Interactive Brokers Is Reasonably Priced Even In A ZIRP Environment

Summary

- Contrary to cursory fears, IBKR earnings growth has been less volatile thanks to interest rate volatility.

- Despite being a high-quality business, IBKR is not in high demand by institutions due to perceived unpredictability of short-term results.

- The company's account growth has remained strong, surpassing historical levels, despite challenging market conditions of late.

- We show that commissions and valuation are large natural hedges for NIM volatility. Regardless, valuation still looks reasonable even when stress testing NIM to a zero rates environment in a vacuum.

Eoneren

IBKR earnings have been less volatile thanks to volatility in rates

Interactive Brokers Group (NASDAQ:IBKR) is not in the most in-demand stock for institutions, despite the fact it is one of the highest quality businesses (very high margin, no capex reinvestment requirements) with high and long term tailwinds. One of the biggest reasons being the impossibility to predict short-term results. Both earnings from commissions or net interest margin are volatile. Because each earnings component seems very volatile and subject to market gyrations, many investors, especially institutionals afraid to look stupid in the short-term, shun this high quality business.

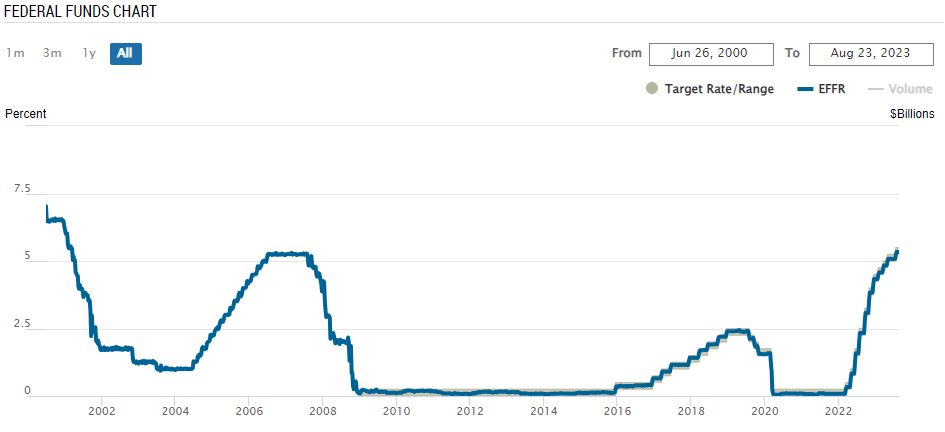

Today, Fed funds rates have risen to 5.2-5.5%. In my 15 years in the market, I have largely seen market participants extrapolate current rates indefinitely (at whatever level), which means pessimism for IBKR when rates are zero, and optimism when rates are high or rising.

Fed Funds rates (US Federal Reserve )

For this reason, I made a Seeking Alpha post in 2020 reviewing IBKR’s bright future in 2020 even with rates at zero indefinitely. I concluded IBKR earnings were set to double by 2025 in this scenario. Because I believe it would be imprudent to repeat this exercise at higher rates, let me redo this analysis. But this time, I will restate IBKR’s historical financials to see what earnings growth would have been if rates did not move at all. The surprising conclusion is that earnings would have been more volatile with zero Fed Fund rate volatility!

But first, let’s discuss the main changes in the business in the meantime.

Interactive Brokers recent trends in KPI’s

I believe it is important to track IBKR’s monthly KPI metrics meticulously, which I have charted since IPO:

Author's own compilation of IBKR's monthly metrics since IPO

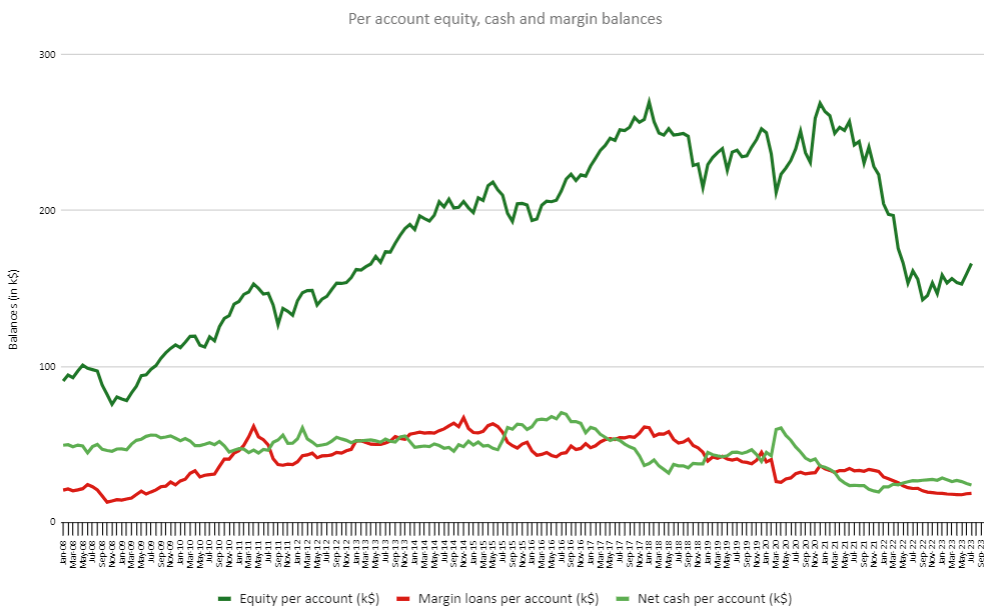

By far the most important long-term value driver for IBKR I consider is accounts growth. The reason being that almost no one, except accounts that go broke, leave IBKR: churn is very low. A new client is hence a recurring revenue source, though volatile from year to year. What’s more, a given client relationship tends to grow over time. IBKR experiences – what they call in SaaS businesses – some negative revenue churn (the growth of revenue per loyal account more than offsets the churn).

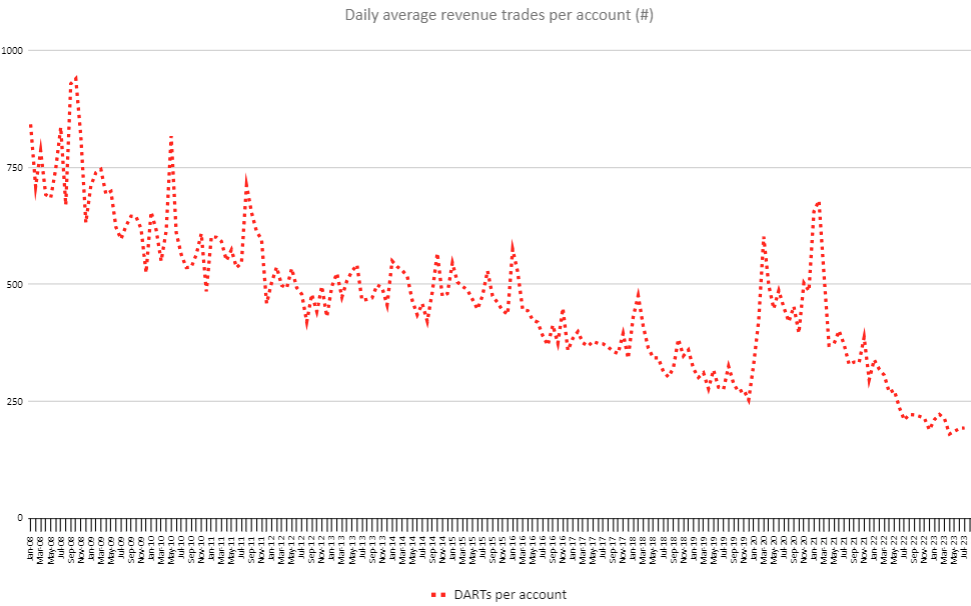

My chart above (all metrics are YoY, and I included S&P 500 returns) beautifully captures how IBKR’s KPI’s move with the vicissitudes of the market: as market returns go in the red for longer,

trading activity slows (though contrary to common belief and the superfluous quarterly reporting on DARTs, trading is not the main value driver of IBKR, net interest margin is)

client equity obviously falls: my analysis shows a beta (or sensitivity) of 0.7X. That is to say, every percentage point drop in the SPY has historically translated into a 0.7 pp drop in IBKR’s client equity, though IBKR has outgrown the SPY thanks to e.g. clients depositing new assets

account growth slows (see blue line)

