Assertio's Financial Horizon Amidst Indocin Generic Entry

Summary

- Assertio's Q2 earnings report showed a 16.7% annual growth in revenue, exceeding forecasts by $1.16M.

- The company's profitability and liquidity are promising, with a positive operating cash flow and substantial cash on hand.

- Assertio faces a significant challenge from FDA-approved generic competition for Indocin.

- Recommend maintaining a "Hold" position on Assertio stock, monitoring future earnings closely for potential decline.

Klaus Vedfelt

Introduction

Assertio (NASDAQ:ASRT) is a pharmaceutical enterprise, dedicated to delivering distinctive products primarily in neurology, rheumatology, and pain management. Using a unique non-personal promotional strategy, Assertio has grown its portfolio through both enhancements of existing products and strategic acquisitions, including the recent acquisition of Spectrum Pharmaceuticals. Among their flagship products are Indocin (indomethacin), Otrexup, Sympazan, Sprix, Cambia, and Zipsor.

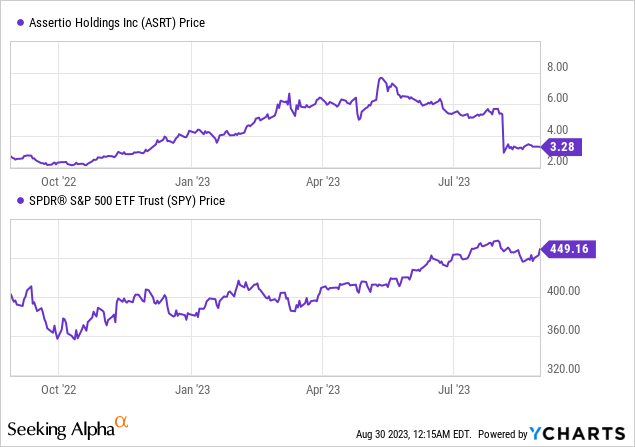

I previously analyzed Assertio, noting their strategic diversification which boosted sales and profitability. Their stock surged by 89% over a year. However, their dependency on biotech acquisitions, particularly Spectrum and its product Rolvedon, posed risks. I expressed concerns about Rolvedon's market potential amidst competition and Assertio's rising costs post-acquisition. I advised monitoring their next earnings and recommended a 'Hold' position on their stock. The stock has since declined 37%.

Recent Developments: Assertio's Q2 showcased a Non-GAAP EPS at $0.19, missing by $0.03. Their revenue stood at $40.99M, marking a 16.7% annual growth and exceeding forecasts by $1.16M. Earlier this month, the FDA approved generic indomethacin 50 mg suppositories.

The following article discusses Assertio's financial performance, the potential impact of FDA-approved generic competition for Indocin, and recommends a "Hold" position on their stock.

Q2 Earnings Report

Looking at Assertio's most recent earnings report, net product sales rose by 13% to $40.1M, driven by increased sales of Indocin, Otrexup, and the addition of Sympazan. Gross margin for the quarter was 88.1%, up from 87.2% last year due to shifts in sales mix. SG&A expenses stood at $16.8M, a significant increase from the $10.5M reported in the same quarter of 2022, with $3.4M attributed to transaction-related costs. Adjusted EBITDA rose to $24.8M. By the end of the quarter, Assertio had cash on hand amounting to $70.2M.

Cash Inflow & Liquidity

Turning to Assertio's balance sheet, the combined values for 'Cash and cash equivalents' stand at $70.2M as of June 30, 2023. In evaluating the company's cash inflow, the "Net cash provided by operating activities" for the six months ended June 30, 2023, is a positive $41.3M, resulting in an approximate addition of $6.9M per month to the company's resources.

Assertio showcases a promising liquidity status with a substantial amount of cash on hand. The balance sheet reveals the existence of long-term debt which stands at $38.3M, and the reduction in this debt from December 2022 to June 2023 indicates the company's active efforts in managing its financial obligations. Given its positive operating cash flow and the prevailing liquidity, the possibility of Assertio securing additional financing, if needed, appears favorable. Yet, these observations and/or estimates are my own and might vary from other analyses.

Valuation, Growth, & Momentum

According to Seeking Alpha data, Assertio's enterprise value is at $155.50M, suggesting a minimal debt relative to its market cap with strong cash reserves. The company boasts impressive valuation metrics, with a forward P/E of 5.98 and an EV/Sales under 1, signaling potential undervaluation. With consistent sales growth forecasted in the coming years, Assertio is on a stable trajectory, though the slight dip in EPS in 2025 needs consideration. While stock momentum over the last three months and six months has been negative, a yearly view reveals an upward trend, indicating potential turn-around.

