Jobs Cooldown Permits Pivot

Summary

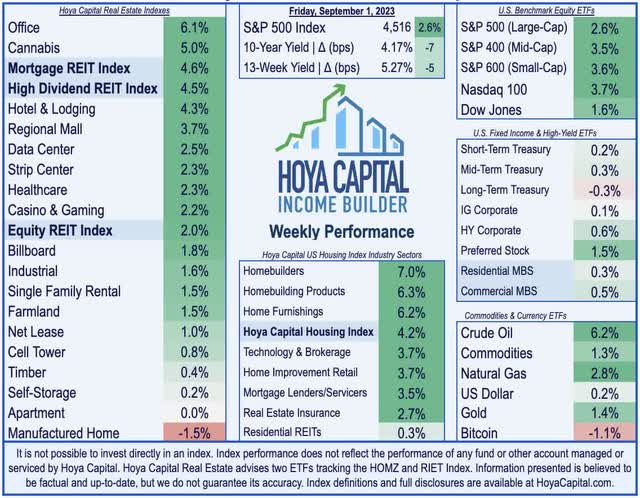

- U.S. equity markets rallied for a second-straight week while benchmark interest rates retreated from multi-decade highs after employment data showed long-awaited cooling in the previously red-hot labor market.

- Rebounding from a three-week skid with back-to-back weekly gains, the S&P 500 advanced 2.6%. Bonds rallied as swaps markets indicated an end of the historically aggressive Fed rate hike cycle.

- Buoyed by the interest rate retreat, real estate equities also posted broad-based gains on a week that saw several more examples of opportunistic acquisitions from well-capitalized REITs.

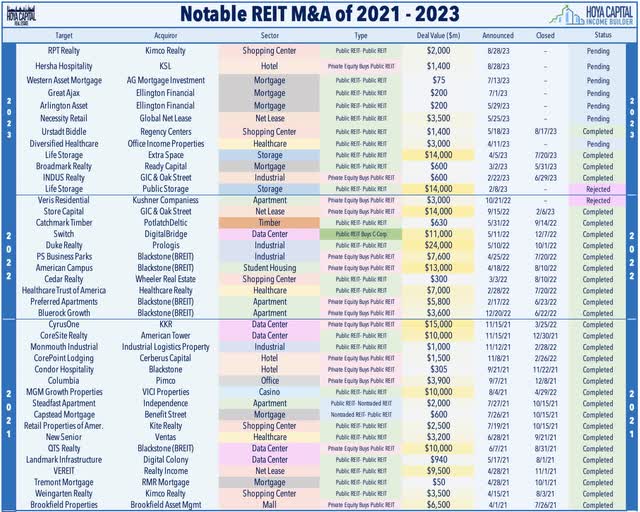

- Kimco Realty - the largest strip center REIT - announced that it will acquire RPT Realty in an all-stock merger deal valued at roughly $2B. Hersha Hospitality soared more than 50% this week after it received a takeover offer from private equity firm KSL Capital Partners.

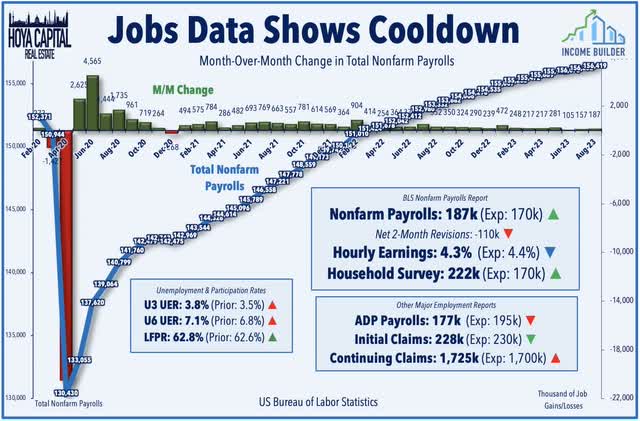

- The critical BLS nonfarm payrolls report this week showed that the U.S. economy added 187k jobs in August - roughly in-line with expectations - but net revisions of -110k over the prior two months resulted in the weakest net change in employment since April 2020.

