Banco Macro: Lagging Its Peers

Summary

- Banco Macro is one of the primary traditional banks in Argentina, with the largest branch network in the country. The bank has a robust balance sheet and an excellent risk profile.

- The company is overvalued based on Excess Return valuation, but compared to other major banks in LATAM, it is cheap.

- The acquisition of Banco Itau Argentina will increase the company`s branch network and ATM count. In the long term, it will grow the bank`s customer base and its revenues.

- I give a hold rating due to BMA lagging against its competitors in digital banking services.

ferrantraite

Thesis

Banco Macro (NYSE:BMA) is one of the primary traditional banks in Argentina. It has the largest branch network in the country. The deposit composition is dominated by time deposits and saving accounts. Corporate bond issuance represents 5.1 % of company liabilities. On the other hand, the bank`s loan portfolio is focused on retail customers, primarily credit cards, consumer loans, and overdrafts. The nonperforming loans are 1.37 %, much lower than the country`s average of 3.2%.

Based on Excess Return valuation, the company is overvalued, but compared to other major banks in LATAM, it is cheap. The country-specific risk has been priced, and the share price has risen since the beginning of the year.

I give a hold rating due to Banco Macro management's disinterest in expanding its digital services. Its major competitors, Grupo Galicia, Santander Argentina, and Banco Nacion, compete head to head with the fintech start-ups.

Company Overview

This article is another chapter from my LATAM adventures. The previous time, I analyzed Banco BBVA Argentina. Banco Macro is a traditional bank operating in Argentina. All will briefly explain why Argentina is a dominating theme in my portfolio.

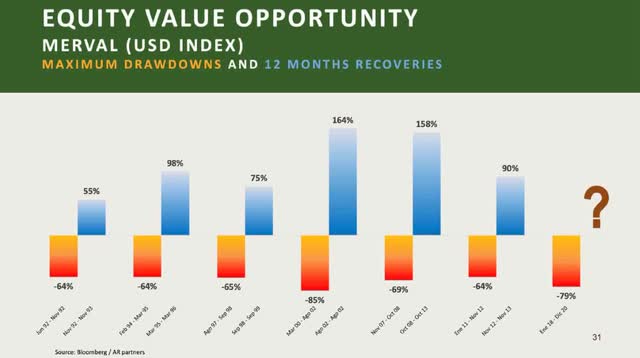

The political pendulum swings abruptly from left to right and vice versa. Argentinean equities have shown a strong correlation with the dominant political force. Now, the pendulum moves from left to right. The chart below shows the pronounced cyclicality of the Argentinean equity market:

After a brutal bear market, it always follows an exuberant bull market. Then rinse and repeat. I have been a strong proponent of Argentinean investments, reflected in my portfolio. Said that, I believe the boom cycle just started. My focus is the Argentinean banking segment. It is ignored due to rational reasons, but in the meantime, it offers exceptional asymmetric potential.

The banking segment in Argentina shares similarities with its neighboring countries. The major trends are serving the unbanked population and transitioning to digital banking.

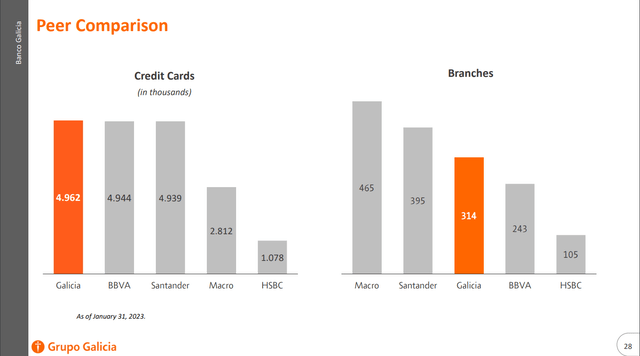

Banco Marco is another vehicle to express my opinion on Argentina. The two charts below from Grupo Galicia (GGAL) compare the banks in Argentina by size:

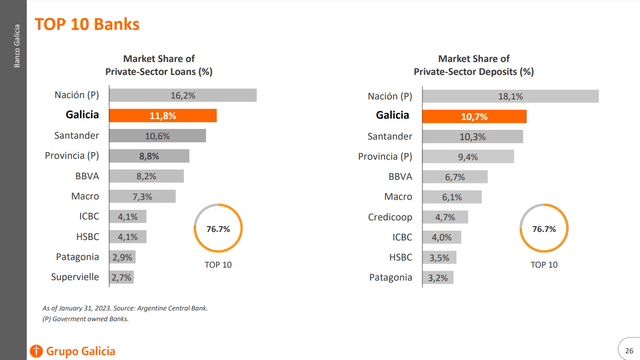

BMA is fourth to GGAL in credit card customer services and first in branch network size. Banco Macro has deep penetration, considering its physical presence. But that is not enough. The banking industry's digital transformation moves the focus to remote services and reduces the ROI of maintaining an extensive branch network. The chart below from Grupo Galicia compares the top ten Argentinian banks by private sector deposits and private sector loans.

