Freeport-McMoRan And Southern Copper: Copper Oversupply May Be Coming

Summary

- Copper spot prices remain elevated compared to pre-pandemic levels, naturally triggering the premium embedded in FCX's and SCCO's stock valuations and prices.

- However, while we have been bullish about the role of lithium, it is uncertain if copper may sustain its premium spot prices attributed to the natural substitution to aluminum.

- Multiple EV OEMs, including TSLA, also opted to use thinner copper foils to cut down their reliance by up to -75%, while switching to the new 48V low-voltage system.

- As a result of the potential destruction of copper demand by up to -5.2M MT by 2030, market analysts' previously bullish spot price projection of $5.45 per pound by 2025 may be nullified after all.

- Therefore, commodity investors who have yet to dip their toes may want to observe the situation a little longer before adding at any dips for an improved margin of safety.

laurence soulez

The Copper Investment Thesis Seems Uncertain In The Face Of Over Supply

We previously compared Freeport-McMoRan (NYSE:FCX) and Southern Copper Corporation (NYSE:SCCO) in April 2023, discussing the critical role of copper in the electrification and decarbonization cadence over the next few decades, attributed to the global net zero ambitions by 2050.

With copper comprising 69.2% of FCX's overall FQ2'23 top-line (+6.1 points QoQ/ -11.9 YoY) and 76% of SCCO's H1'23 sales (-1.9% YoY), it is unsurprising that their stock performances are inherently tied to the copper spot prices.

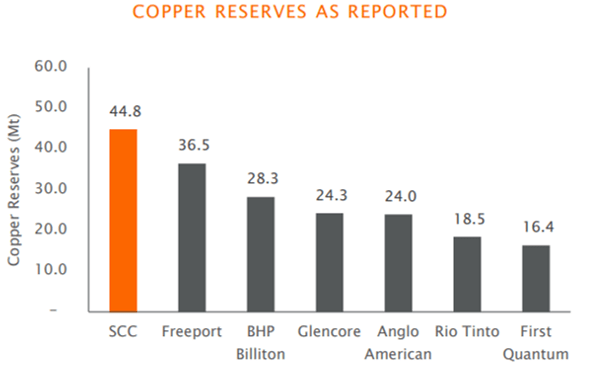

FCX and SCCO's Copper Reserves

SCCO

This is on top of both producers boasting the two largest global copper reserves, securing their spots as the second and fifth largest producers by volume in 2022.

Copper Spot Prices

Trading Economics

For now, the copper spot price has remained somewhat stable at current levels, maintaining its premium by +39% compared to pre-pandemic averages of $2.68 per lbs.

Correlation of Copper Spot Price To Lithium Spot Price

It is also not by accident that the copper spot price is inherently linked to the lithium spot price in our view, with the latter similarly soaring during the heights of the pandemic before moderating to current levels.

This is because both commodities are highly critical to the next decade's electrification cadence, with copper often used as a highly conductive metal and lithium being the common choice as the battery base material for both EVs and renewable energy storage.

Demand for EVs appears to be robust as well, with the global EV sales (including BEVs and PHEVs) still growing to 5.83M YTD as of June 2023 (+40% YoY), despite the elevated interest environment. We have observed a similar cadence in the US, with the top five automakers reporting 463.89K of EVs sold YTD as of June 2023 (+37.4% YoY).

The EIA also projects the growth of global renewable projects to accelerate by +32.1% to over 440 GW in 2023, thanks to the "expanding policy support, growing energy security concerns, and improving competitiveness against fossil fuel alternatives."

As a result, we maintain our belief that the decarbonization cadence through the next decade may still provide massive tailwinds for copper producers, naturally supporting FCX's and SCCO's stock prices.

Copper Over Supply May Be Coming By 2025

However, copper investors must also temper their exuberance, since multiple projects are expected to come online moving forward, adding "a combined 722K MT of mined copper supply by 2025."

These will mostly come from FCX's ramp up in Indonesia, Codelco's Chuquicamata underground mine in Chile, Rio Tinto's (RIO) Oyu Tolgoi project in Mongolia, Anglo American PLC's Quellaveco mine in Peru, and Zijin Mining Group Co. Ltd.'s Kamoa-Kakula project in Democratic Republic of the Congo.

This is on top of the estimated additional supply of 4.39M MT per annum between 2025 and 2030 from 43 committed projects/ expansions globally.

Therefore, assuming that all of these production ramps are completed successfully, we may see a quick reversal in the copper spot prices, similar to those that we are seeing in polysilicon spot prices.