Gian Lorenzo Ferretti Photography

Real Estate Weekly Outlook

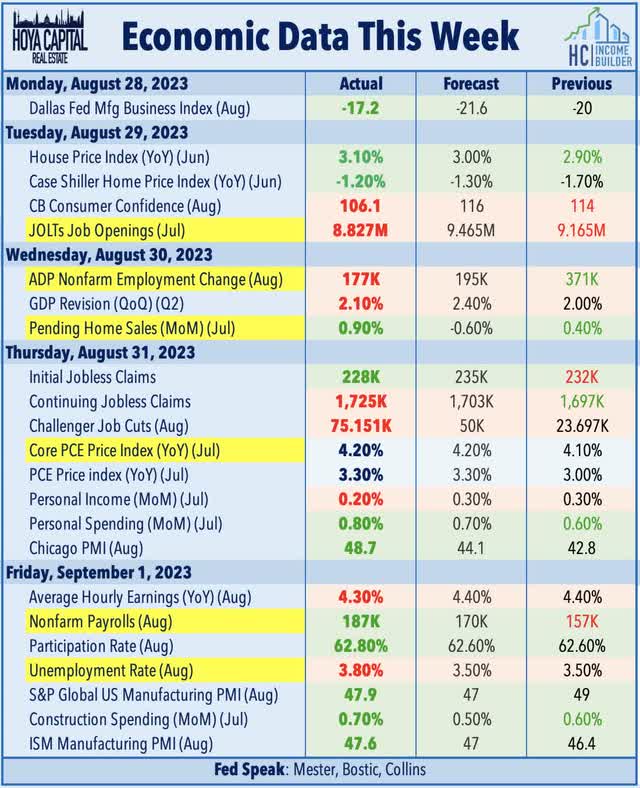

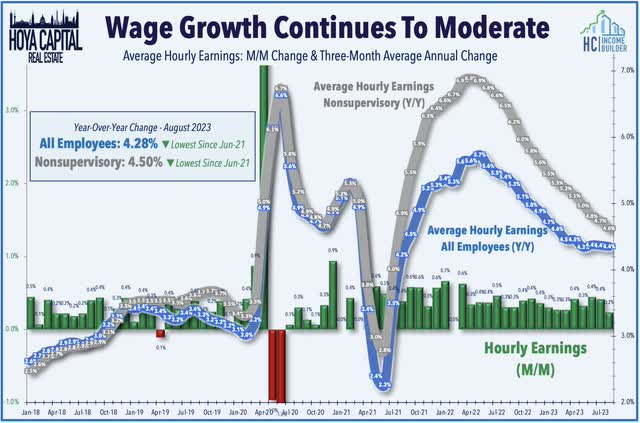

U.S. equity markets rallied for a second-straight week while benchmark interest rates retreated from multi-decade highs after a critical slate of employment data showed long-awaited cooling in the previously red-hot labor markets. While evidence of cooling inflationary pressures has become increasingly evident across most inflation reports - including the PCE data this week showing that core prices posted the smallest back-to-back increase since late 2020 - several Fed officials have pinned their "pivot" decision on evidence of moderating wage pressures, of which there was no shortage this week, as hourly earnings posted their weakest increase since the early days of the pandemic while job openings dipped sharply for a third-straight month.

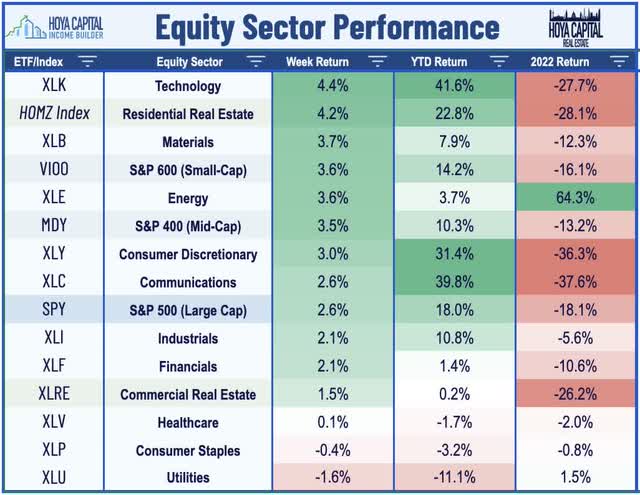

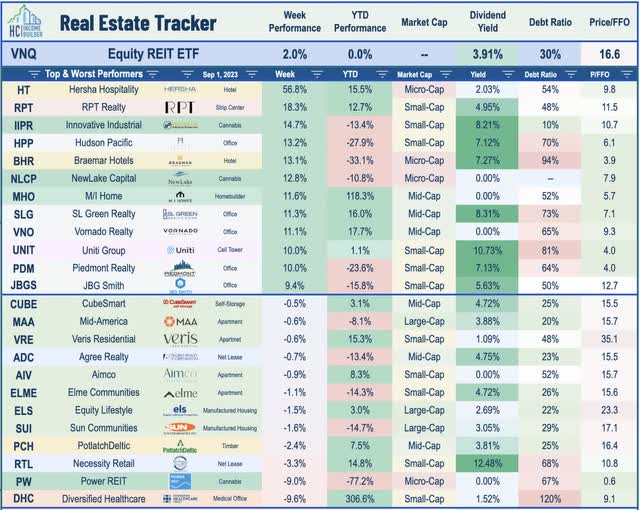

Posting a second week of gains following a three-week skid, the S&P 500 advanced 2.6%, while gains were even stronger across the major equity benchmarks, with the Mid-Cap 400 and Small-Cap 600 each rallying by more than 3.5%. Buoyed by the interest rate retreat, real estate equities also posted broad-based gains on a week that saw several more examples of opportunistic acquisitions from well-capitalized REITs. The Equity REIT Index advanced 2.0% on the week, with 16-of-18 property sectors in positive territory, while the Mortgage REIT Index rallied by nearly 5%. Homebuilders and the broader Housing Index were among the leaders this week as the combination of lower mortgage rates and data showing steadiness in national home values eased concerns of a deeper housing slowdown.