Banco Macro stands in the middle of the scoreboard. Last month, it was announced that Banco Macro will acquire Banco Itau Argentina. Below is a citation from the announcement:

The price of the Agreement was set at US$50,000,000, which will be paid on the closing date of the transaction (the "Closing Date"), and an additional amount resulting from a potential adjustment that will be eventually set based on the results obtained by Banco Itaú Argentina S.A., Itaú Asset Management S.A., and Itaú Valores S.A. between April 1, 2023, and the Closing Date.

Banco Itaú Argentina S.A. is a subsidiary of the Brazilian bank, Banco Itaú S.A, the second largest private bank in Latin America and a relevant player in the Southern Cone, with growing operations in Argentina, Chile, and Uruguay. The acquisition will add 140 ATMs and 99 branches to the BMA network.

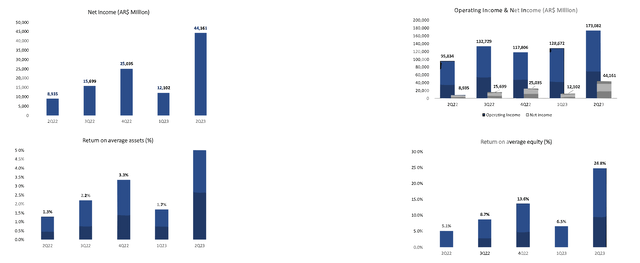

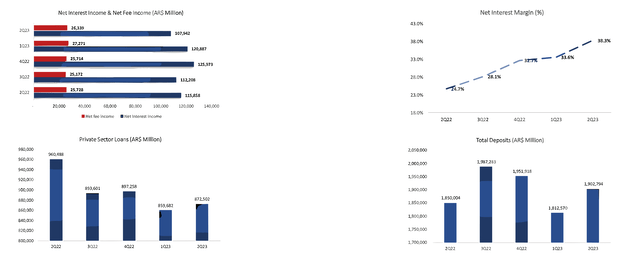

The acquisition will increase the former with 10 % and the latter with 21 %. In the long term, it will impact income growth. The chart below is from the BMA Q2 report. They illustrate the bank's ability to generate income and return on equity.

BMA management has proven his skills in navigating the Argentinean uncertainties. The bank's net income is steadily risen in the last few quarters. The rising inflation pushed the BCRA to raise the interest rates, thus widening net interest margins (NIM). The chart below illustrates the income composition.

Last quarter it reached 38 % partially due to the above reasons. The net fee income is stable and constitutes approximately 19 % of the total bank`s income.

Compared to Banco BBVA Argentina (BBAR) and Grupo Galicia (GGAL), Banco Macro is not involved in the industry's digital transformation. BMA focuses more on reaching the country`s interior and low-income retail customers. Argentina has 28 % of its population without access to banking services. This is a potential demand for BMA services. However, if BMA wants to prosper long-term, it must participate in the digital transformation. Grupo Galicia is the best example with its fintech company, NaranjaX.

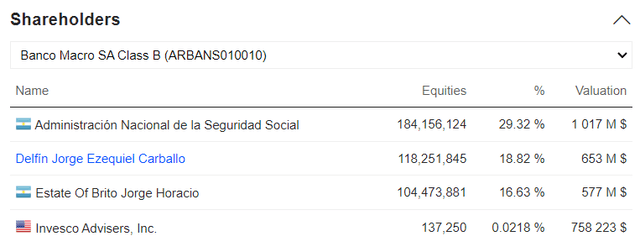

BMA has one thing I like. The company control is in the hands of Jorge Carballo, chairman, and Jorge Brito (younger), vice chairman and beneficial owner of the JHB Trust. Previously, the bank was controlled by Carballo and Brito (elder), founders of the company. Brito (elder) died last year in a tragic accident. The image below from Market Watch illustrates who are the major shareholders.

