SCHG: The No-Brainer ETF I'm Looking To Buy On Weakness

Summary

- I'm considering a shift from growth to value stocks amid recent growth stock outperformance due to declining inflation and expected Fed rate actions.

- The Schwab U.S. Large-Cap Growth ETF stands out as a top growth investment option, offering diversification and cost efficiency, especially for those seeking technology exposure.

- Concerns of overvaluation and potential headwinds for growth stocks like rising inflation and interest rates prompt me to monitor SCHG and consider deploying cash strategically for a more balanced portfolio.

- Looking for more investing ideas like this one? Get them exclusively at iREIT on Alpha. Learn More »

Dragon Claws/iStock via Getty Images

Introduction

Whenever I plan future investments, I tend to plan as far ahead as I can without having to rely on low-probability events.

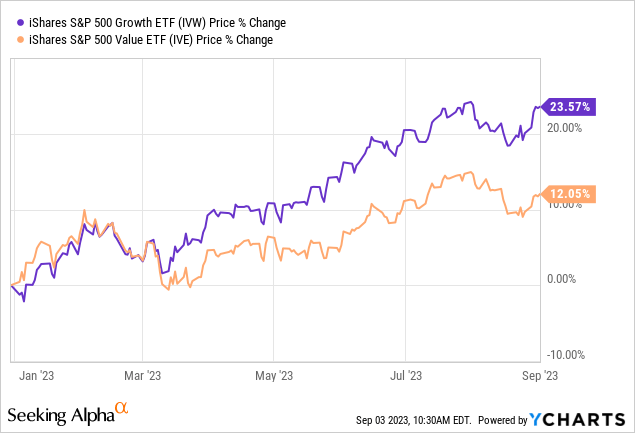

Right now, I'm planning for a rotation from growth to value after value stocks have lagged growth stocks by a wide margin since the start of this year.

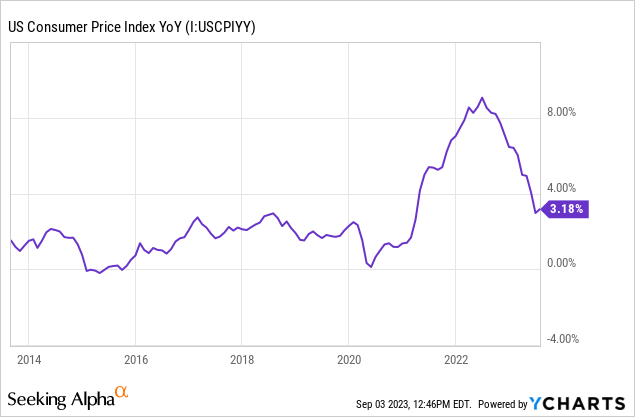

This outperformance is a result of a steep decline in inflation and the hope that the Fed will soon stop hiking while benefiting from a potential soft landing to slowly cut rates in the future.

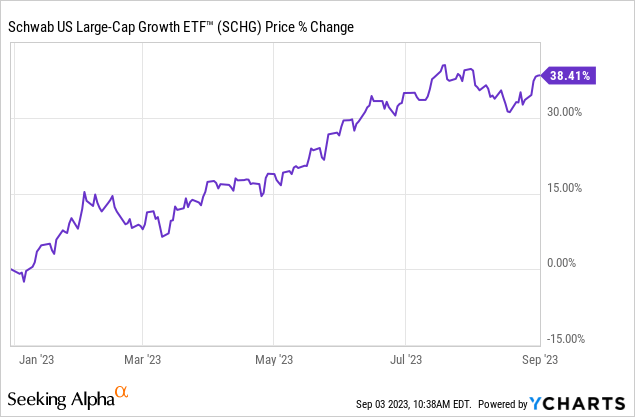

The biggest beneficiaries of this are large-cap growth stocks, which include companies benefiting from AI. The Schwab U.S. Large-Cap Growth ETF (NYSEARCA:SCHG) is up 38% year-to-date, beating the S&P 500 Growth ETF (IVW) by roughly 15 points!

