NextEra Energy: One Of The Best Times In 5 Years To Buy This Dividend Aristocrat

Summary

- NextEra Energy is trading at the lowest PE in five years, triggered by a 25% bear market.

- The company is a world leader in green energy with plans to double its capacity by 2026.

- Even that growth represents less than 1% of its growth potential by 2050.

- While NextEra Energy has excellent management, investors should have realistic expectations about its growth potential and not expect a rapid return to record highs. 7% long-term growth is management's guidance. Management has never been wrong about its growth rate over the last decade.

- NEE is a potentially good buy for anyone who understands they're signing up for 9% to 10% long-term returns, possibly for the next 30 years. The days of zero rates driving 16% returns due to PE expansion are at an end.

- Looking for more investing ideas like this one? Get them exclusively at iREIT on Alpha. Learn More »

frender

This article was coproduced with Dividend Sensei.

It's been years since NextEra Energy (NYSE:NEE) was finally reasonably priced or a good buy.

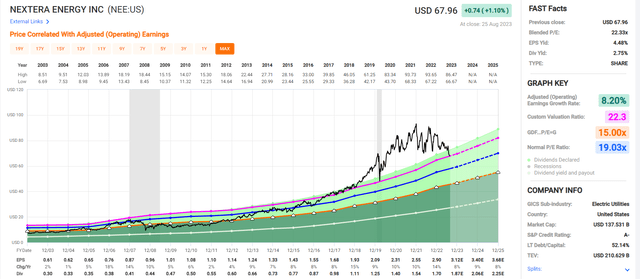

FAST Graphs, FactSet

NextEra hasn't been reasonably priced for five years. For the first time in half a decade, prudent income growth investors can buy it without paying an absurd premium as high as 37X earnings or a 42% historical premium.

NEE is about 15% undervalued and a potentially strong buy for anyone who loves this business and is comfortable with its risk profile.

But does that mean you should run out and buy NEE right now?

Not necessarily. Let me show you why the 25% bear market in NEE might not be over just yet, and even if it is, NEE isn't likely to maintain the 13% annual returns of the last decade.

NextEra Energy: The King Of Green Power

NEE was founded in 1925 as Florida Power & Light.

(I'm a FL Power & Light customer in West Palm Beach.)

It consists of two parts, the regulated Florida Power & Light, or FPL, and the faster-growing NewEra Energy Resources or NEER. Combined, it owns 67 GW worth of power generation capacity enough for a total of 50.3 million homes.

FPL has 5.8 million customers and 34 GW of that capacity, with 33 GW representing the renewable power business spread across the US.

By 2025 NEE plans to invest $33 billion into growing its regulated business, as it expands its ability to power Florida's rapid economic growth.

NEE has a long-term plan to shift its baseload power for FPL to renewables. Specifically, it plans to be 83% solar, battery, and hydrogen, along with 16% nuclear by 2045. That's compared to 71% natural gas today. The company is confident that as the world's green energy leader, it can save money and grow profits while making this 23-year shift.

How does FPL plan to accomplish this?

92 GW of new capacity (69 million homes worth of power)

50 GW of that new battery storage capacity (38 million homes worth of power)

16 GW of hydrogen (13 million homes worth)

FPL has benefited from years of very low costs for consumers, and very happy customers. However, in recent years, the company has faced challenges. Regulators have started to crack down on what has historically been one of the friendliest regulatory regimes for utilities in the country.

NEER is one of the industry leaders in green energy. It typically obtains 20-year purchase power agreements with regulated utilities before building a new renewable asset.

NEER has 31 GW of capacity and is now selling off all of its pipeline assets. That's part of a long-term financing support package for NEP, its yieldCo, which has run into growth concerns in an era of higher rates.

NEP is like an old-school MLP whose sponsor would sell its assets in order to recoup part of its initial investment (capital recycling) while still owning a significant amount of the cash flow.

The trouble today is that NEP's price has plunged.

NEP is in a 40% bear market, the third worst in its history. During the pandemic, it fell 50%, and in the 2015 industry apocalypse created by SunEdison's bankruptcy, Brookfield ended up profiting by acquiring its yieldCos for pennies on the dollar.

NEE kept NEP afloat during this period when NEP's cost of capital soared, and it could keep growing its distribution at 3% per quarter (15% annually).

50% of its renewable customers are regulated utilities, 39% are large industrial customers (like Target), and 11% are municipal governments and coops.

How big is NEE in green energy? It currently produces 56% of all the wind power in the US, and its plans for the future are even more impressive.

