Buy GDX: Greatest Gold Lease Rate Spike Since Late 2008

Summary

- Unusual upside action in gold lease rates suggests physical gold shortages are spreading, which should support price.

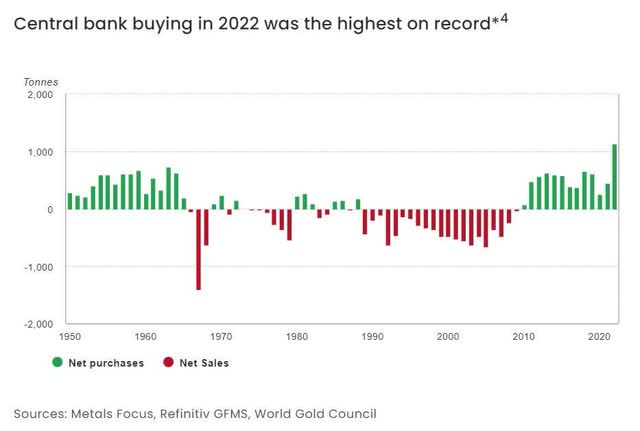

- Record global central bank accumulation of gold is one reason.

- The VanEck Gold Miners ETF is recommended for exposure to the gold market, as it holds the biggest and most valuable mining outfits.

- A quick historical review of the effect of past lease rate spikes on gold bullion and GDX since 2008 is included.

VladK213/iStock via Getty Images

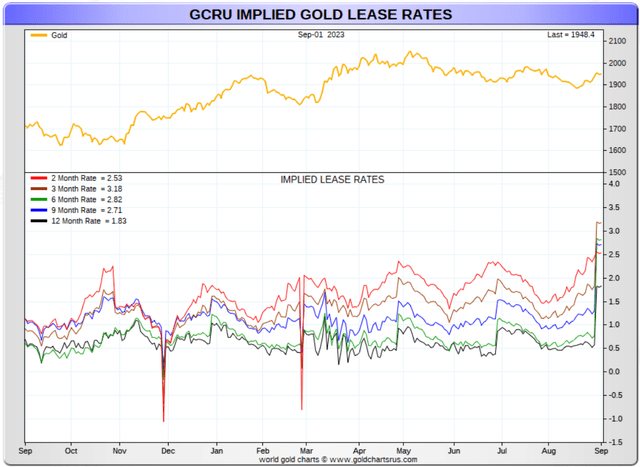

Believe or not, we may have reached for one of the strongest buy signals in the gold asset market since Lehman Brothers was allowed to fail in September 2008, a good 15 years ago. An unusual and very rare spike higher in the premiums to spot paid in the futures market has generated a real-world signal that physical gold shortages are spreading. The "implied" lease rate level, across the board, has jumped well above 2% to as high as 3% annually for 3-month pricing, to readings roughly 3x higher than September of 2022. And, a big portion of this rise has occurred just over the latest week of trading!

GoldChartsRUS.com - Gold Lease Rate Picture, 1 Year

Why should gold investors pay attention to lease rates (or what buyers are willing to pay in interest before getting physical bullion delivery at a specified future date)? It is the single best readout on whether central banks, billion-dollar hedge funds, brokerages, banks and other financial institutions have any gold to sell into the immediate marketplace. If demand is outstripping available supply, price premiums for future physical deliveries will jump much faster than usual.

Last week, I mentioned the jump in 2-month lease rates to multi-decade highs (and a large inversion position to later contracts) in a bullish article here on the Direxion Daily Gold Miners Index Bull 2x Shares ETF (NUGT). For gold bugs, the outlook for gold assets has gotten even more bullish over the past few trading days.

