Futu Holdings: Shares Surge To Fair Value, Technical Resistance In Play

Summary

- Hong Kong stocks have performed poorly in 2023, but online brokerage firm Futu Holdings has seen a surge in its stock price.

- Futu is a well-rounded online financial services platform with a large user base and strategic partnerships.

- The stock received a bullish rating from Bank of America, but its valuation has become less attractive after a 20% rally.

- I outline key price levels to watch following the strong summer share price rise.

shih-wei

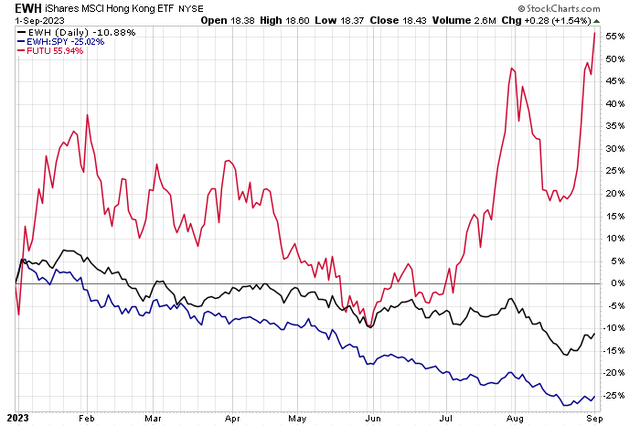

Hong Kong stocks have suffered in 2023. The iShares MSCI Hong Kong ETF (EWH) is down more than 10% on a total return basis, underperforming the S&P 500 by some 25 percentage points. One online brokerage firm, Futu Holdings (NASDAQ:FUTU) has surged since late May. After the solid run-up, I am downgrading shares from a buy to hold, mainly on its fair valuation.

FUTU Bucks the Bearish Hong Kong Trend in 2023

According to Bank of America Global Research, Futu is a well-rounded online financial services platform, providing trading, wealth management, market data and information, social collaboration, and corporate services. It mainly serves the mainland China and Hong Kong population's investment demand in Hong Kong and the US, and is expanding globally. It had 20.5 million users, 3.4 million registered clients, and 1.6 million paying clients by 2Q23. Mr. Leaf Li, the founder, Chairman and CEO of Futu, is the largest shareholder. Tencent is a strategic partner and the second-largest shareholder.

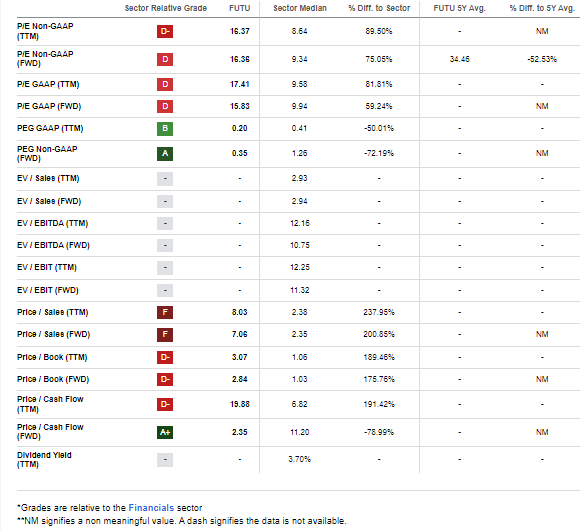

The Hong Kong-based $8.9 billion market cap Investment Banking and Brokerage industry company within the Financials sector trades at a near-market 17.4 trailing 12-month GAAP price-to-earnings ratio and does not pay a dividend. With earnings in the rearview mirror, implied volatility is still elevated at 51% while its short interest is high at 13.6%.

FUTU received a bullish double-upgrade from BofA last week, helping to send the stock from the mid $50s to above $60. Optimism is seen in the China regulatory environment which could lead to earnings improvement while the company’s overseas operations could further diversify its earnings power. BofA had noted that the stock was to cheap side, but with a quick 20%+ rally, I assert that is no longer the case.

The sanguine stance from BofA came following FUTU’s mixed Q2 report. The firm issued GAAP EPADS of $1.02, slightly worse than the consensus estimate while operating adjusted net income surged 73% year-on-year. Total clients and assets grew from year-ago levels, but total trading volume in the second quarter declined 28.7% year-over-year to HK$1.0 trillion. Its share buyback program is another aspect to like about FUTU. Key downside risks include the potential for stricter-than-expected regulations, significant corrections in the US or Hong Kong markets, and heightened competition.

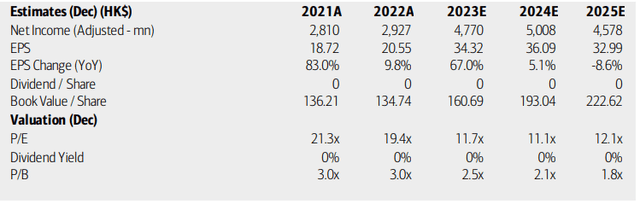

On valuation, analysts at BofA see earnings rising sharply this year after jumping just 10% last year. Per-share profits are expected to top HK$36 in 2024, or about $4.60 in USD. The consensus EPS growth rate is seen as slowing by 2025, however. No dividends are expected to be paid on the stock, though book value per share is projected to rise at a steady and fast clip over the coming quarters. Using forward estimates, the stock trades near to slightly under fair value in my opinion today.