'Bad news' on the labor market front was 'good news' for financial markets this week, as the soft slate of employment data raised optimism that the Fed's rate hiking cycle may be reaching its conclusion. Swap markets now imply a roughly 30% chance that the Fed will hike again this year, down sharply from an implied probability of roughly 70% at the start of the week. Bonds rallied in response, with 10-Year Treasury Yield dipping seven basis points to 4.17% - now comfortably below its intra-day high above 4.30% in mid-August - while the 2-Year Yield plunged by twenty-one basis points to 4.87%. Despite the rate retreat, the US Dollar strengthened for a seventh-straight week, underscoring even more significant economic softness in Europe and Asia. Expectations of extended OPEC production cuts lifted WTI Crude Oil prices to their highs of the year, a looming "thorn in the side" for the inflation outlook.

Real Estate Economic Data

Below, we recap the most important macroeconomic data points over this past week affecting the residential and commercial real estate marketplace.

The long-awaited cooldown in labor markets - which some Fed officials have pinned their "pivot" upon - appears to finally be upon us, according to each of the three major monthly employment reports this week. The critical BLS nonfarm payrolls report this week showed that the U.S. economy added 187k jobs in August - roughly in-line with expectations - but net revisions of -110k over the prior two months resulted in the weakest net change in employment since April 2020. The relatively soft report followed a "miss" on ADP private payrolls report earlier in the week, which showed job growth of 177k - below expectations of 195k. Several of the most economically sensitive employment categories saw a continued slowdown - or retraction - in employment levels throughout the summer. Transportation and warehousing lost 34,000 jobs in August - driven largely by the bankruptcy of shipping giant Yellow - while a Hollywood writers' union strike resulted in 17,000 job losses.

Average hourly earnings ("AHE") - a key inflation indicator - provided further evidence of normalizing labor market conditions following pandemic-era shortages. AHE rose 0.2% in August, which was lower than expected and continued the trend of moderation observed in the annual increase for both the 'All Employees' and 'Nonsupervisory Employees' indexes. Since the start of 2023, AHE for all employees has averaged 3.8% on an annualized basis - which is only marginally above the 3.3% increase in 2019 in a year that CPI inflation averaged just 1.8% - suggesting that concerns over wage-driven inflation are likely overstated. The average workweek, meanwhile, remained near three-year lows at 34.3 hours while the labor force participation rate stood at 62.6% for the fifth consecutive month, which remains stubbornly below the 63.0% pre-pandemic average from 2016-2019.

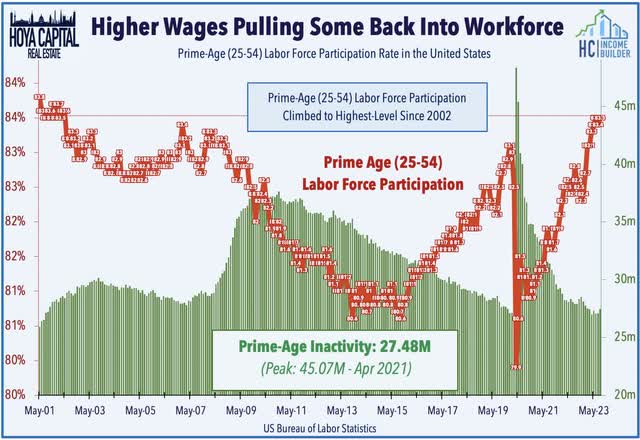

Earlier in the week, the Job Openings and Labor Turnover Survey ("JOLTS") showed that job openings in July dipped below 9 million for the first time since early 2021 - a far steeper decline than expected - to levels that were 22% below the peak last March. The roughly 8.8 million job openings, however, were still about 25% above pre-pandemic levels seen in 2019. The "headline" U-3 unemployment rate, meanwhile, ticked up to 3.8% from 3.5% - but for mostly "good reasons" - as nearly three-quarters of a million individuals entered the labor force in August, the most since January. The U-6 "underemployment rate" - seen as a broader measure of joblessness that includes those working part-time but would prefer to work full-time work - rose to 7.1%, the highest in over a year. Meanwhile, the number of temporary workers fell for a seventh month to the lowest in nearly two years, a category that is seen as a leading indicator of the broader labor market.

