BNP Paribas: Likely Re-Rating Incoming

Summary

- BNP Paribas reported solid Q2 and H1 2023 results, beating analyst consensus on topline and earnings.

- BNP's strong Q2 results support a bullish thesis, with improved profitability and balance sheet strength.

- Looking into 2H 2023 and beyond, BNP will likely continue to outpace expectations, anchored on strong NII.

- Reflecting on an estimated FWD 2025 P/E of ~5.5, and a P/TBV of ~0.6 vs. a 12-13% ROTE, I expect a re-rating of BNP shares to be imminent.

BalkansCat

BNP Paribas (OTCQX:BNPQF) reported solid Q2 and H1 2023 results (announced about a month ago), beating analyst consensus on both top- and bottom-line. BNP's consensus beat confirms my view that markets continue to underprice BNP's earnings potential through 2025; and, anchored on an estimated FWD 2025 P/E of ~5.5, and a P/TBV of ~0.6 vs. a 12-13% ROTE, I expect a re-rating of BNP shares to be imminent.

In February this year, I argued that after closing FY 2022 with record profitability, BNP is poised for chasing another record in 2023 -- aided by a supportive interest rate backdrop and an improving economy. Now, six months into 2023, I am confident to reiterate my bullish recommendation. In fact, following BNP's strong Q2 results, I update my EPS expectations for France' largest lender through 2025; and I now calculate a fair implied target price for BNP.PA of approximately EUR 128.09/ share.

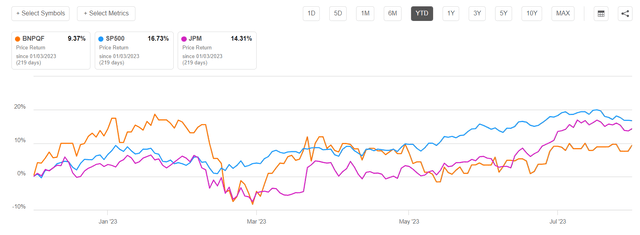

For reference, although BNP Paribas continues to report solid fundamentals, the bank's stock has underperformed YTD: Since the start of 2023, Societe Generale stock is up only about 9%, as compared to a gain of 14% for industry leader JPMorgan (JPM) and a gain of 17% for the S&P 500 (SP500).

(Note: For the purpose of this article, I reference the BNP.PA Paris listing, which is the most liquid equity paper for BNP Paribas' stock. The core takeaway, however, that BNP Paribas is undervalued is not influenced by the exchange listing of the underlying, and percentage upside/ downside estimates remain consistent across listings.)

Strong Q2 Supports Bullish Thesis

Revenue And Earnings Above Expectations

BNP Paribas posted a solid Q2 2023, with both topline and earnings ahead of consensus estimates: During the period from April to end of June, BNP generated approximately EUR 11.8 billion of revenues, up about 2% YoY as compared to Q2 2022, and about EUR 100 million above analyst consensus expectations according to data compiled by Refinitv.

Pointing to BNP's profitability, I would like to highlight that the bank's operating income was reported at EUR 4.9 billion, as compared to EUR 4.7 billion for the same period one year earlier (up 3.5% YoY), and to EUR 4.75 billion estimated by analyst consensus at midpoint. BNP's after tax income came in at EUR 3.26 billion, an increase of 10% YoY vs. the EUR 2.96 billion achieved one year prior.

BNP's profitability on equity continues to outclass European peers - with adjusted return on tangible equity currently at 13.6%, vs. an average of 8-9% for the European banking industry.

Solid Performance Across Operating Units

Several of BNP's operating business divisions outperformed expectations: While there was selective relative weaknesses in some retail markets, excl. France, the Global Markets segment was pushed by strong Equities trading momentum, which helped deliver an overall expectations beat within the Markets franchise. In Global Banking, BNP continues to take market share from competitors, which helps offset declining loan balances on a market/ macro level.