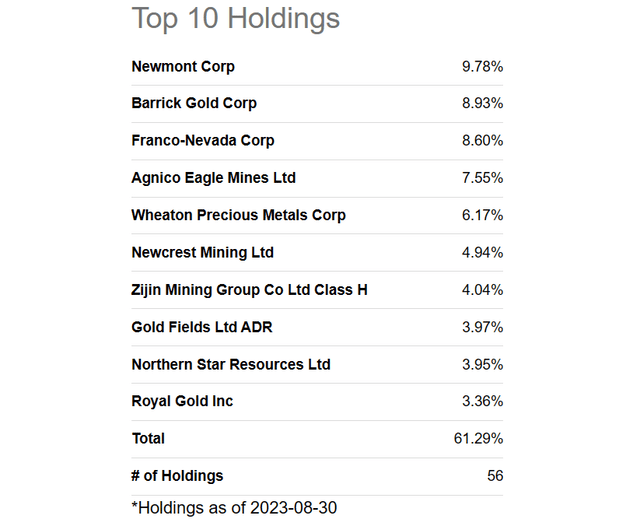

If you are new to the gold market and gold miners in particular, and you don't want to (1) carry the extra leverage and risk of NUGT or (2) delve deeper into which individual miners are the best to own over the next 6-12 months, I definitely suggest opening a position in the VanEck Gold Miners ETF (NYSEARCA:GDX). This product holds the biggest and most valuable mining outfits, giving you quick and diversified exposure.

It's also the largest gold miner ETF for stronger liquidity in trading with AUM of $11.8 billion and a 0.51% annual management expense. GDX does pay a respectable dividend yield of 1.65%, slightly better than the S&P 500 equivalent. I fully expect higher gold prices next year will lead to dividend raises from many of its holdings.

The Top 10 holdings of GDX include Newmont (NEM), Barrick Gold (GOLD), Franco-Nevada (FNV), Agnico Eagle (AEM), Wheaton Precious Metals (WPM), Newcrest Mining (OTCPK:NCMGF) (OTCPK:NCMGY), Zijin Mining (OTCPK:ZIJMF) (OTCPK:ZIJMY), Gold Fields (GFI), Northern Star Resources (OTCPK:NESRF), and Royal Gold (RGLD). You are buying a piece of mining assets located on all the world's continents outside of Antarctica, with ownership structures from percentage partnerships, to fully owned resource and production assets, to royalty financing firms getting a piece of future sales.

Seeking Alpha Table - GDX, Top 10 Holdings, August 30th, 2023

This article will review how GDX has performed after similar spikes in gold lease rates over the last 15 years, with the 2008 instance holding the closest similarities to our current financial market condition, in my opinion.

Why Getting Bullish on Gold Makes Sense

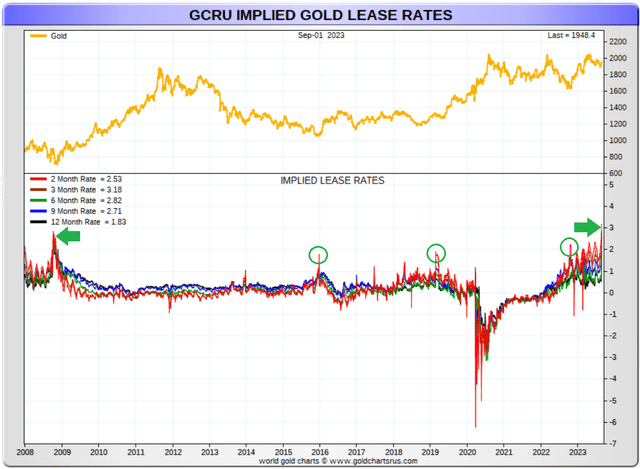

Below we can look at a 15-year graph of the gold prices vs. changes in lease rates, via GoldChartsRUS.com. I have drawn green arrows to point out the similarities between today and October-November 2008. Plus, I have circled in green the closet cousins for a spike in lease rates during late 2015, March-April 2019, and last year's autumn setup.