With that in mind, there are multiple reasons why I'm writing this article.

- I expect a rotation from growth to value stocks, which could turn the top-tier SCHG ETF into an underperformer, making future investments more attractive.

- I want to highlight the SCHG ETF, as I believe it might be the best growth ETF without being too exposed to technology like the tech-heavy ETF (QQQ). Last month, I wrote an article comparing QQQ to SCHG.

- As I am now able to buy American ETFs, I made the decision to involve ETFs in my portfolio. In this case, I'm focusing on one major deficit in my portfolio: technology and growth.

So, with all of this in mind, let me explain why SCHG is on my watchlist, as I want to use the potential rotation to buy tech at variable valuations.

Filling A Gap With The Best

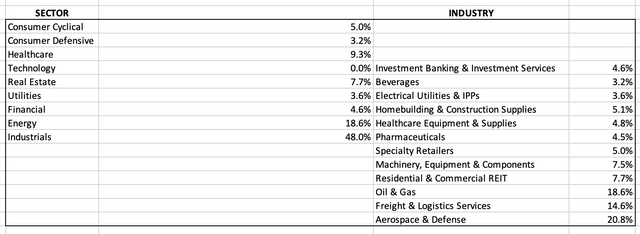

I currently have 0% technology exposure in my dividend growth portfolio.

Essentially, this is caused by three factors:

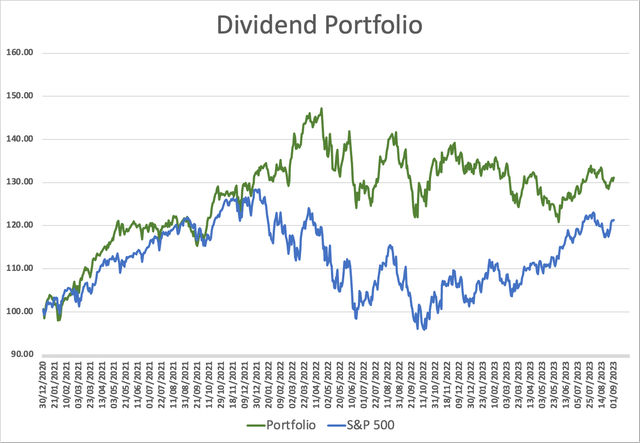

- I started this portfolio in 2020. Since then, I had the belief that value stocks and value/growth hybrids (the sweet spot) would outperform pure-play growth stocks. Tracking the stocks that I currently own back to December 2020, we see that these investments have generated alpha. Please note that the chart below does not take the timing of my investments into account.

- I have somewhat of a bias against pure-play growth stocks. It is very hard to find good dividend growth stocks in the growth/tech space. Fast-growing stocks tend to have low yields, while higher-yielding investments tend to be companies that have lost their edge.

- Related to the point above, the tech/growth space is extremely competitive. Even some of the big guys tend to have small moats, as it takes one smart innovation to ruin the expected growth trajectory of competitors. Having personally witnessed how small companies disrupt entire industries, it has left a mark.

ETFs solve these issues!

While I want to avoid ETFs as much as possible, I believe buying an ETF solves my technology issue. I need exposure for the next tech upswing without having to bet on 1-2 players in the industry. After all, I do not want to bet on specific technology breakthroughs in a LONG-TERM portfolio.

In my prior article, I wrote that I prefer QQQ because of its elevated tech exposure compared to SCHG.

I changed my mind because SCHG comes with growth in a bigger number of sectors (beyond tech), which makes more sense for my portfolio. SCHG is also cheaper (expense ratio).

In general, I think it can be said that SCHG is the gold standard of growth investing through ETFs.

Both Morningstar and Seeking Alpha (quant ratings) show that SCHG is among the best ETFs money can buy.

