Paramount Global: You've Got To Be Looking At The Stock Now

Summary

- Paramount Global hits a 52-week low at $13.62, with a high debt level of $15 billion and a market cap of $10 billion.

- Positive valuation based on sales and book value, but struggling with cash flow and bottom-line performance.

- Similar situation to Warner Bros. Discovery with leverage, valuable assets, and a motivated management team to improve performance.

- Considering valuation, management's plan to de-leverage, and the collection of filmed entertainment, the stock is a buy for patient investors.

Eamonn M. McCormack/Getty Images Entertainment

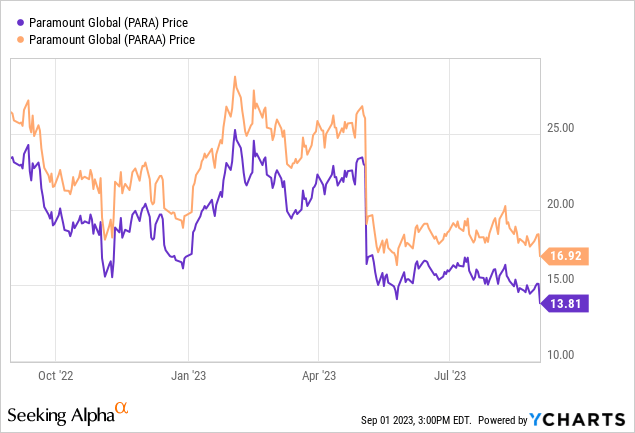

Paramount Global (NASDAQ:PARA) (NASDAQ:PARAA) hit a 52-week low on Friday, September 1 (perhaps in part because of a warning by media insider Barry Diller). That price point was $13.62 (for PARA), and the 13-handle finds itself versus a 25-handle for the 52-week-high. Here's a chart of the stock:

I consider Paramount Global a buy, and this brief article can be considered an updated reiteration of a previous article back in May, expressing my current thoughts on various aspects of the story.

In terms of valuation, SA currently rates it in the green. However, growth ratings are firmly in the red. What's going on?

Well, for one thing, the positive valuation is centered on sales and book value, while the after-revenue, bottom-line stuff (e.g., cash flow) is suffering.

In terms of price action, the company's debt - as of last quarter, reported on August 7 - was $15 billion, and that was steady compared to the debt level at the end of 2022 (and steady is obviously not good in this scenario). Keep in mind, this company has a market cap of $10 billion (at the time of writing). With that debt, the enterprise is obviously quite leveraged.

That debt, by the way, isn't looking attractive.

There are a lot of headwinds, including the strikes in Hollywood. But the company is in a similar situation to Warner Bros. Discovery (WBD), a stock I own in addition to Paramount: a lot of leverage, a valuable collection of assets, and a highly-motivated management team to right the ship.

The first part of the story for me is the asset collection, which is comprised of a lot of valuable brands that possess the potential to be reinvigorated. Of that collection, here is the big bet I believe the company can make: the Paramount movie studio.

I've talked about this before, but with the movie studio, my thinking is studio head Brian Robbins goes even further in attempting to replicate the Disney (DIS) model of a tight focus on branded IP. The interesting thing too, is, where Disney almost seems as if it wants to unwind its trade in the Fox assets and focus exclusively on tentpole content, Paramount's studio is diverse enough that it can make bets on different genres and various budgetary levels that stand a good chance of generating box-office returns as well as powering the P+ streaming service. That gives it flexibility; that's how one can have a Top Gun juggernaut alongside a Smile horror picture.

Of course, whenever one bets on the movie business, it can be difficult when a slate doesn't seem to be working as good as the competitors'. Let's consider three recent releases.

The latest Transformers movie grossed $440 million globally as of this writing, with domestic coming in at $157 million. The latest Mission: Impossible film pulled in over $550 million worldwide; domestic theaters stand at around $170 million in ticket sales. The Teenage Mutant Ninja Turtles revival is credited with just under $140 million worldwide, with North American markets just over $100 million at the thirty-day mark of release.

Notice something in common with all these pictures? None of them have a global gross that begins with a b instead of an m. As a shareholder, I don't like it, either. There are two ways of looking at this: things never improve; things will definitely improve at some point. I am in the latter camp. My reasoning? I've seen this game before, and I bet you have as well: sometimes a slate works exceptionally well, and sometimes it doesn't. Paramount will get to a billion dollars again with its IP, just as it did last year with Top Gun. While it's very surprising to me that the latest Impossible feature didn't gross a billion based on the halo effect of Gun, and while I do acknowledge that not having a billion-dollar movie in the summer marketplace is most definitely the very definition of how not to play the Disney game, my feeling is Paramount will reconfigure its movie strategy to keep up with companies like Comcast's (CMCSA) NBCUni (of Super Mario fame) and the aforementioned Warner Bros. Discovery (currently killing it with new franchise entry Barbie).

When slate success improves, streaming will benefit. The good news on that count is that Wall Street is now over subscriber count as the prime metric; profitability is the talk of the markets now. That means that P+ can breathe easy (well, maybe easier, not easy so much) when it reports 61 million subscribers, which represents a flat growth rate on a sequential basis. Revenue increased for direct-to-consumer by 40% to roughly $1.7 billion in Q2, driven by P+'s advertising sales and subscriber expansion year-over-year, as well as the company's FAST platform Pluto TV. However, the loss at DTC was flat at $424 million in OIBDA for Q2, and for the six-month frame, it saw a small increase to $935 million.

