Flagship Communities Offers A 3.5% Yield With A 55% Payout Ratio

Summary

- Flagship Communities reported strong financial performance with increased Net Operating Income and AFFO per unit.

- The REIT has successfully raised rents and increased occupancy, contributing to higher NOI.

- Flagship Communities has locked in mortgage debt at a low-interest rate, minimizing the impact on interest expenses.

- I do much more than just articles at European Small-Cap Ideas: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

Nature, food, landscape, travel/iStock via Getty Images

Introduction

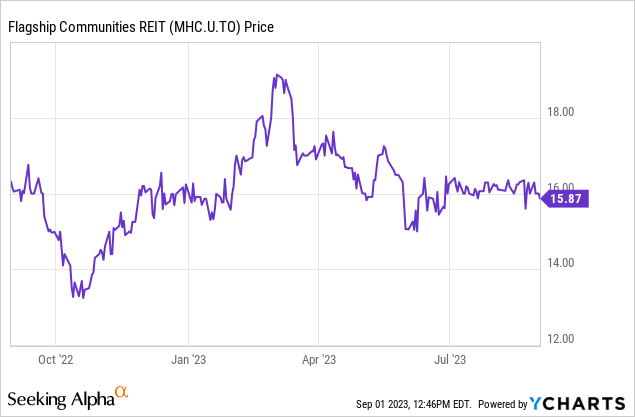

It has been almost eight months since I last discussed Flagship Communities REIT (OTCPK:MHCUF) ((MHC.UN:CA)) and as the REIT has reported on the financial results of three quarters since the publication of my previous article, I figured an update on its financial performance would be useful. I'm mainly interested in seeing how the REIT’s AFFO result is holding up and what the interest rate risk is. As a reminder, Flagship Communities is a Canadian REIT focusing on the manufactured housing market in the US. It's a direct competitor of UMH Properties (UMH) but trades at a lower valuation. Flagship Communities reports its financial results in US dollars.

The AFFO remains important - and all is well on that front

Right now in the REIT sector there are only two important metrics here: How is the AFFO impacted by the increasing interest rates on the financial markets, and how are the capitalization rates evolving (and how does this impact the loan to value ratio on the balance sheet).

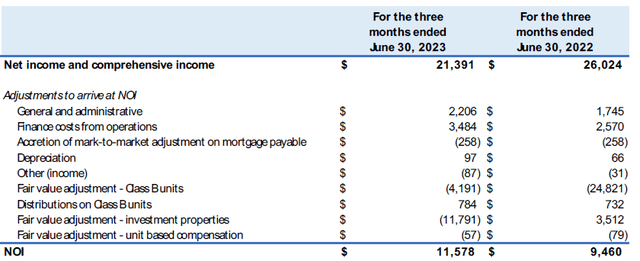

As the REIT still is in full expansion and has been successful in raising the rent, the Net Operating Income increased pretty substantially. Whereas Flagship reported a NOI of US$9.5M in the second quarter of last year, this already increased to $11.6M in the second quarter of this year. That’s a 22.4% jump and even the NOI margin increased as well, to approximately 66.6%.

Flagship Communities Investor Relations

The majority of the higher NOI was caused by rent hikes as well as a higher occupancy ratio (84.9% compared to 83.6% on a same community basis). Meanwhile, the revenue on a "same community basis" increased by 9.1% while the same community NOI increased by 9.4%. So while the expansion in the past year definitely has contributed to the higher NOI, let’s definitely not forget the same community NOI increased by a high single-digit percentage as well.

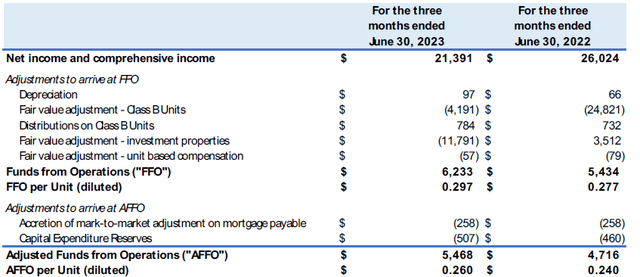

Meanwhile, the FFO and AFFO calculations remain important as well. As you can see below, the FFO increased by $0.8M, while the AFFO increased by a slightly lower $0.75M to $5.5M. This translated into an AFFO per unit of US$0.26 which is an increase of just over 8% compared to the AFFO generated in the second quarter of last year.