So, what makes SCHG so special?

Why SCHG Is Top-Rated

Its performance is obviously one of the reasons why it enjoys such a great rating.

However, there's more to it.

Essentially, SCHG's goal is to track the Dow Jones U.S. Large-Cap Growth Total Stock Market Index. This means we're dealing with a low-cost fund that benefits from its size and passive nature.

The company has an expense ratio of just 0.04%, which is a terrific deal!

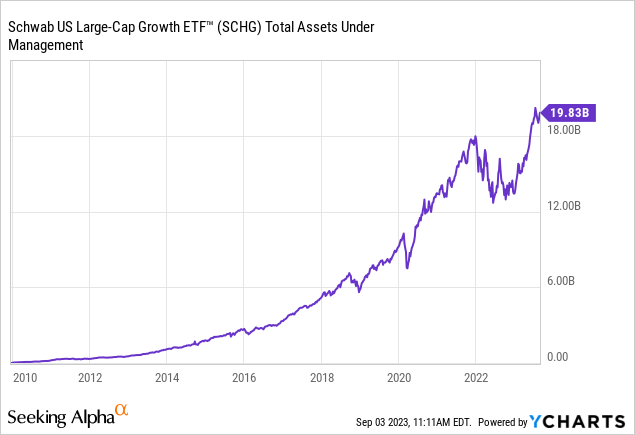

Incepted in 2009, the company currently has close to $20 billion in assets under management.

On top of having a very attractive expense ratio, SCHG is well-diversified in the growth space.

The company has 243 holdings with a turnover rate of 8.7%, which means the ETF has bought and sold less than 9% of its holdings over the past 12 months.

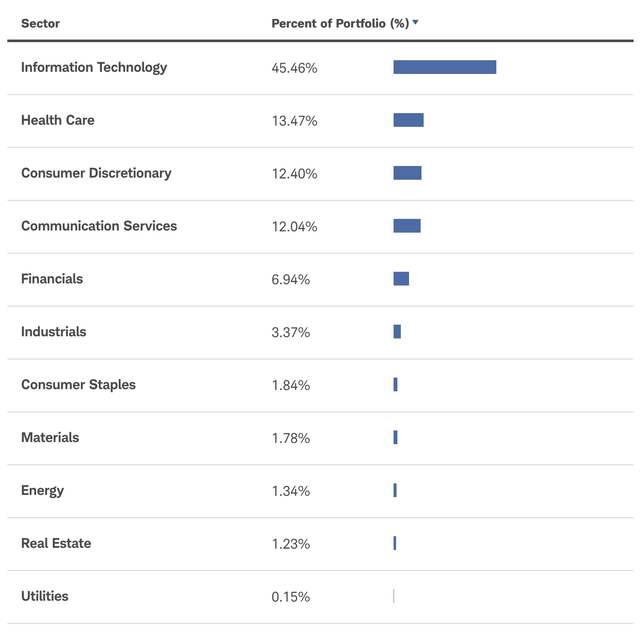

Whereas QQQ has 58% technology exposure, SCHG has 45% information technology exposure. Healthcare comes in second with 13% exposure.

Consumer discretionary and communications services add 12% each.

When taking a closer look at its top 10 holdings, we see the usual suspects.

Its top ten holdings have a weighting of 55%, led by Apple (AAPL) with 13.5% exposure, followed by Microsoft (MSFT), Amazon (AMZN), NVIDIA (NVDA), Alphabet (GOOG) (GOOGL), and Tesla (TSLA). Only the top five holdings have individual weightings of more than 4%.

