Karora Resources: Growth At A Reasonable Price

Summary

- Karora Resources Inc. reported record gold production and higher AISC margins year-over-year.

- The company's costs came in below the industry average, but AISC was above my estimates due to higher G&A expenses and continued cost pressure from labor, contractors, and power/fuel.

- In this update, we'll dig into the Karora Q2 results and see where the updated low-risk buy zone for the stock sits after its ~30% correction from its January highs.

Elena Bionysheva-Abramova

It was a mediocre Q2 Earnings Season for the Gold Miners Index (GDX), with the record average realized gold price offset by continued inflationary pressures (labor, contractors, and some consumables) plus one-time headwinds (weather, strikes) that diluted any expected margin expansion. Fortunately, Karora Resources Inc. (OTCQX:KRRGF) was one name that bucked this trend, with record gold production, higher AISC margins year-over-year, and costs coming in well below the industry average. In this update, we'll look at the Q2 results and see if KRRGF stock is trading near a low-risk buy zone yet:

All figures are in United States Dollars unless otherwise noted with a C$ (Canadian Dollars) in front of the figure.

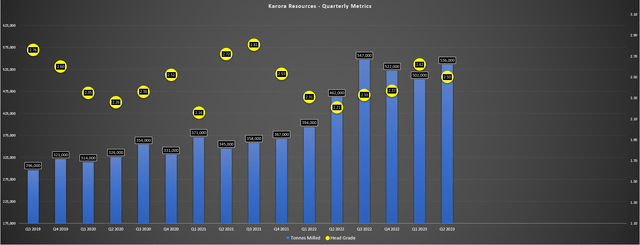

Q2 Production & Sales

Karora Resources released its Q2 results last month, reporting record quarterly gold production of ~40,800 ounces, a 33% increase from the year-ago period. This was driven by higher throughput at both of its sites, with ~319,000 tonnes processed from Beta Hunt at 2.62 grams per tonne of gold (Q2 2022: ~295,000 tonnes) and ~217,000 tonnes processed at Higginsville (Q2 2022: ~167,000 tonnes). The Lakewood Mill acquisition, which boosted company-wide throughput to ~2.5 million tonnes per year made the increased throughput possible. Notably, this total capacity should increase further to ~2.8 million tonnes per annum, with preparation for the tie-in of the Dumford ball mill advancing, which will boost Lakewood's capacity to 1.2 million tonnes per annum next year.

Karora - Quarterly Operating Metrics - Company Filings, Author's Chart

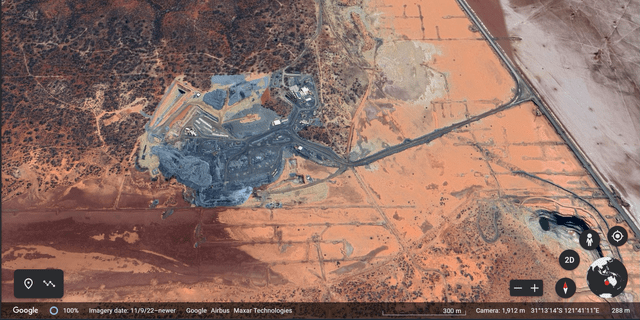

Digging into the production results a little closer, Beta Hunt had another exceptional quarter, producing ~25,700 ounces of gold, a 34% increase from the year-ago period. As noted, the increased production was driven by higher throughput (benefit of the completed second decline) and a further boost from better grades, which improved ~23% year-over-year to 2.62 grams per tonne of gold. And on a year-to-date basis, tonnes mined is sitting at ~597,000 at an average grade of 2.89 grams per tonne of gold, translating to an annualized rate of ~1.2 million tonnes per annum and slowly working towards the larger goal of 2.0 million tonnes per annum as part of the company's planned expansion. Meanwhile, regarding development, the second vent raise was completed, with the final ventilation raise set to be commissioned by year-end, a key deliverable to improve ventilation to support the higher mining rates.