Flagship Communities Investor Relations

And that's a good result. Sure it may perhaps look disappointing to see an AFFO increase of just $0.75M after seeing a $2.1M NOI increase, but the majority of the difference could be explained by the higher interest expenses (+$0.9M) and higher G&A expenses (+$0.45M). This also means the AFFO per share remained flat in the second quarter and the AFFO for the entire first semester came in at $10.6M for a per-share performance of $0.52. And after completing the new acquisition (a US$23M purchase in Indiana with a 95% occupancy ratio), the AFFO should increase slightly in the second half of the year and I think it would be safe to assume a full-year AFFO of US$1.05 per share which could subsequently further increase towards $1.10 next year.

Flagship Communities Investor Relations

Flasgship Communities has made the smart decision to lock in its mortgage debt for an extended period of time. Between now and the end of 2027, only $4M in principal payments are required on the $329M in mortgage debt. Considering the average contractual interest rate was/is just 3.78%, I doubt Flagship will see any severe pressure on its interest expenses in the near future. The only other financial debt on the balance sheet is a $2M line of credit, and the increasing interest rates should only have a very marginal impact on the bottom line.

As of the end of June, the REIT had 5.6M Class B units outstanding as well as 15.5M common units. This means the total unit-equivalent count is approximately 21.1M units. Which means the $504M in equity + value of the Class B units represents a NAV of just under US$24 per share. This indicates the stock is trading at a discount of about 33% to the NAV. That NAV is based on a capitalization rate of 4.81% throughout the portfolio, but as the NOI is rapidly increasing, the implied capitalization rate should be slightly higher. The book value of the investment properties is approximately $830M, while the annualized NOI exceeds $46M at this point.

The distribution is still well covered

Now we have established the REIT is trading at a discount to NAV, and even if you’d increase the capitalization rate to 6% the stock is still trading at a discount of in excess of 20% to its NAV, and now we have established Flagship Communities is trading at an AFFO multiple of just 15 times this year’s AFFO and about 14.5 times the anticipated AFFO for next year, it’s perhaps also a good moment to have a look at the distribution.

During the second quarter, the REIT paid $0.281 per unit in distributions (the monthly distributions are$0.0468 per unit) during the semester, and considering the AFFO per share was approximately $0.52 there’s very little doubt the distributions are fully covered: the payout ratio was just under 55%. And that means the current yield of 3.5% appears to be safe.

This also means there's ample room for distribution increases, but it also means the REIT is retaining about $2.5M per quarter in AFFO which it can then spend on adding assets to its empire. Considering it's still buying assets at a capitalization rate in the mid-5% range (as the cost of debt is to increase, I expect Flagship to be able to purchase less-desirable assets at a cap rate of in excess of 6%), the $10M in annually retained AFFO could easily add $0.5-0.55M per year to the AFFO which would add about $0.025/share per year.

Investment thesis

When I published my previous article on Flagship Communities in January, I wanted to keep an eye on the stock. While the share price has not been hit as hard as I thought by the increasing interest rates on the financial markets, the REIT is still printing very robust financial results, obviously helped by its own low mortgage rates of 3.78% on the existing mortgages (new mortgages will obviously be more expensive).

The current yield of 3.5% may not be the highest on the market, it appears to be very well covered with plenty of possibilities to increase the distributions further down the road. US competitors UMH Properties (UMH) and Sun Communities (SUI) are trading at about 18 times the anticipated AFFO for 2024 (this still is a moving target of course) applying a similar multiple to my anticipated $1.10 AFFO result for 2024 would result in a fair value of $19.80.

I currently have no position in Flagship Communities, but the REIT is now definitely on my watch list.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Consider joining European Small-Cap Ideas to gain exclusive access to actionable research on appealing Europe-focused investment opportunities, and to the real-time chat function to discuss ideas with similar-minded investors!

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (2)