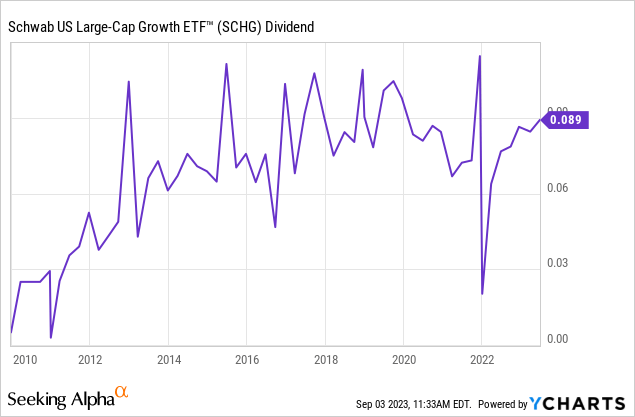

Unfortunately, the dividend yield is disappointing, but that's no surprise. After all, we're dealing with growth stocks.

SCHG currently yields 0.4%. The ten-year average annual dividend growth rate is 2.6%.

The reason dividend growth is nonexistent is the fact that fast-growing stocks tend to quickly replace stocks that have lost momentum in the ETF's top holdings.

For the purpose of buying fast-growing stocks, that's a good thing. It's not great for income-oriented investors, who should likely buy the high-yield brother (SCHD) of SCHG.

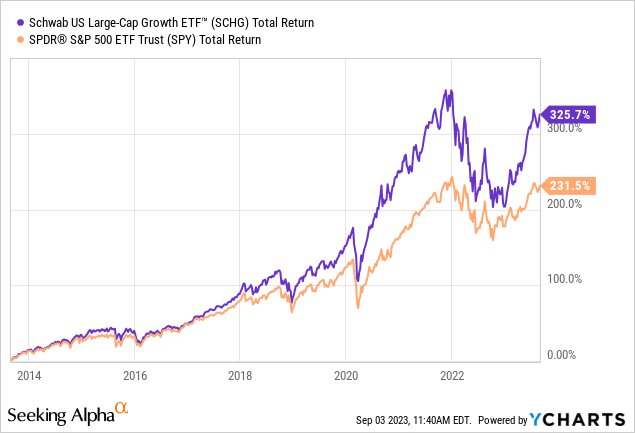

With regard to the ETF's performance, SCHG has beaten the S&P 500 by a wide margin over the past ten years. SCHG has returned 326%. The S&P 500 has returned 232%, which is also far from a poor performance.

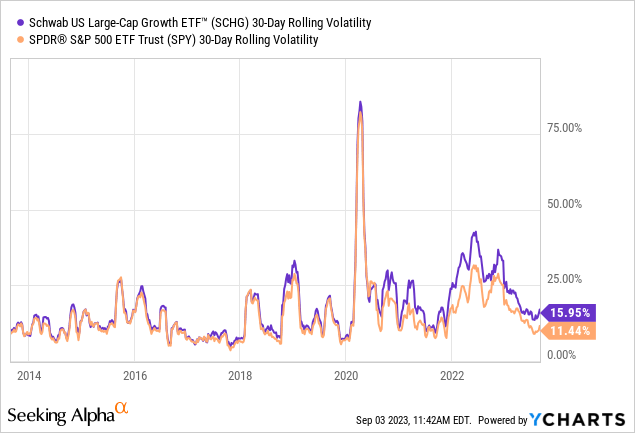

Moreover, SCHG has outperformed the market with barely higher volatility. Volatility started to rise after the pandemic, when volatility, in general, started to pick up.

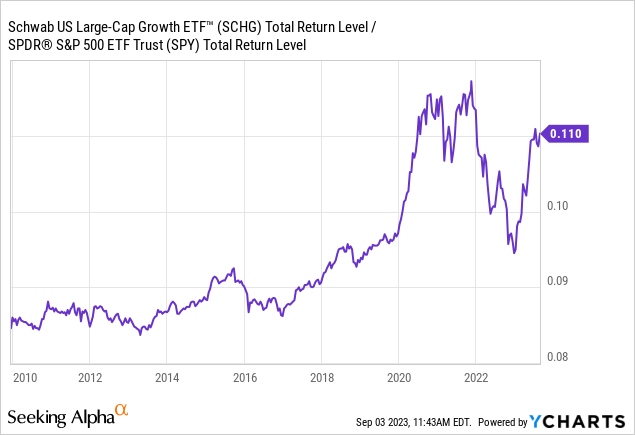

When looking at the ratio between SCHG and SPY (including dividends), we see that SCHG has been a consistent outperformer.