Potential Substitution Of Copper With Aluminum

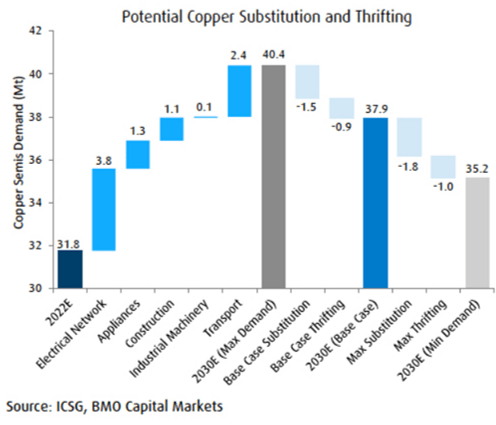

ICSG, BMO Capital Markets, Mining

It also remains to be seen if the robust electrification cadence is able to digest all of the incoming copper supply through the end of the decade, since the recent spike in copper spot prices have also triggered the substitution process to aluminum instead.

With aluminum comparatively being cheaper by -60%, many OEMs have already replaced copper across industrial sectors, including the fiber optic communications networks, renewable generation projects, and air conditioning systems, amongst others.

This is on top of multiple EV OEMs, including Tesla (TSLA), using thinner copper foils to cut down their reliance on the commodity by up to -75%, while switching from the generic 12V system to the new 48V low-voltage system.

Therefore, it is unsurprising that the BMO Capital Market has already projected a decelerating expansion in copper demand to 35.2M MT by 2030, expanding a minimal CAGR of +1.28%, compared to the previously more bullish projections of 40.4M MT and 3.04%, respectively.

As a result of the potential destruction of copper demand, market analysts' previously bullish spot price projection of $5.45 per pound by 2025 may be not take place after all in our view.

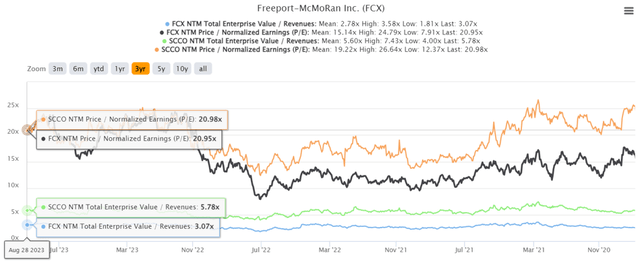

FCX & SCCO 3Y EV/Revenue and P/E Valuations

For now, FCX is trading at a NTM P/E of 20.95x and SCCO is trading at a NTM P/E of 20.98x, elevated compared to their 1Y mean of 19.90x/ 20.71x and 3Y pre-pandemic mean of 14.99x/ 18.17x.

The same has also been observed when compared to its Metal & Mining peers median P/E of 10.14x, demonstrating the baked-in premium for copper producers.

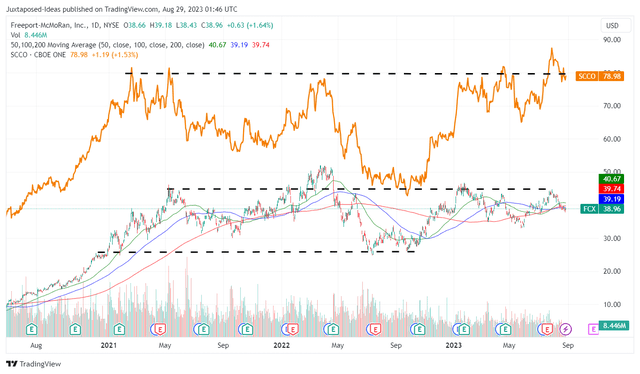

FCX & SCCO 3Y Stock Price

However, both FCX and SCCO stocks remain highly buoyant for now, trading near their all-time highs, despite the moderation in copper spot prices by -11.5% from the January 2023 peak.

Therefore, commodity investors who have yet to add both stocks may want to observe the situation a little longer before adding at any dips for an improved margin of safety.

So, Which Copper Producer Stock Is The Better Buy?

FCX & SCCO 5Y/10Y Returns

At the time of writing, FCX pays out 0.78% in dividend yields and SCCO at 5.14%, compared to their 4Y average of 1.14%/ 4.74% and sector median of 2.25%. Despite so, both stocks have yielded similar returns over the past five and ten years, depending on investment timing and portfolio allocation.

While both companies are incorporated in the US, we suppose that FCX may have a more geopolitically diverse mining/ smelting/ refining locations across North America, South America, Spain, and Indonesia, compared to SCCO's concentration in South America.

Therefore, depending on individual investor's risk tolerance and investing style, both stocks offer differing investment thesis fit for commodity portfolios. We maintain our previous conclusion that the logical choice may be to diversify the volatile South American geopolitical risk by adding FCX, while enjoying SCCO's higher dividend yields.

However, as a result of the potential moderation in copper demand/ spot prices and the volatility in their stock prices, we prefer to rate both FCX and SCCO stocks as Hold (Neutral) here.

Bottom fishing investors may continue monitoring their price movements for a little longer, and only add FCX at its previous May 2023 support levels of $33 and the SCCO stock at $65 for an improved margin of safety.

There is no need to chase this rally in our view.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (10)