Seeking Value With PNC Financial Services Group

Summary

- The PNC Financial Services Group, Inc. has been unfairly scrutinized following the March 2023 banking crisis.

- Rising interest rates and poor capital markets have hurt confidence in PNC Financial.

- Current yield: 5.15%.

- Target for The PNC Financial Services Group stock: $140.

Althom

Investors should buy shares of The PNC Financial Services Group, Inc. (NYSE:PNC).

PNC is a large-cap regional bank that has established itself as one of the east coast's premier financial institutions. The firm's equity shares have appreciated quite nicely over the past decade. However, investor sentiment has soured since the stock reached its all-time high in early 2022. PNC is currently down 23% year-to-date.

Robust dividend payments have become a characteristic of most financial sector firms, and PNC is no exception. Shares currently yield over 5%, meaning that buying a share of PNC is akin to buying a 2-year treasury note (US2Y) from an income perspective.

Catalysts

PNC has several key business components that should be analyzed to better understand the firm's operations. While PNC's leaders have not announced any recent major strategic initiatives, there are still a few catalysts affecting the market's valuation of the firm.

1. Deposit Base

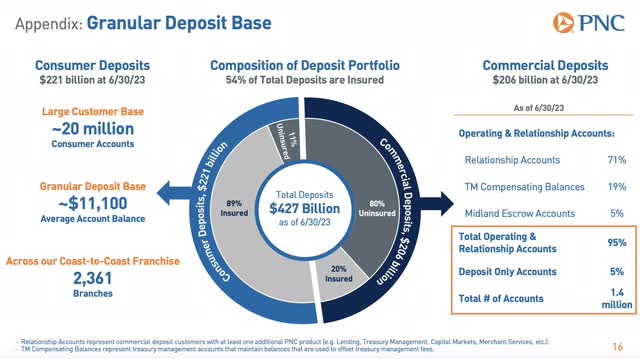

Deposits are a critical element in the operations of any bank. During the preceding decade, investors did not place much emphasis on the composition of a firm's deposit portfolio. However, the collapse of various banks in March 2023 altered much of this thinking, and bank valuations have fallen as investors have taken a greater interest in potential risk areas.

54% of PNC's deposit base is under the FDIC's $250,000 insurance coverage threshold. This seemingly reduces the likelihood of any bank runs should the firm be perceived to be in trouble. Moreover, as reported in July 2023, PNC has over 20 million consumer accounts with over $220 billion in deposits and an average account balance of $11,100. Its commercial deposit base consists of 1.4 million accounts with over $205 billion in deposits.

The market likely does not place too much weight on the composition of PNC's deposit base. However, it is important for investors to consider potential areas of improvement in PNC's operations. If the firm can continue rebalancing its deposit portfolio to effectively minimize risk, then incremental cash flow improvements could follow.

PNC Financial Corporation 2Q 2023 Investor Presentation

2. Credit Quality

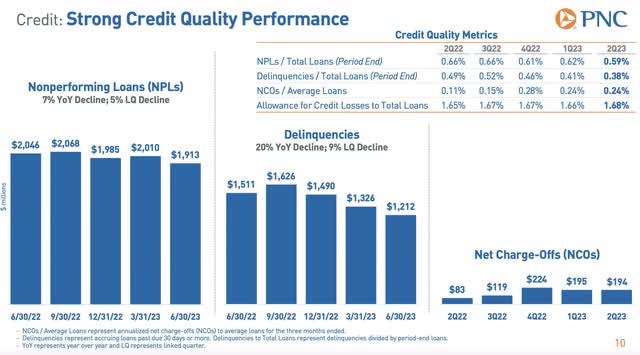

Net interest margin is one of the most important profitability measures for a bank. However, a high net interest margin isn't always a good thing because it could be the result of risky lending (Remember Washington Mutual?). Financial managers need to strike the appropriate balance between risk and reward. Moreover, investors tend to seek quality during times of economic strife. This often comes in the form of higher lending standards and favoritism of firms with good reputations.

PNC recently reported a fall in nonperforming loans and delinquencies. In addition, the firm increased its allowance for credit losses which indicates an expectation for potential future losses. These are both interesting indicators, and the market's reaction has likely been mixed. The true test will come over the next few reporting periods as the market continues to respond to the Federal Reserve's interest rate hikes. Intuition seems to suggest that PNC might run into a bit of trouble given the fact that much of its business is tied to its ability to offer loans to quality customers. As the pool of available candidates continues shrinking, PNC will be in even fiercer competition with community banks, regional banks, and national banks to attract business. Can PNC win this battle? It is likely that the firm has decent brand reputation as a "Main Street" bank, and this could help the company attract more customers.

PNC Financial Corporation 2Q 2023 Investor Presentation

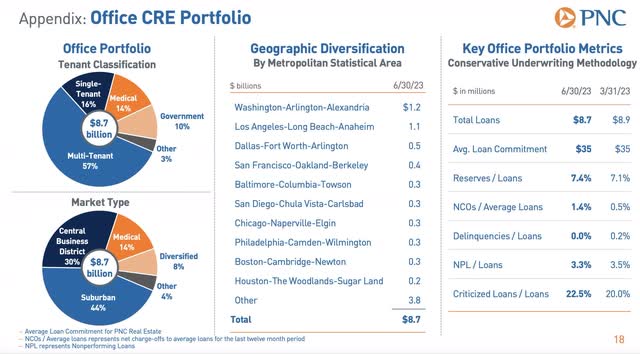

3. Commercial Real Estate Portfolio

Is commercial real estate the next crisis? Remote work has certainly taken a toll on office leasing activity. Of PNC's nearly $320 billion in total loans, 11% ($36 billion) are CRE loans. Of this $36 billion, $2.8 billion are retail loans and $8.7 billion are office loans. These two areas present risks that the market is likely concerned about. In addition, it is alarming that roughly half of the $8.7 billion in office loans are Class B and C suburban spaces. These buildings have bore the brunt of the effects of remote work, and PNC might have some future issues with these spaces. The firm's management needs to find a way to ameliorate this situation so that large-scale future write-offs aren't needed.