Company Financials

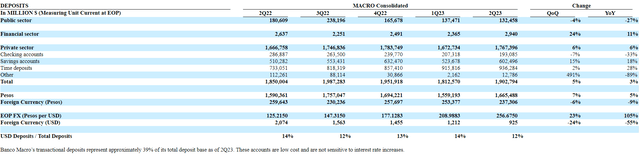

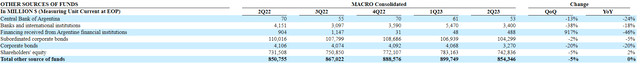

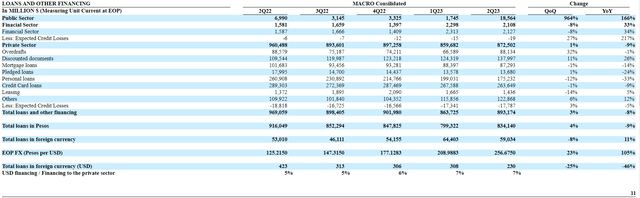

I love analyzing because of the nuanced balance sheets. The banks are the sole industry using money as a funding source and input material. At a glance, they constitute just financial assets and liabilities. But the devil is the details. The deposits and loan structure tells much about banks' ability to manage their liquidity and credit risk. The tables below are the BMA Q2 report. The show banks funding sources:

Banco Macro Q2 report Banco Macro Q2 report

BMA's primary funding source is the client deposits. Time deposits represent 49 % of the total deposited funds, and savings account for 32 %. Those are the most illiquid client deposits due to fixed maturity and penalties for early withdrawal. A balance sheet with a higher percentage of those deposits is safer for the banks despite being more expensive because longer-term rates are higher than shorter-term ones. BMA has issued corporate bonds constituting 5.1 % of total liabilities. Hence, the liquidity risk is reduced even further. Bonds and borrowings have higher costs than deposits, thus negatively affecting banks' liquidity.

The tables below from BMA Q2 report represent BMA`s assets:

Banco Macro Q2 report Banco Macro Q2 report

The loan portfolio is primarily focused on retail customers. Credit cards represent 29%, mortgages 9.7%, consumer loans 19 %, and overdrafts 9.8 %. On the other hand, the BMA has a lot of liquidity. An impressive achievement is the low non-performing loans rate. Retail loans have an NPL of 1.43 % and commercial loans of 1.18 %. Hence, BMA`s NPL is 1.37 %. The country`s average is 3.2 %.

Cash reserves are 18 % of total liquid assets, and 72 % are held in bonds. Fixed income instruments are divided between Leliq bonds and government bonds. BMA has sufficient amount liquidity to sustain banking turbulence. The table illustrates the BMA balance sheet composition. The data is from the BMA Q2 2023 report.

Asset ratios: assets structure | |

Cash/Total Assets | 10 % |

Credit Cards/Total Assets | 8.2 % |

Loans (ex., Credit cards)/Total Assets | 22 % |

Bonds/Total Assets | 40 % |

Liability ratios: capital structure | |

Deposits/ Total Liabilities | 78 % |

Other liabilities/ Total Liabilities | 9.6 % |

Company bonds/ Total Liabilities | 5.1 % |

Equity/ Total Liabilities + Equity | 23 % |

Solvency ratios: | |

Credit Cards Receivables /Deposits | 13.8 % |

Loans (ex., Credit Cards) /Deposits | 38 % |

Cash/Deposits | 17.4 % |

Borrowings (inc. bonds)/ Total Assets | 3.9 % |

The composition of the assets is vital for banks' survival abilities. I like to see a higher percentage of liquid assets such as cash and government bonds. BMA is doing well on those metrics - for every peso in assets, the banks hold 0.10 pesos in cash, and against every peso in assets is 0.40 invested in government bonds.

On the liabilities side, I am looking at how the bank finances its assets acquisitions. The primary source of funds for every bank is deposits, and secondary are bond issuance and bank borrowing. BMA primarily uses deposits to fund its operations. The deposits form 78 % of the BMA`s liabilities. Company-issued bonds constitute another 5.1 % of its liabilities.

Putting together both sides of the balance sheet, I estimate the bank`s solvency. The most critical metric is cash to deposits, i.e., how many pesos of liquid funds the bank holds against every deposited peso. BMA performs well; the bank holds 0.17 pesos for every deposited peso. In other words, one very 6 pesos in deposits, BBAR has 1 peso in cash reserves.