Equity REIT Week In Review

Best & Worst Performance This Week Across the REIT Sector

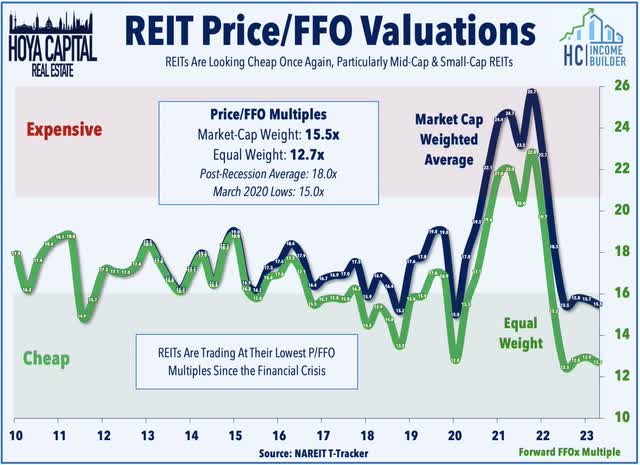

This week, we published REITs Are Historically Cheap. Commercial and residential real estate markets remain an easy transmission mechanism - or "punching bag" - of the Federal Reserve's historically swift monetary tightening cycle. The business models of many private equity funds and non-traded REITs were simply not designed for a period of sustained 5%+ benchmark rates or double-digit declines in property values. Private market players and non-traded real estate platforms were willing to take on more leverage and finance operations with short-term and variable-rate debt - a strategy that worked well in a near-zero rate environment but quickly crumbles when financing costs double or triple in a matter of months. "Hope" is the only strategy for some highly-levered property owners amid a dearth of buying interest and dwindling refinancing options. Pockets of distress remain almost entirely debt-driven, however, as property-level fundamentals remain solid across nearly every property sector. Public REIT reported that "same-store" property-level income was 10% above pre-pandemic levels in the most recent quarter. Nareit reported earlier this year that nearly 50% of private real estate debt is priced based on variable rates compared to under 10% for public REITs. Bottom line - macroeconomic conditions are aligning in an ideal manner for low-levered entities with access to "nimble" equity capital - conditions that maximize the true competitive advantage of the public REIT model, which these entities have been unable to exploit in the "lower forever" rate environment.

Strip Center: On that point, we're beginning to see some REITs with balance sheet firepower become more aggressive. Just a week after the closing of Regency Centers (REG) acquisition of small-cap Urstadt Biddle, we saw more REIT-to-REIT consolidation in the strip center REIT space this week. Kimco Realty (KIM) - the largest strip center REIT - announced that it will acquire RPT Realty (RPT) in an all-stock merger deal valued at roughly $2B, including the assumption of debt and preferred stock. RPT owns 56 open-air shopping centers across a national footprint (45% in the Midwest) with a similar tenant and "quality" mix as Kimco, which itself owns 528 properties. RPT shareholders will receive 0.6049 shares of KIM per RPT share, representing a 19% premium to RPT's prior closing price. Upon closing in early 2024, Kimco expects the leverage-neutral acquisition to be immediately accretive to FFO, citing cost synergies, redevelopment opportunities, and benefits of scale. Kimco plans to sell a "limited group of Midwest properties" following the acquisition and also noted that it will acquire RPT’s 6% stake in a 49-property net lease joint venture with GIC Real Estate. RPT Realty surged 18% on the week, while Kimco advanced 1%.

Hotel: Hersha Hospitality (HT) - a small-cap hotel REIT that owns 25 upscale urban hotels along the East Coast - soared more than 50% this week after it received a takeover offer from private equity firm KSL Capital Partners. The all-cash deal is valued at $10/share in cash - representing a 60% premium to Hersha's prior closing price. Hersha's three preferred issues - which had been trading at steep discounts ranging from 20-30% - would also be redeemed at $25 par value plus accrued dividends. The deal - which is expected to close in Q4 - has an implied portfolio valuation of roughly $400k per key and follows a "multi-year comprehensive review" which it had begun back in 2021 in the wake of several private equity takeovers of similarly-sided REIT peers at steep premiums. In 2021, small-cap REIT CorePoint Lodging was acquired by a group led by Cerberus Capital, while fellow REIT Condor Hospitality was acquired by Blackstone (BX) in 2022. The hotel outlook remains solid even as other indicators of economic activity show signs of slowing. Recent TSA Checkpoint data shows that travel demand has hovered around 100% of pre-pandemic levels since late 2022. Travel data firm STR expects that hotel Revenue Per Available Room ("RevPAR") will average about 10% above 2019 levels for full-year 2023.

