Lakeland: Trading At A Discount Despite Improving Financials

Summary

- Lakeland Industries is trading at a discount despite improving financials and has potential upside.

- The protective clothing market is projected to increase, providing opportunities for Lakeland to grow its market share.

- Lakeland has shown strong improvement in margins and has a long-term target for further growth.

Magnifical Productions/iStock via Getty Images

Investment Thesis

Lakeland Industries (NASDAQ:LAKE) has underperformed the broader markets with a 7% return in a year. However, Lakeland is trading at a meaningful discount despite improving financials and has a potential upside. The in-depth analysis of the industry reveals Lakeland is a solid company with projected growth in the addressable market. It is poised to outperform due to sustainable long-term revenue growth, adjusted EBITDA margin enhancement, better management of cost structure and reasonable valuation.

Lakeland Industries manufactures and sells safety garments and accessories for the industrial protective clothing market primarily in North America, China, India, and Brazil.

Stock Catalyst

1. Large Markets With Strong Tailwinds

The protective clothing market is projected to increase due to a rise in concerns regarding the safety of employees in various sectors. With rapidly growing industrialization, the awareness among the employees for safety is also on the rise. There is a huge demand for protective clothing due to an increase in complexity, hazardous environment and ESG implementation. The total addressable market for protective clothing is $6 billion, which is expected to increase with a single to high single digit growth rate.

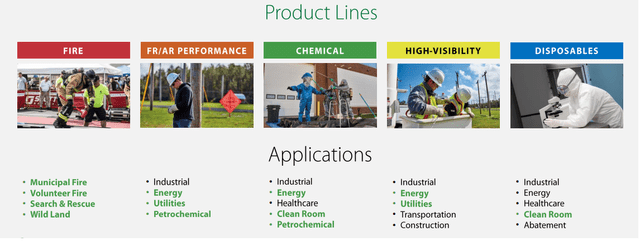

Lakeland Product Line, Company Presentation

Lakeland manufactures protective clothing in 78 countries with applications in the fire department, petrochemical, healthcare, energy, industrial and clean rooms. With a wide range of product offerings, Lakeland is well positioned to increase market share in the addressable market and improve revenue growth. To further solidify its market position, Lakeland acquired UK-based Eagle Technical Products in 2022. The acquisition improves Lakeland’s product portfolio, especially within fire service protective clothing, and expands its sales in the Middle East and Europe.

Globally, factors contributing to the growth of protective clothing include increased relevance of safety and PPE, growing demand from end-user industries and future technology advancement. Furthermore, industries are focusing more on worker safety in hazardous environments due to ESG initiatives. In the current situation, most of the companies are trying to address ESG complaints and this initiative will be helpful for the protective clothing industry. Moreover, post-pandemic, even governments started focusing on enforcement of safety and environmental standards globally. In summary, Lakeland is operating in industry with growth driven by increased demand from end-user industries and governments at large. With the right product offering, Lakeland will be able to achieve better performance and valuation.

2. Robust Long-Term Growth Driven By Operational Efficiency

In Q1-2024, Lakeland generated 43% revenue from the USA by selling disposables. The disposable protective garments used by integrated oil/petrochemical refineries, automotive manufacturers, pharmaceutical companies, construction companies, telephone utility companies, laboratories and governmental entities. This shows the application of Lakeland products across industries and prospective growth.

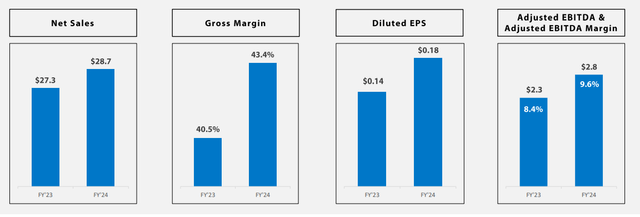

Q1-2024, Income Statement Analysis

The sales increased to $28.7 million in Q1-2024, an increase of 5.2% Y/Y driven by robust growth of 103% in the fire product line through a shift into a higher value and strategic product categories. The growth in the fire turnout product category was further aided by the Eagle acquisition, whose sales are increasing rapidly in key geographic markets outside of the U.S. Furthermore, the Woven product line is also showing momentum driven by increased oil and gas turnaround activity. However, the disposable product line in China is still showing signs of distress as the impact of COVID-19 lockdowns waned early in 2023. Also, foreign exchange currency translations negatively impacted sales due to the strengthening of the U.S. dollar against the Chinese yuan. According to management, the revenue growth will be mid to high single digit in core markets for the 2025-2027 target. More significantly, this growth will be higher than the market by 200bps-300bps per year, showing the resilience of the Lakeland business model.

Operational Enhancement Through Better Product Mix, Increase in High Value Products and Cost Saving

I believe improvement in margin can be better understood from the margin bridge compared to previous year's margin.

Q1-2024, Margin Bridge

In terms of gross profit margin, Lakeland has shown strong improvement in margin with increase an of 290 bps Y/Y to 43.4% margin due to an improved product mix through focus on high value products, a continued focus on cost savings, and contribution from recently acquired Eagle Technical Products. However, the company faces headwinds in China in sales of disposable products which can be seen in the margin bridge as well, which decreased margin by 4.7%. Moreover, management has a three-to-five year target for gross profit margin in the range of 40% to 45% and 43.4% is well within the range.

Lakeland's improved gross margin, product mix and Eagle acquisition are also reflected in adjusted EBITDA margin which has increased to 9.6% from 8.4%. The long term target for adjusted EBITDA margin is projected in the high teens.

In summary, Lakeland has better projected revenue growth and with better product mix and cost saving, the margins are projected to be within the long term target.

3. Lakeland Is Trading At Discount Despite Improving Financials

| Peers | EV/EBITDA (Forward) |

| Lakeland Industries (NASDAQ:LAKE) | 6.93x |

| DuPont de Nemours (NYSE:DD) | 13.36x |

| MSA Safety (NYSE:MSA) | 18.77x |

| Honeywell International (NASDAQ:HON) | 14.67X |

| Kimberly-Clark (NYSE:KMB) | 13.41X |

| Median Multiple | 14.04x |

Based on the above peers analysis, we can conclude that Lakeland is trading at a meaningful discount at 6.93x compared to 14.04x for peers. I believe, post-pandemic, the awareness has increased for protective clothing and ESG initiatives will contribute to industry growth. With revenue growth, operating margin enhancement and continued strong cash generation, Lakeland has a potential to trade at higher multiples and provide investment opportunities for the future.

Investment Risk

Lakeland generated 43% revenue from the USA and the remaining from the rest of the world. In such a situation, management of foreign currency becomes crucial. Hence, any significant change in currency can impact Lakeland's performance.

In the protective clothing industry, quality is crucial to protecting workers. Any harmful impact on workers due to an inefficient product could be detrimental to a company's market position.

The management has projected long term targets for revenue and margins. Investors should track the trend and see if it's in the range of management.

Final Thoughts

The key investor takeaway is that Lakeland is a solid company with projected growth in the addressable market. It is poised to outperform due to sustainable long-term revenue growth, adjusted EBITDA margin enhancement, better management of cost structure and reasonable valuation. However, investors have to watch closely the impact of foreign currency changes on revenue growth. In addition, the investor should keep a close eye on management guidance related to revenue and margins for the long-term target of 2025-2027. In nutshell, Lakeland is trading at a meaningful discount despite improving financials and has a potential upside.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.