However, the ETF underperformed in late 2015 and 2022. Both periods saw accelerating inflation and higher interest rate expectations.

These developments are toxic for growth and tech stocks.

This is why I put SCHG on my watchlist, as I expect similar developments to result in favorable buying opportunities.

Why Growth May Start Underperforming

When do we buy value, and when do we buy growth?

Merrill Lynch has an answer (emphasis added):

Which strategy - growth or value - is likely to produce higher returns over the long term? The battle between growth and value investing has been going on for years, with each side offering statistics to support its arguments. Some studies show that value investing has outperformed growth over extended periods of time on a value-adjusted basis. Value investors argue that a short-term focus can often push stock prices to low levels, which creates great buying opportunities for value investors.

History shows us that:

- Growth stocks, in general, have the potential to perform better when interest rates are falling and company earnings are rising. However, they may also be the first to be punished when the economy is cooling.

- Value stocks, often stocks of cyclical industries, may do well early in an economic recovery but are typically more likely to lag in a sustained bull market.

So far this year, inflation has come down, which resulted in investors betting on a more dovish Fed in the future. After all, if the Fed is able to cut rates without causing inflation to soar again while protecting economic growth, it would be the perfect environment for growth stocks.

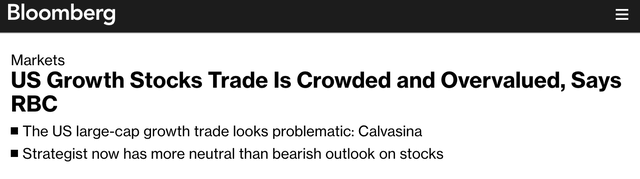

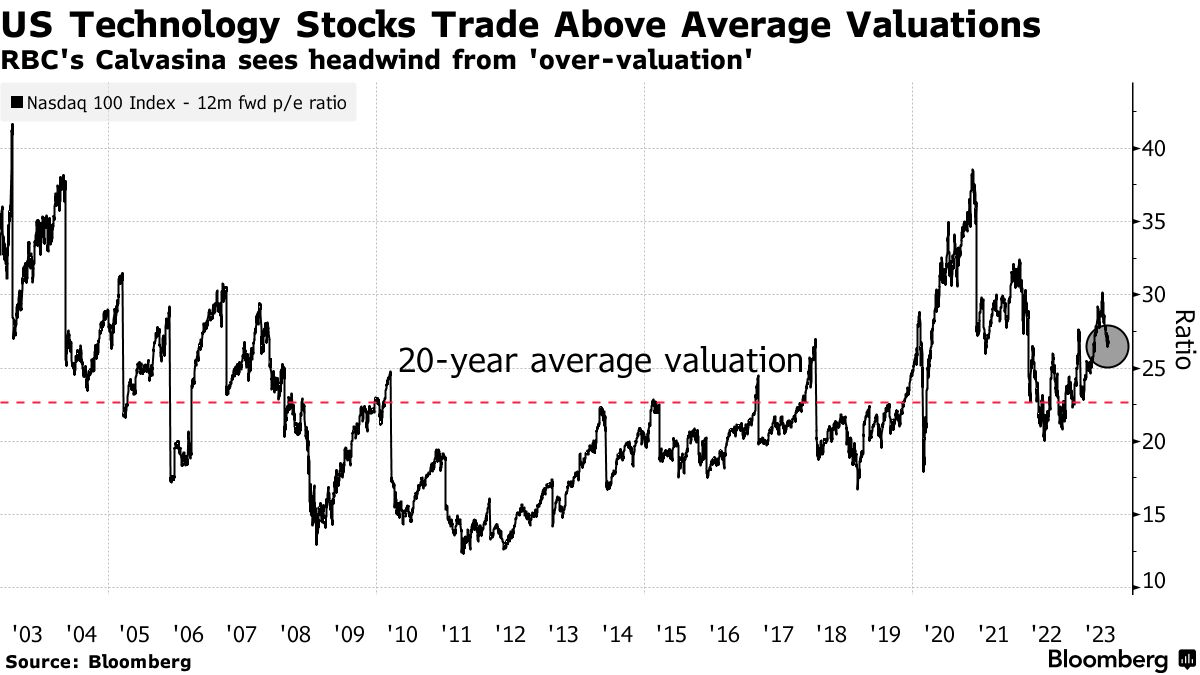

This has resulted in growth becoming a very crowded trade, according to RBC.

According to the article, despite a monthly decline in the Nasdaq 100, which is still up by 37% in 2023, optimism surrounding artificial intelligence advancements and expectations of an impending peak in interest rates have propped up the index.