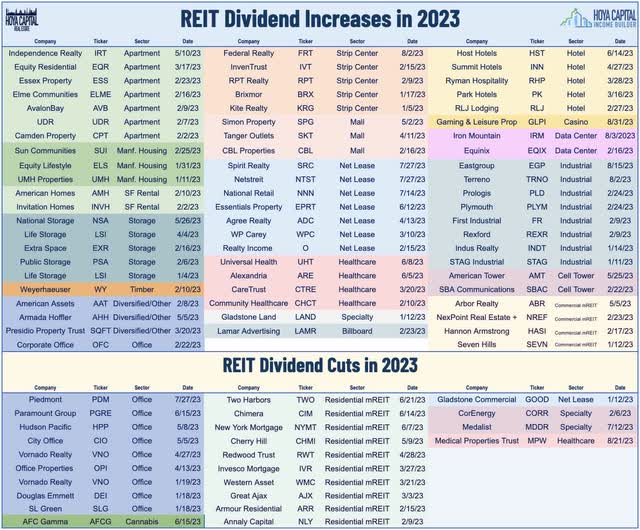

Casino: Gaming and Leisure Properties (GLPI) rallied 4% this week after it hiked its dividend for the second time this year, raising its payout by 1% to $0.73/share (6.2% dividend yield). A day earlier, GLPI announced that it acquired the land under the Hard Rock Casino development in Rockford, Illinois, from an affiliate of 815 Entertainment for $100.0M. At the same time, GLPI entered into a ground lease with 815 Entertainment for a 99-year term. The initial annual rent for the ground lease is $8.0M, subject to fixed 2.0% annual escalation starting on the lease's first anniversary and through its entire term. In addition to the ground lease, GLPI also committed to providing up to $150M of development funding via a senior secured delayed draw term loan at an interest rate of 10.0%. The term loan has a draw period of up to 1-year and a maximum outstanding period of up to 6 years. GLPI will also receive a right of first refusal on the building improvements if there is a future decision to sell them once completed. To cap off a strong week, after the close on Friday, S&P announced that GLPI will be added to the S&P Mid-Cap 400 - replacing office REIT Highwoods Properties (HIW) - upon its index rebalance on September 18th. HIW will be added to the S&P Small-Cap 600.

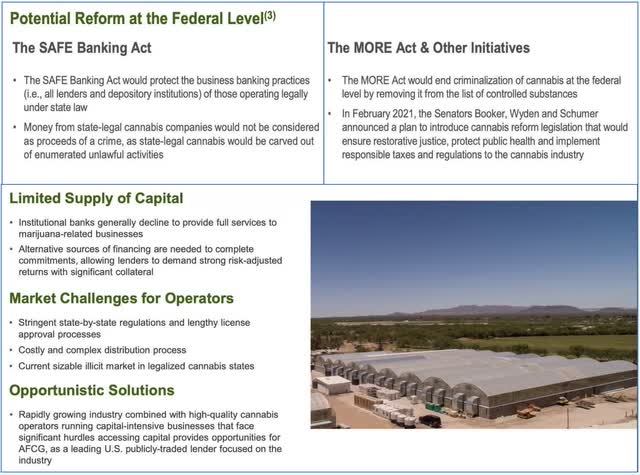

Cannabis: The two cannabis equity REITs - Innovative Industrial (IIPR) and NewLake Capital (OTCQX:NLCP) - each rallied more than 12% this week as the cannabis industry cheered some long-awaited indications of progress toward Federal marijuana legalization. Following years of sluggish progress that some critics have characterized as "broken promises" by elected officials, the U.S. Department of Health and Human Services is officially recommending that marijuana be moved from Schedule I to Schedule III under federal law following a scientific review, a move that industry participants see as an important step towards official legalization. Cannabis REITs had been under pressure since mid-2022 amid concern over defaults from their cannabis cultivator tenants, which have been smoked by plunging wholesale cannabis prices and setbacks on federal legalization. The 10 largest publicly traded cannabis REIT tenants soared by an average of 60% this week. For Cannabis REITs - which have concentrated leasing and lending efforts on larger multi-state operators ("MSOs") and publicly traded firms in recent years - tenant default issues have remained limited to a handful of smaller single-state operators.

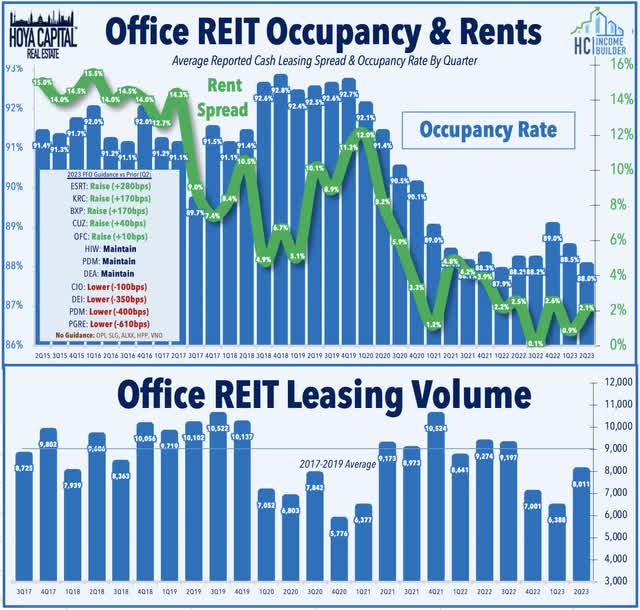

Office: A pair of coastal-focused office REITs - Vornado Realty Trust (VNO) and Hudson Pacific Properties (HPP) - were also among the leaders this week with double-digit percentage-point gains after the pair jointly announced alongside Blackstone that they entered into Manhattan's first public-private partnership with the City of New York to build out a purpose-built studio campus at Pier 94, the companies said Tuesday. The three are expected to invest a combined $350M into Sunset Pier 94 Studios with VNO owning a 50% stake, HPP owning 26%, and Blackstone's institutional Core+ Real Estate strategy will own 24%. Construction is slated to start in Q3, utilizing $183M in construction financing led by RBC, and delivery of the project is expected by the end of 2025. Development of the 266K square-foot, content production-focused project will be handled by Vornado while design, oversight, and management of the facility's leasing and operations will be provided by Hudson Pacific - which operates the largest collection of studio properties, an area of significant weakness for the firm in recent years. As noted above, S&P announced on Friday afternoon that Highwoods Properties (HIW) would be moved to the S&P Small-Cap 600 from the Mid-Cap 400. Orion Office (ONL) and Office Properties Income (OPI) were both deleted from the Small-Cap 600. Meanwhile, OPI announced on Friday afternoon that it is terminating its controversial merger agreement with Diversified Healthcare (DHC).