Reflecting on BNP's strong Q2 results, mostly carried by net interest income, I feel the discussion around sustainability of profits will likely drive investor positioning through the rest of 2023 and early 2024. In that context, I think it reasonable to argue that BNP -- as well as other western banks -- are currently overlearning on credit spreads; however, it should be clear by now that full deposit repricing will likely take until 2025 earliest, supporting a strong NII through 2H 2023 and 2024.

And there is an additional argument to consider, in my opinion: as the compression of net interest margin begins to gather pace on downtrending interest rates in U.S. and Europe (estimated 2H 2024), there is a strong likelihood of increased engagement within the capital markets where BNP has built a strong franchise in the past few years, notably ECM and DCM, as well as M&A dealmaking. Thus, ignoring short-term fluctuation, BNP's overall, cyclically adjusted group ROTE should likely be defended >13% though the cycle, in my opinion.

Strong Balance Sheet Supports Shareholder Buybacks

With regards to asset quality and balance sheet strength, a few encouraging metrics stand out to me: First, I would like to highlight that BNP's cost of risk in Q2 2023 actually decreased vs. Q2 2022, falling to EUR 689 million (as compared to EUR 758 million for the same period one year earlier). BNP's downtrending cost of risk contrasts to what has been reported by other banks, including Deutsche Bank, J.P. Morgan, BofA, Citi and Barclays; Second, I note that BNP's liquidity coverage ratio improved QoQ, to 143%; And third, I like BNP's strong capital positioning, referencing a 13.6% CET1.

In line with strong Q2 results, and a solid balance sheet, it is no surprise that the ECB has given approval to BNP for executing on the second installment of the EUR 2.5 billion share buyback program, which is now expected to be completed by year-end 2023, providing support to shares.

Target Price: Raise To EUR 128.09

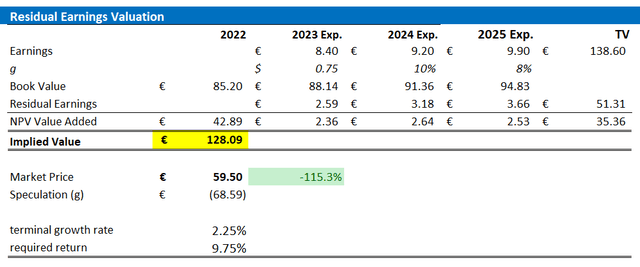

Following BNP's Q2 2023 results, I update my EPS expectations for the French bank through 2025: I now estimate that BNP's EPS in 2023 will likely expand to somewhere between EUR 8.2 and EUR 8.6. Moreover, I also raise my EPS expectations for 2024 and 2025, to EUR 9.2 and EUR 9.9 respectively.

I continue to anchor on a 2.25% terminal growth rate (approximately in line with nominal global GDP growth to reflect conservatism), as well as a 9.75% cost of equity.

Given the EPS update as highlighted below, I now calculate a fair implied share price for BNP.PA equal to EUR 128.09, seeing more than 100% upside vs. EUR 58/ share as of early August 2023.

Company Financials & Analyst Consensus Estimates; Author's Calculations

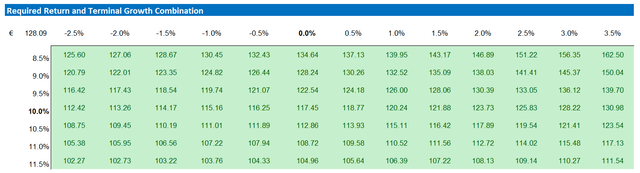

Below is also the updated sensitivity table.

Company Financials & Analyst Consensus Estimates; Author's Calculations

Conclusion

BNP Paribas reported solid Q2 and H1 2023 results, beating analyst consensus on topline and earnings. Now, looking into 2H 2023 and beyond, BNP will likely continue to outpace expectations, on the backdrop of a strong NII. Following BNP's strong Q2 results, I update my EPS expectations for France' largest lender through 2025; I now calculate a fair implied target price for BNP of approximately EUR 128.09/share. Overall, with BNP outpacing consensus expectations for multiple quarters now, I expect a re-rating of BNP shares to be imminent.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

not financial advise

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.