GoldChartsRUS.com - Gold, Lease Rate Picture, 15 Years, Author Reference Points

Here is how each occurrence played out over the following months and years for both gold bullion quotes and GDX total return performance. The conclusion which is easy to reach: past lease rate spikes have foretold of coming price gains, usually large ones over time.

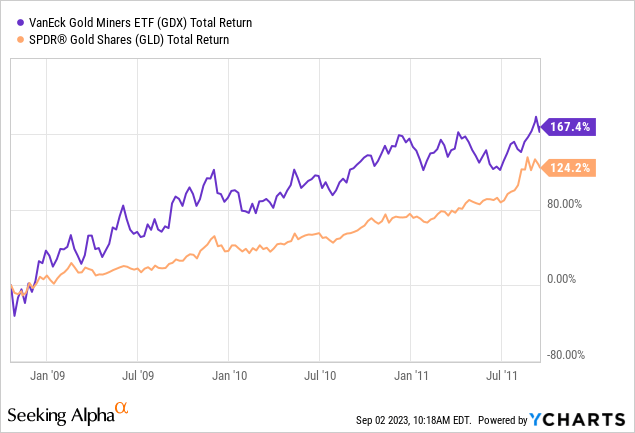

2008-11

YCharts - GDX Total Return vs. Gold Bullion Percent Change, Oct 2008 - Sept 2011

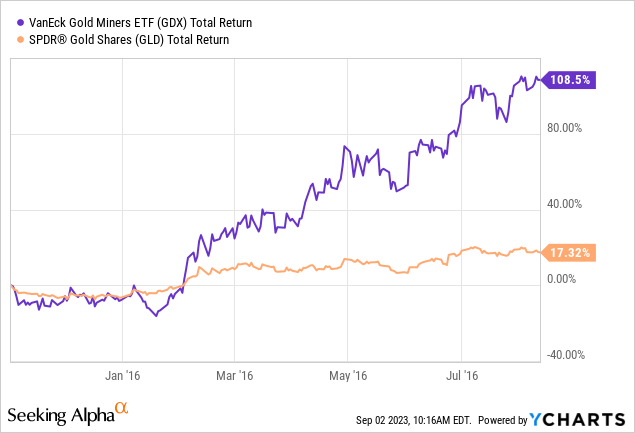

2015-16

YCharts - GDX Total Return vs. Gold Bullion Percent Change, Nov 2015 - Aug 2016

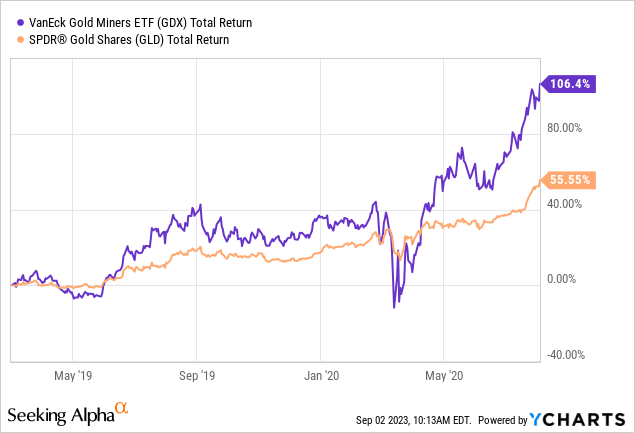

2019-20

YCharts - GDX Total Return vs. Gold Bullion Percent Change, Mar 2019 - Aug 2020

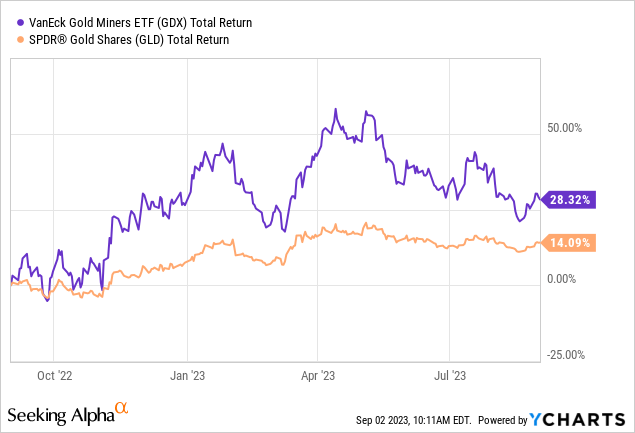

2022 to Present

YCharts - GDX Total Return vs. Gold Bullion Percent Change, Sept 2022 - Present

Final Thoughts

Does a lease rate spike lead to an immediate jump in gold prices? The answer is not necessarily. It could take a few weeks or months for the gold bull run higher to appear. That's what evidence over the last 15 years has proven. However, if you buy now and close your eyes (ignoring daily fluctuations and news flow) for 6 to 12 months, I am quite confident gold bullion and gold miner pricing will be dramatically higher than today.

That's exactly what the tight physical market setup is telegraphing for the future. To find a better balance between supply and demand forces, much higher quotes look to be necessary. Bringing existing above-ground gold supplies to market through the profit-motive is how capitalism works.

Part of the tightness in the physical bullion market is related to record gold accumulation by central banks around the world since early 2022. If their buying continues, who knows how high gold can rise in constantly debasing U.S. dollars backed by mathematically unpayable Treasury debt numbers. Any dollar confidence crisis could shoot gold above US$3000 an ounce without much warning. This target is close to my long-term "fair value" calculation for gold using 60 years of relative pricing to other asset classes and U.S. money/debt creation trends. I have explained this fair-value idea in previous gold/silver articles over the years.

Reuters Article - World Gold Council Estimates, Net Central Bank Gold Activity

And, if we get a recession soon, with new stress on the global financial system, another round of record QE buying of Treasuries (to prevent credit markets from freezing up) and increases in money supply aggregates (to prevent a debt-default depression) will only serve to stoke interest in the hedging characteristics of monetary metals, both gold and silver.

