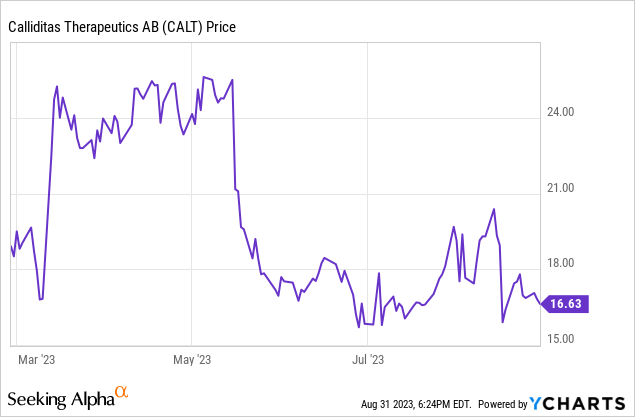

Calliditas: Q2 Earnings De-Risk This Biotech Play, 2024 Expected To Be Inflection Point

Summary

- Calliditas Therapeutics downgrades Tarpeyo sales guidance due to slower-than-expected sales growth and market access challenges.

- Potential growth drivers include full-label expansion of Tarpeyo and addressing the educational gap about the duration of treatment.

- Delays in the TRANSFORM trial of setanaxib pose risks, but management remains optimistic about potential partnering discussions.

- We reiterate our non-consensus buy rating moving into 2H 2023 and see 2024 as a potential inflection point for the stock.

ljubaphoto/E+ via Getty Images

Reason for the update: Q2 earnings and change to our thesis moving forward

Calliditas recently announced Q2 2023 earnings; during the call, Calliditas Therapeutics (NASDAQ:CALT) management reported a downgrade in Tarpeyo sales guidance from $120-150M to $100-120M. This alteration was attributed to the slower-than-expected sales growth of Nefecon (marketed as Tarpeyo in the U.S.). Market access friction was identified as a chief impediment, with 15-20% of prescribed patients still awaiting payer approval and an estimated 5-15% potentially opting out of Tarpeyo treatment due to challenges with their payers. Though these numbers were below expectations, CALT made promising strides in commercial success, adding a significant 422 new patients and 232 new prescribers within the quarter, which we find highly reassuring.

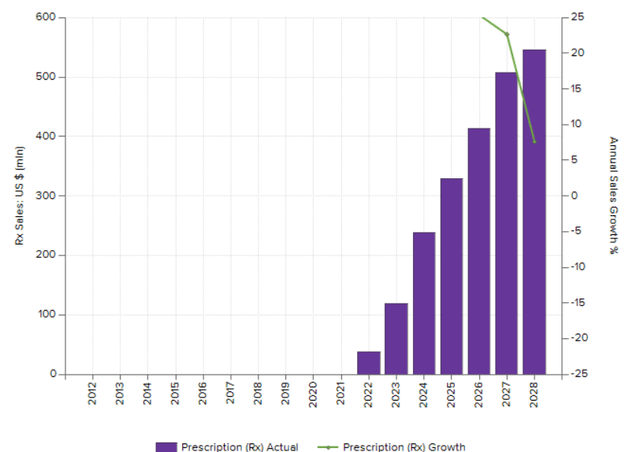

For Calliditas, several potential growth drivers loom on the horizon. Anticipation surrounds the full-label expansion of Tarpeyo, particularly if the PDUFA slated for December 20, 2023, grants full approval. Such approval could expand the label to include patients with UPCR>0.8g/g, mitigating current market access challenges and strengthening its foothold. Furthermore, we believe addressing the educational gap about the Tarpeyo duration of treatment is key. While the average duration currently sits at roughly eight months, management emphasized that with better familiarity, physicians might extend treatment, and recurrent treatment cycles could further bolster topline growth over time. We believe the results of the ongoing physician detailing will result in better-than-expected earnings during 2024 and see 2H 2023 as a buying opportunity, especially at the current "depressed" valuation.

Tarpeyo sales consensus (Evaluate)

Pipeline expansion optionality is not valued appropriately by the market.

Another crucial update revolves around the TRANSFORM trial of setanaxib, which experienced delays. Originally anticipated for 1H 2024, the readout is now pushed to mid-2024 due to slower study enrollments and subsequent regulatory discussions. Despite the setback, management remains optimistic, expecting the data to guide the next stages of the trial and open doors for potential partnering discussions. Additionally, data from the Ph2 evaluation of setanaxib in HNSCC is scheduled for 1H24, with a PoC study targeting Alport syndrome set for 2H23 initiation.

Sufficient Funding for Operations

At the end of 2Q23, Calliditas reported approximately SEK866M in cash and cash equivalents, and considering that the company burnt SEK255.2M during the first six months of 2023, we believe the company to have at least 1-2 years of cash runway, which is highly assuring. Furthermore, considering the continued, slow but steady ramp of Tarpeyo, we believe that the company shouldn't need to raise capital anytime soon and the dilution risk remains low at this point.

Risk to thesis

However, potential risks in investing in CALT are undeniable. The slower ramp in Tarpeyo sales and the revised lower share in IgAN impact the company's peak sales projections. Current challenges with payer friction and market access, if unresolved, could continually plague the growth trajectory of Tarpeyo, even with full approval.

Conclusion

In summary, our core thesis hinges on the undervaluation of CALT. The market has exhibited a strong knee-jerk reaction to the lowered sales print. Yet, given the prospective levers the company can engage, particularly with the potential full approval and label expansion of Tarpeyo, we forecast 2024 as a turning point. Sales are predicted to ascend, surpassing consensus, especially since analyst projections are expected to continuously turn conservative due to current updates moving into Q4 2023. Furthermore, we believe the company's mid-stage clinical developments have not been properly priced into the valuation.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Biotechvalley Insights (BTVI) is not a registered investment advisor, and articles are not targeted toward retail investors. The content is for informational purposes only; you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained in our articles or comments constitutes a solicitation, recommendation, endorsement, or offer by Biotechvalley Insights or any third-party service provider to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction. The research and reports made available by BTVI reflect and express the opinion of the applicable BTVI entity as of the time of the report only. Reports are based on generally-available information, field research, inferences, and deductions through the applicable due diligence and analytical process. BTVI may use resources from brokerage reports, corporate IR, and KOL/expert interviews that may have a conflict of interest with the company/assets that BTVI covers. To the best of the applicable BTVI's ability and belief, all information contained herein is accurate and reliable, is not material non-public information, and has been obtained from public sources that the applicable BTVI entity believes to be accurate and reliable. However, such information is presented “as is” without warranty of any kind, whether express or implied. With respect to their respective research reports, BTVI makes no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results to be obtained from its use. Further, any analysis/comment contains a very large measure of analysis and opinion. All expressions of opinion are subject to change without notice, and BTVI does not undertake to update or supplement any reports or any of the information, analysis, and opinion contained in them.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.