Clear Secure: Strong Growth Prospects But Valuation Remains High

Summary

- Clear Secure operates a biometric verification platform and has expanded into industries like healthcare and entertainment.

- The company differentiates itself with state-of-the-art biometric capture technology and partnerships with airports.

- I expect YOU to perform in line with the market and don't expect a multiple re-rating in the near term.

da-kuk/E+ via Getty Images

Investment Thesis

Clear Secure, Inc. (NYSE:YOU) operates a subscription-based platform that employs biometric verification for automated identity authentication of its users. Initially centered on the travel sector with CLEAR Plus, the company has broadened its scope into other industries like healthcare, sports, and entertainment, capitalizing on pandemic-induced opportunities. These fresh applications have the potential to significantly enlarge Clear's market presence and revenue. Despite encountering considerable challenges in the past year, the company demonstrated resilience with a 91% retention rate in the previous quarter. Looking forward, Clear aims to achieve a consistent growth in reservations and enhance its profit margins, targeting a 35% adjusted EBITDA in the long-term. This expansion will be propelled by both the core business and new income streams from TSA Pre and other emerging sectors. While the company's position and growth prospects remain attractive, the current elevated valuation multiple informs my hold rating on the stock.

Competitive Position Supported by Platform Construction and Network Effects

CLEAR differentiates itself from its competitors by focusing on state-of-the-art biometric capture technology in its platform construction. This technology, coupled with its presence in over 50 of the top 100 domestic airports, creates significant network effects and sets the company apart. The current management team, which acquired CLEAR in 2010, understood the value of existing sign-ups and partnerships with airports like Denver and Orlando in advancing the platform with an optimized business model. Data security is of utmost importance to CLEAR, and it is committed to maintaining it. To attract sophisticated travelers, CLEAR implements an opt-in process that utilizes credential authentication, including advanced biometric capture technology and other methods to identify individuals accurately. The technologies used include biometric matching, backend identity verification, and proprietary techniques that establish a secure connection between an individual's identity and their biometrics.

Platform Opportunities Expand Network Beyond Aviation

CLEAR focuses on creating partnerships (for ex: Amex) to drive customer growth, leading to an increase in total cumulative enrollments on the platform. This expansion goes beyond aviation and aims to broaden the company's revenue base. The company provides two key metrics, "Total Cumulative Enrollments" and "Total Cumulative Platform Uses," which encompass both aviation and non-aviation use cases. When CLEAR introduces a new platform customer unrelated to CLEAR Plus aviation subscription, the total cumulative enrollments metric can be influenced by trends outside of aviation. These platform customers utilize the Powered by CLEAR verification SDK, which offers a low-code integration solution. This integration allows partners and customers to create a seamless experience for their users by enabling identity verification through a simple selfie and easy enrollment in partner services. By implementing the SDK, partners benefit from reduced friction and costs while increasing overall conversion rates for their members. An example of this is Avis, who integrated the Powered by CLEAR verification SDK to provide a hassle-free experience for their customers. Avis customers can skip the counter and proceed directly to their vehicle, and early analysis indicates that 40% of these users were already existing CLEAR members.

Valuation & Financial Outlook

Currently, the adjusted EBITDA margin is around 8%, while the FCF margin is 24% as the company benefits from working capital related to the Amex partnership and natural deferred revenue tailwinds to cash flow as customers pay a year in advance up-front. I believe over time the company's adjusted EBITDA margin can expand significantly due primarily to leverage in operating expenses as platform investments scale over time with revenue, or they are eventually scaled back if these investments are not yielding results. In FY22, the working capital benefit from the American Express partnership was about $37 million, which implies FCF for the underlying business about $100 million or 22.8%, which is still an impressive margin. Note, the expected dilution from stock based compensation is also pegged at only 1-2% longer-term, and the high SBC expensed in FY22 was due to the exercise of warrants by pre-IPO investors. As a result, I believe there's not been any change to the underlying unit economics for the airport business, which is today the primary source of valuation for the company. I expect the company can eventually achieve better long-term FCF margins, but do believe that some discount is warranted for the risk primarily of competition, while I am less concerned around the impact of a travel slowdown and Amex becoming increasingly penetrated.

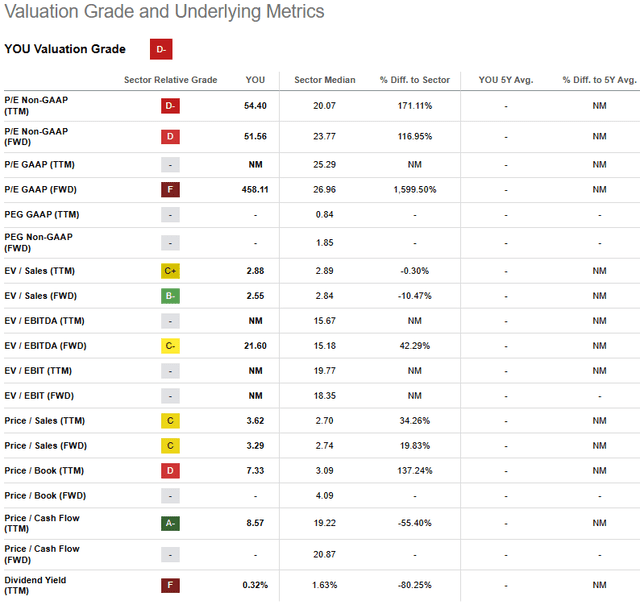

YOU is trading at elevated earnings multiples, which reflects the firm's growth prospects, potential ramp in operating leverage, clean balance sheet as well as the unique differentiated nature of the business. I think many investors will be looking further out on more normalized EBITDA margins to the future to determine the fair value of this stock. On an EV/Sales basis, the stock is trading at ~2.5x to 2023 sales, which is at par with other consumer subscription peers. I believe the multiple is fair for a subscription-based business, but which is also facing uncertainty tied to the pace of travel recovery and contribution from other emerging business segments (TSA Pre + broader platform). Hence, I expect YOU to perform in line with the market and don't expect a multiple re-rating in the near-term.

Downside Risks to Rating

A decrease in travel demand, caused by macroeconomic factors, might affect the demand for CLEAR Plus memberships. If net member retention falls below its usual levels, even though it is currently performing better than historical trends, this could negatively impact revenue growth. Moreover, Cybersecurity risk. If the company were to have a cybersecurity breach related to their database of members, confidence could be impacted in the CLEAR service.

Conclusion

YOU is operating in an extensive target market that can be swiftly tapped into, coupled with the rebound in the travel sector. The integration of CLEAR Plus memberships is directly linked to the rise in boarded passengers, which has already seen a 41% during the last quarter. Moreover, the partnership between CLEAR and Amex has significantly fueled member growth since its establishment in Q3 2021. The current trading multiples of YOU are higher, reflecting the market's optimism about the company's growth potential and its distinctive and innovative business model. While I expect the company to continue to post robust revenue growth and improve margins, I assign a hold rating to the stock given the current elevated valuation multiple, leaving room for limited upside from current levels.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.