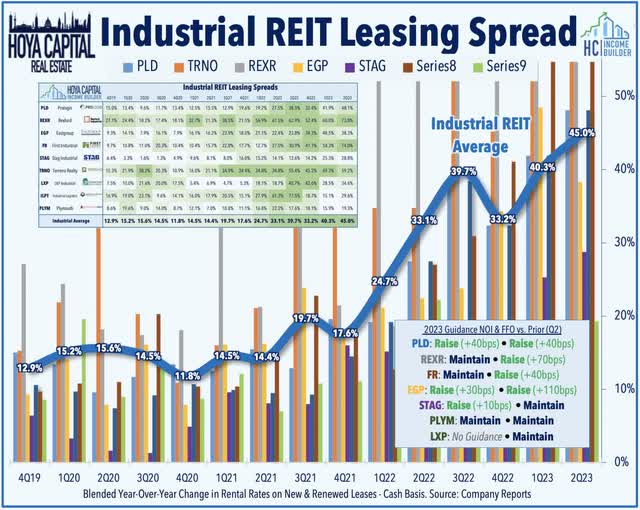

Industrial: Prologis (PLD) - a public REIT with one of the strongest balance sheets across the entire real estate ecosystem - gained 2% this week after it announced it cleared all redemption requests for its two major strategic capital funds, Prologis European Logistics Fund and Prologis U.S. Logistics Fund. These joint ventures - which are effectively private equity funds managed by Prologis that typically invest in projects and properties that are outside the footprint of PLD's primary REIT portfolio - had faced similar redemption requests in recent months as Blackstone's NTR. Prologis announced this week that it received an additional commitment of $500M to the funds, €250M in PELF and $250M in USLF which will "allow the funds to further invest in high-quality industrial assets, creating value for investors and strengthening Prologis' position as the global leader in its sector." In our Earnings Recap, we noted that industrial REITs reported another very strong slate of earnings reports showing that rent spreads have actually reaccelerated in early 2023, perhaps credited to a moderation in cost pressures for tenants in other areas of the supply chain, specifically freight costs.

Mortgage REIT Week In Review

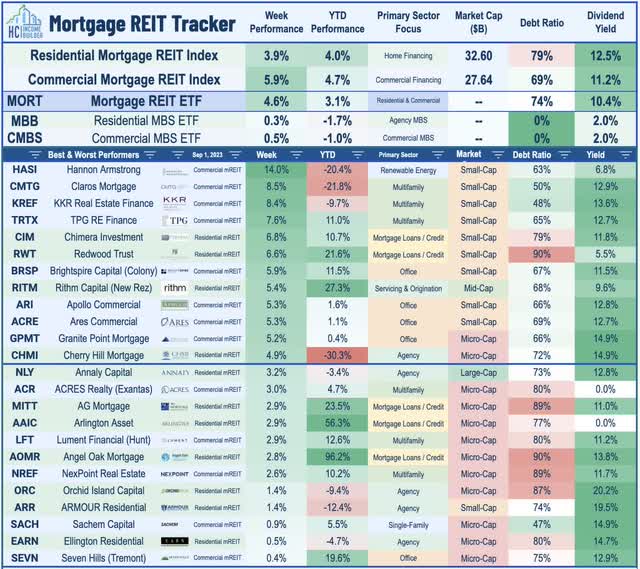

Mortgage REITs posted strong gains for a second-straight week, with the iShares Mortgage REIT ETF (REM) advancing 4.6% as interest rate volatility - as measured by the MOVE Index - calmed to its lowest levels since February. Renewable energy-focused lender Hannon Armstrong (HASI) rallied 14% this week after it announced an expansion of its partnership with Summit Ridge Energy, the nation's leading commercial solar and energy storage company, to construct, own, and operate a 250-megawatt (MW) community solar portfolio. In a deal that doubles the size of its existing joint venture, HASI will provide financing for Summit Ridge Energy’s pipeline of community solar projects in Illinois and Maryland over the next two years. Rithm Capital (RITM) rallied 5% as it appeared to get closer to a finalized deal to acquire asset manager Sculptor Capital (SCU), which had received a competing bid from another investor group that was rejected by the Sculptor Board, citing "significant uncertainty" in the unnamed group's ability to close a deal. Sculptor said Sunday that while the $12 offer was higher than Rithm's $11.15 offer, it only includes committed financing for less than half of the amount required to consummate the transaction.

