Local Government Financing Vehicles: A Growing Risk For China's Economy?

Summary

- Chinese leaders at the July Politburo meeting pledged to formulate "a basket of plans" to resolve risks stemming from local government debt.

- LGFVs are considered a component of China’s overall “augmented debt”, which includes official reported government debt and other sources of debt financing.

- In the worst-case scenario, a collapse of the LGFV bond market could drag China’s GDP growth down by about 1 percentage point over one year.

- We remain cautious on LGFV credit, especially those originating from weaker regions.

Igor Kutyaev

Local governments have been instrumental in driving China’s remarkable economic growth over the last 30 years, in particular by providing massive public investments in critical physical and social infrastructure. Yet, amid a slowing economy and an ailing property market, debt-laden municipalities now pose a potential risk to China’s economic growth and financial stability.

Market concerns have resurfaced over local governments' off balance sheet debt, which amount to 55-60 trillion yuan (U.S. $7.5-8.2 trillion) by our estimates. These off balance sheet entities, known as local government financing vehicles (LGFVs), were set up to fund infrastructure projects. According to Bloomberg, a record number of LGFVs failed to make payments on short-term debt in July, amounting to 1.86 billion yuan (U.S. $258 million), up from 780 million yuan in June.

Chinese leaders at the July Politburo meeting pledged to formulate "a basket of plans" to resolve risks stemming from local government debt. In August, Chinese media reported that local governments (LGs) will be allowed to sell about 1.5 trillion yuan (U.S. $210 billion) of special financing bonds to help 12 regions repay debt.

We do not believe LGFVs pose a systemic risk to the banking system. However, idiosyncratic credit events could occur over the next 6 to 12 months – and, in the long run, banks will likely have to bear some of the cost of debt resolution. In the worst-case scenario, which we see as unlikely, a collapse of the LGFV bond market could drag down China’s GDP growth by about 1 percentage point over one year.

How big is the LGFV debt market?

LGFV debt has quadrupled since 2012, from 13.5 trillion yuan (U.S. $1.8 trillion) to 55 trillion yuan in 2022. There is no official public data; estimates are derived from bottom-up aggregates of bond issuers’ financial statements and data from industry and governmental bodies.

The composition of LGFVs loans, which are classified as corporate debt, is approximately 60% bank loans, 30% bonds, and 10% other financings. They account for about 24% of corporate loans in the banking system, or 15% of total loans. Their size relative to China’s GDP has increased over the past decade, but over the past three years has held steady at about 45%.

