XOMA Corporation: Playing The Drug Royalty Strategy Via Preferreds

Summary

- XOMA Corporation helps fund drug research and clinical trials in exchange for payments. Developing a new drug is expensive and high-risk, with a 90% failure rate in clinical trials.

- Along with its no-dividend Common, XOMA offers two preferred stocks for investors interested in funding the company and potentially earning higher yields.

- While I like the unique strategy, XOMA seldom generates a profit, making defaulting on the Preferreds and Chapter 11 for the common a distinct possibility. All issues rated as Sells.

- Looking for more investing ideas like this one? Get them exclusively at Hoya Capital Income Builder. Learn More »

adventtr/iStock via Getty Images

Introduction

Developing a new drug is a very expensive, high risk venture. One statistic I found said that it takes 10-15 years and over $1b USD to develop one successful drug and 90% of drug candidates in clinical trials fail. Even large Pharmaceutical or Biotech companies cannot absorb too many failures. That is where a company like XOMA Corporation (NASDAQ:XOMA) comes into the picture. In return for helping fund the research and clinical trials, XOMA receives payments when a drug enters the marketplace.

With such a high failure rate, the expertise of XOMA's management team to invest in the best trials will drive results. Of course, the second part of a successful drug is the size of the potential market for what it cures or prevents. For investors who like the concept but would rather fund the funder, XOMA has two Preferred stocks they could use:

- XOMA Corporation 8.375% DP PFD B (NASDAQ:XOMAO)

- XOMA Corporation 8.625% CUM PERP PFD SER A (NASDAQ:XOMAP)

After reviewing XOMA itself, both Preferreds are reviewed and compared so potential investors can decide if the current yields are worth the risks they take on, even with owning the Preferred stocks over the Common stock. Since Speculative Buy on the Common and both Preferreds is not a choice, I give all three a Sell rating except for high-risk investors.

Understanding the XOMA Corporation

Seeking Alpha describes this company as:

XOMA Corporation operates as a biotech royalty aggregator in Europe, the United States, and the Asia Pacific. The company engages in helping biotech companies for enhancing human health. It acquires the potential future economics associated with pre-commercial therapeutic candidates that have been licensed to pharmaceutical or biotechnology companies. The company focuses on early to mid-stage clinical assets primarily in Phase 1 and 2 with commercial sales potential that are licensed to partners. The company was incorporated in 1981.

Source: seekingalpha.com XOMA

XOMA describes their strategy as:

XOMA plays a unique role in helping biotech companies achieve their goal of improving human health. We do this by acquiring the economic rights to future milestone and royalty payments associated with partnered pre-commercial clinical candidates. In return the seller receives non-dilutive, non-recourse funding to advance their internal drug candidate(s).

Source: xoma.com

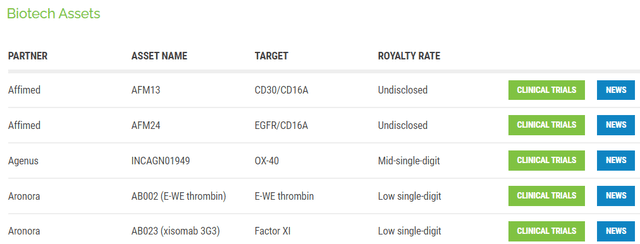

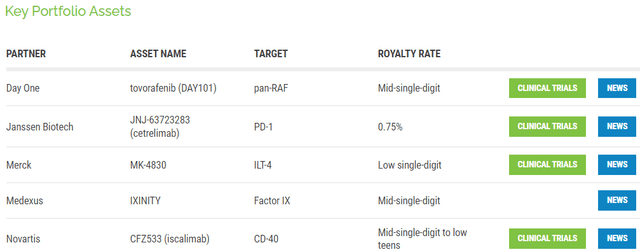

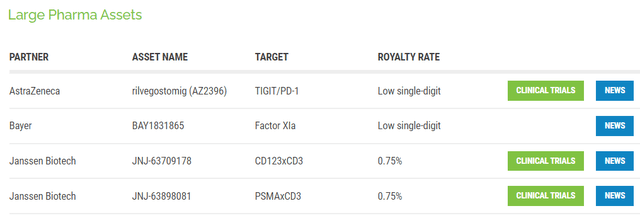

The site lists over 70 places where they are invested, which they break into three strategies. Here are partial lists of each one.

xoma.com/portfolio/#keyportfolio

xoma.com/portfolio/#largepharma

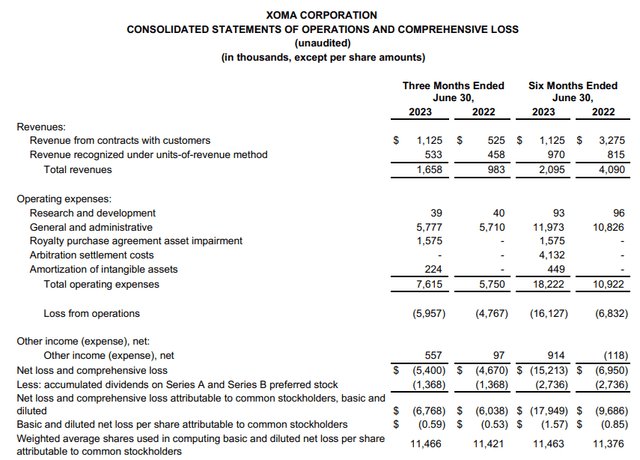

The financial picture of XOMA provides reasons to own the Preferred stock over the Common shares, which pays no dividends, but still not a totally secure one.

