Equinor: 11% Yield, Very Strong Balance Sheet

Summary

- The energy sector has seen a 13% rise in the past 3 months, making it an attractive option for income.

- Equinor ASA raised its dividend payouts from $.18/share to $.90/share in response to rising energy prices.

- Equinor has experienced tough comps in 2023 due to lower prices, but management expects production growth and continues to pay dividends.

- Looking for more investing ideas like this one? Get them exclusively at Hidden Dividend Stocks Plus. Learn More »

wmaster890/iStock via Getty Images

Looking for a way to gain some income from the Energy sector?

Over the past 3 months, the Energy sector has led all others, rising 13%. This sector is also known for being cyclical, but also has some attractive dividend paying stocks.

One of them, Equinor ASA (NYSE:EQNR) went on a big dividend paying spree in 2022, raising its total quarterly payouts from $.18/share to $.70/share, as energy prices soared in the wake of the Russian invasion of Ukraine. Prices have fallen in 2023, but EQNR's management still raised the total quarterly payouts to $.90/share in Q1-Q3 '23.

Company Profile:

Equinor ASA, an energy company, engages in the exploration, production, transportation, refining, and marketing of petroleum and petroleum-derived products, and other forms of energy in Norway and internationally. The company was formerly known as Statoil ASA and changed its name to Equinor ASA in May 2018. Equinor ASA was incorporated in 1972 and is headquartered in Stavanger, Norway.

Equinor’s operations are managed through operating segments, which are:

- -Exploration & Production Norway (E&P Norway)

- -Exploration & Production International (E&P International)

- -Exploration & Production USA (E&P USA)

- -Marketing, Midstream & Processing (MMP)

- -Renewables (REN).

Earnings:

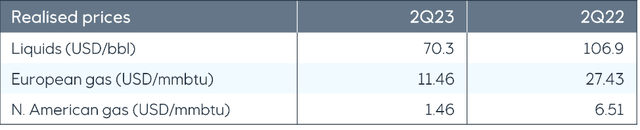

EQNT has had very tough 2022 comps so far in 2023, due to much lower prices. Liquids pricing fell 51%, while European gas fell 58%, and North American gas fell ~77% in Q2 '23 vs. Q2 '22.

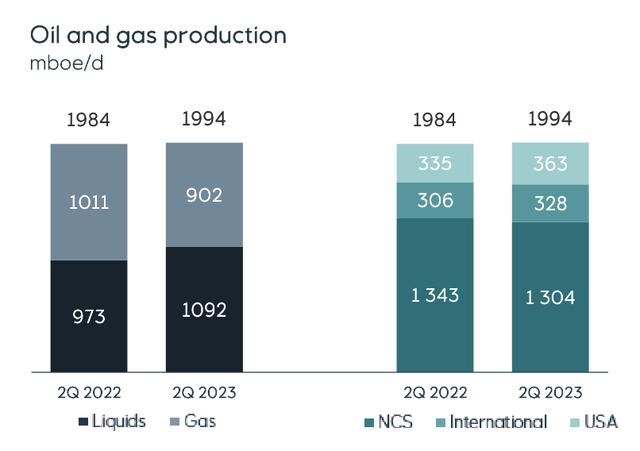

Liquids production rose 12%, whereas Gas volume fell ~11% in Q2 '23, vs. a year ago. The NCS region's volume rose 3%, but the international region volume fell ~7%, and U.S. volume fell ~8%"

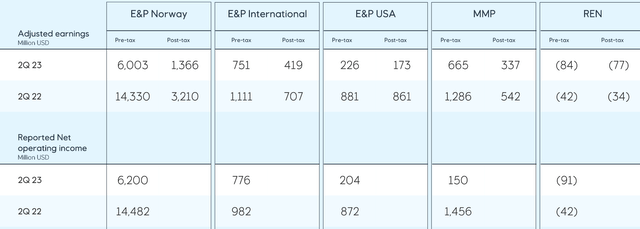

Norway E&P is the largest segment - it delivered 79% of EQNR's adjusted earnings in Q2 '23. E&P International earned 10%, MMP contributed ~9%, and E&P USA earned ~3% of Q1 '23 adjusted earnings. REN, the Renewables segment had -$84M in Adjusted Earnings.