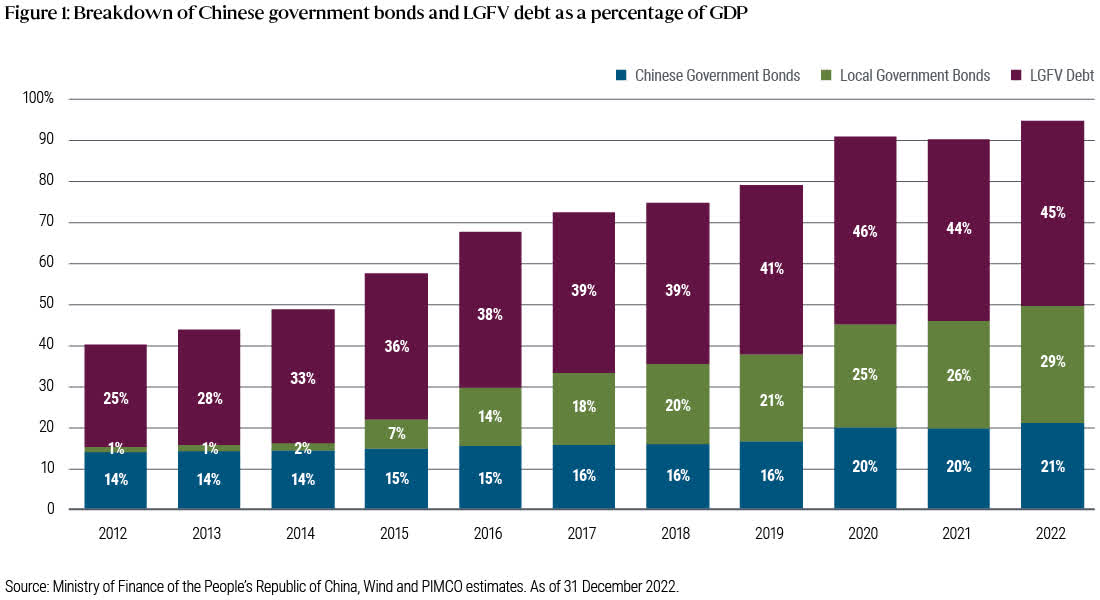

LGFVs are considered a component of China’s overall “augmented debt”, which includes official reported government debt and other sources of debt financing. The total of China’s government bonds and LGFV debt rose from 40% of GDP in 2012 to 95% in 2022 (see Figure 1).

Why have concerns resurfaced over LGFVs?

The standalone fundamentals of LGFVs have always been weak due to their function: They fund infrastructure projects, which often fail to generate sufficient returns to cover debt payments, leaving many reliant on refinancing or government support to stay afloat. Hence, local rating agencies, lenders, and investors tend to assess LGFVs based on the fiscal strength of the LGFV’s parent LG.

While no LGFV has defaulted on a public bond, concerns have risen amid China’s slowing economy and its struggling property sector. Worries have been compounded by recent idiosyncratic credit events, most notably the January 2023 debt deferment and restructuring of 15.6 billion yuan (U.S. $2.1 billion) in loans of an LGFV in Guizhou province, which involved 18 banks ranging from large state-owned commercial banks to regional small banks.

Importantly, market concerns focus on a handful of provinces with weak fiscal capacity and relatively high leverage, while confidence in the majority of regions remains strong. We estimate that the five weakest provinces account for around 8% of total LGFV debt and the 10 weakest around 13%–18%.

Technically, LGFV debt is not considered LG debt, but lenders and investors generally assume an implicit government guarantee exists. We believe LGs are willing to continue supporting LGFVs, as preventing systemic financial risk remains a top government priority. However, many investors have become increasingly concerned over the ability of LGs to provide support, especially given significant reductions in land-sale revenues in recent years.

How might LGFV debt issues affect China’s banking sector?

There is little disclosure of banks’ LGFV exposures. We estimate the amount could be equivalent to 12%–15% of total banking assets, with regional banks most exposed.

We believe Chinese banks may need to share the burden of resolving LGFV debts in the coming years. However, we don’t anticipate a systemic crisis, chiefly because recognition of large-scale impairments and write-offs is unlikely. More probably, coordinated debt restructurings will be the solution for troubled LGFV debt, as we saw in the Guizhou LGFV case.

The cost of restructuring these debts will likely result in lower asset yields for banks. Given the revision of asset classification rules in February 2023, restructured loans no longer need to be classified as nonperforming loans. Thus, banks will likely see net interest margin gradually decrease over time, rather than experiencing a direct hit to capital through provision charges. We expect this will weigh on banks’ profitability, and weaker capitalised banks may need to raise capital or cut dividend payouts. Small regional banks are at higher near-term risk, while large state-owned banks may have a more active role in long-term LGFV debt restructuring.

In our stress test scenario, assuming 15% of banks’ LGFV exposures require restructuring (approximately 2% of total assets) a 300 basis point (BP) reduction in loan yields would lower sector profits by around 6%, equivalent to a 50–60 bp decline in return on equity. A 10% provision coverage on these restructured exposures would be a greater hit on profitability in the near term, reducing it by approximately 20%. However, the impact would likely be spread over multiple years. To offset the impact on capital resulting from a 10% profit drag, the sector may need to cut the dividend payout ratio by 10 percentage points or raise additional equity externally.

What does this mean for China’s economy?

If any LGFVs were to default, it would likely create volatility in China’s financial markets, widen credit spreads, cause rates to decline due to a flight-to-quality from corporate to government bonds, and even weaken the yuan. However, we believe that the impact would likely be short term.

Another risk is that infrastructure and property fixed-asset investments (FAI) could be crowded out, as LGs would need to mobilise resources to help LGFVs. LGFVs and local state-owned enterprises (SOEs) account for 30% of infrastructure FAI, and LGFVs have helped support the struggling property market over the past two years.