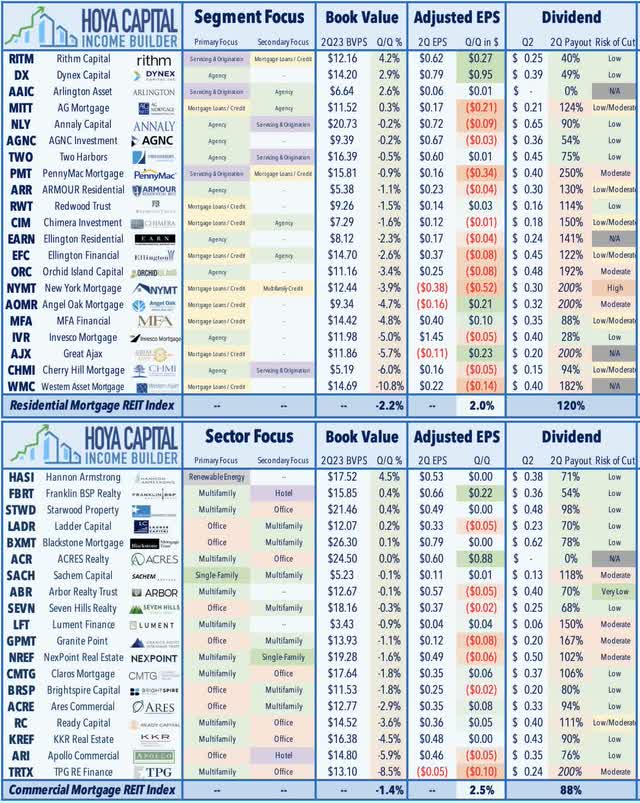

ARMOUR Residential (ARR) was little changed after it announced that it will initiate a one-for-five stock split, effective September 29th. ARR also announced that it would maintain its monthly dividend at the same split-adjusted level with a monthly payout of $0.40/share, representing a dividend yield of 19.5%. Elsewhere, PennyMac Mortgage (PMT) finished flat this week after it maintained its dividend at $0.40/share (11.96% dividend yield). In our Earnings Recap, we noted that mREITs stand on steadier ground with dividend coverage after a relatively solid slate of earnings results showing a modest increase in earnings per share. On average, the 21 residential mREITs reported an average BVPS decline of 2.2% in Q2, but recorded a 2.0% increase in their distributable earnings. On average, the 19 commercial mREITs reported an average BVPS decline of 1.4%, while the average commercial mREIT reported a 2.5% increase in comparable EPS.

REIT Capital Raising & REIT Preferreds

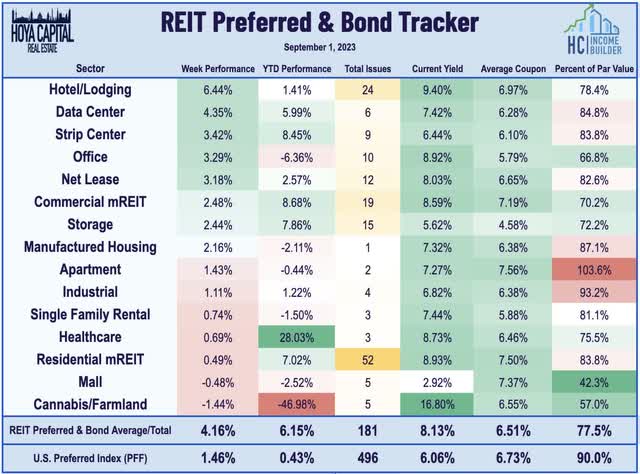

The REIT Preferred ETF rallied 4% on the week, led by 25% gains from the three preferreds of Hersha Hospitality (HT), outperforming the iShares Preferred ETF, which gained 1.5%. For the year, the REIT Preferred ETF has delivered total returns of roughly 12.2%, topping the 4.8% total returns from the broad-based iShares Preferred ETF. Residential mREIT PennyMac (PMT) was in focus this week after announcing last Friday afternoon that its two fixed-to-floating preferred issues will not transition to a floating reference rate next year as initially expected due to the end of the USD LIBOR benchmark on which the reference rate was calculated. PMT 8.125% Series A (PMT.PR.A) had been slated to reset to a dividend rate of three-month LIBOR+5.831% beginning next March, while PMT 8.00% Series B (PMT.PR.B) was slated to transition to LIBOR+5.99% next June. One of several unsettled and often controversial ambiguities that have resulted from the LIBOR to SOFR transition, while some fixed-to-float preferred securities have transitioned from LIBOR to a comparable SOFR reference rate. These two preferred issues declined by about 6% on the week, while PMT's fixed rate preferred (PMT.PR.C) traded flat on the week.