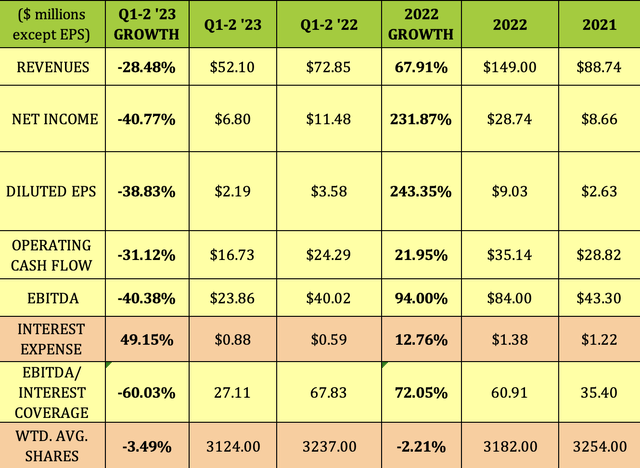

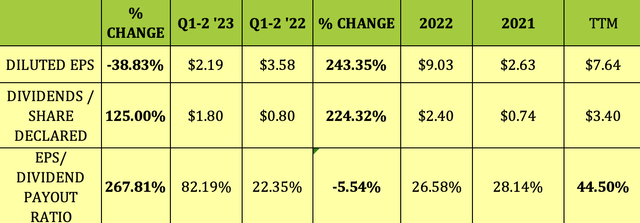

Drastically lower prices and mixed volume growth led to double-digit decreases in revenue, Net Income, EPS, Operating Cash Flow, and EBITDA in Q1-2 '23. While EQNR has very low debt, Interest Expense still rose 60%, and EBITDA/Interest coverage fell 60%. The share count decreased 3.5%.

Those bleak numbers are in marked contrast to those of 2022, when EQNR enjoyed 3-digit Net Income and EPS growth, 94% EBITDA growth, and 68% Revenue growth:

Growth Projects:

Management sanctioned 13 projects in 2022, adding around 600M barrels in reserves. They have around 35 exploration wells planned in 2023. EQNR continues to have several large projects in the works for 2023 - 2025 in its E&P Norway and E&P International segments.

By the end of the decade, management expects the production to be on par with current levels, while delivering a 50% reduction in EQNR's emissions. EQNR has 6 Renewables projects in operation, with an additional one, the Hywind Tampen sanctioned for 2023, and the world's largest offshore wind farm, the Dogger Bank, being developed in 2024-2026. EQNR owns 40% of this joint venture.

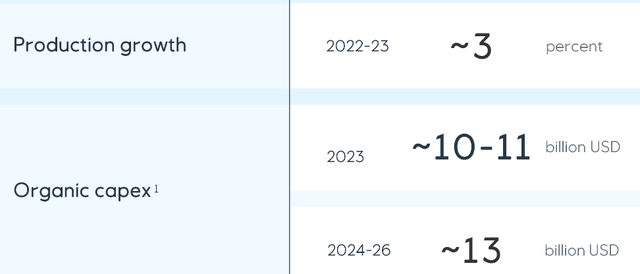

Guidance:

Management guided to ~3% production growth for 2023, with ~$10-$11B in organic Capex.

Dividends:

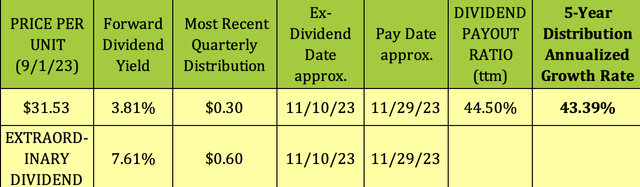

EQNR has a very strong 5-year dividend growth figure of over 43%, due to its rapid escalation, up 224%, in dividends in 2022. That climb reversed EQNR's formerly negative dividend growth rate. Thus far in 2023, EQNR has paid 3 quarterly $.90 payouts, increasing its base dividend from $.20 to $.30, and paying extraordinary dividends of $.70 in Q1 '23, and $.60 in Q2-Q3 '23.

EQNR's base dividend yield is only 3.81%, but its extraordinary dividend yield is 7.6%, for a total potential forward yield of 11.42%. The big question whether or not management will continue paying those large extra dividends in coming quarters.

EQNR also has share buyback a program for 2023 of $6 billion, and management expects a capital distribution of around $17 billion for 2023.

It has distributed ~$10B in Q1-2 '23, leaving a ~$7B balance for Q3-4 '23. With 3.1B shares, the $.90/share distribution totals ~$2.8B/quarter, so it seems that EQNR can continue to reward shareholders with more quarterly $.90 payouts this year.

The Q1-2 '23 EPS/Dividend Payout ratio was 82.19%, still tenable, but way up from Q1-2 '23, when it was only 22.35%.

Taxes:

While Norway imposes a 25% withholding tax on dividends received by foreign investors, there is a tax credit on foreign taxes paid that you can take on your US tax return. However, you should consult your tax advisor for more info on this matter.

