IYW: Top ETF To Touch The Hot Technology Sector

Summary

- IYW provides superior exposure to the technology sector, which is on fire.

- Once the hype around AI subsides, the fundamental factors of the technology could drive the financial performance of the IT sector for many years to come.

- Despite the high valuation of IYW, I am bullish on the technology sector since the latter adapted to the new realities faster than expected.

pixdeluxe

It may sound weird to someone but technology looks like an island of safety so far in 2023. The rapid development of AI initiated a new technology cycle, which brought iShares U.S. Technology ETF (NYSEARCA:IYW) up by 40% since the beginning of the year and showed how much investment and interest innovation can attract. Despite the IT sector being the most expensive currently, it delivered a higher EPS surprise than the S&P 500 average. Further earnings growth and positive forecasts could reassess future financials, raise target prices and support the accumulated positive momentum in the technology sector. I gave a Buy rating to IYW, since in my view, at the point when the hype around AI will subside, the fundamental factors will remain intact, making it clear that the technology could be a real engine of innovation and progress.

Fund overview

IYW is established to track the performance of the US technology sector, providing broad exposure to electronics, computer software/hardware, and information technology companies.

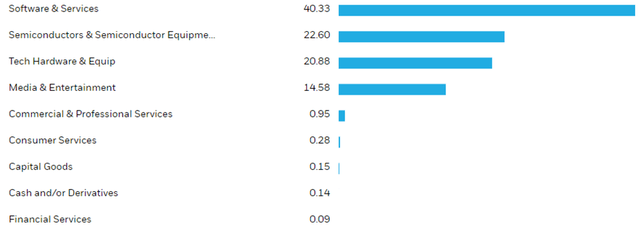

Specifically, the fund allocates 40.3% of the portfolio to software & services, 22.6% to semiconductors, 20.88% to hardware and 15% to media & entertainment. However, the ETF is highly concentrated around the top 5 positions, which account for half of the fund's portfolio of 136 holdings overall. In particular, Apple (AAPL) is qualifying with 18% share; Microsoft (MSFT) with 16%; Alphabet (GOOGL and GOOG) with 10.32 and NVIDIA (NVDA) with 5% in the portfolio.

Top 10 positions (ishares.com)

As of August 30, 2023, net asset value of the fund is $11.4 billion, which costs the investors 0.39% on annum.

Technology sector is hot again

Since the beginning of 2023, the technology sector showed a strong growth of around 40% and came out on top of the US market. The performance is quite impressive amid the 15.2% gain of the broad index S&P 500, and is definitely the best in the last few decades. One of the main drivers for this could be attributed to the rapid development of AI, which gave positive momentum to technology players, even those with marginal involvement in artificial intelligence. However, it's worth noting that at least half of that performance came from Apple, Microsoft and Nvidia.

It appears those investors' fears related to the formation of a bubble in the IT sector amid the AI boom are not materializing. The financial results of the main AI players are confirming strong demand for AI-related products and solutions. Of course, there is hype around artificial intelligence, but I believe that once it subsides, the fundamental factors could drive the financial performance of technology companies for many years to come. I will share some thoughts from my article on BOTZ:

And if, in the seed stage, AI could appear as hype, I believe this could end up in decent progress and real benefits for the economy.

And except for the clear beneficiaries of generative AI, there are many others entering the AI race, with new products emerging from Amazon, Meta, Cisco, IBM, Salesforce and more.

Looking at the financial results of the technology sector, the 3.5% EPS growth came as an 8.9% surprise compared to the expected 5% decrease in EPS. The tech sector has always been given special attention during the earnings season, since the dynamic of big techs can set the overall direction of the broad market going forward. Add to the earnings surprise the comments from managers that AI is a real driver for the growth of tech corporations. And we can actually see this in the market expectations for Microsoft and Nvidia, where the EPS estimates were revised upwards since the beginning of the year.

Moreover, the EPS dynamics of the technology sector turned out to be better than the S&P 500 average for the first time since Q1 2022, which could indicate that the possible bottom in corporate profits was passed and the situation may improve going forward.