23-08-08_XOMA_Reports_Second_Quarter_2023_Financial_436.pdf

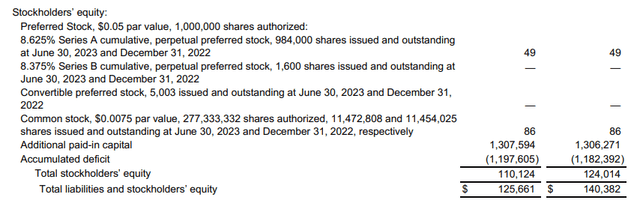

The question thus becomes is how safe are the Preferred stocks from not being paid dividends and possible redemption? Looking at the last part of the Balance sheet, safe for now but...

23-08-08_XOMA_Reports_Second_Quarter_2023_Financial_436.pdf

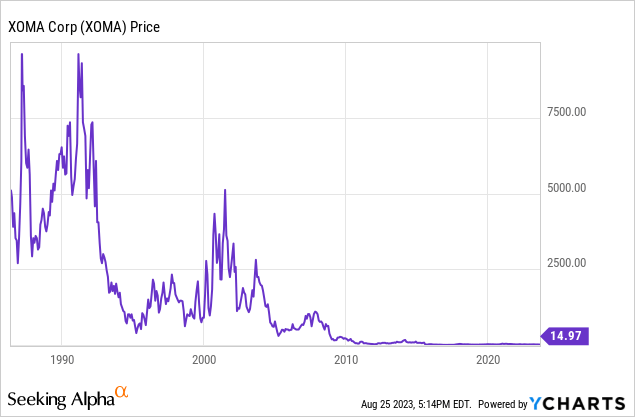

Not sure how the $49m was determined since the Series "A" is $25/share. Also, each actual tradable Series "B" share represents 1/1000 of what is shown above, meaning a redemption value of $50m. As a note, back in late 2016, XOMA executed a 1-for-20 reverse split on the Common shares.