It is therefore all the more surprising new accounts growth is still higher than historical, despite:

the new tough comp of a higher accounts base in the wake of the CV-19 trading craze

the recently lackluster market returns

The average account growth pre-CV19 was around 16%, while the YoY account growth as recently as July 2023 was still at 19.3%, despite the above headwinds. This beat is consistent with management guidance and target (which they communicated in 2022) to grow faster going forward in percentage terms versus history despite a bigger absolute user base.

What else has changed?

Since my post in 2020 (and since Milan Galik took over as CEO in 2019), some product things have steadily improved and changed:

-

Product innovation increased somewhat, especially on Mobile

Bill pay and other checking account functionality: allows North American users to use brokerage account for paying almost anyone, or get paid salary to IBKR account. Combine this with the IBKR credit card and rock bottom forex rates and you have a very useful account for everyday life, especially as an expat. Instant deposits allow US clients to fund their account instantly, which also helps with margin calls.

Offerings of YouTube courses greatly increased, I can attest to the ease of starting out with IBKR’s API for Python thanks to a course which didn’t exist a few years ago

Many new ESG analytics and carbon offsets, driven by Peterffy’s son

To keep account growth high, and lower the barrier to entry for small accounts, the minimum activity account fees were discontinued in 2021

The percentage of free float has increased from 21.5% to 24.5%, improving liquidity (this is the share of what the C-corp owns versus the employee partnership. Net income will only show the C-Corp’s growing share, while share count looks like dilution, but in fact reflects the conversion of partnership shares into the C-Corp, mainly by Peterffy’s programmatic sales of 1 MUSD a day since 2021)

Trading products have increased: US overnight trading, IBKR is now one of the cheapest crypto trading platforms, interest rate futures, and Micro/Nano futures on many products (avoiding the trading of 100 KUSD lots), new FX currencies (THB, AED), many bonds were added. An increase in offerings of ETF’s and mutual funds. Lastly, fractional share trading in both the US and EU.

Exchanges and countries coverage was increased, much of which in H1 2023 (Denmark, Taiwan, Prague). Regarding 2021 and 2022, the ’22 10K notes 150 exchanges in 33 countries, up from 135 and 33 in 2020.

Useful new order types: notably liquidity adding order types that float with a fixed offset relative to the best bid or offer. A variety of order types either routing to exchanges with the highest probability of executing, or resting within IBKR’s internal execution engine. These order types allow even individuals to capture some of the bid-ask spread and win liquidity rebates from exchanges

Marketing - a self-admitted weakness of the founder - has increased in both size and efficiency since Galik took over. Today IBKR is doing a mix of several channels, which is necessarily optimal for a large corporation, with notably more targeted digital marketing. In the past, IBKR did mostly print and TV brand advertising

Peterffy has repeatedly stressed the importance of hiring more programming talent, and has probably benefitted from the VC company layoffs due to the impact of the rising rate environment. IBKR total employees are up 40% in just 2 years, though this metric historically grew at >15% CAGR.

Regarding customer mix shift since 2020:

Secular trend towards international has continued: 80% of customers are now international, up from 76% in 2020

Mix shift towards individuals: 59% of customers are institutions, down from 64%. Some of this is driven by growth in small accounts with introducing brokers

Income statement

In 2020 investor relations noted the secular trend of rising execution, clearing and distribution fees from exchanges. However, this trend has reversed. These costs as a percentage of commissions revenue has fallen by 10%. This might be due to the speculative shift towards futures and options (up resp. 20% and 30% versus broadly flat for stocks), a better routing algorithm trading off multiple competing exchanges, and/or a network effect from the growing client base IBKR is able to execute internally. The company also noted a larger average trade size because of high hedge fund activity of late.

