Pfizer: The Floor To This Decline Remains To Be Seen

Summary

- The decelerating COVID-19 portfolio and underperforming bolt-on acquisitions have directly contributed to PFE's lowered FY2023 guidance range.

- In an attempt to boost its pipeline, thanks to the patent cliff from 2025 onwards, the company has also embarked on aggressive R&D efforts, comprising 20.5% of its overall revenues.

- With its COVID windfall depleted and long-term debts growing to $61.67B, PFE also faces inflated annualized interest expenses of $2.03B.

- Thanks to the massive dividend obligations worth $9.24B annually, we do not expect any share repurchases over the next few quarters as well.

- PFE shareholders may want to brace for impact, due to the potential new normal in its profit margins, possibly further impacting its stock valuations/ prices in the intermediate term.

tiero

The PFE Investment Thesis Remains Shaky Here

We previously covered Pfizer (NYSE:PFE) in May 2023, discussing its mediocre historical stock performance compared to its pharmaceutical peers. Most of the pessimism was attributed to the decelerating COVID-19 portfolio and $22B worth of annualized patent cliff from 2025 onwards.

This was on top of the overly aggressively M&A activities the management had undertaken, likely to deplete its hyper-pandemic windfall while incurring an eye-watering debt of $31B.

For now, PFE has reported a further decline in its Comirnaty sales to $1.48B (-51.6% QoQ/ -83.2% YoY) and Paxlovid sales to $143M (-96.4% QoQ/ -98.2% YoY), naturally contributing to the drastic decline in its overall sales of $12.73B (-30.3% QoQ/ -54.1% YoY) in FQ2'23.

This is on top of the lowered FY2023 revenues guidance range of between $67B and $70B, compared to the FQ1'23 guidance range of between $67B and $71B.

While the PFE management has maintained its previous FY2023 adj EPS guidance range of between $3.25 and $3.45, we are uncertain if the company is able to hit even the lower end of these numbers.

Based on its FQ1'23 adj EPS performance of $1.23 (+7.8% QoQ/ -24% YoY) and FQ2'23 adj EPS of $0.67 (-45.5% QoQ/ -67.1% YoY), the company has a lot of catching up to do, in our opinion.

If the next two quarters develop as to how FQ2'23 has, we may see PFE only achieve FY2023 adj EPS of $3.24 (-50.2% YoY), naturally missing its own guidance. While the management has been optimistic about an uptick in its COVID sales in H2'23 as they enter the commercial US markets, we are less certain.

On the one hand, we have been previously confident about the robust growth of PFE's core portfolio, excluding Comirnaty and Paxlovid, with it already performing exceedingly well in H1'23 with revenues growth of +5% YoY.

On the other hand, investors must also note that the management has lowered its FY2023 guidance growth range (ex-COVID portfolio), from between 7% and 9% in the FQ4'22 earnings call, to 6% and 8% in the FQ2'23 earnings call.

While the PFE management has cited the Rocky Mount production facility as a top-line headwind, we are less certain since the facility is already back in operation within three weeks of the tornado.

We suppose most of the growth headwind may be attributed to its multiple bolt-on acquisitions, which have yet to yield any significant results.

For example, its recently acquired therapies, Nurtec ODT/Vydura from Biohaven (BHVN) only contributed $247M in global revenues, with Oxbryta from Global Blood Therapeutics (GBT) similarly reporting $77M in revenues. This is despite the hefty acquisition price tag of $11.6B and $5.4B, respectively.

The declining COVID related revenues have also exposed PFE's intensified R&D efforts, with an annualized FQ2'23 expenses of $10.48B (+5.2% QoQ/ -6.7% YoY) comprising 20.5% of its overall revenues (+6.9 points QoQ/ +10.4 YoY). This is compared to the FY2019 levels of $7.72B and 18.8%, respectively.

As a result of its impacted top line prospects and burgeoning long-term debts to $61.67B (+92.8% QoQ/ +78.7% YoY), thanks to the Seagen deal (SGEN) and elevated interest rate environment, we are not surprised that the company also reported an elevated annualized interest expense of $2.03B (+59.7% QoQ/ +73.3% YoY) in the latest quarter.

These developments have directly contributed to PFE's drastically moderated net income margins of 18.3% in FQ2'23 (-12 points QoQ/ -17.4 YoY), compared to the hyper-pandemic averages of ~29% and the pre-pandemic averages of ~33%.

Therefore, long-term shareholders may want to brace for impact, due to the potential new normal in its profit margins, possibly further impacting its stock valuations and stock prices in the intermediate term.

Combined with the massive dividend obligations worth $9.24B annually, we do not expect any share repurchases over the next few quarters as well.

So, Is PFE Stock A Buy, Sell, or Hold?

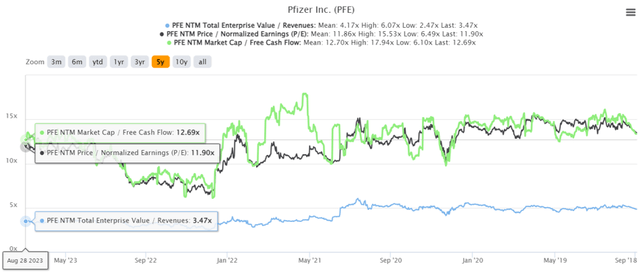

PFE 5Y EV/Revenue, P/E, & Market Cap/ FCF Valuations

For now, PFE trades at NTM EV/ Revenues of 3.47x, NTM P/E of 11.90x, and NTM Market Cap/ FCF of 12.69x, elevated compared to its 1Y mean of 3.38x/ 10.79x/ 11.31x, though moderated compared to its 3Y pre-pandemic mean of 4.65x/ 13.50x/ 13.48x, respectively.

The stock appears to be attractively valued as well, in comparison to the pharmaceutical sector median EV/ Revenues of 3.18x, P/E of 12.83x, and Market Cap/ FCF of 13.66x.

However, despite the drastic correction thus far, we believe there is still no margin of safety at these levels, since the PFE stock still trades above its fair value of $31.89, based on the annualized FQ2'23 adj EPS of $2.68 and NTM P/E valuations.

There is also a minimal upside potential to our long-term price target of $41.76, based on the consensus FY2025 adj EPS estimates of $3.51.

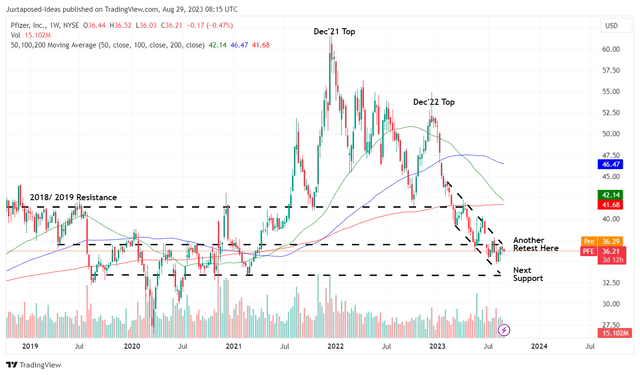

PFE 5Y Stock Price

Furthermore, the PFE stock appears to be continuously declining, with it charting lower highs and lower lows over the past five months. As a result, we may see the stock further retrace to retest its previous support levels of $33 in the near term.

Therefore, while we prefer to rate the PFE stock as a Hold here, interested investors may want to observe the situation a little longer and only add if bullish support materializes at those levels.

Assuming that there are no changes to its dividend policy, those levels may also unlock an expanded forward yield of 4.96%, compared to its 4Y average of 3.74% and sector median of 1.49%.

Patience may be a more prudent strategy for now.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (6)