XOMA Preferred stocks reviewed

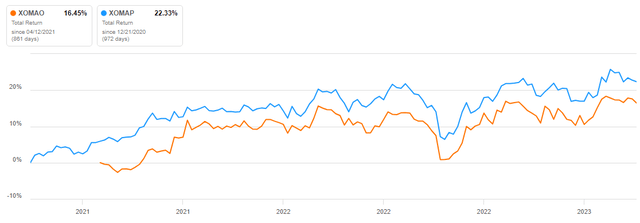

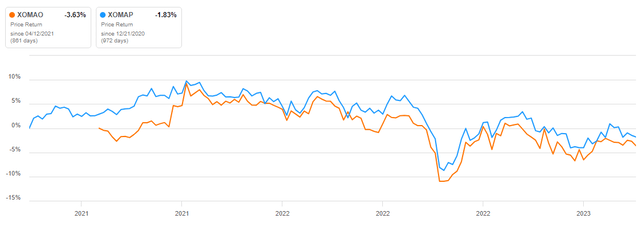

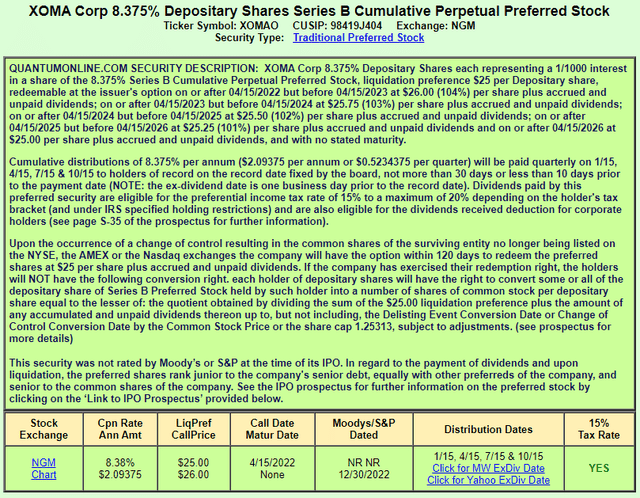

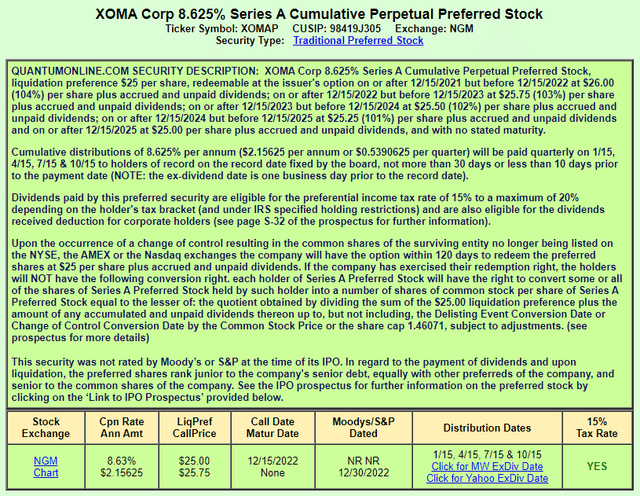

seekingalpha.com charting quantumonline.com XOMAO quantumonline.com XOMAP

| Factor | XOMAO "B" | XOMAP "A" |

| Coupon | 8.375% | 8.625% |

| Price | $23.87 | $24.07 |

| Yield | 8.77% | 8.97% |

| Call date | 4/15/2022 | 12/15/2022 |

| Shares outstanding | 1600k shares* | 984k shares |

| Possible Bonus payment if redeemed | Yes | Yes |

| 15% tax rate | Yes | Yes |

| Average volume | 3.2k | 1.7k |

* Each share represents 1/1000th of each share listed on the balance sheet.

Investor returns

This translates into a 6.77% CAGR since inception for XOMAO, and a 7.85% CAGR for XOMAP.

Portfolio strategy

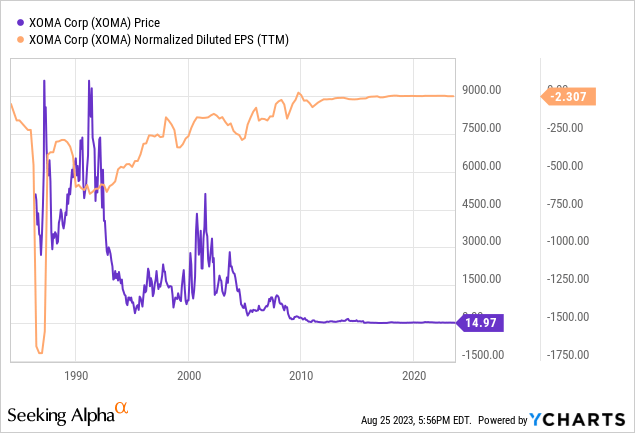

The price chart for XOMA shows some wild price peaks. Wondering if they were driven by EPS spikes, I generated the next chart. Answer: no.

Over the past five years, XOMA was profitable only four times, maybe ten quarters since incorporating. As drug price regulating takes deeper root in the US, it will become harder to profit from launching new drugs. Holding the XOMA would best be described as a Speculative Buy for those investors who like to gamble on a big payoff. If XOMA keeps losing money like the last six months, the stockholders' equity will be gone before 2028.

New holders of XOMAP can earn a yield near 9% if they bought at today's prices, a decent yield even with interest rates up. The question is whether that yield is enough to justify the risk of XOMA filing for bankruptcy before the decade is out. My experience in reaching for extra basis points has not ended well (bought Lehman Brothers debt six months before they folded). My personal preference is owning baby bonds or term preferreds, knowing there is an exit-at-Par date, assuming no default. I have reviewed several I purchased recently or held at the time of writing I would recommend over the XOMA Preferreds.

In summary

- XOMA Common is a speculative buy at best, only for risk taking part of a portfolio.

- XOMA Preferreds, despite nearing yield 9%, I would also put in the speculative buy category as XOMA hasn't shown the ability to generate income.

- BDCs and Preferred CEFs are a safer means, in my view, to generate the same level of income.

I ‘m proud to have asked to be one of the original Seeking Alpha Contributors to the 11/21 launch of the Hoya Capital Income Builder Market Place.

This is how HCIB sees its place in the investment universe:

Whether your focus is high yield or dividend growth, we’ve got you covered with high-quality, actionable investment research and an all-encompassing suite of tools and models to help build portfolios that fit your unique investment objectives. Subscribers receive complete access to our investment research - including reports that are never published elsewhere - across our areas of expertise including Equity REITs, Mortgage REITs, Homebuilders, ETFs, Closed-End-Funds, and Preferreds.

This article was written by

I have both a BS and MBA in Finance. I have been individual investor since the early 1980s and have a seven-figure portfolio. I was a data analyst for a pension manager for thirty years until I retired July of 2019. My initial articles related to my experience in prepping for and being in retirement. Now I will comment on our holdings in our various accounts. Most holdings are in CEFs, ETFs, some BDCs and a few REITs. I write Put options for income generation. Contributing author for Hoya Capital Income Builder.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.