Investing in Assertio, with its market capitalization below $300 million, poses typical microcap risks. Microcap stocks, like Assertio's, can often face limited public information, making reliable valuations challenging. Additionally, they can be susceptible to less regulatory oversight and can be targets for price manipulations or fraudulent schemes. The smaller market capitalization means fewer shares in circulation, leading to wide bid-ask spreads and price fluctuations, which can result in higher transaction costs for investors. Lastly, the low liquidity implies that significant buy or sell orders can disproportionately influence the stock price, potentially leading to rapid losses.

Assertio Strategizes Amid Market Challenges and Innovations

In their recent earnings call, Assertio's management exuded confidence regarding Rolvedon's trajectory, highlighting a Q2 sales surge of 34% from the previous quarter, culminating in $21M. They emphasized Rolvedon's distinction as the first innovative product in the long-acting GCSF segment in over two decades that isn't a biosimilar. Despite this strong growth, they acknowledged the fierce competitive nature of the market. Their strategy is deeply anchored in the successful integration of Spectrum and Rolvedon's continued market introduction.

Significantly, the FDA's approval of a generic indomethacin product was revealed. While this development was somewhat anticipated, its weight is amplified when considering Indocin's massive revenue contribution. For clarity, Indocin registered $28.08M in net product sales for Q2 2023, an increase from $22.84M in 2022. This resulted in a total of $58.42M for the first half of 2023, a clear progression from $44.20M during the same span the previous year.

Assertio expressed a resilient stance, drawing parallels to their strategies after the exclusivity loss of Cambia. Despite the challenges, they successfully managed to retain a significant portion of their year-on-year volume and revenue. This accomplishment is credited to their team's excellent execution, well-designed market access programs, and sharp commercial strategies. Their optimism extends to their prospective tactics against the imminent generic competition. The conversation also touched upon the performance metrics of their other products and their strategic decision to divest from the opioid sector.

My Analysis & Recommendation

In light of the facts and figures detailed above, it's essential to summate the various challenges and prospects that Assertio is navigating.

Foremost, the FDA's greenlighting of a generic version of Indocin could be a double-edged sword for Assertio. Historically, the company demonstrated adeptness in managing the competition post-exclusivity loss with Cambia. If they can emulate that strategy, the damage to their bottom line might be mitigated. However, investors need to be wary; Indocin's significant revenue contribution implies that even minor disruptions in its sales volume due to generic competition could substantially impact Assertio's overall financial health.

That being said, Assertio's robust liquidity position, evident in their balance sheet, the growth in product sales, especially with Rolvedon, and their strategic divestment from the opioid sector, present glimpses of promise. The upward momentum seen in the yearly stock trend underscores the market's underlying faith in the company's long-term prospects.

For investors, the immediate future appears to be a mixture of uncertainties interspersed with growth opportunities. Monitoring upcoming earnings reports, especially post the generic Indocin's release, will be crucial. The company's ability to adapt its strategies and navigate challenges will play a significant role in shaping its trajectory.

In summary, considering both the advances and hurdles faced by Assertio, I continue to advise investors to keep their stance: retain a "Hold" position on the stock, but be aware of a potential further decline despite sparkling valuation metrics.

Risks to Thesis

When the facts change, I change my mind.

It is imperative for investors to recognize the inherent risks associated with investing in pharmaceutical enterprises like Assertio. Firstly, the pharma industry is subject to rigorous and often unpredictable regulatory scrutiny, which can jeopardize product approvals and market rollouts. The recent FDA approval of the generic indomethacin product exemplifies the unpredictability of the industry and underscores the looming threat of reduced profit margins for flagship products. Moreover, Assertio's dependency on acquisitions, especially its heavy reliance on Spectrum and its Rolvedon product, introduces additional layers of vulnerability. A slowdown in Rolvedon's market acceptance or any negative clinical or regulatory development can have disproportionate consequences for the company's bottom line. Lastly, the high SG&A expenses and any unforeseen post-acquisition costs can strain the company's financials, creating potential liquidity crises in the long run. As such, while Assertio presents promising growth avenues, investors must also weigh these inherent risks carefully in their decision-making.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article aims to offer informational content and is not meant to be a comprehensive analysis of the company. It should not be interpreted as personalized investment advice with regard to "Buy/Sell/Hold/Short/Long" recommendations. The predictions and opinions expressed herein about clinical, regulatory, and market outcomes are those of the author and are rooted in probabilities rather than certainties. While efforts are made to ensure the accuracy of the information, there might be inadvertent errors. Therefore, readers are encouraged to independently verify the information. Investing in biotech comes with inherent volatility, risk, and speculation. Before making any investment decisions, readers should undertake their own research and evaluate their financial position. The author disclaims any liability for financial losses stemming from the use or reliance on the content of this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.