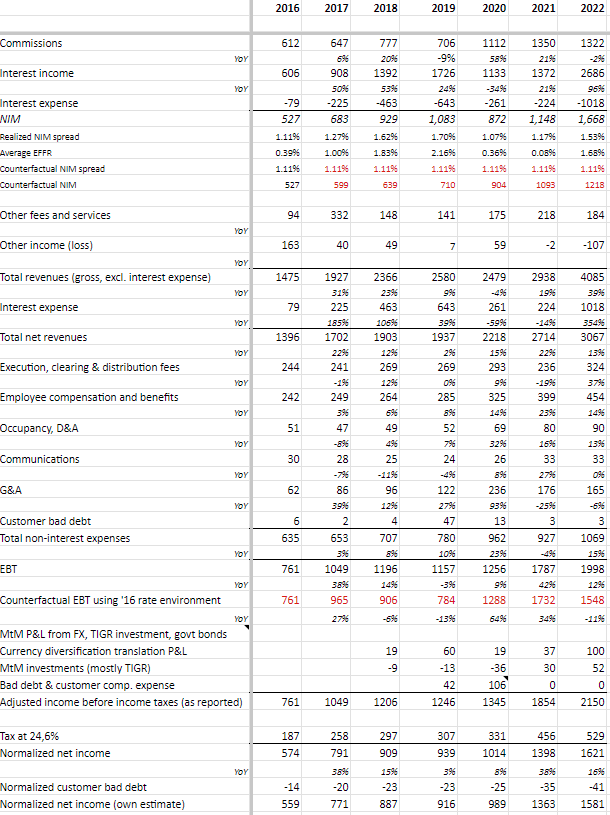

Restated IBKR earnings using counterfactual fixed Fed Funds rates at 0.4%

As I stated in the introduction, to allow for a better understanding of IBKR’s underlying earnings growth regardless of interest rate gyrations, I will create a counterfactual history.

For this, I need to estimate the impact of Fed Funds rates (EFFR) on IBKR’s net interest rate spread. I used 7 years of data from two sources:

net interest spread reporting by IBKR in its 10-K’s

US Fed Funds rates ‘EFFR’ (averaging the EFFR for each year)

Remarks:

international rates move differently, but less than 30% of customer currencies/debts are not denominated in USD. The assumption of parallel moves to USD rates is a good one

the rates IBKR’s interest-earning assets (mostly T-Bills) garner lags EFFR a bit, but the interest cost follows instantaneously. Everything else equal, NIM should be higher in an environment when EFFR goes down

Loyal followers of IBKR know that the CFO reports IBKR’s sensitivity to EFFR in every conference call, and has noted many times the inflection point where the sensitivity decreases if EFFR rates rise above 0.5%. The simple reason is that IBKR’s USD funding costs (i.e. the interest it pays for customer’s cash) is EFFR minus 0.5%, or - crucially - 0%, whichever is higher. IBKR’s spread hence compresses below 0.5%. One question for this analysis remains, which interest rate do I choose to model IBKR’s normalized earnings? Some considerations:

EFFR has averaged almost exactly 1.0% in the 2015-2023 period

IBKR’s NIM spread has an inflection point at 0.5%

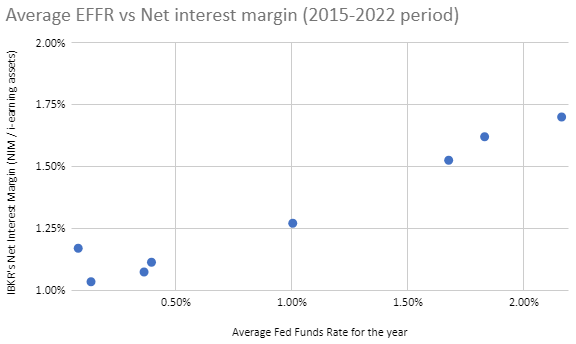

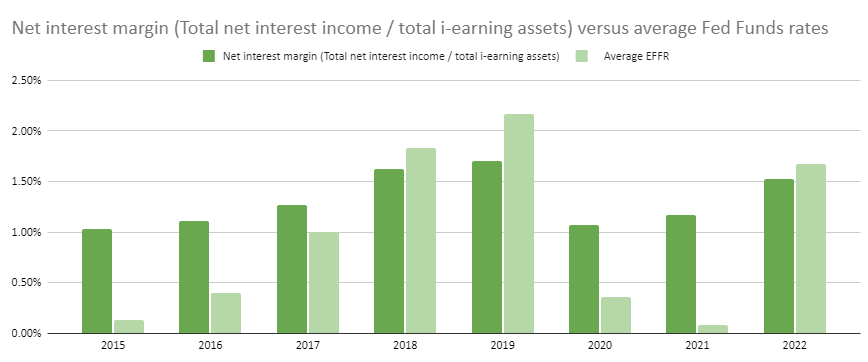

Let us first look at the empirical correlation between NIM spread and rates:

Company 10-K filings and US Fed

Company 10-K filings and US Fed

Surprisingly, we see that IBKR’s realized NIM seems to have been less sensitive when EFFR has been below 0.5%. The inflection point the company talks about is an “everything else equal” argumentation. Of course, when rates move, everything is not equal! Mix shifts happen as customer behavior changes. Speculation and hence margin loans could go up in low rate environments (margin loans are more profitable than lending customer cash to Uncle Sam). This is what we saw in the years after CV-19 hit. Longer term, mix shifts in customer types also change NIM spreads. On small accounts (e.g. such as the rapidly growing i-broker segment), IBKR takes a bigger spread from both margin loans and customer cash (it pays little to no interest on customer cash on small accounts).

I prefer to use realized data to pick my counterfactual constant NIM to adjust IBKR’s financials for rate cycle noise. Some other interesting observations:

the lowest NIM ever observed in the period was 1.03% in 2015 (EFFR at 0.13%)

as recent as 2020 (without a stock mania), NIM was 1.07% while EFFR was 0.36%

In the subsequent year of 2021, NIM rose to 1.17% while EFFR was 0.08%. This was an extraordinary year with high margin loans in the mix, and high short selling lending fee rates in the NIM

Choosing 0.5% as a ‘through the cycle’ EFFR would sound very conservative, but given the bigger theoretical downside below 0.5%, a more conservative thing to do would be to choose say 0.4%. Actually, 2016 happens to be in this case, with a NIM of 1.11%.

We now proceed to restate IBKR’s historical NIM earnings to 1.11% instead of the historical margin (see model below in red):

Author's own calculations based on company filings

As you can see, I made a counterfactual EBT based on this restatement exercise.

Surprisingly, the counterfactual EBT growth profile with zero rates volatility makes IBKR’s growth more volatile (the variance of the annual EBT growth rate was almost double the true one).

What I believe this shows is that everything about rates is not equal, and market behavior in terms of commissions is a natural hedge to NIM income:

when interest rates drop quickly, it typically means there is some crisis, paving the way for higher commissions at first from panic, and more trading and margin borrowing from speculation in a low rates environment

when rates go up, speculative excesses and trading activity decreases

The counterfactual profit from NIM was of course less volatile. Interestingly, it grew exactly 15% CAGR for the last 6 years. There are a lot of moving parts to reconcile this with the superior accounts growth (typical new account is smaller, % of client equity in cash and margin loans decreasing, different NIM spreads on different account sizes). The true NIM CAGR in the period was 21% thanks to higher rates. The counterfactual split (normalized split you could say, if you believe in the return to zero rates in over indebted economies) between gross profit from NIM and commissions was about 55%/45% in 2022 (I deduct execution costs from commissions to get a commissions gross profit).

Commissions grew at a CAGR of 13.7%.

In the latest section I will discuss my reasonable future estimates and valuation metrics.

