Alvotech: FDA Overhang Remains, Remaining Constructive, Initiate Hold

Summary

- The biosimilar drug market is projected to grow at a rate of ~18% from 2023-2028, attracting significant investment.

- Alvotech is positioned within the biosimilars value chain and has the potential to generate value with its pipeline assets.

- The company has faced FDA setbacks, but late FY'23/early FY'24 could be key dates for potential asset launches.

- Net-net, initiate coverage at a hold.

Matteo Colombo

Investment briefing

The biosimilars drug market is forecast to expand at a geometric growth rate of ~18% from 2023—2028, garnishing immense capital inflows along the way. Alvotech (NASDAQ:ALVO) is firmly positioned within the biosimilars value chain and has the potential to unlock compelling value should it successfully convert its pipeline assets.

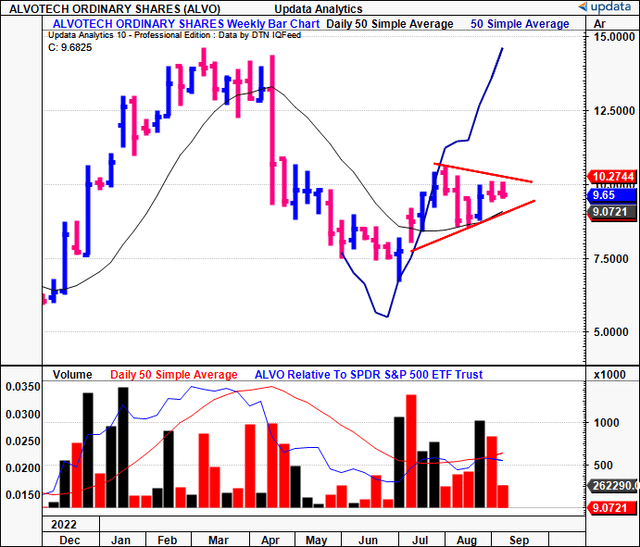

To date, the company's stock price has been plagued by a number of FDA setbacks, which have seen it sell around 300bps lower from the start of the year. This report will unpack all of the moving parts in the ALVO investment debate, and make detailed reference to the critical investment facts. Net-net, I am initiating coverage on ALVO at a hold, but am constructive on the name. By the looks of it, late FY'23/early FY'24 might be the key dates to watch out for, as management expects to potentially launch its core assets by then. Net-net, rate hold.

Figure 1.

Critical investment facts forming hold thesis

Brief overview of company

ALVO is a biotech company that specializes in developing and producing biosimilar drugs. For reference, biosimilars are biological assets that are highly similar to—but have no clinically meaningful differences from—existing FDA-approved drugs (In the EU—CE Mark, in Australia, TGA/ATAGI, and so forth). The already approved labels are often called "originator" or "reference" drugs.

A critical distinction is that biosimilars are not generic drugs. Generics are exact copies of reference drugs. Instead, they developed to be highly similar to the reference biologic, but again, they cannot be identical.

The critical features of biosimilars therefore include:

High similarity—biosimilars must demonstrate similarity to the reference biologic in terms of quality, efficacy and so forth (it's in the name);

Related to point (1)—safety and efficacy—they must meet the same safety and efficacy standards as the reference compound.

Perhaps most uniquely, they need to possess interchangeability, meaning they can be substituted for the reference biologic without the need for an entirely new doctor's prescription.

ALVO has exhibited quite remarkable growth over the last year or so, thanks to its flagship product, AVT02. This is a biosimilar that replicates the effects of AbbVie's (ABBV) adalimumab, sold under the brand Humira. ABBV's label is indicated in a number of pain/inflammatory disorders, such as rheumatoid arthritis, ankylosing spondylitis and Chron's disease. The label generated $21.2Bn in global sales in 2022; hence there is scope for ALVO to potentially capture some of this market if it can convert its pipeline.

AVT02 received regulatory approval in November 2021 to enter the European market. Subsequently, Canada and the UK also granted regulatory approval for the compound in January 2022. ALVO's strategic partner, JAMP Pharma, launched the biosimilar in the Canadian market in April 2022 under the brand name SIMLANDI with early success.