In the worst-case scenario, a collapse of the LGFV bond market could drag China’s GDP growth down by about 1 percentage point over one year. Furthermore, if property FAI continues to fall by another 10% – it declined 7.9% year-on-year in 1H 2023 – growth could be dragged down by 2 percentage points over the next 6–12 months, potentially slowing China’s GDP growth rate from 5.5% year-on-year in 1H 2023 to 3% year-on-year in 2024. A slowdown of that size could further reinforce negative sentiment. More important, below-trend growth could place tremendous pressure on the job market, prolong the dampening of animal spirits, and make recovery more difficult.

What measures could be taken to alleviate the current LGFV situation?

We see several potential measures:

- LGs could swap their LGFV debt into government bonds: We think a debt-swap programme on the scale of the one between 2015 and 2018 (which amounted to some 12 trillion yuan of bonds) is very unlikely. However, the quota for LGs to do so could be increased incrementally, which could help ease short-term debt-servicing pressure, particularly in economically weak regions.

- Banks could issue loans to restructure or refinance debt: Banks would need to accept losses, as discussed earlier, but this could be combined with a debt-swap programme. Additionally, banks may refinance some debt with longer-term loans at lower cost. Policy banks, along with large SOE banks, would likely play a bigger role.

- LGs could monetise state-owned assets: LGs may be pushed to sell or mortgage some SOE assets or equity for debt repayment, such as in the 2020 Kweichow Moutai equity transfer in Guizhou.

- LGFVs could be commercialised and consolidated with SOEs: This would entail injecting cash-generating assets into LGFVs to facilitate their commercialisation and consolidation with local SOEs.

Investment implications

We remain cautious on LGFV credit, especially those originating from weaker regions. However, we believe China’s large state-owned banks have the financial strength to withstand near-term pressures, and we expect strong sovereign support if necessary. However, given the outlook for weakening profitability in the long term and the need to issue more bonds to meet the total loss-absorbing capacity (TLAC) requirement1, we believe that current valuations of both senior and capital bonds do not offer sufficient spread pick-up for investors.

1 TLAC refers to the sum of capital and debt instruments of global systemically important banks (G-SIBs) that can absorb losses by being written down or converted into equity in, and immediately following, a resolution.

Disclosures

All investments contain risk and may lose value. Investing in the bond market is subject to risks, including market, interest rate, issuer, credit, inflation risk, and liquidity risk. The value of most bonds and bond strategies are impacted by changes in interest rates. Bonds and bond strategies with longer durations tend to be more sensitive and volatile than those with shorter durations; bond prices generally fall as interest rates rise, and low interest rate environments increase this risk. Reductions in bond counterparty capacity may contribute to decreased market liquidity and increased price volatility. Bond investments may be worth more or less than the original cost when redeemed. Investing in foreign-denominated and/or -domiciled securities may involve heightened risk due to currency fluctuations, and economic and political risks, which may be enhanced in emerging markets. Bank loans are often less liquid than other types of debt instruments and general market and financial conditions may affect the prepayment of bank loans, as such the prepayments cannot be predicted with accuracy. There is no assurance that the liquidation of any collateral from a secured bank loan would satisfy the borrower’s obligation, or that such collateral could be liquidated.

Forecasts, estimates and certain information contained herein are based upon proprietary research and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product.

Statements concerning financial market trends or portfolio strategies are based on current market conditions, which will fluctuate. Outlook and strategies are subject to change without notice.

References to specific securities and their issuers are not intended and should not be interpreted as recommendations to purchase, sell or hold such securities. PIMCO products and strategies may or may not include the securities referenced and, if such securities are included, no representation is being made that such securities will continue to be included.

PIMCO as a general matter provides services to qualified institutions, financial intermediaries and institutional investors. Individual investors should contact their own financial professional to determine the most appropriate investment options for their financial situation. This material contains the opinions of the manager and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. PIMCO is a trademark of Allianz Asset Management of America LLC in the United States and throughout the world. ©2023, PIMCO.

CMR2023-0822-3075767

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

This article was written by