The table below presents BMA's solvency ratios. All data is sourced from the BMA Q2 report.

Capital (in millions AR pesos): | |

Regulatory Capital | 717,000 |

Tier 1 capital | 677,120 |

Common equity tier 1 (CET1) | 645,220 |

Risk-Weighted Assets | 2,051880 |

Basel III Ratios: | |

Regulatory capital ratio (Capital adequacy ratio) | 35.9 % |

Tier 1 ratio | 33 % |

CET1 ratio | 31 % |

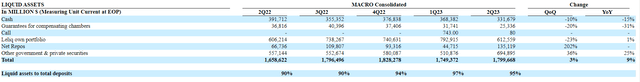

BMA is a safe bank considering all ratios. The table below from S&P Intelligence shows where to stand Argentina compared to its LATAM peers. BMA exceeds the country's average values despite the prevalent economic turbulence. The banks have an impressive CET 1 ratio, more than double that of BIS requirements.

S&P Intelligence

The image above illustrates another critical metric for any bank - Return on Assets (ROA). BMA ROA is 3.9 %, higher than the country's average of 2.3 %. The table below illustrates the rest of the efficiency parameters I like to use. All data is sourced from the BMA Q2 report.

ROE | 15.5 % |

RoTE | 17.7 % |

RoCET 1 | 19.0 % |

ROA | 3.9 % |

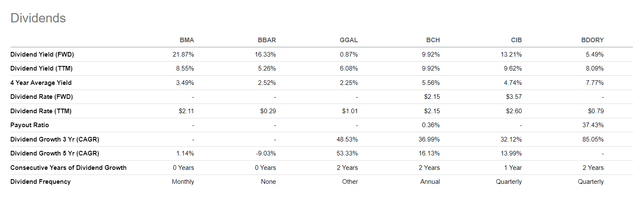

BMA performs well on efficiency metrics. All large LATAM banks pay dividends, and BMA is not an exception. The table below compares BMA's dividend policy with its peers.

Seeking Alpha Banco Macro profile

BMA dividend TTM is higher than average. It is expected to rise even more based on a growing customer base and expanding net interest margins. The dividend income could be an essential reason to buy a particular stock. However, the case with Argentinian equities is different. Their pronounced boom-bust cycle means investing motivated by income is dangerous. Holding Argentinean stocks is like position trading with a 12-24-month horizon.

Valuation

For the valuation of BMA, I use the Excess Return Model. I do follow Professor Damodaran's framework and its database.

Assumptions and inputs:

- Risk-free rate equals the 5Y average of USA long-term Government bond Rate, 2.2 %.

- Growth rate, g, equals the 5Y average of the USA long-term Government bond Rate, 2.2 %.

- Argentina's equity risk premium is 23.21 %.

- BMA's book value per share is $ 4.53 (02/09/2023).

- Banks' unlevered Beta 0.41.

- BMA Debt/Equity ratio 14 %.

- Argentina's effective tax rate is 35 %.

- BBAR ROE 15.5 %

Important note: BMA, as a foreign company, has listed ADRs on the NYSE. Thus, calculating book value per share must count all issued shares, not just the ADRs. If doing so, the book value will grow to $41 per share. Using fully diluted shares (including the ADRs), the book value per share is $ 4.53.

1. Calculate Levered Beta with the formula below:

Levered Beta = Unlevered Beta * (1+D*(1-T)/E).

2. Calculate the discount rate (discount rate as the cost of equity) using the resulting value for leveraged beta. The formula I use is:

Cost of Equity = Risk-Free Rate + (Levered Beta * Equity Risk Premium).

3. Calculate Excess Returns using NU's ROE, Book Value, and Cost of Equity:

Excess equity return = = (Stable Return on equity - Cost of equity) x (Book Value of Equity per share).

4. Calculate Excess Returns Terminal Value assuming perpetual constant growth and stable cost of equity:

Excess Returns Terminal Value = = Excess Returns / (Cost of Equity - Expected Growth Rate).

6. Calculate the Value of Equity.

Value of Equity = Book Value per share + Terminal Value of Excess Returns.

For BMA, I get the following results:

Terminal Value of Excess Returns Per Share = $ (1.2)

Intrinsic value per share = $ 3.33

Current market price = $ 26.06 (09/01/2023)

The negative terminal value is caused by higher equity cost than BMA return on equity. Estimating the cost of equity is considered country-specific, and as we know, Argentina is among the most peculiar countries.