Recent developments + financial insights

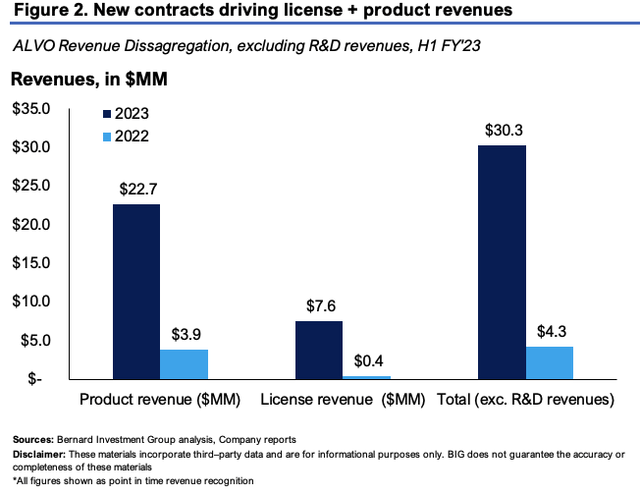

As mentioned, ALVO launched AVT02 in Canada and select European markets, bringing in $22.7mm in product revenue for H1, as shown in Figure 2. Although product revenues were up substantially, there was a significant decline in license and other revenues due to the recognition of a $34.7mm R&D milestone in the prior year, which was achieved through the successful completion of its main AVT04 clinical program. It pulled this to a net loss of $184mm for H1, which adjusts to a loss of $21.6mm when stripping out its R&D investment that is expensed on the income statement.

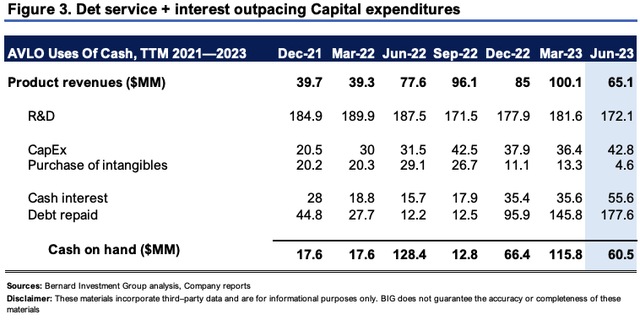

Figure 3 also outlines the company's uses of cash on a rolling TTM basis. Critically, the company has $786mm in long-term debt at the time of writing (in USD), and its liabilities of $1.39Bn outstrip $910mm of assets, leading to negative equity of $478.5mm. Contrasting to the $60mm in cash it has on hand, it repaid $233mm in debt principle + interest in the last 12 months. It also invested ~$43mm towards CapEx and another c.$4.5mm to the purchase of various intangibles. These are related to the improvements of its Reykjavik facility based on FDA requirements (discussed later).

I wouldn't say this is the most healthy cash profile. For one, on a TTM basis, debt servicing outweighs revenues brought in by a factor of 3.6-to-1. Second, the pace of CapEx etc. is 71% of the current cash balance. There is no doubt in my mind AVLO will need to raise additional cash—and plenty more of it—based on these economics.

This is not unexpected for a company in ALVO's lifecycle. But, it also begs the question on whether it is an investment grade company for long-term positioning. It may very well be a little early.

Additional factors concerning ALVO's recent developments are as follows:

1). New partnerships

- ALVO recently announced an expansion of its partnership with Advanz Pharma that includes 5 additional proposed biosimilars aimed at European markets. The biosimilar candidates cover SIMPONI and Entyvio equivalents, along with 3 undisclosed early-stage biosimilars. This move strengthens ALVO's pipeline, bringing the total number of clinical assets under agreement to 11.

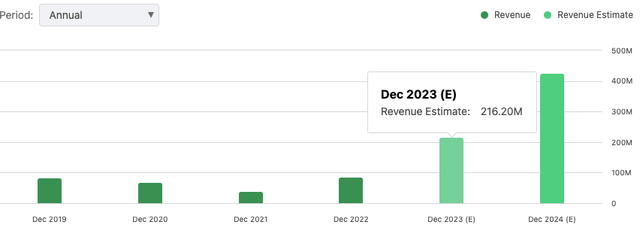

- From a financial standpoint, the deal secures an upfront payment of around $61mm for ALVO, in addition to potential milestone-based payments that could exceed $287mm. ALVO can also retain 40% of in-market sales. The deal has caused a stir on Wall Street with consensus now baking in $216mm in top-line revenues for FY'23.

- It also announced an extension of its partnership with Teva Pharmaceuticals (TEVA), its current U.S. commercial partner. The extended collaboration includes the addition of 2 new biosimilar candidates, and line extensions for 2 proposed biosimilars.

2). Regulatory challenges:

- Perhaps the biggest hurdle to overcome from a risk standpoint here in the investment debate is the recent developments concerning its Reykjavik facility in Iceland, where the company is domiciled.

- In fact, despite the successes outlined thus far, ALVO has encountered a number of regulatory challenges from the FDA in relation to its biologics license applications ("BLAs"). Starting in September 2020, ALVO submitted the BLA for AVT02 to the FDA, but the application was deferred in September 2021. In February 2022, the FDA then accepted ALVO's BLA submission for what's known as an interchangeability review.

- But in April 2023, ALVO faced a significant regulatory setback when the FDA issued a complete response letter ("CRL") for its BLA. You do not want one of these if trying to get a drug approved, across all phases of research into commercialization. Moreover—you don't want your company to receive one either, for the sake of your capital gains. The letter identified specific deficiencies discovered during the FDA's reinspection of the Reykjavik facility. The CRL explicitly stated that fixing these issues is a prerequisite for BLA approval.