Performance:

While EQNR has outperformed the S&P 500 over the past month and quarter, it has lagged the S&P and the Oil & Gas Majors industry's average performance over the past year and so far in 2023 by a wide margin.

Analysts' Price Targets:

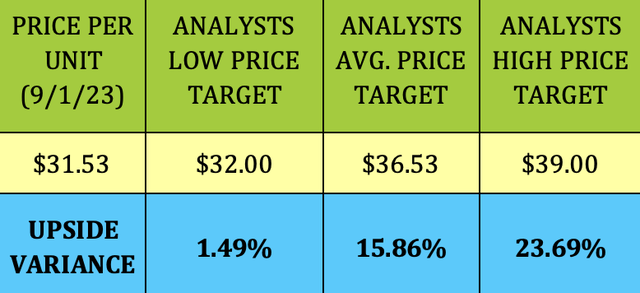

EQNR just received an upgrade from Morgan Stanley this week, from Underweight to Equal Weight. It also got an upgrade from RBC on 8/9/23, from Sector Perform to Outperform.

At its 9/1/23 intraday price of $31.53, EQNR was 1.5% below analysts' $32.00 lowest price target, and ~16% below their $36.53 average price target.

Valuations:

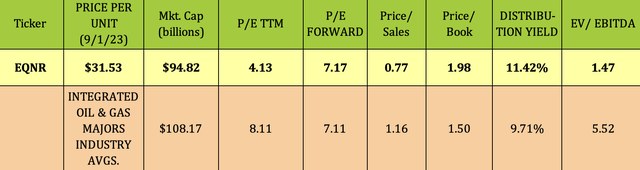

EQNR looks much cheaper than its industry on a trailing P/E basis, at 4.13X vs. the industry average P/E of 8.11X. However, it's roughly even on a forward estimated P/E basis. It looks cheaper on a P/Sales basis, and more expensive on a P/Book basis.

EQNR's EV/EBITDA of 1.47X is very low, due to it having a very small amount of Net Debt.

Debt, Profitability & Liquidity:

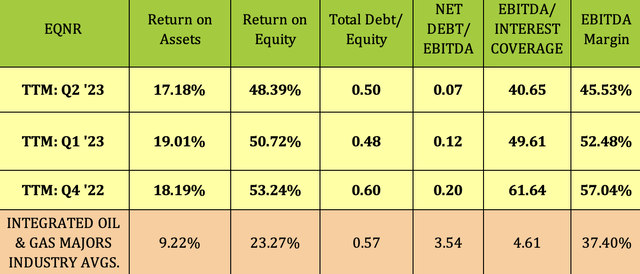

EQNR has remaining long-term bond debt of USD $24.7B, with an average of ~8.5 years to maturity. However, it has $19.65B in Cash, plus ~$23B in short term investments, hence its extremely low Net Debt/EBITDA leverage of just .07X. Its interest coverage is very strong, at over 40X.

While ROA, ROE, and EBITDA Margin have receded somewhat in Q1-2 '23, they all remain much higher than industry averages.

Parting Thoughts:

We rate Equinor ASA a speculative buy, but don't jump in just yet, wait for a potential market pullback in the treacherous month of September. Another alternative would be to sell puts below EQNR's price/share.

All tables furnished by our investing group, unless otherwise noted.

Our Marketplace service, Hidden Dividend Stocks Plus, focuses on undercovered, undervalued income vehicles, and special high yield situations. Our portfolio's average yield is over 9%.

We scour the US and world markets to find solid income opportunities with dividend yields ranging from 5% to 10%-plus, backed by strong earnings.

We publish exclusive articles each week with investing ideas for the HDS+ site that you won't see anywhere else.

We offer a range of high yield income vehicles, and there's currently a 20% off sale on our service.

This article was written by

Robert Hauver, MBA, was VP of Finance for an industry-leading corporation for 18 years, and publishes SA articles under the name DoubleDividendStocks. TipRanks rates DoubleDividendStocks in the Top 25 of all financial bloggers, and Seeking Alpha rates us in the Top 5 of several categories, including Dividend Ideas, Basic Materials, and Utilities.

"Hidden Dividend Stocks Plus", a Seeking Alpha Marketplace service, which focuses on undercovered and undervalued income vehicles. HDS+ scours the world's markets to find solid income opportunities with dividend yields ranging from 5% to 10%-plus, backed by strong earnings.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of EQNR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: This article was written for informational purposes only, and is not intended as personal investment advice. Please practice due diligence before investing in any investment vehicle mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (6)