Investment takeaways

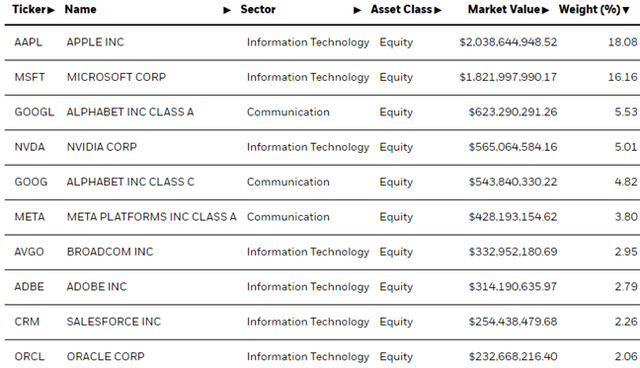

Face to face comparison of IYW with Invesco QQQ Trust (QQQ), Technology Select Sector SPDR ETF (XLK) and Vanguard Information Technology ETF (VGT) shows that the former is outperforming with a 49% gain so far in 2023. Compared to the next being QQQ, the portfolio composition of IYW reveals a significantly higher exposure to Apple and Microsoft, hence the outperformance.

Looking at the prospects, I find a 22% exposure to semi-industry quite attractive, which could allow IYW to catch the growth from the spread of 5G, GPUs demand for AI-models development, resilient automotive/industrial markets and overall transition to lower nodes.

It's worth noting that since the beginning of the year, the valuation of IYW increased accordingly, where the forward P/E rose 40% to 28.6x, which is 16% above the 5-year average of 24.6x. However, I believe that the IT sector adapted to the new realities of high inflation and interest rates faster than expected, while the ongoing diffusion of AI across economic sectors provides for a new growth story, justifying the above average valuation.

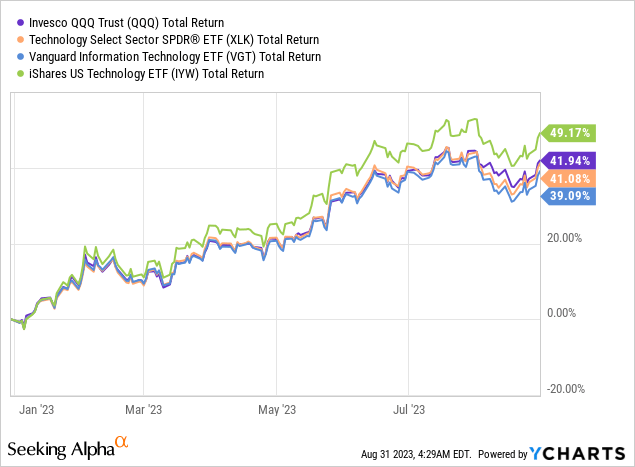

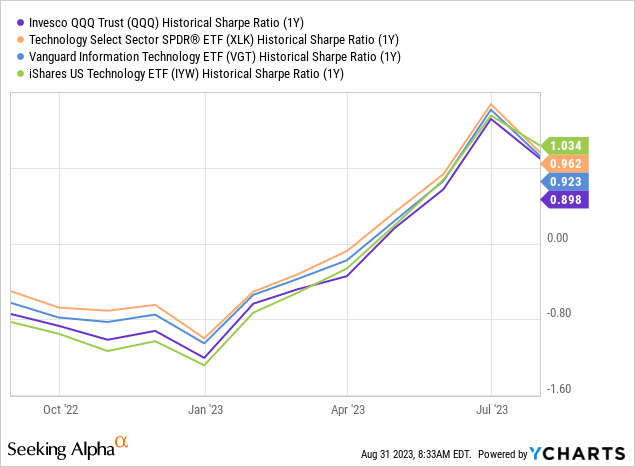

Taking into account the risk/return characteristics, IYW appears to be a better choice, since the fund provides the highest Sharpe ration of 1.03x out of the selection. Thus, I am inclined to believe that IYW should be rated with a Buy rating, since the fund has delivered a superior performance since the beginning of the year, meaning that IYW managed to exploit better the development of AI, which is a basis of a new technology cycle.

Risk factors

Fear of a recession and banking crises have eased, but didn't completely disappear. The probability of additional rate hikes is still in place, hence further tightening shouldn't be ruled out, which could further increase the volatility of the technology sector. Such negative macro developments could further restrain corporations' IT budgets. In addition, the technology sector remains the most expensive of all sectors in the S&P 500 index. However, if the tech players continue to report strong EPS and give positive forecasts for the back half of the year, the sector could attract more attention and investments.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.