EVT: Discount Opens Up Opportunity For Long-Term Income Investors

Summary

- Eaton Vance Tax-Advantaged Dividend Income Fund has been trading lower recently, and the fund's discount has been opening up since our last update.

- EVT has a value-oriented portfolio with a benchmark of the Russell 1000 Value Index, providing a differentiated positioning from tech-heavy funds.

- EVT's performance has been strong relative to the S&P 500 Index, and it offers a reasonable distribution rate after a reduction last year.

- This idea was discussed in more depth with members of my private investing community, CEF/ETF Income Laboratory. Learn More »

DKosig

Written by Nick Ackerman, co-produced by Stanford Chemist.

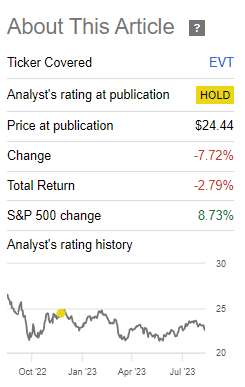

Eaton Vance Tax-Advantaged Dividend Income Fund (NYSE:EVT) has been under some pressure more recently as equities take a hit with higher risk-free yields. Additionally, since the last time we covered the fund at the end of 2022, shortly after the distribution was trimmed, the fund's discount has opened up. That has put additional pressure on the fund's returns during this period.

EVT Performance Since Prior Update (Seeking Alpha)

Aside from discount widening in this period, the fund is also positioned with a more value-oriented portfolio. Its benchmark is the Russell 1000 Value Index, which EVT positions closer to those weightings instead of the usual tech-heavy weighting that the S&P 500 Index runs with. Tech is less than 7% of EVT's portfolio. Tech had been the strongest performing sector on a YTD basis, which has provided strong returns despite equities slipping more recently.

I like the differentiated positioning of EVT and that a discount is opening up. However, I'd still be hesitant to add further leveraged exposure to my portfolio. With that being said, EVT is rather modestly leveraged relative to the usual ~33% leverage we see implemented for closed-end funds.

The Basics

- 1-Year Z-score: -1.45.

- Discount: -6.24%.

- Distribution Yield: 7.97%.

- Expense Ratio: 1.11%.

- Leverage: 20.17%.

- Managed Assets: $2.216 billion.

- Structure: Perpetual.

EVT focuses on "dividend-paying common and preferred stocks and seeks to distribute a high level of dividend income that qualifies for favorable federal income tax treatment." They also include a "value investment style and seek to invest in dividend-paying common stocks that have the potential for meaningful dividend growth." The investment objective is to "provide a high level of after-tax total return consisting primarily of tax-advantaged dividend income and capital appreciation."

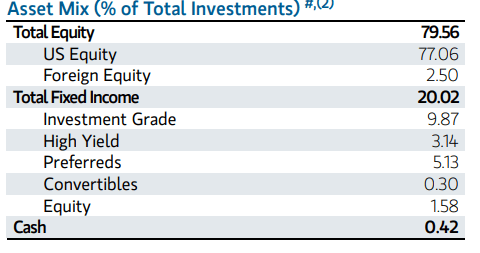

While the fund is heavily focused on equities, EVT is technically a hybrid fund. This is because they run with a material 20% portfolio weighting that is invested in fixed-income investments. This is across the credit quality spectrum too. The fund isn't limited to U.S. investments, but only carries around 8% weighting to international.

As is the case with most leveraged closed-end funds, they are seeing their borrowing costs rise sharply. The fund's total expense ratio due to that has bumped up to 2.42% in the last semi-annual report from the 1.51% it was at the end of fiscal 2022. The Fed has bumped up rates a couple more times since this report as well, which means higher costs have continued for these borrowings.

Their borrowings are financed at a rate of OBFR plus 0.62%, with OBFR at 5.32%, we now see borrowing costs pushing ~6%. Eaton Vance has not hedged against these rising costs or rates, taking the full brunt of the negative impact. A bit of a silver lining is that EV funds aren't generally highly leveraged, which means the impact is relatively smaller than we can see in some other leveraged funds.

