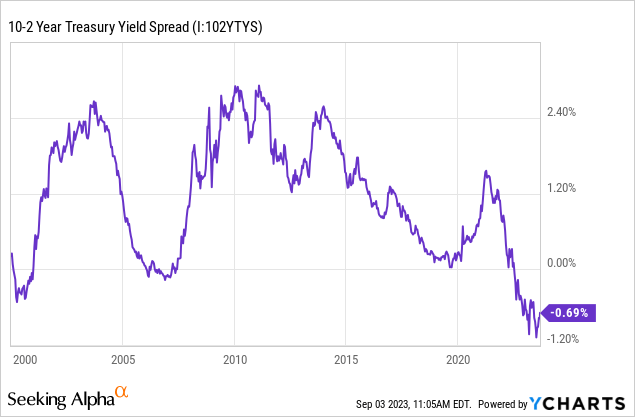

The final bearish factor for BND is the potential rise in the yield curve. The yield curve is very inverted today, usually indicating economic stagnation; however, stock market crashes and recessions do not usually occur until sometime after curve inversion happens, averaging around fifteen months. The curve inverted in July of 2022, fourteen months ago - implying we're in a prime time for a recessionary crash. See below:

Most often, the yield curve rapidly steepens during the crash as the Federal Reserve reduces its interest rate outlook due to disinflation-created recessions. Long-term rates are comparably less sensitive to recessions than short-term rates driven by Federal Reserve management. However, despite historically very high recession odds, the Fed is not keen on cutting rates, likely because fundamental inflation levels are well above their target.

Accordingly, a re-steeping of the yield curve would cause BND to decline as long-term rates slowly rise above short-term. If the curve increases back to its ~1.2% average without the discount rate being cut, BND's yield will increase by around 1.9% (based on the yield curve's -70bps level today), likely causing BND to lose about 12% of its value based on its duration risk. The "yield-curve" risk factor in BND is tied to the "inflation risk" factor detailed above; however, if the curve steepens while the inflation outlook increases, BND may lose around 20% of its value as its yield rises by ~3% or more.

The Bottom Line

Overall, I remain bearish on BND and believe it will continue to lose value over the coming year. My core thesis, as it has since mid-2020, continues to be that the market is underpricing inflation risks - due to a generally poor understanding of inflation from most economic analysts, including Federal Reserve officials. In my opinion, most understand inflation based on outdated economic models made <1980. Since then, the expansion of technology in the supply chain has caused inflation to be more commodity supply-sensitive (as machines replace human labor), meaning the Fed's ability to influence inflation with interest rates is much lower than they believe. It also means the relationship between unemployment and inflation is much weaker than it used to be (Phillips curve).

This issue creates a bearish potential for BND and stocks, which may be overpriced due to the "bad news is good news" relationship between economic data and interest rate reduction hopes. Assuming lower economic demand does not mean lower inflation (for the reasons above), bad news is bad news because poor economic data will not promote the same level of disinflation as it had in decades past. Indeed, a slower economy may increase inflation because it may push the US dollar's value lower, increasing import costs - a significant issue since the US trade deficit has expanded dramatically.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (2)