Beta Hunt Operations - Google Earth

While gold production was higher at Beta Hunt, nickel production was lower in the quarter, impacted by restrictions on ventilation in planned mining areas.

Moving over to the company's smallest Higginsville Mine Operations, ~217,000 tonnes were processed at 2.31 grams per tonne of gold in the period from Higginsville (total throughput of ~326,100 tonnes with Beta Hunt feed), benefiting from throughput from the Mouse Hollow Pit which began production in April. This translated to a significant increase in output year-over-year at marginally lower grades (Q2 2022: 2.32 grams per tonne of gold), and translated to production of ~15,100 ounces, up from ~11,500 ounces in the year-ago period. Karora noted that production in H2 will be sourced from the Mouse Hollow/Pioneer pits and Aquarius UG. However, while production was higher, cash costs at HGO increased year-over-year to $1,151/oz (Q2 2022: $1,130/oz), well above the industry average.

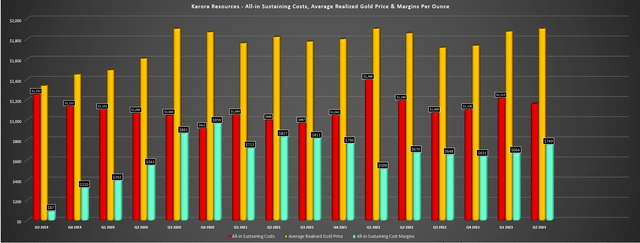

Costs & Margins

Moving over to costs and margins, Karora controlled its costs well, reporting cash costs of $1,068/oz and all-in sustaining costs [AISC] of $1,160/oz, with the latter coming in below the industry average. The $24/oz decline in AISC year-over-year company-wide was related to lower costs related to higher grades at Beta Hunt, which offset the higher cash costs at HGO, offset by continued pressure on labor, contractor, power, and fuel costs at its operations. That said, all-in sustaining costs came in above my estimates of $1,140/oz despite lower sustaining capital spend than expected, driven by significantly higher G&A expenses of C$5.0 million vs. C$1.9 million in Q2 2022. And looking at the H1 results, year-to-date AISC is sitting at $1,184/oz, slightly above the $1,175/oz guidance mid-point.

While the solid AISC performance year-to-date might suggest that Karora will beat its guidance mid-point of $1,175/oz, it's important to note that the company has benefited from extremely low sustaining capital spend relative to its annual guidance. In fact, H2 2023 should be much heavier from a sustaining capital standpoint, with year-to-date sustaining capital spend sitting at just ~C$0.70 million vs. a guidance mid-point of C$11 million. This represents less than one-tenth of planned spending this year and should offset the benefit of slightly higher production in H2 2023. So, while I would otherwise expect similar or lower AISC in H2 2023, it's not clear if this will be the case given the catch-up on capital spending (deferred to H2 due to wet weather), the rebound in energy prices, and similar production levels.

Karora - AISC, Gold Price, AISC Margins - Company Filings, Author's Chart

Moving over to Karora's margins and financial results, Q2 AISC margins came in at $749/oz, well below my expectations of $820/oz because of a lower average realized gold price ($1,909/oz, which was one of the weakest prices sector-wide) and slightly higher AISC. Fortunately, the company still reported exceptional financial results, with record quarterly revenue of C$110.6 million (+50% year-over-year), operating cash flow before working capital changes of C$39.0 million, and free cash flow of C$10.6 million, a significant improvement from [-] C$23.6 million in the year-ago period. This helped Karora to finish the quarter with C$70.6 after a one-time payment (stamp duty of C$4.0 million) related to the Lakewood Mill acquisition.

So, how does the stock look from a valuation standpoint?

