Foot Locker: A Valuation Update After The Dividend Suspension

Summary

- Foot Locker's quarterly results have been disappointing, with declining sales, missed earnings estimates, and negative cash flow from operations.

- The company has cut its guidance for the full year and suspended its dividend, impacting the stock's valuation.

- Due to the tough macroeconomic environment and high uncertainty, we modify our rating from "buy" to "sell".

Justin Sullivan

Foot Locker, Inc., (NYSE:FL) through its subsidiaries, operates as a footwear and apparel retailer in North America, Europe, Australia, New Zealand, Asia, and the Middle East.

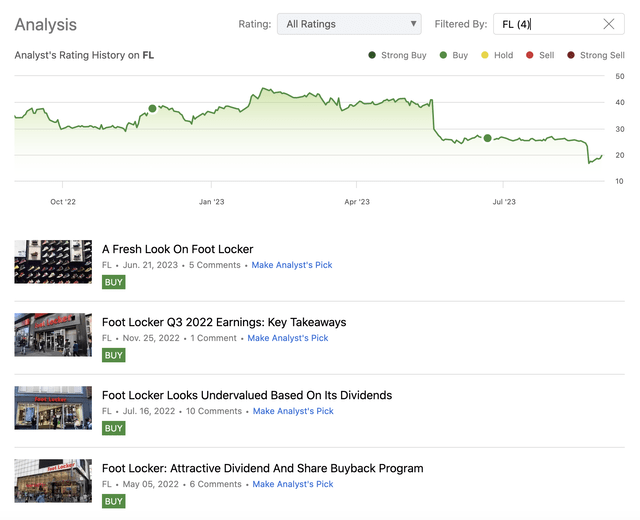

We have started coverage on the firm in May 2022 with a bullish rating and we have maintained this view all the way until now. Our primary reasons for having a continuous "buy" rating on the stock have been the attractive returns to shareholders, both through dividend payments and share repurchase programs, as well as the attractive valuation.

In the past quarters, however, things have begun to change and the stock price has plummeted multiple times, most recently after the announcement of the latest earnings results, the dividend suspension and the guidance cut. As a result, the stock price has substantially underperformed the SPY during our period of coverage.

As most of our investment thesis and valuation have been based on dividends, more precisely on dividend discount models, we have to make sure to modify our models to be reflective of the dividend suspension, as it has a tremendous impact on the company's fair value.

The aim of today's article is to give our readers a brief overview of the latest earnings results and then to give an updated view on the valuation with our modified inputs.

Quarterly results

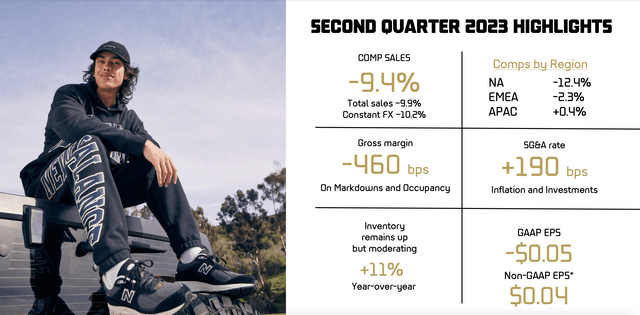

While in the latest quarter the firm's Non-GAAP EPS came in positive, at $0.04, it has missed consensus estimates by $0.01. At the same time, the top line results have also failed to impress. Revenue has declined by roughly 10% year-over-year to $1.86B, missing estimates by $20 million.

Further, comparable store sales have also been trending down, falling more than 9% year-over-year, primarily driven by the weak demand for FL's products and the changing vendor mix (primarily related to Nike (NKE)).

On top of the disappointing results, the firm has also cut the guidance for the full year. Both sales, comparable sales and EPS estimates have been substantially lowered.

Let us look ahead a bit now and formulate our expectations.