I rate VanEck Gold Miners a Buy, leaning toward a Strong Buy, if prices do not rise immediately, using a 12-month outlook. Gold and related mining concerns are not getting much positive attention in the press, and futures market positioning by non-commercial accounts highlights a clear absence of bullish interest over the last year despite a +15% gold gain. That's a good thing, as the precious metals cycle turns up, plenty of new buying interest is now sitting on the sidelines. We'll have to wait and see if we are entering a new gold rush in investment interest into 2024. It depends on the economy's direction and how the Federal Reserve reacts.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GLD, IAU, NEM, NUGT, AEM, GOLD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This writing is for educational and informational purposes only. All opinions expressed herein are not investment recommendations and are not meant to be relied upon in investment decisions. The author is not acting in an investment advisor capacity and is not a registered investment advisor. The author recommends investors consult a qualified investment advisor before making any trade. Any projections, market outlooks, or estimates herein are forward-looking statements based upon certain assumptions that should not be construed as indicative of actual events that will occur. This article is not an investment research report, but an opinion written at a point in time. The author's opinions expressed herein address only a small cross-section of data related to an investment in securities mentioned. Any analysis presented is based on incomplete information and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. The author expressly disclaims all liability for errors and omissions in the service and for the use or interpretation by others of information contained herein. Any and all opinions, estimates, and conclusions are based on the author's best judgment at the time of publication and are subject to change without notice. The author undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional materials. Past performance is no guarantee of future returns.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (6)

Look out above in US$ I say.

super interesting!

like all the buy signs lately this one has more statistical certainty over the next few months than the next few days.

but there are lots of potential catalysts, including the year’s best seasonality starting now, gold having made a solid bottom in august, ongoing global political risk, emerging $ weakness etc etc

and also as you point out this is a rare buy sign on a number thats normally incredibly stable.

which seemingly reliably indicates a gold supply shortage at current prices