Valuation

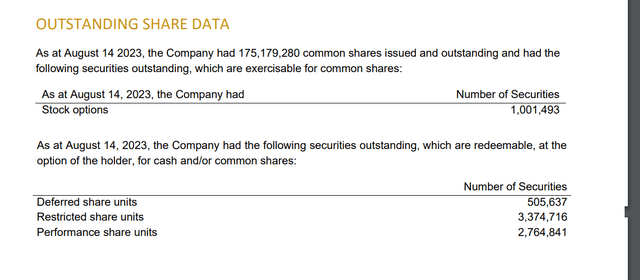

With Karora growing into a ~200,000-ounce producer, the company remains very reasonably valued at a market cap of ~$628 million, especially given that it has a better balance sheet than most junior producers and higher margins, with a path to further margin improvement (higher output and increased by-product credits as nickel production ramps up). And using what I believe to be a fair multiple of 1.0x P/NAV for a Tier-1 jurisdiction producer with below-average costs and 7.0x FY2024 operating cash flow estimates and applying a 65/35 weighting for price to net asset value (65%) and price to cash flow (35%), I see a fair value for Karora of US$4.15. That said, I prefer a minimum 40% discount to fair value for small-cap producers, pointing to an ideal buy zone of US$2.50 or lower to bake in an adequate margin of safety.

Karora Share Count - Company Filings

For this reason, I remain neutral on Karora in the short term, given that while it scores well on asset quality and jurisdiction, it still doesn't meet my stringent buying criteria to justify starting a new position. And if one looks out across the sector, there are a handful of names trading at larger discounts to fair value, which I see as more attractive areas to allocate new capital. Obviously, I could be wrong, and the stock could continue to melt higher, but with diversified names like B2Gold (BTG) trading at just ~6x FY2025 free cash flow estimates with larger operations that are paying investors ~5.2% to hold their shares, I see names like these as better reward/risk setups.

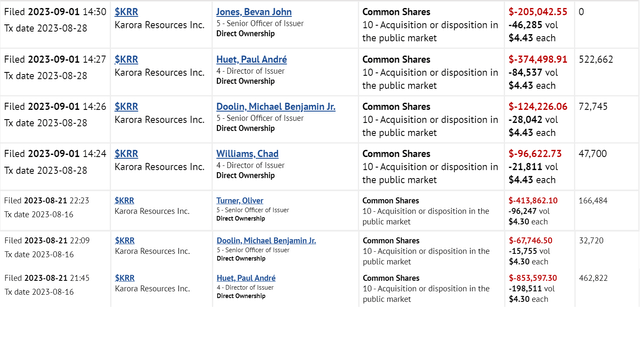

Karora Resources Insider Sales - SEDI Insider Filings

Summary

Karora Resources Inc. had a solid Q2 report, and I continue to see the stock as a top-15 producer sector-wide with the unique setup of growing production, improving margins, and a unique benefit from nickel by-product credits. Notably, the company also benefits from being one of the better exploration stories, with new discoveries that should continue to support reserve growth at Beta Hunt.

That said, we have seen a pickup in Karora Resources Inc. insider sales recently, and while the stock remains reasonably valued; I don't see nearly enough margin of safety to justify starting a new position or adding to one's position above US$3.45. So, while I see Karora as a solid buy-the-dip candidate, I plan to remain on the sidelines unless we see lower prices.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BTG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: Taylor Dart is not a Registered Investment Advisor or Financial Planner. This writing is for informational purposes only. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Taylor Dart expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing. Given the volatility in the precious metals sector, position sizing is critical, so when buying small-cap precious metals stocks, position sizes should be limited to 5% or less of one's portfolio.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (2)

Merger activity will pick up at some point but you really have to wonder why this one is still being passed over by AUS and other firms. $GFI right next door with St Ives went for a big investment in Canada in $OBNNF. I guess the fact companies are not tripping over themselves to merge or buy things is perhaps a testament to discipline that should be admired. Will it last? when it doesn't ala 2011-12, time to take a hard look at the companies. Wow on the insider selling too. Prefer other names now as well. Long $OBNNF small holding. Bea

https://imgur.com/a/6fcWjD6Subscription Link:

buy.stripe.com/...