- ALVO then received yet another CRL from the FDA in late June after it’s 2nd BLA. Critically, the application had strong data to support its claim as a high-concentration biosimilar and had been designated as interchangeable. But the FDA again pointed to issues during the facility reinspection in Reykjavik, which were again reiterated in the CRL. Alas, the entire fate of AVT02 rests on the FDA making a positive inspection during the second facility review. TEVA has purportedly stepped in to help ALVO pass the bar, so to speak, but it remains to be seen what the FDA's final outcome would be.

In my estimation, this is a meaningful overhang that could plague ALVO's equity stock if not sorted in a reasonable time frame. At the same time, there's no saying investors won't pile into the stock on a positive outcome either. Hence, I'm balanced on this point at the moment, and will need clarification either way.

Outlook for clinical programs and top-line growth

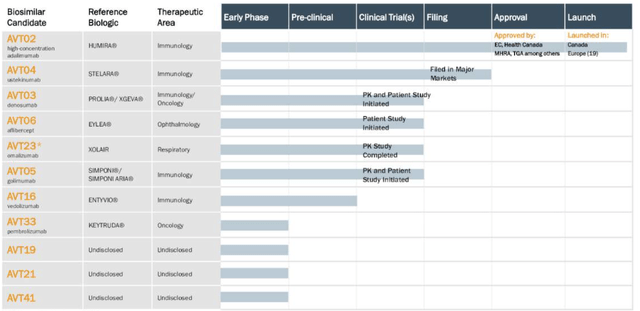

ALVO's future prospects depend on a few critical factors in my best estimation. The most obvious is the resubmission of an interchangeable BLA for AVT02. If the BLA is approved, management expects to start booking AVT02 revenues as early as 2024. The company's full pipeline is outlined in Figure 4.

To ensure a successful reinspection by the FDA, and compliance with the CRL's regulatory requirements, the company has dedicated considerable investment to improving its manufacturing and quality processes based on feedback received during these inspections (hence the large CapEx numbers outlined earlier).

Figure 4. ALVO full clinical pipeline

Source: ALVO H1 Investor presentation

As I mentioned earlier, The Street has tremendous growth expectations for the company these next 2 years. It is eyeing a 160% YoY growth rate to $216mm in sales this year, stretching to $426mm in FY'24. However I'd stress there is a lot of optimism baked into these assumptions. One being the FDA granting the BLA. There's no saying this won't happen, but timing may or may not be an issue. The second is the adoption rates of the drug, being that ABBV's Humira label brought in >$21Bn in turnover last year.

Figure 5.

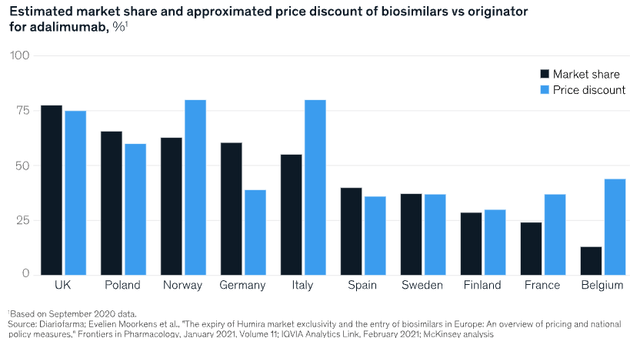

There's good research from McKinsey (2021) that suggests biosimilars engender rapid uptake in the market once commercialized. Most of the success has been observed in Europe, with the U.S. catching up fast. McKinsey noted that "[o]ne of the reasons for biosimilars success is often their ability to offer lower prices". It even makes reference to Humira as the core example in its research. It also notes that the average biosimilar costs anywhere between $100–$300mm to make, mostly due to the clinical trials needed.

But it also cautions on how things like discounting (vs. major brands) may be implemented, and noted the risk of price reductions being "more significant than in prelaunch market models". In fact, concerning Humira, Brennan (2018) outlined that ABBV itself noticed discounts "upwards of 80%" from biosimilar competitors to its label—with the highest being in the Nordic market. Mckinsey made similar observations, as seen below.

Figure 6.

Source: McKinsey & Company (2021): "An inflection point for biosimilars".

In short

ALVO presents with a compelling set of clinical assets should the FDA/regulatory overhang absolve in a reasonable time frame. The biosimilars market is a potential long-term compounder with interesting economics tied into the mix, and already investors have started to crack on to ALVO's potential in this domain. Unfortunately its equity stock has been plagued by the repeated setbacks from its Reykjavik facility, and this has drawn in considerable resources to get it up to scratch (otherwise known as FDA standards). There's no saying ALVO won't be granted its BLAs, but its the timeline that is uncertain. It is eyeing a potential U.S. launch of AVT02 by 2024, and this could be the date to watch. In the meantime, I'll be watching from the sidelines, but would note I'm quite constructive on this name provided all the stars fall into line. In that vein, I'm initiating coverage on ALVO at a hold.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.