2023 Performance Recap & 2022 Review

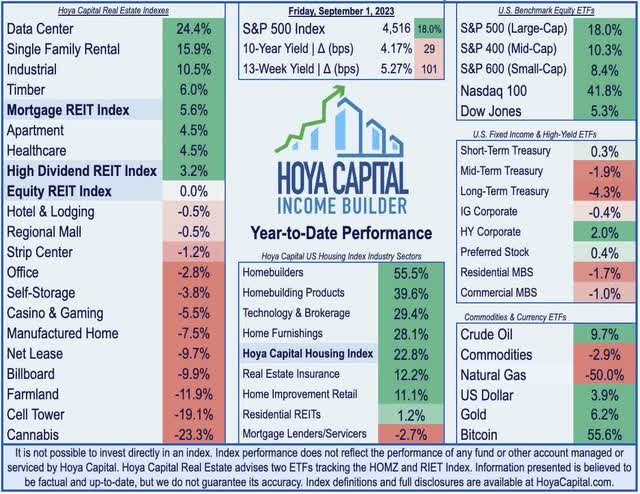

Through eight months of the year, the Equity REIT Index is flat on a price return basis for the year (+5.0% on a total return basis), while the Mortgage REIT Index is higher by 5.6% (+11.4% on a total return basis). This compares with the 18.0% gain on the S&P 500 and the 10.3% advance for the S&P Mid-Cap 400. Within the real estate sector, 6-of-18 property sectors are in positive territory on the year, led by Data Center, Single-Family Rental, Industrial, and Timber REITs, while Cannabis and Cell Tower REITs have lagged on the downside. At 4.17%, the 10-Year Treasury Yield has increased by 29 basis points since the start of the year - up sharply from its 2023 intra-day lows of 3.26% in April - but down from its intra-day peak of 4.35% in August. The US bond market has stabilized following its worst year in history as the Bloomberg US Aggregate Bond Index has gained 0.9% this year. Crude Oil - perhaps the most important inflation input - is now higher by 10% on the year but remains 20% below its 2022 peak.

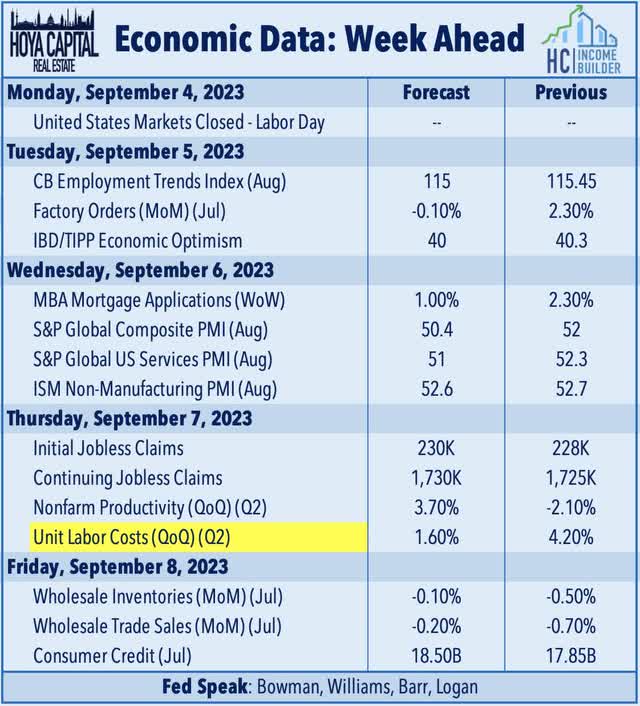

Economic Calendar In The Week Ahead

The economic calendar slows down in the holiday-shortened week ahead. U.S. equity and bond markets will be closed on Monday in observance of Labor Day. The most closely watched report of the week will come on Thursday with the BLS' Productivity and Costs Report, which includes one of the key inflation measures - Unit Labor Costs - which is expected to show a sharp deceleration in Q2 from the prior quarter. Earlier in the week, we'll see S&P Global's final Services PMI data for August, which had dipped to six-month lows in the initial reading earlier this month. We'll also be watching weekly MBA Mortgage Market data on Wednesday and Jobless Claims data on Thursday, along with the IBD Consumer Confidence report on Tuesday. Expect no shortage of 'Fed Speak' in the week ahead, as the FOMC's "quiet period" begins on Saturday ahead of their September 20th rate decision.

For an in-depth analysis of all real estate sectors, check out all of our quarterly reports: Apartments, Homebuilders, Manufactured Housing, Student Housing, Single-Family Rentals, Cell Towers, Casinos, Industrial, Data Center, Malls, Healthcare, Net Lease, Shopping Centers, Hotels, Billboards, Office, Farmland, Storage, Timber, Mortgage, and Cannabis.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read The Full Report on Hoya Capital Income Builder

Income Builder is the premier income-focused investing service on Seeking Alpha. Our focus is on income-producing asset classes that offer the opportunity for sustainable portfolio income, diversification, and inflation hedging. Get started with a Free Two-Week Trial and take a look at our top ideas across our exclusive income-focused portfolios.

With a focus on REITs, ETFs, Preferreds, and 'Dividend Champions' across asset classes, members gain complete access to our research and our suite of trackers and portfolios targeting premium dividend yields up to 10%.

This article was written by

Real Estate • High Yield • Dividend Growth

Visit www.HoyaCapital.com for more information and important disclosures. Hoya Capital Research is an affiliate of Hoya Capital Real Estate ("Hoya Capital"), a research-focused Registered Investment Advisor headquartered in Rowayton, Connecticut.

Founded with a mission to make real estate more accessible to all investors, Hoya Capital specializes in managing institutional and individual portfolios of publicly traded real estate securities, focused on delivering sustainable income, diversification, and attractive total returns.

Collaborating with ETF Monkey, Retired Investor, Gen Alpha, Alex Mansour, The Sunday Investor, and Philip Eric Jones for Marketplace service - Hoya Capital Income Builder.Hoya Capital Real Estate ("Hoya Capital") is a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations is an affiliate that provides non-advisory services including research and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital has no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RIET, HOMZ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (2)