FUTU: Earnings, Valuation, BVPS Forecasts

If we apply normalized EPS of $4.20 over the coming 12 months and apply a 15 multiple (below that of its competitors in the online broker marketplace due to heightened regulatory risks), then the stock should be near $63, about the current price. What is encouraging, however, is that the company’s forward PEG ratio appears low, though it has a somewhat high price-to-book ratio using current figures. FUTU’s normal P/E since China regulations heated up is near to slightly above 15.

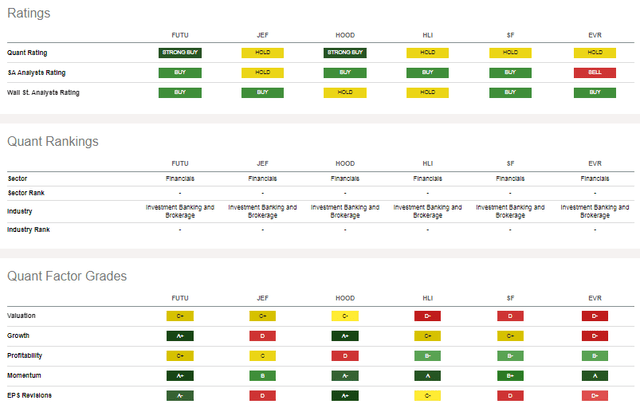

FUTU: Priced Cheaper than US Broker Peers

Seeking Alpha

FUTU has a high growth rating from Seeking Alpha’s quantitative rankings along with robust momentum and strong earnings revisions, but the valuation is not as favorable when taking all risks into account, in my opinion. Compared to its US competitors, the China regulatory risk is apparent as FUTU sells at a lower P/E for the most part.

Peer Analysis

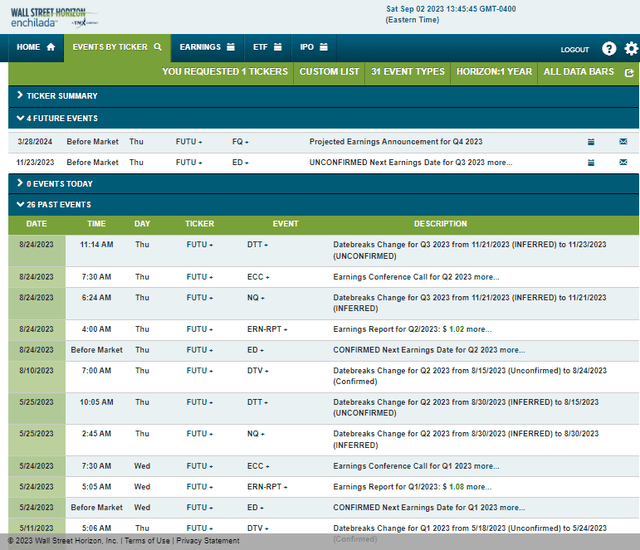

Looking ahead, corporate event data provided by Wall Street Horizon show an unconfirmed Q3 2023 earnings date of Thursday, November 23 BMO. No other volatility catalysts are expected.

Corporate Event Risk Calendar

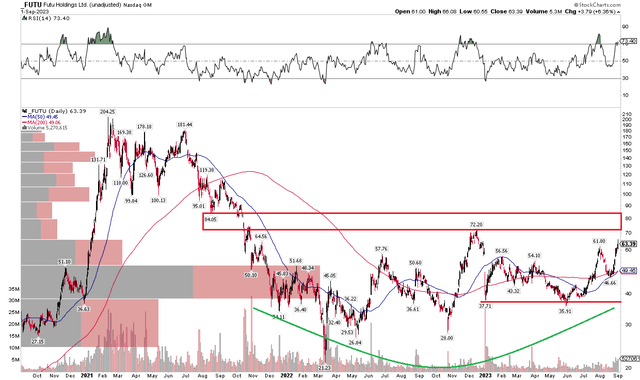

The Technical Take

FUTU is up since I initiated coverage on the stock late last year. My buy rating was ill-timed, however, as shares immediately sank about 30% last December. Today, though, this high-volatility Financials sector stock is in rally mode with strong momentum. Notice in the chart below that shares are threatening an area of resistance I see in the $72 to $84 range.

So, given the momentum, I see some upside to the stock from here before the going gets tough for the bulls. On the downside, support appears to be way down in the $35 to $37 area. Thus, the risk-reward setup is not all that favorable right now. Bigger picture, there is a bearish to bullish reversal happening, but old buyers from the early 2021 range highs may prove problematic on a longer-term rally. Still, with high volume by price in the $40 to $51 range, there should be a cushion on pullbacks, too.

Overall, there are mixed signals, and the chart is merely a hold right now.

FUTU: Bearish to Bullish Reversal, but Resistance Not Far Above

The Bottom Line

I have a hold rating on FUTU. I was bulled up on some Asia stocks late last year, but momentum has not materialized very much. Still, the stock is higher for 2023 but is near fair value today.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.