Array Technologies: Undervalued Stock With Solid Growth

Summary

- ARRY reported solid Q2 FY23 results, with a 21% rise in revenue and significant improvement in gross margins.

- The stock price of ARRY has shown strength and potential for an uptrend after breaking out of a one-year consolidation.

- ARRY is undervalued with a solid upside potential, making it a great buying opportunity with strong financials and fundamentals.

Marco VDM/E+ via Getty Images

Ground-mounting tracking systems are produced by Array Technologies (NASDAQ:ARRY) for use in solar energy installations. ARRY announced solid Q2 FY23 results. The company’s financial and fundamental situation has improved a lot. In this report, I will review its Q2 FY23 results. I believe the setup of ARRY is quite favorable, and it can provide solid returns to the investors. Hence, I assign a buy rating on ARRY.

Financial Analysis

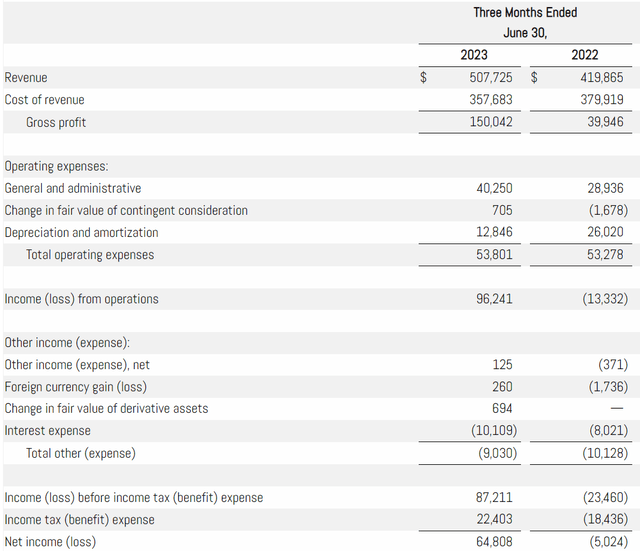

ARRY posted its Q2 FY23 results. The revenue for Q2 FY23 was $507.7 million, a rise of 21% compared to Q2 FY22. I think a 16% rise in the overall amount of megawatts shipped was the major reason for the revenue increase. Its gross profit margin for Q2 FY23 was 29.5%, which was 9.5% in Q2 FY22. I think the significant improvement in gross margins was due to lower freight and material costs and higher pass-through pricing.

The adjusted EBITDA for Q2 FY23 was $115.6 million, which was $20.9 million in Q2 FY22. Due to the significant improvement in the gross profit and EBITDA, its net income reached $64.8 million in Q2 FY23, compared to a net loss of $5 million in Q2 FY22. In addition, if we look at its balance sheet, its cash & cash equivalents by the end of June 2023 was $155.9 million, which is 16.4% higher compared to December 2022. The debt has also declined by 2.5%. This quarter has been quite solid, for the company reported strong numbers. The result ticked every box with strong revenue growth, significant improvement in the gross margins, strong rise in EBITDA and net income, and solid improvement in the company's balance sheet. The company's share price is still below its IPO price levels, and the company has struggled with IRA issues and delays in the past. But looking at the solid results and fundamentals, I believe we might see appreciation in the share price soon.

Technical Analysis

ARRY is trading at the $24.8 level. The stock has recovered quite well after making a bottom at $5.5. The stock was trading in a range of $17-$24 for the past one year. But recently, the stock broke out of the one-year consolidation, which indicates strength in the stock. After being in a downtrend for about three years, the stock is showing strong signs of trend reversal. I believe there is a high chance that the stock might go into an uptrend soon. Because the breakout has come after a long consolidation in the stock price, which increases the chances of the breakout being successful. I do not see any major resistance that might stop the stock price. The next major resistance zone that I see is $35, so I think it has the potential to reach $35.

Should One Invest In ARRY?

The company posted solid Q2 FY23 results, and as a result, the share price of the company has started to appreciate. With strong results, improved fundamentals, and the stock price giving a breakout at the same time, it is a solid setup. The setup being built in ARRY is quite positive and is one of the most preferred setups I like to trade. In addition, if we look at ARRY’s valuation, we can see that ARRY is undervalued with a solid upside potential. The five-year average P/E of ARRY is around 53x, and it is currently trading at a P/E [FWD] ratio of 23.71x. ARRY has a PEG [FWD] ratio of 0.7x, compared to the sector ratio of 1.76x. So, it shows that ARRY is currently trading below the historical average, and looking at their strong revenue growth in Q2 FY23, I think they are trading at a discounted price. Hence, after considering all the factors, I think it is a great buying opportunity. Hence, I assign a buy rating on ARRY.

Risk

Many end users rely on financing for the initial capital investment to build a solar energy plant. Because of this, a rise in interest rates or a decline in the availability of project debt or tax equity financing may reduce the number of solar projects that receive funding or otherwise make it challenging for clients or clients of clients to obtain the financing required to build a solar energy project on favorable terms, or even at all, which may reduce demand for their products and restrict their ability to grow or lower their net sales. Additionally, I think that a sizeable portion of end users build solar energy installations as investments, financing a sizeable chunk of the initial capital expenditure with funds from outside sources. Further increases in interest rates may reduce the return on investment for investors in solar energy projects, raise the amount of equity needed, or make alternative investments more alluring than solar energy projects, all of which may lead these end-users to look for alternative investments.

Bottom Line

The company's financial situation has dramatically improved, and its balance sheet has also improved. After being in a downtrend for so long, its share price has given a breakout, which can signify a trend reversal. The company is ticking all the boxes that are required for an investment, with solid financials and fundamentals, low valuation, and stock giving a breakout. I think it can be a great buying opportunity, and I assign a buy rating on ARRY.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.