Goldman Sachs: Poised For A Strong Recovery If You Have Enough Patience

Summary

- Goldman Sachs stock has failed to maintain a robust recovery despite bottoming out in July 2022. However, investors must remain patient to participate in its subsequent recovery.

- GS lost most of its July gains as sellers rushed out after its Q2 earnings release. However, I assessed buyers have returned last week.

- Given the current challenges, investors remain cautious about assigning higher valuation multiples to GS. However, investors are urged to look ahead and not focus on the present.

- Goldman Sachs is on schedule to lap much easier comps in the second half, lowering the bar for the bank to outperform Wall Street estimates.

- I argue why investors who can wait out the near-term volatility should find the current levels attractive to buy more.

- Ultimate Growth Investing members get exclusive access to our real-world portfolio. See all our investments here »

Michael M. Santiago

Goldman Sachs (NYSE:GS) stock has underperformed the S&P 500 (SPX) (SPY) since my previous update in April 2023. The recent volatility in GS as it topped out in July (post-Q2 earnings) saw sellers digesting most of its July gains.

However, GS maintained its consolidation above the critical low $300s zone, suggesting robust dip-buying support. Given the recent volatility, as buyers returned close to the $320 zone, I assess whether the current opportunity is timely for investors to capitalize.

Goldman Sachs' investing banking business was battered by the pandemic boom and bust as it initially drove deal-making to its 2021 heights. As such, sellers aptly sold out at its November 2021 highs, as they expected Goldman Sachs' operating performance to crumble in 2022.

Coupled with the Fed's unprecedented rate hikes that hammered Goldman Sachs' net revenue and EPS, investors fled despite its relative discount against its peers. Investors are reticent about assigning higher-than-average multiples to Goldman Sachs' volatile deal-making business, as GS' P/E multiple remains close to its 10Y average of 10.2x.

However, I urge investors to look forward, as recent inflation and employment data have increased the likelihood that the Fed is close to or at peak rates. Moreover, the momentum from the 10Y yield has stalled, suggesting investors have already priced in a hawkish Fed. Notably, while the 10Y yield reached the heights last seen in October 2022, the S&P 500 remains well above its October 2022 lows.

With that in mind, I believe investors' expectations about a hard landing have dissipated as they look forward to the normalization of interest rates moving ahead. Moreover, Goldman Sachs will lap much easier comps in the second half, lending a much-needed tailwind to bolster its ability to outperform Wall Street's estimates.

Nonetheless, I believe investors are likely discounting the investment bank's ability to meet its RoTCE target of between 15% to 17%. Citi (C) analysts remain skeptical, suggesting it requires "time and a more favorable investment banking environment."

I concur with the market's view that GS' valuation is appropriate if we remain in a highly challenging environment. For GS to move into a multiple expansion phase, we require better execution from CEO David Solomon and his team, even as they engineer their exit from their loss-making consumer businesses. It has also made recent changes to its wealth management business, as it refocuses on its ultra-high net worth segment by selling its mass affluent business.

Notwithstanding the near-term pessimism, I believe the current levels have robust support from dip buyers, presenting an opportunity for patient investors willing to ride out market volatility.

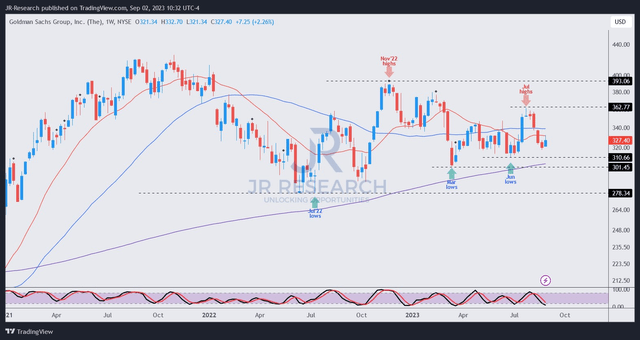

GS price chart (weekly) (TradingView)

As seen above, GS buyers defended the steep selloff in March 2023 and never allowed the pessimism to slide further toward its July 2022 lows. As such, GS remains secured in a long-term uptrend, supportive of buying significant dips.

The recent post-earnings selloff consolidated above its June lows, which must be closely watched. I assessed buying sentiments improved last week, constructive for dip buying. However, I must emphasize that GS is mired in a considerable consolidation range, with no discernible medium-term uptrend that could attract momentum buyers to return confidently.

Still, the recent dips are attractive opportunities for investors to add more exposure, as its valuation isn't aggressive. Coupled with a more positive economic outlook in the second half and bolstered by possible rate cuts from 2024, it should improve the potential for Goldman to outperform moving ahead.

Therefore, I believe it's reasonable for dip buyers to remain confident at the current levels, although they need to temper their expectations of a quick recovery. While I want to maintain my Strong Buy rating, the recent market pullback has offered more attractive opportunities elsewhere, as GS' momentum and near-term recovery will likely remain challenging.

Rating: Downgraded to Buy. Please note that a Buy rating is equivalent to a Bullish or Market Outperform rating.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA's bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!

This article was written by

Ultimate Growth Investing, led by founder JR Wang of JR Research, helps investors better understand a range of investment sectors with a focus on technology. JR specializes in growth investments, utilizing a price action-based approach backed by actionable fundamental analysis. With a powerful toolkit, JR also provides insights into market sentiments, generating actionable market-leading indicators. In addition to tech and growth, JR also offers general stock analysis across a wide range of sectors and industries, with short- to medium-term stock analysis that includes a combination of long and short setups. Join the community today to improve your investment strategy and start experiencing the quality of our service.

Seeking Alpha features JR Research as one of its Top Analysts to Follow for the Technology, Software, and the Internet category, as well as for the Growth and GARP categories.

JR Research was featured as one of Seeking Alpha's leading contributors in 2022.

About JR: He was previously an Executive Director with a global financial services corporation and led company-wide, award-winning wealth management teams consistently ranked among the best in the company. He graduated with an Economics Degree from Asia's top-ranked National University of Singapore (NUS). NUS is also ranked among the top ten universities globally. I currently hold the rank of Major as a Commissioned Officer (Reservist) with the Singapore Armed Forces.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of C either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (2)

who wants to invest in that?