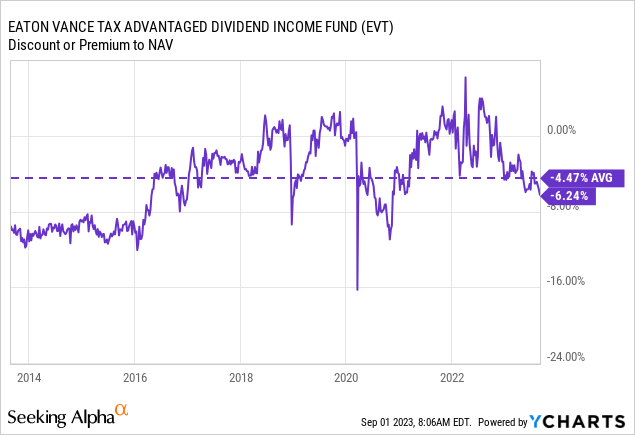

Performance - Attractive Discount

The fund has moved to an attractive discount more recently after flirting at a premium a year ago. In fact, in most of the last five years, the fund has traded at a premium on a fairly regular basis. The one exception was the deep discounts presented during the Covid crash. However, a note of caution is that this period was more of an anomaly and not perhaps indicative of where the fund should have been trading. This would be because prior to around 2016, a double-digit discount had been more regular.

The current discount puts the fund right near the last decade's average, which makes it much more appealing than where it was a year ago. Still, it also means it's not necessarily a screaming deal, either.

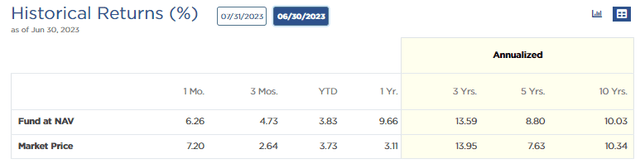

In terms of annualized performance, the fund has put up respectable results.

EVT Annualized Performance (Eaton Vance)

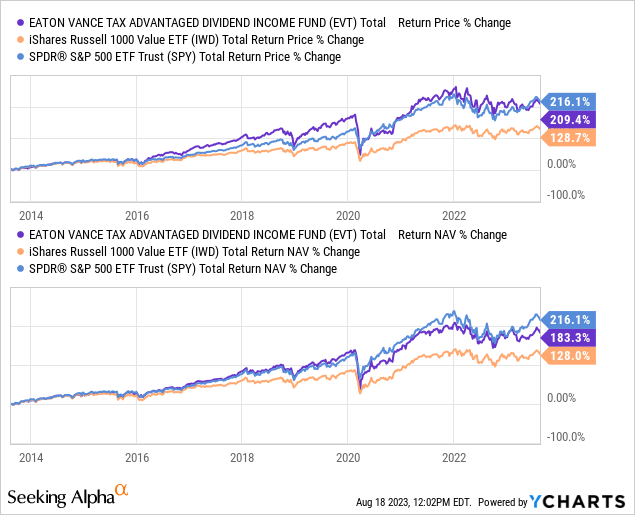

As we noted, it isn't positioned similarly to the S&P 500, so using that as a benchmark wouldn't be appropriate. However, we can include that along with the iShares Russell 1000 Value ETF (IWD) to see some context of how EVT has performed. Even IWD might not be the most appropriate because IWD doesn't have any fixed income exposure, but that's what they've designated as their benchmark.

YCharts

With that being said, we can see that EVT has been able to put up some strong results relative to the S&P 500 Index. It was mostly 2023 when the performances really started to diverge. However, the sort of positioning that EVT carries was also the reason why the fund performed meaningfully better in 2022 when tech dragged down the market.