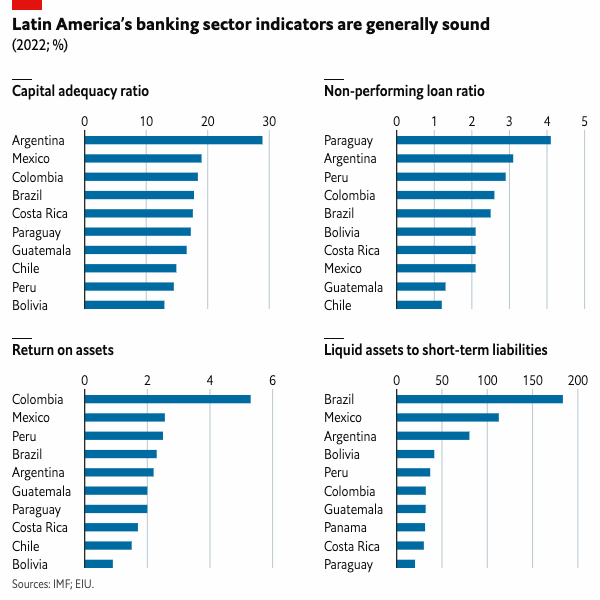

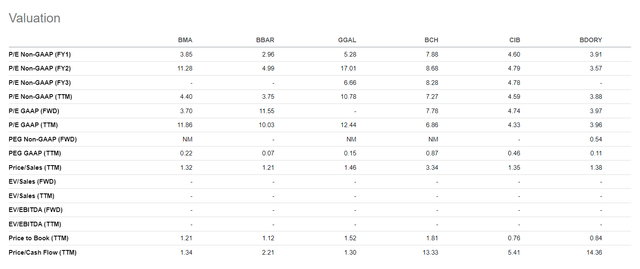

In such cases, relative valuation is a more coherent tool to estimate where the company stands. The chart below compares BMA with other large banks in LATAM.

Seeking Alpha Banco Macro profile

When I weigh up banks, I use price to book and price to sales. Both metrics are not perfect but are less prone to manipulation. Against its peers, BMA is cheaper. Otherwise, the stock is highly overvalued based on excess return estimates.

Risks

In my previous article, I analyzed Banco BBVA Argentina (BBAR). Regardless of whether the risk accompanying investing in Banco Macro is the same, it is worth recalling it.

Argentina is not a destination for buy-and-hold investors. The Argentinian equity market is brutally cyclical. Unlike in the US or Europe, you cannot have stocks for decades, realize capital gains, and receive regular dividends. Long-term positions for over a few years are dangerous. Investing in Argentine companies requires a strict risk management plan that requires active position management.

Investing in Argentina carries many risks, but one of the most pronounced is the default risk. Last month, the Argentinean Central Bank ran out of reserves. The country was close to another default. On 23 August, the IMF approved a $ 7.5 billion disbursement, extending the financial lifeline to the impoverished government. The second risk specific to every commodity-based economy is the economic risk, i.e., the inflation rate, commodity prices, etc. Argentina is a major commodity exporter, and its economy is the first derivative of livestock, oil and gas, and cash crop prices.

Banks have four significant risks: liquidity, credit, market, and operational. The liquidity risk is the bank`s ability to face its debt obligations. Credit risk is the potential for the borrower or other bank`s counterparty to be unable to meet its obligations by the agreed terms. In BMA`s case, that means a high percentage of non-performing loans and credit card delinquencies. As we saw, the bank`s NPL is well below the Argentinean average. Regarding liquidity, BMA is well positioned because the primary origin of its funds is deposits, and only 5 % of its funding comes from bond issuance. Most of them are time deposits and savings accounts with longer maturities.

Conclusion

Banco Macro is among the best traditional banks in Argentina. It has a robust balance sheet well composed to mitigate liquidity and credit risks. The rising inflation and rising interest rates are widening the company`s NIM. Compared to its peers BMA is cheaper and is expected to pay attractive dividends.

I have been an investor in BMA for the last year. However, my opinion has changed due to BMA management's disinterest in expanding its digital services. Its major competitors, Grupo Galicia, Santander Argentina, and Banco Nacion, compete head to head with the fintech start-ups. Said that I would keep holding my position, but will not add more.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BMA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)

The share holders are 639.000 millions.

And then your comments are disappointed.