NEER has 31 GW of capacity today. Worst case management thinks that in the next two years alone, it will build 33 GW more. That's over 100% capacity growth, and NEER isn't just building to build. Every project has a long-term (20 year) contract before a shovel goes into the ground.

Over 50% of that new capacity is solar, NEE's new world to conquer.

In fact, by 2026, NEE thinks it can add 41 GW, more than doubling its renewable power capacity, to 69 GW, enough power for 52 million homes.

To give you an idea of how big 69 GW is, it's approximately 6% of all US power capacity. From one company's renewable power capacity. Imagine 1/15th of all US power running on NextEra's green power capacity alone. That's what management plans for 2026 and says they're on track to achieve.

To give you an idea of how potentially massive NEE's growth market is, there's about 7,000 GW of power capacity in the US economy, and eventually, all of it is expected to go zero carbon. NEE owns 31 GW of that, or 0.4% of its potential growth market. And this is the industry leader, and NextEra has barely begun to tap into its growth market.

By 2030 alone, an estimated 250 GW of new capacity for renewables is expected, and NEE, with all its massive spending power, is expected to provide just 23% of that.

When the No. 1 player is providing 23% of new capacity and has tapped into 0.4% of its growth potential, you can see why Wall Street was so in love with this stock for so long.

OK, but what if you don't get excited by GW and industry terminology? How about this. NEE estimates that its growth market is $4 trillion in investable size, and it plans to invest about $40 billion in the next few years.

That's 1% of the growth potential through 2025. This opportunity is so large that even when the industry titan drops cash by the tens of billions, it barely makes a dent.

That's how big this growth runway is. It's not years long, its decades long.

We're not even just talking solar, wind, and batteries. NEE is now breaking into green hydrogen, thanks to tax breaks from the Inflation Reduction Act.

Green hydrogen is a potential $3.2 trillion global market by 2030 according to Cummins, and includes such industrial uses as agriculture (fertilizers), refineries, petrochemicals, alternative fuels (like aviation fuel), and even powering forklifts.

Yes, NEE might end up helping Amazon run its fast-growing business pretty soon!

In total, NEE is expected to invest about $80 billion through 2027 into its regulated and non-regulated businesses, driving around 9% rate-based growth and some of the best overall EPS growth in the sector.

NEE has been a Wall Street darling for over a decade, turning 8.3% annual EPS growth into 10% annual dividend growth and then converting that into almost 700% gains in its stock price since 2007.

Tech up 541%

S&P up 255%

Utilities up 191%

That's courtesy of the multiple expansion you often get when rates seem only to go down, and the growth potential of solar and wind seems almost infinite.

Finally A Wonderful Company At A Reasonable Price

DK quality rating: 90% medium-risk 12/13 Super SWAN quality dividend aristocrat utility

DK safety rating: 99% (1.05% severe recession dividend cut risk, 0.5% current cut risk)

historical fair value: $80.71

current price: $68.48

discount: 15%

DK rating: potential good buy

yield: 2.8%

growth consensus: 6.8%

long-term return potential: 9.6% vs 9.9% S&P 500

10 year value boost: 1.6% CAGR vs -1.4% CAGR for S&P

10-year consensus total return potential: 11.2% CAGR = 189% vs 8.5% for S&P = 126%

NEE is not overvalued for the first time in five years. But that doesn't make it an ultra-value buy, or a very strong buy, or even a strong buy. It's merely a potentially good buy for someone seeking reasonable, though hardly knock your socks off, returns from the green energy utility king. That's about 50% higher return than the S&P 500 is expected to deliver.

Yes, it can roughly triple your money in a decade, which is great, unless you have inflated expectations that could cause you to panic sell or sell out of disgust at the wrong time.

Have Realistic Expectations About NextEra

For many years NEE was growing at double digits, fueled by free money and being able to issue new shares at a 20%, 30% or even 40% historical premium.

When money is free or virtually free, even utilities' growth rates can be remarkable.

Management now expects to deliver about 7% EPS growth and roughly 10% long-term returns at current dividend yields. Why the slower growth?

The Era Of Free Money Is Over

The bond market now doesn't expect any rate cuts until June of 2024 and expects the Fed to still be 4.75% by the end of next year.

Just a few months ago, the Fed going to 4.75% at all would have seemed insane, and now the bond market thinks the Fed will go to 5.5% and stay higher for nearly an entire year.

NEE doesn't borrow from the Fed, it borrows from bond investors, but you get the idea. The golden era of "there is no alternative" and NEE being able to command a sub 2% yield is done.