Distribution - Reasonable Rate After Reduction Last Year

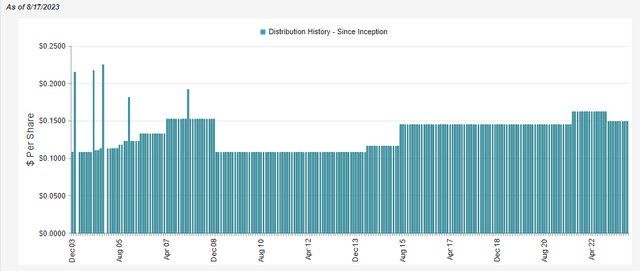

The recovery in the broader market since EVT (and the other equity EV funds) cut their distributions has meant a more reasonable NAV distribution rate. At this time, EVT's NAV rate comes to 7.47%. EVT is one of the few CEFs that have a higher price and NAV now than when it did at inception, while it was also launched pre-global financial crisis.

Being that it is higher now than at NAV, it's probably not too surprising that we also see that the monthly distribution is higher. The fund is also paying a higher distribution amount now than it had been before the last raise.

EVT Distribution History (CEFConnect)

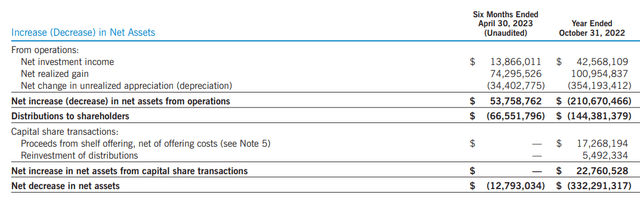

Like most equity funds, the fund will require significant capital gains to fund its payout. Thus, when we were in such a down year as 2022 and had rising borrowing costs, it made sense to cut the payout. Net investment income has come down from the prior fiscal year if we annualized the latest figure. However, on the capital gains front in this last report, the fund has looked much better than it did in fiscal 2022.

EVT Realized/Unrealized Gains/Losses (Eaton Vance)

On a per-share basis, the last six-month figure came to $0.186 NII compared to $0.575 last year for some further context.

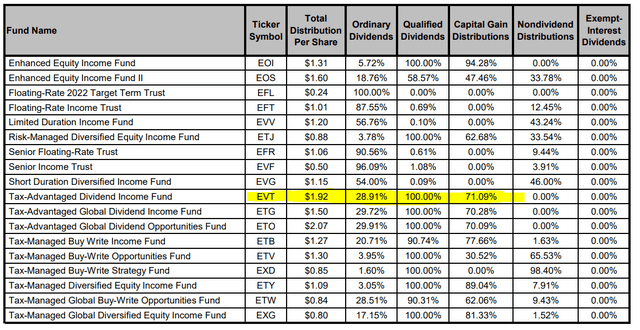

For tax purposes, the fund is tax-advantaged because of the qualified dividends and long-term capital gains that are consistently classified for distribution. Both of these tax rates are relatively lower than ordinary income rates. For 2022, the entire distribution was either qualified or LTCG. This was virtually the same breakdown that was also seen in 2021.

EVT Distribution Tax Classification (Eaton Vance (highlight from author))

EVT's Portfolio

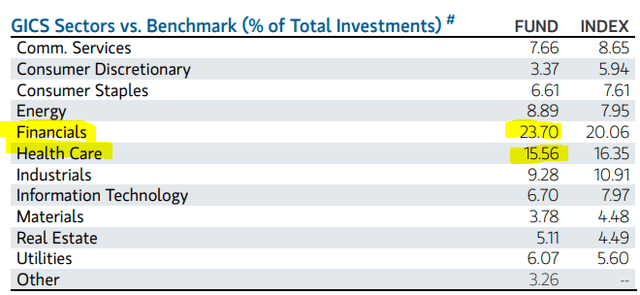

EVT's portfolio has consistently put an overweight on financial sector exposure. That being said, this financial exposure has come down from the previous levels. Healthcare exposure is the second-largest weighting of the fund, and that has been fairly consistent since our last update. From there, the fund is really mostly balanced between material exposure to industrials, energy, and communication services.