RBC's Calvasina highlighted that growth valuations remain significantly above their long-term averages, emphasizing the need for patience to address these overvaluation and crowding issues.

Bloomberg

Calvasina backs her concerns with data indicating that asset managers' positioning in Nasdaq 100 futures points towards an over-ownership of the large-cap growth trade.

This suggests that corrective measures are necessary to address the imbalance in the market.

Furthermore, Calvasina noted that the dominance of growth stocks in earnings revisions is waning, while flows into funds dedicated to this category of equities have turned negative. These trends underscore the evolving landscape in the market.

I have put SCHG on my watchlist instead of my portfolio, as I agree with these comments - especially in light of new inflation issues.

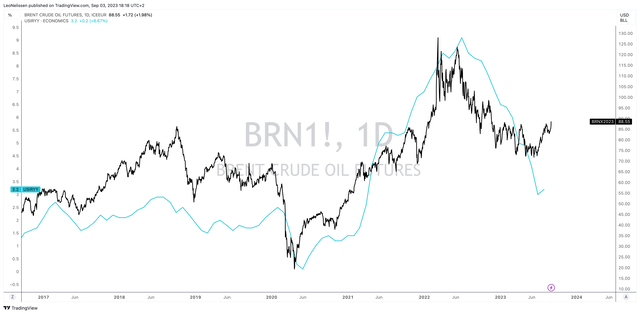

For example, looking at the chart below, we see that energy prices (in this case, Brent crude oil) are turning from an inflation headwind into a tailwind, meaning higher inflation is likely.

TradingView (US Inflation, Brent Crude Oil)

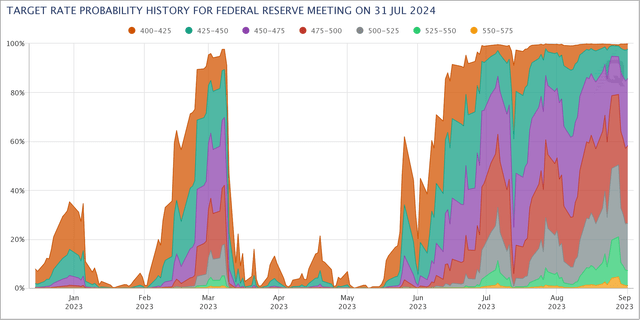

Higher inflation expectations are also leading to higher rate expectations. Looking at the chart below, we see that the implied odds of a >4.00 Fed rate on July 31, 2024, are now at 100%. Before June, that number was close to 0%.

In light of these developments, people are increasingly calling for an abolishment of the 2% inflation target.

For example, this is what a recent Wall Street Journal op-ed said:

The Fed's new framework in 2025 should also explicitly place more weight on the inflation half of its mandate-specifically that it interprets its employment mandate based on the inflationary consequences of different unemployment rates. All this would be re-evaluated again around 2030 based on the continually changing economy and the impact of this policy shift.