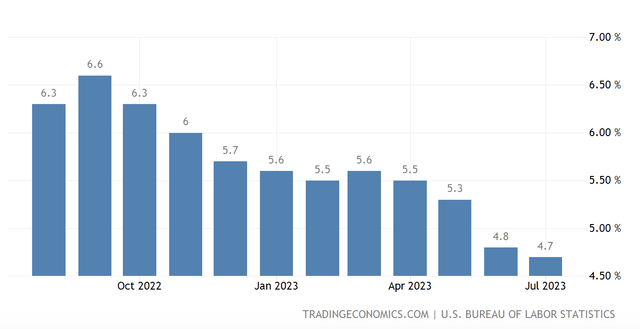

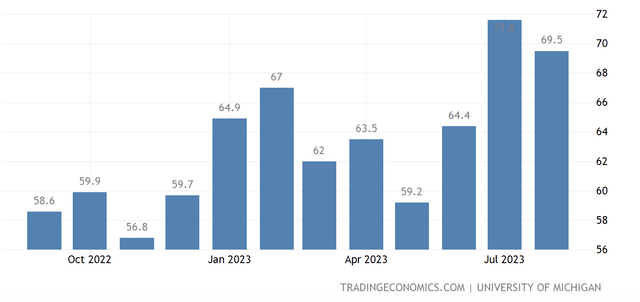

Just like reflected in the guidance, we also believe that the macroeconomic environment is likely to remain challenging in the coming quarters. Although consumer confidence has started to improve in the past months and inflation has been trending down, it will take a few months until their positive impacts will be felt by the businesses. In our opinion, consumer spending and demand is likely to start normalizing in the first half of 2024. Until then, most costs and margin are likely to remain under pressure.

U.S. Core inflation (tradingecnomics.com) U.S. Consumer confidence (tradingeconomics.com)

Further, inventory levels are still too high and growing, likely driven by the continuing soft demand and "wrong" product/brand mix. We would like to see this line item significantly decrease, as excess and obsolete inventory is creating additional downward pressure on the margins, due to the potential need for further steep markdowns.

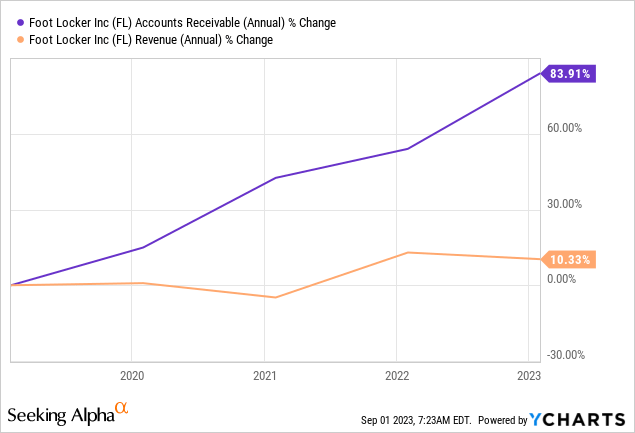

Also, the change in accounts receivable in relation to revenue change also raises some concerns. If accounts receivable grow at a faster rate than revenue, it may be an indication that the firm is artificially trying to inflate sales, by pulling demand forward from future periods.

All in all, the quarterly results along with the guidance definitely fail to impress, and in our opinion the sell off, to a certain extent, is justified.

Valuation

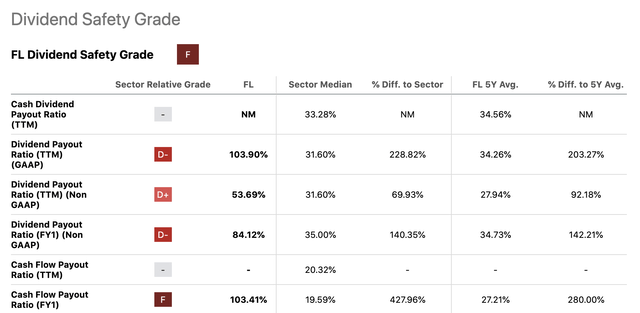

When talking about the valuation, it is important to talk about the dividend suspension.

On one hand, we believe that suspending the dividend at this point is justified. The firm has had two consecutive quarters of negative cash flow from operations, while CAPEX has remained relatively high. If the dividend cannot be covered by the free cash flow, we normally believe that suspension is the right way to go. Financing dividends from debt, for example, just for the sake of keeping the payments going, would have a much more severe effect. On the other hand, of course, it is quite a blow to investors, who have been buying and holding FL's stock for the dividends and dividend growth.

Looking forward, we have to understand how the dividend suspension impacts the fair value of the stock. So let us start by reviewing our prior fair value estimate, and discuss how the input parameters to the model need to be changed to reflect the new reality.

In our previous writing, we have determined the fair value to be between $18 and $23, based on a required rate of return of 12.75% and a perpetual dividend growth rate between 3.5% to 5.5%. We have highlighted that these estimates do not take into consideration of the positive impacts of potential new share buyback programs and potential near-term high-growth opportunities.