Changes in disclosures in the annual report

A welcome new disclosure is the extra color on collateralized transactions and repledging. IBKR now has a nice table in financial note 7 where it breaks out its rights to use customer assets as collateral on the one hand, and the effective usage of that right (IB is allowed to use customer assets as overnight collateral for its 100% own benefit when a customer uses margin, or when the customer explicitly allows securities lending through the Yield Enhancement Program for a 50% benefit share).

At the end of December, IBKR had the right to pledge 42B customer assets because of customer margin usage, 62.7B because of the Stock Yield Enhancement Program. In total, only 24B of these rights were used though, mostly from customers trading on margin, as IBKR prioritizes securities lending where it retains 100% of the benefit (in the Yield enhancement Program, the profit split is 50/50 with the customer). There was also a disclosure how many assets 3rd parties, in turn, are allowed to repledge from IB. Reassuringly, this was virtually zero. I believe there are technical reasons why it’s not completely zero: the counterparties that are allowed to repledge a tiny amount of securities are clearing houses or exchanges.

Recently, IB started disclosing the AUM in crypto assets under custody with Paxos. This number is very modest for now, at just 134 million dollars compared to a third of a trillion in customer equity at the time. Peterffy admitted adoption has failed for now, despite low crypto trading commissions.

Latest developments and near future

New accounts tend to get funded slowly (in a matter of years). High account growth in the last years therefore is a good leading indicator of improving metrics that drive IBKR’s net profit (deposits ultimately drive net interest margin).

Another tailwind is two large introducing brokers being added in Q3 and (hopefully already in) Q4 this year. Based on Q3 2022 earnings call comments by Peterffy “onboarding these introducing brokers would have our account growth YoY at 30%”, and a follow-up answer in the Q&A “this 30% number is 65% to 75% driven by the onboarding of these brokers only”, we can estimate the amount of underlying customers at these introducing brokers at 20% times the number of customers in Q3 ’22, or 400 thousand. Assuming 12% annualized accounts growth for the rest of the year (i.e. 5% absolute to December) from other sources, this means IBKR has a line of sight on 2850 customers or a staggering >36% YoY growth come New Year.

This has to be nuanced by the fact that introducing broker accounts are the smallest of all client types, though the net interest margin (% spread, not dollar) is the highest. As I mentioned in my previous post, an underappreciated fact of introducing brokers accounts is that most of the NIM margin accrues to IBKR itself (as opposed to the commissions), and remember NIM is the most important contributor for IBKR to begin with. At current interest rates, I estimate the annual pre-tax contribution margin per client to be around 170 USD. These add 70 MUSD in annual operating profit.

Wrapping up: How to think about valuation

Consensus has IBKR earnings 3.05 BUSD in EBT for 2023. I verified with my own quarterly model this implies the continuation of current Fed Funds. IBKR today has almost exactly a 40 BUSD market cap (including partnership interests). This implies a 13X P/E ratio.

Based on Q1 and Q2 reporting, and my model on the other hand, I also estimate IBKR will realize a NIM spread of 2.4% in 2022. If rates were to crash down come Christmas 2023 to 0.4% in a matter of days, IBKR’s NIM spread would go back to 2016 levels by Q2 2023. Thanks to a lag effect though, Q1 2023 would roughly be in between the Q4 2022 NIM (my est. is 2.5%) and the 2016 level because of a lag effect of old T-Bill earnings This would yield an average 2024 NIM of 1.28% and - to come back to our hypothetical zero rates forever environment - 1.11% in the years after.

To estimate what IBKR’s valuation metrics would look like, I will now redo my counterfactual EBT exercise for 2023, 2024 and onward. For this I normalize to a NIM of 1.11% and discuss the normalized underlying growth rates to be expected afterwards.

Based on the previous paragraph, I estimate IBKR is overearning by 1.5 BUSD versus a zero rate environment. This is roughly half of actual earnings, so the hypothetical 2023 P/E ratio would be at 26X.

