TFLO: Betting Against A Fed Miracle

Summary

- The iShares Treasury Floating Rate Bond ETF currently has a 30-day SEC yield of 5.3%, which is high relative to inflation expectations and yields on risky bonds and stocks.

- The TFLO tracks US Treasury floating rate bonds, which have coupon payments that periodically reset based on short-term interest rates.

- Despite high yields on short-term bonds, investors are still favoring risk assets, making the TFLO's yield even more impressive compared to stocks and corporate bonds.

MicroStockHub/iStock via Getty Images

The relative case for cash continues to strengthen, with the 30-day SEC yield on the iShares Treasury Floating Rate Bond ETF (NYSEARCA:TFLO) now at 5.3%, which is extremely high relative to inflation expectations and the yields available on risky bonds and stocks. It would likely take significant Fed rate cuts and a pickup in growth and inflation for the TFLO to underperform relative to stocks and bonds over the coming years.

The TFLO seeks to track the investment results of an index composed of US Treasury floating rate bonds, whose principal is guaranteed and interest payments adjust to reflect changes in interest rates. Floating rate assets have coupon payments that periodically reset based off a short-term interest rate, known as the "reference rate." In the case of the TFLO the reference rates are 3-month T-Bills. The 5.3% yield reflects the impact of the 0.15% expense fee, and since its inception in 2014 the TFLO has tracked the Bloomberg US Treasury floating rate total return index very closely, less this expense fee.

No Need To Take On Risk To Generate Strong Returns

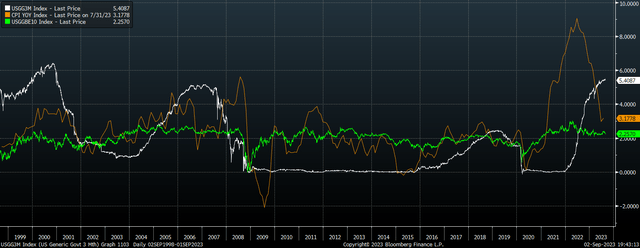

Since my last TFLO: Sticky CPI And Equity Rally Suggests Rate Cuts Unlikely Anytime Soon (TFLO) on the ETF in May, the nominal and real yield has become even more attractive. The following chart shows 3-month yields relative to headline inflation as well as 10-year breakeven inflation expectations, which is the average inflation rate expected over the next decade as measured by the yield differential between regular and inflation-linked bonds. After years of ultra loose monetary policy where short-term rates were forced deeply below inflation, they are now far higher, meaning investors do not need to take on risk to generate strong real returns.

3-Month T-Bill Yield Vs CPI and 10-Year Breakevens (Bloomberg)

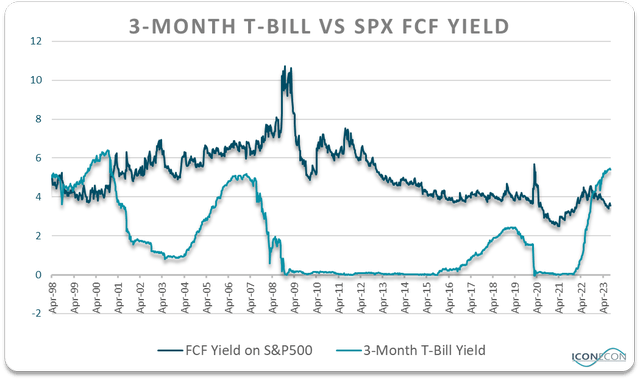

Despite high real yields on short-term bonds, investors continue to pile into risk assets. As a result, the yield on the TFLO is even more impressive when compared against stocks and corporate bonds. The following chart shows the yield on the US 3-Month T-Bill relative to the free cash flow yield on the S&P500. 3-month yields are now above the FCF yield on stocks by the widest margin since the 2000 market peak.

Bloomberg, Author's calculations

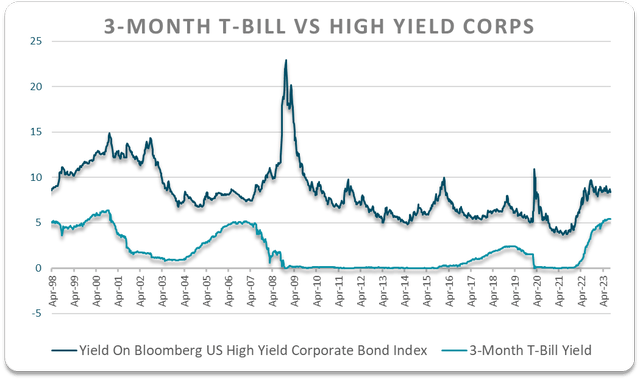

The yield on T-Bills is equally strong when compared to the yield on high yield bonds. While the yield to maturity on the Bloomberg High Yield US Corporate Bond Index far exceeds the FCF yield on stocks, it is just 3pp higher than 3-month yields, its lowest ever spread outside the 2007 credit market bubble.

Bloomberg, Author's calculations

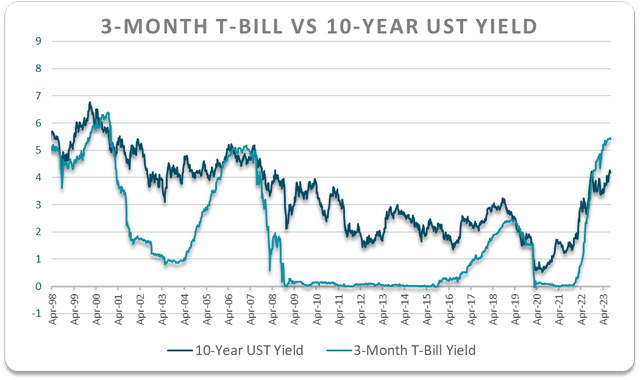

While we have seen some slight steepening in the bond yield curve, it remains extremely inverted, which is positive for the TFLO on a relative basis. Not only is the income from the TFLO set to outstrip that of longer dated bonds, but there is also the risk of capital losses in the latter should the Fed keep rates at current levels. Rate markets are already pricing in over 100bps of rate cuts in 2024, and if these cuts do not arrive, the TFLO is highly likely to outperform bonds.

Bloomberg, Author's calculations

The following chart shows the 3-month T-Bill yield versus an average of 10-year breakeven inflation expectations, high yield bond yields, the S&P500 FCF yield, and the 10-year Treasury yield. Since the late-1990s 3-month yields have averaged 3pp below the average yield on these three assets, and they are now almost a full percent higher. This strongly suggests that the TFLO will outperform over the coming years relative to a basket of stocks and bonds.

Bloomberg, Author's calculations

TFLO Underperformance Would Require Rate Cuts And Strong Growth

The only way I can see the TFLO underperforming over the coming years is if the Fed cuts rates aggressively even as the US economy avoids recession and inflation remains elevated. This would likely drive up bond prices directly and would provide support to stocks by raising the equity risk premium as well as income from dividends. However, market valuations across bonds, stocks, and credit, are already pricing in such a scenario, suggesting it would take a strong pickup in growth and monetary easing for the TFLO to underperform. Considering the poor track record of policymakers avoiding a recession following high extreme asset valuations and monetary tightening, such an outcome seems highly unlikely.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (2)

Best of luck.