PNC Financial Corporation 2Q 2023 Investor Presentation

4. Capital Markets

PNC managers tend to present the firm as a "Main Street" bank. This is true, but the firm does have a robust capital markets business unit. Harris Williams & Company, a subsidiary firm headquartered in Richmond, Virginia, is a global M&A advisor that has guided a multitude of middle-market deals during its history. Moreover, PNC offers a wide variety of capital markets services, including securitization, public finance, private placements, and loan syndications. 2023 has been a difficult year for the deal markets, and PNC's capital markets and advisory revenue has fallen 32%. Fortunately, should the deal markets regain strength, PNC will experience a solid bump in revenue.

Valuation

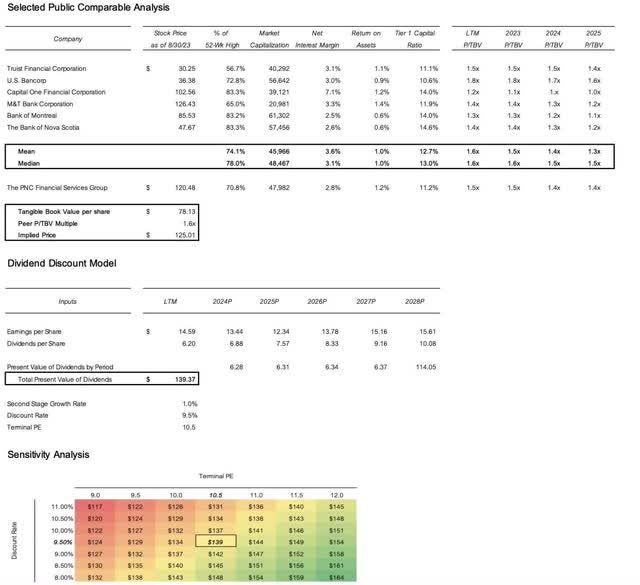

Trying to price any bank's stock is difficult, but PNC presents a unique challenge due to the lack of similar public comparable companies. A good peer group is important because it allows for the comparison of pertinent operating metrics across firms. Therefore, this serves as a disclaimer that PNC's comparable companies' valuation may be a bit skewed and should be scrutinized prior to using it to make investment decisions.

When selecting a peer group for PNC, multiple criteria were used:

- Market capitalization

- Business segments

- Geographic coverage

- Operating ratios (net interest margin, return on assets, tier 1 capital ratio).

Following a thorough analysis of potential comparable companies, a peer group of Truist Financial Corporation (TFC), U.S. Bancorp (USB), Capital One Financial Corporation (COF), M&T Bank Corporation (MTB), Bank of Montreal (BMO), and The Bank of Nova Scotia (BNS) was created.

Proper credit should be given to S&P Global's (SPGI) Capital IQ database, which provided details surrounding each firm's net interest margin, return on assets, tier 1 capital, and tangible book value. The key multiple used for valuation, price to tangible book value, is an effective metric for banks for a few reasons. First, mark-to-market accounting rules under U.S. Generally Accepted Accounting Principles allow firms to carry many of their investment securities at prices similar to their fair market values. Since most of a bank's assets are able to be carried on each firm's balance sheet at their market values, book value is viewed as an appropriate proxy for each firm's assets. Finally, tangible book value is used because it strips out various intangible assets such as goodwill. While there is certainly value in goodwill stemming from M&A activity and takeovers, it is hard to value and subject to imprecise estimates.

To effectively price PNC, the averages and medians of historical and forward-looking P/TBV multiples were calculated. Moreover, PNC's tangible book value per share of $78 was computed based on a comparison of the firm's intangible assets. Using a forward-looking multiple of 1.6 times, PNC was valued at $125 per equity share.

Multiples valuation provides an exogenous valuation of a firm. However, it is also important to value a firm endogenously. For PNC, this was accomplished using a dividend discount model because the company has a history of distributing cash flows to shareholders via dividend payments. The inspiration for using a DDM was taken from David B. Moore, a CFA with Marathon Capital Holdings in San Diego, California. Mr. Moore published a guide on valuing community banks whereby he argues the merits of using a DDM to price bank stocks.

Based on the firm's future discounted dividends, PNC has an intrinsic value of $139 per share. This can be further amended to a target range of $117 to $164 per share, which implies major upside and minor downside. With respect to assumptions included in the base-case model, a 9.5% discount rate was used in addition to earnings and dividends estimates taken from CapIQ. Moreover, a second stage growth rate of 1% was used along with a terminal price to earnings ratio of 10.5. Please remember that these are estimates and are meant to illustrate a reasonable base case that does not consider a significantly positive or negative event.

Investment Summary

The key question that is examined throughout this article is whether PNC presents a value opportunity for investors with a reasonable margin of safety. The market's negative response towards PNC and other regional banks in an otherwise strong year for the S&P 500 (SP500), Nasdaq (COMP.IND), and Dow Jones (DJI) indicates that something must be wrong with the firm or the sector. For PNC, it appears that the market is afraid of another Silicon Valley Bank or First Republic Bank (OTCPK:FRCB). Many see better investments elsewhere and view regional banks with skepticism. However, as 2023 becomes 2024 and 2024 becomes 2025, confidence should return to banks like The PNC Financial Services Group, Inc. as investors realize that banking is a highly profitable industry with many future growth opportunities.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PNC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.