The more successful the Fed is in fighting inflation now, the more room it will have to make the right long-term moves for the U.S. economy. It is time for the Fed to start making a hawkish pivot to a higher inflation target.

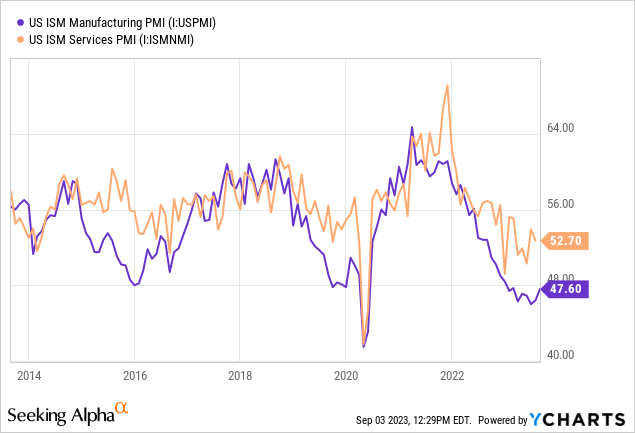

The worst part is that despite higher inflation expectations, economic growth continues to slow. Both services and manufacturing indices are showing weakness.

Hence, stagflation risks are currently going through the roof, which unfortunately confirms my longer-term thesis.

In light of these developments, I'm currently adding to stocks that would do well in this environment, which includes energy and basic materials.

I'm also buying beaten-down cyclical (like railroads) stocks on weakness and building a war chest for the next rotation.

Over the next few quarters, I expect SCHG to underperform the market. If that is the case, I'll deploy cash in SCHG once the current inflation resurgence starts to fade again.

That way, I can maintain a more balanced portfolio going into the next disinflationary environment.

Takeaway

My investment strategy involves careful planning and adaptation to market dynamics.

Currently, I'm eyeing a shift from growth to value stocks, keeping a close watch on the SCHG ETF.

While I've traditionally avoided pure-play growth stocks due to their competitive nature and low yields, SCHG offers a compelling solution.

SCHG stands out as a top-rated growth ETF, boasting low expenses and broad diversification across sectors. Its consistent performance, minimal turnover, and focus on sectors beyond tech make it an attractive choice for my portfolio.

However, its low dividend yield may not suit income-oriented investors.

As I anticipate growth stocks' potential underperformance in the face of rising inflation and interest rates, SCHG remains on my watchlist.

I plan to deploy cash into SCHG when inflation pressures ease, ensuring a well-balanced portfolio for the next market phase.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas' FREE book.

This article was written by

Welcome to my Seeking Alpha profile!

I'm a buy-side financial markets analyst specializing in dividend opportunities, with a keen focus on major economic developments related to supply chains, infrastructure, and commodities. My articles provide insightful analysis and actionable investment ideas, with a particular emphasis on dividend growth opportunities. I aim to keep you informed of the latest macroeconomic trends and significant market developments through engaging content. Feel free to reach out to me via DMs or find me on Twitter (@Growth_Value_) for more insights.

Thank you for visiting my profile!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (17)

I see Leo's comment below indicating willingness to buy SCHG around the 55 to 60 area. We would certainly look at going outright long SCHG or the others with comparable price declines.

We are looking for total return ( dividend yield not relevant ) .

I note these are essentially pure index ETFS, although not based on the same index, but no valuation judgement input.

Very different from SCHD which has qualitative factors affecting its portfolio inclusion and its periodic adjustments, so we have both long and option positions in SCHD, but the higher dividend of SCHD is not what affects our decision.

What law changed that you are now able to buy American ETFs??

Congratulations on that!!

Now we can talk...

As far as SCHG is concerned, it has Crummy dividend growth

I also recently bought NETL, which Brad Thomas can weigh in with his opinion.