We discussed the historical growth CAGR of commissions (almost 14% CAGR) and counterfactual NIM growth if rates would’ve been permanently at 0.4% (15% CAGR). Naive extrapolation would yield a revenue CAGR of around 14.5%. I think this might be reasonable for the foreseeable future because of some offsetting puts and takes:

Tailwind: We discussed the supernormal growth in accounts in the back-end of H2 thanks to the onboarding of two large brokers as introducing brokers. Management has been bullish on higher accounts growth going forward as compared to historical one, as already evidenced by the post-CV19 period (even in the last two years with a lackluster market)

Tailwind: some operating leverage from certain fixed costs (this is a small effect as IBKR’s margins are already very high)

Headwind: both volatility and interest rates in the last few years have been good when compared to the very quiet period of 2016-2019

Headwind: the most active (and therefore profitable) IBKR users were the early users because they benefited most from the company’s low cost. As you can see in the below pictures, margin and cash balances (on which IBKR takes a NIM spread) as a percentage of customer equity has been trending down, as well as customer equity itself, and trades per account. However, this trend is already captured in IBKR’s historical growth

Headwind: despite IBKR’s management guidance, IBKR’s size will make it more difficult to grow at the same CAGR

For these reasons, I think it is reasonable to underwrite 14% normalized earnings growth for the next 5 years in a zero rate environment.

Author's compilation of IBKR's monthly metrics

Author's compilation of IBKR's monthly metrics

Wrapping up, in a counterfactual world with rates at zero, IBKR would be trading at a P/E of 26X. As I tried to show, this counterfactual exercise is penalizing, because historically commissions have increased (a lot) when rates tended to go down.

Knowing this, is a P/E ratio of 26X in a bad scenario high for this high quality, yet short-term lumpy, business? Consider IBKR has

a 65% pre-tax profit margin

double digit normalized earnings growth for a long time

virtually zero capital needed to finance that growth (albeit with the caveat that the current owner sees a need to hoard balance sheet cash to grow credibility with institutionals)

Indeed, a 4% earnings yield that is growing 14% for 7 years, with lower terminal growth thereafter implied in a terminal multiple of 20X (remember, we are in a zero rate environment!) has around 33% upside using a 8% discount rate. Framed another way, the IRR would be 13%. This is overly penalizing however, because we did not discuss the optionality of IBKR’s large pool of almost 10 BUSD in excess capital above regulatory requirements. If a reputable bank were to buy IBKR, it could pay 20X in 7 years' time for the earnings stream, and pay a separate amount for the excess cash in the company (a synergy with the large acquirer's reputation). Regulatory minimum capital is not the only constraint though, operationally IBKR needs a bit more to operate in its various jurisdictions. Assuming only 5 BUSD is truly excess operationally, we could add this number, together with the interim excess earnings from H2 2023 to Q1 2024 (my estimate is another 0.6 BUSD) to what an acquirer would pay for the excess cash in year 7 (remember, this cash would be almost invisible on the earnings side with zero rates). This increases the above metrics to 41% NPV upside and 14% IRR.

This is assuming an indefinite zero rate environment without offsetting growth in commissions from said environment, and assuming IBKR’s growth largely calms down after 7 years.

I believe I have shown that

contrary to general skepticism about IBKR’s earnings being subject to wild market gyrations, its historical commissions revenue has offset a good part of its NIM volatility

the IBKR investor returns going forward seem reasonably good even assuming a somewhat artificial zero rates downside scenario (without offsetting higher commissions)

Because IBKR is a growth stock, the valuation tailwind from lower rates is actually another mitigant to its business being hurt from lower rates. For investors, commissions revenue and IBKR’s valuation itself is a mitigant to NIM volatility

Risks

IT glitches, large customer margin losses: for now, IBKR has never suffered a significant margin loss compared to equity capital. 2020 was the biggest ever at 2% of equity capital (some short term oil futures going negative). IBKR is liable for some customer losses if its platform fails to perform. For now, IBKR has one of the best up times and platform stability of all brokers.

Valuation and duration risk: with rates moving up, valuations of growth stocks tend to compress as the duration of cash flows is high for these growth companies. Mitigant: IBKR’s own business benefits from higher rates.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of IBKR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.