The days of it minting free money via ATM share issuances are gone for the foreseeable future.

NEE's cost of capital is still lower than most utilities, thanks to its A-credit rating. But the days of 10% to 12% growth?

With its cost of capital now much higher than when 10-year yields were 0.5%, NEE is now expected to grow around 7% over time. That's still very good for a utility. For context, the REIT industry is growing by about 6%. That's in line with management guidance.

NEE Never Misses Guidance Or Estimates

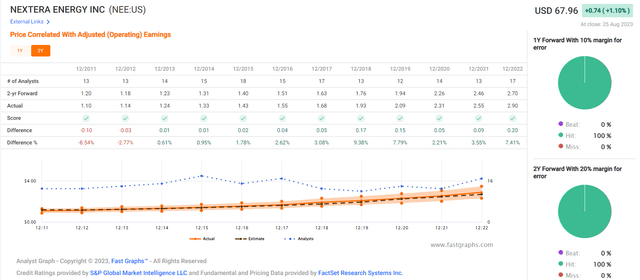

FAST Graphs, FactSet

Within a minimal margin of error, management never misses guidance, or analyst estimates (which are based on its guidance).

NEE is expected to deliver 9% to 10% long-term returns, again, very REIT-like, and a solid return from an A-rated dividend aristocrat industry leader.

And given its historical track record, you can be pretty confident you'll earn 9% to 10% returns in the coming years.

And that green energy bonanza NEE has as a tailwind means it could potentially sustain above-average growth rates (for a utility) for decades to come.

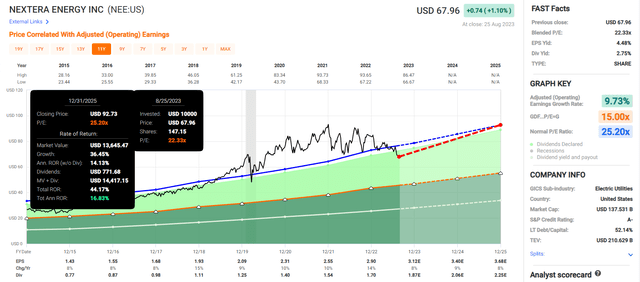

FAST Graphs, FactSet

In the short term, through 2025, you might even earn impressive 45% total returns, or about 16%, about 3X what analysts expect from the S&P.

Rolling Returns Since 2004

Over the last 19 years REITs and utilities have done about 9% average annual returns and around 7% to 8% annual returns over 15 year periods.

These are pension fund-like returns that this sector is supposed to deliver.

NEE? It's averaged 17% annual returns pretty much across every time period. That's compared to the S&P 500's 9% to 10% annual returns.

Do you know how a utility can deliver almost-Buffett-like returns for 15 years? Fast growth yes, but NEE has grown at 8% to 9% over the last 15 years.

It was multiple expansions and a PE that went from 12 to 22 that generated about 25% of those gains. 75% of NEE's total returns over the last 15 years were justified by its yield plus growth.

Those are the 12% or so annual returns that are sanctified by the righteousness of fundamentals.

The remaining 4% per year? Well, that was speculative mania. Does that mean that NEE must keep falling until it returns to a PE of 12? Or even a 20-year average of 19X? Probably not. The management team has proven that it's the master in green energy, and that it likely will be able to sustain above-average growth rates for decades to come.

However, if rates do end up staying higher for longer? Well, then things could get a bit nastier for NEE. And let's take a look at that in the risk section.

Risk Profile: Why NextEra Isn't Right For Everyone

There are no risk-free companies, and no company is right for everyone. You have to be comfortable with the fundamental risk profile.

NextEra Energy's Risk Profile Summary

"We give NextEra Energy a Morningstar Uncertainty Rating of Medium.

The primary uncertainty surrounding our fair value estimate is NextEra's ability to achieve timely, constructive regulatory rate adjustments, particularly given the company's investment plans during the next several years. At the company's regulated utilities, there have been numerous press allegations of federal and state campaign finance violations. Any negative changes in the regulatory environment could have a material impact on our fair value estimate. After an internal investigation at FP&L, NextEra Energy said it believed the company would not be liable for any violations.

NextEra is positioned well to manage its environmental risk compared with its utility peers. The company is the largest developer of renewable energy in the U.S. through its NextEra Energy Resources subsidiary. The company's pipeline of renewable energy projects is over 33 gigawatts during the next four years, aiding in the transition away from carbon emissions.

