DGRW: Dividend Fund With Limited Benefit To Your Portfolio

Summary

- The WisdomTree U.S. Quality Dividend Growth Fund is a U.S. dividend-focused ETF with a market capitalization ratio of approximately $9.8 billion.

- DGRW selects dividend-paying companies based on liquidity and dividend screens, as well as a composite risk score.

- The holdings of DGRW are skewed towards technology stocks, similar to the SPDR S&P 500 ETF, and the performance of the two ETFs is almost identical.

- Given DGRW's net expense ratio and 1.86% yield, there is a significant opportunity cost for investors entering into this ETF.

- Similar alternatives, which focus on quality dividends, provide far more attractive dividend yield and cost less. Moreover, there is a very small difference from the S&P 500, which questions the rationale of DGRW.

bpawesome

The WisdomTree U.S. Quality Dividend Growth Fund (NASDAQ:DGRW) is a U.S. dividend focused ETF with a market capitalization ratio of approximately $9.8 billion.

The underlying objective of DGRW is to deliver safe and growing dividends. There are a couple of steps, which are assumed to warrant stability of the dividends.

- Liquidity and dividend screen. DGRW selects only dividend-paying companies, which are domiciled in the U.S. and have a dividend coverage ratio of at least one. The ETF also applies minimum market cap and average daily volume criteria to avoid liquidity risk and narrow the bid / ask spreads.

- Composite risk score. DGRW incorporates a quality and momentum scoring to scope out the riskiest companies based on the corresponding ranking. Usually this is the case for value traps (i.e., companies where the high yielding dividend and low multiple are justified).

- Stock selection. Based on the aforementioned screens including ESG filtering, DGRW stock selection boils down to the combined score of three fundamental metrics: return on equity, return on assets and analysts' consensus earnings growth estimates.

Now, once the most favourable stocks are defined, DGRW applies a weighting methodology, which is primarily driven by the from the amount of dividend paid by the company over the previous 12 months (i.e., dividends per share multiplied by the total number of shares outstanding). A maximum exposure to a single security is capped by 5%, which on a temporary basis can deviate provided that the decision is properly justified.

As a result, the holdings of DGRW are rather skewed towards technology stocks and sector, which comprise around 30% of the total AUM. In fact, the dominance of technology assumes almost exactly the same share as for the SPDR S&P 500 ETF (SPY). Interestingly, that the top 2 holdings are also the same: Apple Inc. (AAPL) and Microsoft (MSFT).

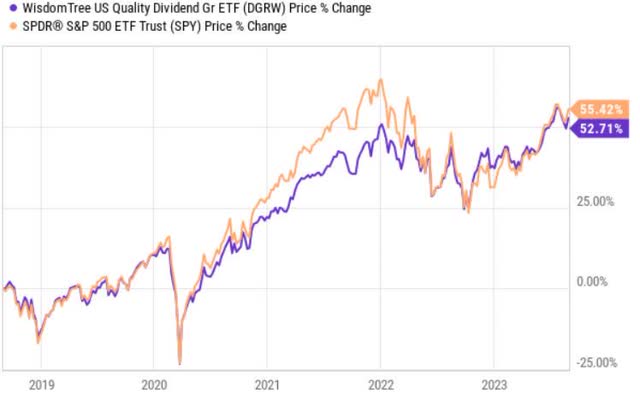

Consequently, the total performance of SPY and DGRW is also almost exactly the same looking back to a past 5-year period.

Even on a price return basis (i.e., excluding the returns, which are associated with dividends) SPY and DGRW have delivered similar returns.

The dividend yield of DGRW (1.86%) is slightly higher than that of SPY (1.45%). Yet, the difference is, in my opinion, very narrow at about 40 basis points.

The thesis

As elaborated above, there is really no material difference between DGRW and SPY. The main reason for this is the liquidity and composite risk scoring mechanisms applied by DGRW, which scopes out small-cap stocks and companies that have been characterized with subpar momentum factors, thereby favouring large-cap, dividend growth stocks. Plus, if you add a skew towards high ROE and only U.S. stocks, you inherently arrive at a sample, which closely resembles the S&P 500 or SPY.

In my humble opinion, there is no significant merit of investing specifically in DGRW due to at least 3 main reasons.

#1 - Unattractive dividend

Given DGRW's focus on the dividend-paying stocks, one should expect a somewhat attractive yield. Currently, offered 1.86% is in my view not attractive at all neither on an absolute level nor especially considering the following:

- Immaterial spread from SPY's yield.

- Negative spread from the U.S. 10 year Treasury at about 240 basis points.

- Negative spread from the U.S. T-bill at about 350 basis points.

- Negative spread from other widely-recognized, liquid, safe and U.S. focused dividend ETFs such as Schwab U.S. Dividend Equity ETF (SCHD) and Vanguard High Dividend Yield ETF (VYM) - at about 150 basis points.

I just do not see how DGRW could be attractive for dividend-seeking investors given the above-mentioned aspects.

#2 - Expensive relative to SPY and other comparables

The net expense ratio of DGRW is 0.28%, while for SPY it is at 0.09%, leading to a 0.19% (or 19 basis points) difference.

If we take into account the difference between SPY and DGRW dividend yield, which is 40 basis points and deduct the difference in net expense, the dividend story of DGRW becomes even less attractive, ~ 21 basis point.

Interestingly that the other two mentioned dividend-focused ETFs not only yield more but also cost less, - 0.06% for VYM and SCHD.

#3 - Vague equity story

Considering DGRW's investment objective to provide safe and growing dividends and taking into account the characteristics of DGRW's dividend and performance patterns, there is a very minor reason to allocate capital towards this ETF.

In essence, by allocating into DGRW, there is a tangible opportunity cost stemming from four aspects:

- Tightly correlated return factors with SPY, which could potentially result in an elevated concentration risk if the investor has already an exposure to the S&P 500 or technology stocks.

- Almost the same return factors, which are embodied by SPY yet at higher cost (i.e., negative delta of 19 basis points).

- Far more attractive alternatives at lower cost and much higher yields.

- Negative real yield or adjusted yield, since both T-bills and Treasury notes are yielding significantly more than DGRW.

The bottom line

In my humble opinion, there are no substantial drivers, which could justify going long on DGRW. The only motivation, which I see, is if investors really value the relatively tiny spread in dividend yield (albeit, paying higher cost) and at the same time wish to participate in strongly correlated ride with the S&P 500.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (4)