Veeva Systems: A Close Look At Its Evolving Valuation

Summary

- Veeva Systems focuses on optimizing operations and enhancing compliance for life sciences organizations.

- Veeva's Q2 2024 results align with expectations, showing no major surprises.

- Despite a not-so-cheap valuation, Veeva's steady growth makes it reasonably priced.

- I do much more than just articles at Deep Value Returns: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

gorodenkoff/iStock via Getty Images

Investment Thesis

Veeva Systems' (NYSE:VEEV) fiscal Q2 2024 results delivered fiscal 2025 guidance that was in line with its previous expectations. Meaning that its most recent quarter didn't surface any negative news.

While I don't consider the stock to be particularly cheap, I have to say, that Veeva continues to grow into its valuation. This means that if Veeva can be counted on to grow at around 20% CAGR in fiscal 2025 and for a few more years beyond that, this valuation is a fair at this point.

Rapid Recap

Back in July, I penned an analysis on Veeva titled "Richly Priced for What it Offers," concluding by saying,

The stock is currently priced at a multiple of 31x forward non-GAAP operating margins, which I find richly priced.

Despite this, Veeva's strong financial position with no debt and substantial cash reserves positions the company well. However, I remain neutral on this name.

In sum, I was neutral on this. However, I find Veeva's fiscal 2025 now attractive enough that I'm now able to revise my hold rating to a tepid buy rating.

Veeva and Its Landscape

Veeva Systems focuses on optimizing operations, enhancing compliance, and increasing efficiency for life sciences organizations, including pharmaceutical and medical device companies. Leveraging its regulatory expertise, Veeva has a competitive edge within the industry, although it does have competitors.

Indeed, Veeva operates in a highly competitive space, especially within its largest product categories.

It competes primarily with cloud-based solutions geared toward the life sciences industry. IQVIA Holdings Inc. (IQV) is a major rival offering similar CRM applications, and there are other competitors for Veeva's data products and analytics, including the relentlessly growing Salesforce (CRM).

All that being said, as noted in Veeva's prepared remarks, despite some notable macro environment challenges, especially for smaller life sciences companies due to funding constraints, impacting some of Veeva's biotech customers, Veeva's product offering continues to increase. Case in point, Veeva now has more than 35 products.

Furthermore, Veeva's Commercial Solutions, including CRM and data products, witnessed positive momentum. Veeva also highlighted its growing presence in China and progress in R&D solutions across clinical operations, data, quality, and regulatory aspects, positioning itself as a strong and dependable platform for drug development.

With this context in mind, let's dig into its financials.

Revenue Growth Rates Expected to Improve

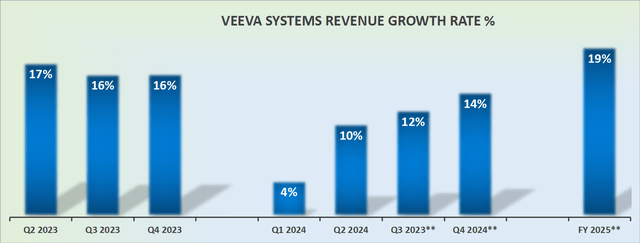

VEEV revenue growth rates

Veeva once again states that in fiscal 2024, the current fiscal year, Veeva's TFC standardization (the contract adjustment) impacts its timing of revenue recognition, but looking out to fiscal 2025, the business will have moved on.

Again, we are told that in fiscal 2025, starting in six months' time, Veeva will be on a path toward nearly 20% CAGR. Needless to say for a company that just reported 10% growth rates in the most recent quarter, for Veeva to be delivering around 20% CAGR this time next year doesn't strike one as such a bad proposition, particularly considering its valuation.

VEEV's Stock Valuation -- Reasonably Priced

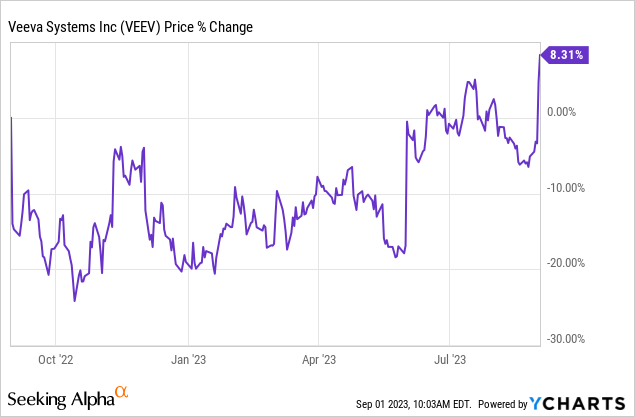

As you can see above, Veeva's share price has re-rated higher in the past couple of months. But if you look back slightly further than a few months, you can see that not only Veeva's share price has been highly volatile, but also, importantly for our discussion, that its share price hasn't really gone very far in the past 12 months. Think about this matter.

Investors have been digesting its lackluster growth this year and this allowed Veeva to grow into its valuation.

Case in point, the stock is now priced at 31x next year's non-GAAP operating margins. Of course, a part of me remains uncertain of whether this is truly such a bargain.

On the other hand, if one can become confident that Veeva could continue to grow its topline at around 20% for a few more years, paying around 31x forward non-GAAP operating profits is a reasonable entry point.

The Bottom Line

Veeva Systems recently reported fiscal Q2 2024 results that didn't bring any negative surprises and provided fiscal 2025 guidance in line with expectations.

While I'm hesitant to call the stock cheap, it's apparent that Veeva is steadily justifying its valuation. If it can maintain around 20% CAGR in fiscal 2025 and beyond, the current valuation seems reasonable. I previously considered the stock richly priced, but now, given the strong Q2 results, I'm cautiously upgrading my hold rating to a tepid buy.

Veeva operates in a competitive landscape, but its diverse product portfolio and market presence continue to expand.

Despite stock price fluctuations, Veeva's valuation seems reasonable if it sustains its growth trajectory. However, there remains an underlying uncertainty about whether this is a true bargain, even if growth projections hold true.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities - stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

- Deep Value Returns' Marketplace continues to rapidly grow.

- Check out members' reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.

This article was written by

Our Investment Group is focused on value investing as part of the Great Energy Transition. For example, did you know that AI uses thousands of megawatt hours for even small computing tasks? Join our Investment Group and invest in stocks that participate in this future growth trend.

I provide regular updates to our stock picks. Plus we hold a weekly webinar and a hand-holding service for new and experienced investors. Further, Deep Value Returns has an active, vibrant, and kind community. Join our lively community!

We are focused on the confluence of the Decarbonization of energy, Digitalization with AI, and Deglobalization.

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

DEEP VALUE RETURNS: The only Investment Group with real performance. I provide a hand-holding service. Plus regular stock updates.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)