Swisscom: CAPEX Situation Better Than Other European Players

Summary

- Swisscom has low CAPEX burden due to completed fibre rollout and mostly completed 5G rollout, but still it has weak FCF yields.

- ARPU pressure and price competition in the telecom industry remain a problem for Swisscom as it does for telco in general, although some of it is discretionary and brand-shift related.

- EBITDA growth is mainly driven by fewer provisions for litigations, and costs are growing due to inflation and marketing expenses limiting profit growth potential.

- It is a fine business, but it's pricey for what it is, and there are endless better opportunities out there.

- Looking for a helping hand in the market? Members of The Value Lab get exclusive ideas and guidance to navigate any climate. Learn More »

Arseniy Rogov/iStock Editorial via Getty Images

Swisscom (OTCPK:SCMWY) is the Swiss telecom player with also a decently large presence in Italy through FastWeb, which is one of the several main telecom brands that provide wireline services in Italy. The primary point we want to make is that compared to other plays in telecoms in Europe like Proximus (OTCPK:BGAOF), the CAPEX burden for Swisscom is thankfully quite low since a lot of the major rollouts of new connectivity infrastructure has already been done. Still, it's not a particularly cheap company, and therefore, really not interesting considering the underlying economics and dynamics of telco, namely price competition. A pass.

Q2 Breakdown

Let's begin with the results, starting with the CAPEX situation, which we believe is the most important and primary thing to look at when analysing a telco player in Europe, since fibre rollouts are expensive.

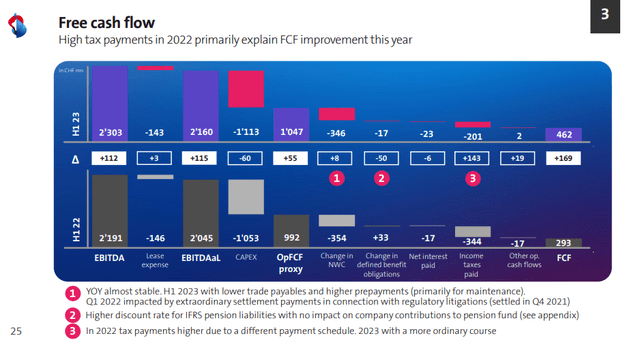

The situation with Swisscom is pretty good in terms of the CAPEX trends. The fibre rollout is actually done at this point, and FTTH targets have been fully achieved. They're far into the 5G rollout as well, so extraordinary CAPEX associated with being an important utility provider to the public is basically over. However, the business is still very capitally intense on the fixed assets side, and FCF yields are pretty weak. While NWC effects will reverse for the FY, the FCFY is still far below the 5% mark. That's not a good start in terms of cash generation or valuation, even if the CAPEX levels won't grow too much.

FCF (Q2 2023 Pres)

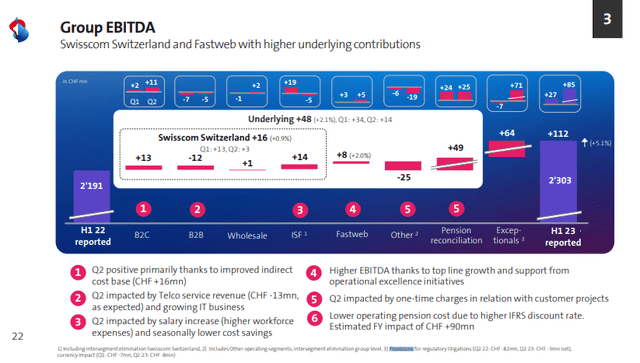

In terms of EBITDA and profitability, there is a general ARPU pressure mostly from idiosyncratic shift of focus to lower value brands, but that ultimately means it will come back as general price competition in the industry which remains a problem. Broadband price competition continues to be strong in broadband Italy with FastWeb, with more entrants into the market, and in general the competition regulation authorities are going to continue to make sure that there can be no favouring of incumbents, even those who operate the fibre infrastructure, that would otherwise be a way to stop new entrants even from outside the telco space like Sky and Enel (OTCPK:ENLAY). Still the company is managing a growth in group EBITDA, but much of it is being driven by the fact that there are less provisions this year for litigations compared to last. Actually, almost 4% of the growth relative to the 5% of EBITDA growth achieved on a headline basis is coming from those provision effects. These are contained in the 'exceptionals' element in the chart below.

EBITDA (Q2 2023 Pres)

The EBITDA strength is still positive and a good performance by the company, as fixed cost inflation, particularly salaries, is a relevant concern across industry. However, the salary increases took effect in April, and therefore only half of the impact is being seen in H1. Run-rate pressure is going to be higher. Nonetheless, the ability to stay ahead of that so far is already quite satisfying.

Bottom Line

Ultimately, Swissco is a telco player. It's tough to grow the business, yet costs are growing on account of inflation. Generally, costs are growing in terms of marketing and promotion as well, since again the industry structure is not that great. These are commodifying services, and the government has a firm hand in these businesses as well which are always going to be regulated by national competition and telco specific authorities. Indeed, this is where the litigation provisions have come from - litigation with COMCO over some details about how they've deployed fibre infrastructure and some potential for gating the industry.

The PE is around 18-19x based on annualised figures, which are neither a conservative nor optimistic estimate given fixed cost inflation, pricing pressures in general against the cost saving programme that is already in effect and achieving run-rate savings. That PE is not compelling given current benchmark rates and the relatively lesser quality of the telco economics and industry structure. A pass.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We've done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration. Give our no-strings-attached free trial a try to see if it's for you.

This article was written by

Formerly Bocconi's Valkyrie Trading Society, seeks to provide a consistent and honest voice through this blog and our Marketplace Service, the Value Lab, with a focus on high conviction and obscure developed market ideas.

DISCLOSURE: All of our articles and communications, including on the Value Lab, are only opinions and should not be treated as investment advice. We are not investment advisors. Consult an investment professional and take care to do your own due diligence.

DISCLOSURE: Some of Valkyrie's former and/or current members also have contributed individually or through shared accounts on Seeking Alpha. Currently: Guney Kaya contributes on his own now, and members have contributed on Mare Evidence Lab.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.