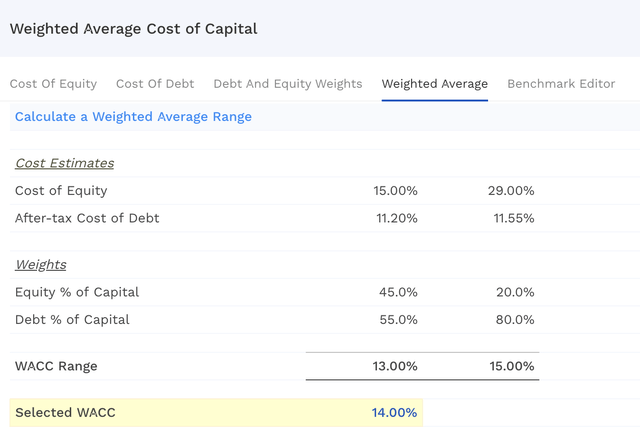

Today, we have to change both our required rate of assumption, to be reflective of the latest estimate of the weighted average cost capital, and the dividend growth rate assumption.

Required rate of return

Our new required rate of return is 14%, based on the company's latest WACC estimate.

Dividend growth

For our calculation, we assume that FL will not be paying dividends until it becomes financially stable again, both in terms of sales and earnings. We will assume that they will restart dividend payments in 2025 only.

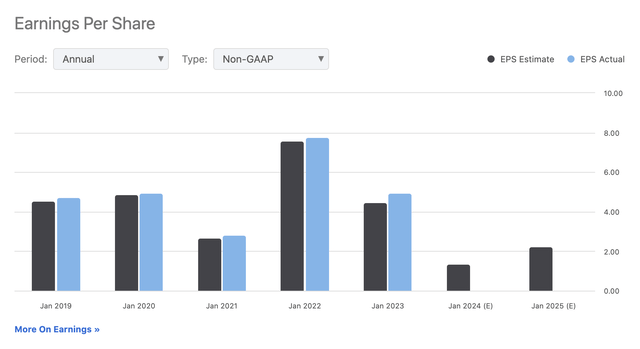

At this point, we will have to decide, what is a reasonable estimate for the dividend payment in 2025. Consensus EPS estimates are $2.22 for that period.

Further, FL used to have a dividend payout ratio around 35%, largely in-line with the sector median. However, to stay conservative, we will be using the sector median of 32%.

Using these assumptions, our estimate for the 2025 dividend is $0.71 per share.

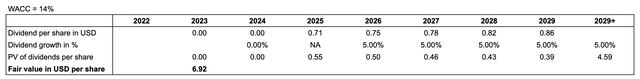

Moreover, if we assume that the perpetual dividend growth rate from that point onwards will be 5%, then we get the following fair value for FL's stock:

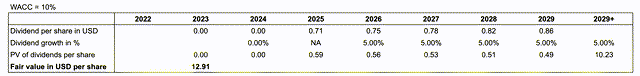

A fair value of $7 per share seems overly pessimistic to us, and this may be primarily driven by the too high required rate of return. If we assume that the macroeconomic environment will improve, that the interest rate will eventually start coming down, then by 2025 the firm's WACC may decline meaningfully. For this reason, we ran the same calculation but with a required rate of return of 10%.

This results in a fair value of $13 per share, still well below the current share price.

To sum up

FL's quarterly results have been disappointing. Sales have declined, EPS came in below estimates and cash from operations has remained negative. For these reasons, along with the tough macroeconomic environment, both the guidance cut and the dividend suspension are reasonable steps.

As we have been valuing FL's stock based on its dividends previously, it was necessary to update our model to reflect the latest reality. This has naturally resulted in a much lower fair value range than previously.

Uncertainty remains high in terms of macroeconomics, strategy, and future dividend payments.

For these reasons, we would not like to be owning this stock currently, and we downgrade it to "sell".

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Past performance is not an indicator of future performance. This post is illustrative and educational and is not a specific offer of products or services or financial advice. Information in this article is not an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. This article has been co-authored by Mark Lakos.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (3)

Stocks that decrease or eliminate dividends take a long time to recover

In forty plus years of investing, stocks bought with dividend in mind that cut or eliminate dividend don’t recover and in my case gets sold to harvest tax loss

IMO FL will be at an attractive price for a while