The takeaway is clear to me: CEO Bob Bakish will probably try to out-Zaslav David Zaslav over at WBD by cutting even more content on P+ and sending that product to other platforms, including FAST services as well as more traditional licensing venues such as cable channels. Get ready, in other words, for subscriber-count contraction, but...don't pull the sell trigger just on that count alone, because see again what I said about what Wall Street values insofar as streaming is concerned. The really good news here is that, with the strikes continuing to keep content production down, Paramount Global's licensing and FAST presence should prosper as original content may be delayed longer than we expect.

Like Lions Gate Entertainment (LGF.A) (LGF.B), the talk of licensing library content has taken on greater importance, and Bakish expressed his admiration for the company's catalogue in the latest earnings call. He mentioned the 200,000 episodic hours Paramount claimed as its own, as well as 4000 feature-length projects. This was early on in the call; the thing he wanted to mention basically first is the de-leveraging event in the sale of Simon & Schuster. That brought in $1.6 billion. With other asset sales, the company could be on a better path toward debt reduction. Paramount Global may even take a cue from Disney and look for investors to take stakes in certain assets (just as Disney is reportedly open to the idea of investors for ESPN, assuming a total sale or spin-off does not occur). Here's an example: while I think the MTV networks are important platforms, one might argue the company hasn't lately taken full advantage of their potential - could outside investors help in this case? As Disney's Bob Iger has been saying all along, what's core these days to a tentpole-theatrical/streaming model and what is not? With the concept of the library in greater play now in media circles, one has to wonder if Bakish may at some point court consolidation suitors in a similar way that Lions Gate's CEO Jon Feltheimer is doing for his studio. As I mentioned in an article on Netflix (NFLX), since that streaming service seemingly professed interest in the Paramount Global studio, it makes one wonder if Bakish will at some point look for a premium from the marketplace via a strategic sale (assuming controlling shareholder Shari Redstone goes along with it).

So, the thesis here, for me, is basically intact, and I view the decline in share price as an opportunity. There are risks, however.

To begin with, the idea that the company may want to sell itself, or part of itself in stake transactions, should be considered strongly, because that may be a concept that will turn out to be an early prediction. When stocks like Paramount Global become contrarian value plays, identification of catalysts does not mean they will appear on an expedited schedule. This is important to note as a risk (as is the fact that the CBS broadcaster may not be an asset some buyers would want).

Another risk: the whole FAST market may not monetize content well in the coming months if advertisers pull back (even further than they have) based on Fed comments and interest-rate environment. I do see FAST as a great way for media companies such as Paramount Global, WBD, and Disney to hedge their streaming operations, but some of that opportunity might really shine when the economy improves.

The movie slate may take a while to get that coveted billion-dollar project, but in general, I am looking for an improvement in global box-office results. Some of the next films coming up include a Pet Sematary sequel in October, a continuation of the Quiet Place series in March of next year, and the next Impossible movie in summer 2024. Still, those horror films represent a strategy I think more media companies should invest in, especially from a Blumhouse Productions' model viewpoint - i.e., keep budgets low on genre-oriented projects and make sure the concepts drive the cinematic proceedings.

Acceleration of de-leveraging may not happen as fast as I would like it to. This is key: Bakish should make that a priority and really strengthen that balance sheet.

And, as always, the Hollywood strikes. They won't be around forever, but they have gone on for longer than perhaps most expected (including me). Projects in development will be delayed, but they will eventually arrive.

You can see a theme with those risks - it's a timing issue in most cases (as in, when will the catalysts appear). And it may impact whether or not you may want to get into the stock right now.

This new 52-week low probably is not the end of the selling, but no one can predict the absolute bottom of a stock during volatile market conditions. You've got to put this one on a watchlist at the very least. For me, Paramount Global is even more attractive since I last wrote about it. If you believe the company is out to improve itself, then the current valuation is compelling.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CMCSA, DIS, LGF.A, LGF.B, NFLX, PARA, WBD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (15)

Paramount has about $15.6 billion in long-term debt. It has sold about $8 billion in assets, Moody’s said. Management agreed this month to sell the Simon & Schuster book division for $1.62 billion. Paramount has also cut its quarterly dividend by 79% to preserve cash.

The negative outlook reflects uncertainty over the company’s ability to reduce its debt leverage of the next two years, Moody’s saidAdd to this:www.bloomberg.com/...

Yet many analysts worry companies have missed their window. “Everyone wants to sell their TV networks and nobody wants to buy them,” Rich Greenfield, co-founder at LightShed Partners, told me by phone Friday.

Private equity firms are one logical buyer. They like businesses that generate profit, even if they are in decline. They can suck out that cash flow and put it to work in other investments, or return it to investors. But high interest rates make it very expensive for private equity firms to do a deal. They would need to raise capital with high costs, suppressing whatever price they are willing to offer. Interest rates aren’t going to collapse any time soon.

Other logical buyers include fellow media companies, local TV station owners and technology firms with a growing interest in media. But all of them face regulatory hurdles. The government has expressed concern about consolidation in general, and concentration of power in media and tech in particular. Lina Khan, the head of the Federal Trade Commission, wrote a seminal paper arguing for a new, more aggressive approach to antitrust law.

“It’s a regulatory environment that’s hostile,” says Greenfield, and government hostility to media deals is only increasing.It seems PARA and WBD have to survive on their own in these harsh times not somebody who buys them in case the business model fails.

I favor WBD over PARA in this scenario though.For the links see:

seekingalpha.com/...

www.bloomberg.com/...

Guess some kind of deal will happen in the endDisney:

Still and all, “We value our relationship with Charter and we are ready to get back to the negotiation table to restore access to our unrivaled content to their customers as quickly as possible.”deadline.com/...