At its regulated utilities, the company owns natural gas and nuclear generation. NextEra's Florida utility plans to invest aggressively to build out its solar portfolio in the state. This would reduce the utility's reliance on natural gas and nuclear generation, although both forms of generation will play a key role in grid reliability in the near term.

Volatile commodity power markets, weather, and reliance on government subsidies for renewable energy create uncertainty around NextEra's long-term earnings strength in its renewable generation business. Over the past decade, renewable energy economics have improved significantly, reducing the risk that growth will depend on subsidies.

Higher costs could threaten near-term renewable energy development, but high fossil fuel costs have helped maintain renewable energy's relative economic advantage. The Inflation Reduction Act also aided renewable energy economics." - Morningstar

NEE's Risk Profile Includes

regulatory/political risk (in terms of rates it can charge its customers)

cost of capital risk: the days of printing overvalued shares to fund massive growth at NEE and recoup with NEP dropdowns is over, for now,

M&A risk: NEE works through NEP to make lots of acquisitions and in a higher for a longer world that might not work anymore

labor retention risk (tightest job market in over 54 years)

cybersecurity risk: hackers and ransomware (such as Colonial Pipeline) - selling of pipelines but hackers could still target the rest of the business

climate risk: Florida is at the heart of hurricane damage in the future (the ultimate black swan we can all see coming but never predict more than a few weeks out)

NextEra Energy has been around for nearly 100 years and has survived interest rates as high as 20% and 10 year treasury yields as high as 16%.

The main concern isn't with NEE surviving or being able to service its debt.

Bond investors are pricing in just a 0.3% risk of a default within a year and just a 3.5% risk of a default within 30 years.

NEE's fundamental risk of bankruptcy has declined 10% over the last three months, according to bond investors.

Bond investors were willing to lend tens of millions to NEE for 60 years during the pandemic for 2082 maturing bonds. If they were worried about NEE's ability to survive, they would not do that.

When the US Treasury asked bond investors if they'd like 50 or 60-year bonds, the bond market laughed. When NEE asked if anyone wanted to buy 60-year bonds, bond investors couldn't get enough.

But here is the most significant challenge for NEE.

Note the yield on the 60-year bonds it sold in 2021, 3.8%. Selling a 60-year bond at 3.8% means just a 1.8% inflation-adjusted or real rate.

That's basically nothing, as NEE is earning over 10% on its investments. Now it's expected to earn about 7% thanks to a higher rate world.

That's still fine, but here's what NEE investors need to understand.

NEE's average borrowing cost is 0.76% right now.

That's how much it benefited from our freakish low-rate world.

NEE's average borrowing cost, including different kinds of bonds like convertibles (aided by a booming stock price), allowed it to lock in a real rate of -1.5%.

It could borrow at negative rates and mint money.

NEE has a lot of debt maturing in 2024 and 2025. In fact only $30 billion of its $72 billion in total debt matures after 2033. That means NEE is going to have to refinance this debt at much higher rates.

How high?

The bond market currently thinks that the Fed will cut to 3.75% long term and then stay put. That's the new normal, 3.75%, not 0%.

Can NEE handle that? Of course, it's dealt with 20% rates in the past. But is anyone buying NEE in the last ten years ready for almost 4% rates as the "new normal"? Only time will tell.

How do we quantify, monitor, and track such a complex risk profile? By doing what big institutions do.

Long-Term Risk Management Analysis: How Large Institutions Measure Total Risk Management

DK uses S&P Global's global long-term risk-management ratings for our risk rating.

S&P has spent over 20 years perfecting its risk model

which is based on over 30 major risk categories, over 130 subcategories, and 1,000 individual metrics

50% of metrics are industry specific

This risk rating has been included in every credit rating for decades

The DK risk rating is based on the global percentile of a company's risk management compared to 8,000 S&P-rated companies covering 90% of the world's market cap.

NEE Scores 54th Percentile On Global Long-Term Risk Management

S&P's risk management scores factor in things like:

supply chain management

crisis management

cyber-security

privacy protection

efficiency

R&D efficiency

innovation management

labor relations

talent retention

worker training/skills improvement

customer relationship management

climate strategy adaptation

corporate governance

brand management

NEE's Long-Term Risk Management Is The 313th Best In The Master List (38th Percentile In The Master List)

Classification | S&P LT Risk-Management Global Percentile | Risk-Management Interpretation | Risk-Management Rating |

BTI, ILMN, SIEGY, SPGI, WM, CI, CSCO, WMB, SAP, CL | 100 | Exceptional (Top 80 companies in the world) | Very Low Risk |