EVT Sector Weightings (Eaton Vance (highlights from author))

Healthcare and financial services are two sectors that are down on a YTD basis as of the time of writing. Financials made a strong comeback, though, from where that sector had been during the banking crisis earlier in 2023. Therefore, seeing EVT having positive results YTD is actually encouraging relative to how the fund is positioned, with the largest sector exposure being negative.

Financials, as a more cyclical sector, can generally be offset by the more defensive healthcare sector. So seeing them correlate quite closely this year is fairly unusual as that doesn't tend to happen historically.

These weightings are also fairly close to the benchmark index that EVT tracks. However, we know that EVT performed significantly better due to a strong bull market in most of the last decade and being leveraged, which could have been a driving factor. However, EVT is also positioned in some fixed-income exposure that its benchmark index isn't going to hold an allocation to as an all-equity index.

The asset mix for EVT has been consistent since our last update. This is also generally how they've been positioned going back even several years ago, too. So this is a fairly standard breakdown of allocation in terms of assets for their portfolio.

EVT Asset Allocation (Eaton Vance)

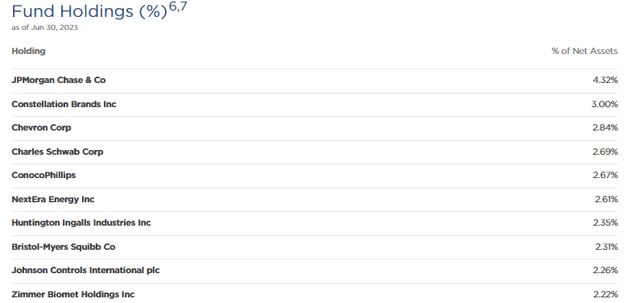

Looking at the fund's top ten holdings, we can see that there isn't a single tech position. I think this really drives home the point that EVT can be a good differentiator for an investor who may be overweight tech and is looking to edge that exposure lower.

EVT Top Ten Holdings (Eaton Vance)

JPMorgan (JPM), the banking behemoth, has consistently been the fund's largest holding going back through our last several updates. JPM benefited from the banking crisis earlier this year by being able to scoop up First Republic on the cheap, which was highlighted that it would be "modestly EPS accretive" for JPM.

Well, it didn't take too long to see those strong results. With the latest earnings, net income was up 67% year-over-year but would have been up 40% if First Republic was excluded. On an EPS basis, earnings were 72% higher YoY.

Net income attributable to First Republic was $2.4 billion in the quarter. This included an estimated bargain purchase gain of $2.7 billion, and a provision for credit losses of $1.2 billion to establish a reserve for the acquired First Republic lending portfolio. During the two months ending June 30, 2023, there was an additional $897 million of net interest income, $436 million of noninterest revenue and $599 million of expense that were attributable to First Republic.

Conclusion

EVT holds a hybrid portfolio, with mostly a tilt towards equities but also a material sleeve of fixed income and preferred. The fund favors investing in financials and healthcare over tech, which can help make it a differentiator in one's portfolio. While tech has certainly seen strong historical results, EVT's performance has still been able to compete with the S&P 500 Index, which has been well above its benchmark results. The fund cut its distribution last year, and it took a little longer for the fund to open up to a more attractive discount. However, we are at a fairly attractive discount for considering this fund, though it also should be noted that it isn't necessarily a screaming deal. Overall, EVT could be a good fit for a long-term income investor.

At the CEF/ETF Income Laboratory, we manage closed-end fund (CEF) and exchange-traded fund (ETF) portfolios targeting safe and reliable ~8% yields to make income investing easy for you. Check out what our members have to say about our service.

To see all that our exclusive membership has to offer, sign up for a free trial by clicking on the button below!

This article was written by

---------------------------------------------------------------------------------------------------------------

I provide my work regularly to CEF/ETF Income Laboratory with articles that have an exclusivity period, this is noted in such articles. CEF/ETF Income Laboratory is a Marketplace Service provided by Stanford Chemist, right here on Seeking Alpha.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of EVT, JPM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (4)

Can you think another EV fund closest to EVT ?

Thank you , very much , for all your writings and guidance.