Strong ESG Stocks | 86 | Very Good | Very Low Risk |

Foreign Dividend Stocks | 77 | Good, Bordering On Very Good | Low Risk |

Ultra SWANs | 74 | Good | Low Risk |

Dividend Aristocrats | 67 | Above-Average (Bordering On Good) | Low Risk |

Low Volatility Stocks | 65 | Above-Average | Low Risk |

Master List average | 61 | Above-Average | Low Risk |

Dividend Kings | 60 | Above-Average | Low Risk |

Hyper-Growth stocks | 59 | Average, Bordering On Above-Average | Medium Risk |

Dividend Champions | 55 | Average | Medium Risk |

Dividend Kings | 54 | Average | Medium Risk |

Monthly Dividend Stocks | 41 | Average | Medium Risk |

(Source: DK Research Terminal)

NEE's risk-management consensus is in the 38% of the world's highest quality companies and similar to that of such other blue-chips as

Dover - Ultra SWAN dividend king

Automatic Data Processing - Ultra SWAN dividend aristocrat

PPG Industries - Ultra SWAN dividend aristocrat

Sysco - Ultra SWAN dividend aristocrat

Pentain - Ultra SWAN dividend aristocrat

The bottom line is that all companies have risks, and NEE is average at managing theirs, according to S&P.

How We Monitor NEE's Risk Profile

21 analysts

three credit rating agencies

24 experts who collectively know this business better than anyone other than management

and the bond market for real-time fundamental risk-assessment updates

"When the facts change, I change my mind. What do you do, sir?"

- John Maynard Keynes

There are no sacred cows. Wherever the fundamentals lead, we always follow. That's the essence of disciplined financial science, the math behind retiring rich and staying rich in retirement.

Bottom Line: It's The Best Time In 5 Years To Buy NextEra But That Doesn't Mean You Necessarily Should

NextEra Energy is a beautiful company, but it's essential to have realistic expectations and not fall in love with any stock.

After being a Wall Street darling for so long and earning a green energy halo premium as high as 40%, some investors expect NEE to pull an Nvidia (NVDA) and rocket back to record highs and beyond the moment it touches fair value.

That's not likely. Right now, utilities are out of favor as fears of higher for longer rates have been weighing down the sector for a while, and that's not likely to change.

Should you buy NEE right now?

That depends on your goals and needs.

Are you looking for a relatively fast-growing utility with rock-solid management, a great balance sheet, and potentially decades of 7% growth ahead of it?

Yes.

Are you looking to earn potentially 45% by the end of 2025 and possibly triple the market's returns?

Then, yes, NEE suits your needs.

If you want a way to earn 16% long-term returns or think that NEE is a coiled spring because it's down 25% off record highs?

Then you are likely to be disappointed.

Note: Brad Thomas is a Wall Street writer, which means he's not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.

Sign Up For A FREE 2-Week Trial

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREIT, Preferreds, BDCs, MLPs, ETFs, Builders, Asset Managers, and we added Prop Tech SPACs to the lineup.

We recently added an all-new Ratings Tracker called iREIT Buy Zone to help members screen for value. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus my FREE book.

This article was written by

Brad Thomas is the CEO of Wide Moat Research ("WMR"), a subscription-based publisher of financial information, serving over 168,000 investors around the world. WMR has a team of experienced multi-disciplined analysts covering all dividend categories, including REITs, MLPs, BDCs, and traditional C-Corps.

The WMR brands include: (1) iREIT on Alpha (Seeking Alpha), and (2) The Dividend Kings (Seeking Alpha), and (3) Wide Moat Research. He is also the editor of The Forbes Real Estate Investor.

Thomas has also been featured in Barron's, Forbes Magazine, Kiplinger’s, US News & World Report, Money, NPR, Institutional Investor, GlobeStreet, CNN, Newsmax, and Fox.

He is the #1 contributing analyst on Seeking Alpha in 2014, 2015, 2016, 2017, 2018, 2019, 2020, 2021, and 2022 (based on page views) and has over 110,000 followers (on Seeking Alpha). Thomas is also the author of The Intelligent REIT Investor Guide (Wiley) and is writing a new book, REITs For Dummies.

Thomas received a Bachelor of Science degree in Business/Economics from Presbyterian College, and he is married with 5 wonderful kids. He has over 30 years of real estate investing experience and is one of the most prolific writers on Seeking Alpha. To learn more about Brad visit HERE.Analyst’s Disclosure: I/we have a beneficial long position in the shares of NEE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (7)

Thank you.