Dynex Capital Is A High-Yield REIT With Substantial Risks

Summary

- Dynex's 9.04% yield is eye-catching but risky due to looming Fed hikes.

- Strong cash reserves exist, but rising rates could eventually hit the dividends.

- Hedging shields against rate risks but eats into profits and limits compounding.

- Best for short-term speculators, not retirees or long-term investors.

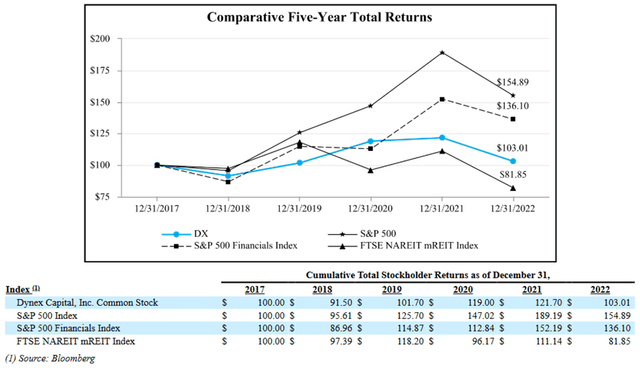

- High yield aside, Dynex's conservative strategy limits growth potential, as evidenced by its long-term performance.

Torsten Asmus

Dynex Capital (NYSE:DX) stands out among MBS REITs with its impressive 9.04% yield. Yet, as many seasoned investors know, high yields often come with their own set of challenges. This analysis aims to peel back the layers of DX's dividend sustainability, assess its vulnerability to the Fed's looming rate hikes, and delve into the macroeconomic factors that could bolster or undermine its financial standing. If DX's high dividends entice you, you should stop and think twice. This high-yield option may not be the universal investment solution it's often touted to be, and I think it's only viable for short-term speculators.

Dividend Sustainability

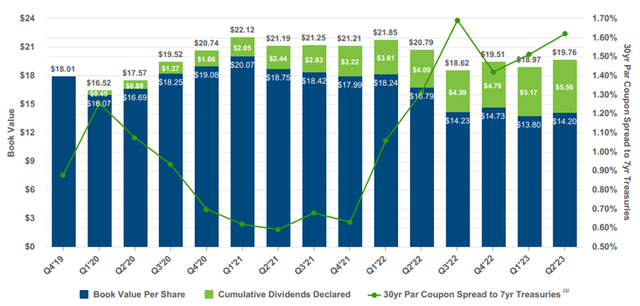

Dynex Capital offers a high dividend yield of 9.04% and a potentially lucrative forward yield of 12.02%, but its long-term sustainability looms large, especially for retirees and risk-averse investors. According to the latest 10-Q filing, the company has cash reserves of $300.1 million, a significant buffer to sustain dividend payments. However, the bearish perspective warns about the impact of rising interest rates on the company's ability to maintain this yield.

Regarding rates, remember that the Fed's recent economic outlook is for more rate hikes in 2023, potentially taking interest rates as high as 5.6%. This could increase Dynex's borrowing costs, putting pressure on its ability to sustain its high dividend yield. However, the Fed's more optimistic views on economic growth and lower unemployment rates could bode well for real estate investments, including mortgage-backed securities, potentially offsetting some of the increased costs. These factors collectively add nuance to the risk-reward analysis for DX, especially in the context of dividend sustainability. So, while the dividend is high, it's certainly not a guaranteed stable long-term dividend.

Risk-Reward Analysis

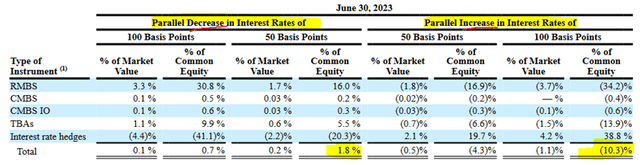

At its core, the bearish view on DX primarily revolves around the potential impact of rising interest rates, which could increase borrowing costs and affect the value of mortgage-backed securities. On the flip side, the bullish perspective highlights the company's attractive dividend and asset allocation strategy, which focuses on agency MBS that are considered safer and backed by the U.S. government.

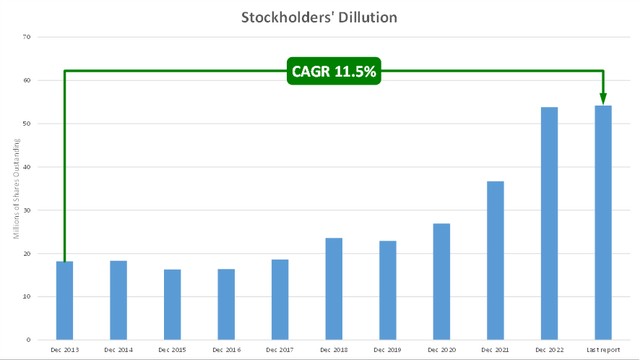

Still, after looking at the company's financials, it's evident that they actively hedge against interest rate risks. It's true that hedging is costly and reduces profitability, but it protects investors' capital. Yet, I believe this mostly ensures the REIT's survivability (management fees are nice) rather than helping towards long-term capital compounding. This is further reinforced by what I'd consider aggressive dilution of existing shareholders.

Seeking Alpha plus the author's elaboration

Furthermore, looking at its asset allocation strategy appears to be a hedge against some of the risks associated with fluctuating interest rates. Investors must also account for management fees and the high hedging costs, especially in our current uncertain investing environment. And note that hedging costs can continue to escalate if market uncertainty remains high.

So, putting it all together, DX promises an exceedingly high dividend. However, such dividend is by no means "safe" and "stable" but rather highly dependent on factors largely out of the control of management. This isn't to say DX can't be an investment alternative but to remind investors that they're mostly making a bet on fluctuating macroeconomic factors. DX is not a "buy and forget" investment. It can be very profitable if the right circumstances appear: high rates on MBS, low interest-rate volatility (uncertainty), tight spreads, and rates slowly trending lower.

How do these four variables look today? Well, MBS is indeed paying nicely today because rates are high across the board. Still, interest rate uncertainty remains high because some market participants believe tail risks could force the Fed to cut rates swiftly. Still, at the same time, inflation continues above the Fed's target, forcing its hand toward future hikes. So, these two factors put together create uncertainty, which makes hedging more expensive and hampers DX's profitability. As for spreads, the MBS market is expected to experience a prolonged period of wide spreads compared to Treasuries, so that's not favorable for DX either. And lastly, rates are certainly not trending lower, at least for now.

While agency MBS are generally considered safer than regular MBS, they typically offer lower yields. In this context, DX's asset allocation strategy appears conservative in mitigating interest rate risks. However, this conservative positioning may result in lower profitability, especially in a stable or declining interest rate environment. Additionally, DX's current exposure is geared towards minimizing interest rate risks to the downside rather than the upside (see image above). Therefore, regarding the overall risk-reward balance, I think the current outlook isn't favorable for DX.

Investor profiles

DX seems more suited for speculation and short-term holding than long-term investment. The company's performance is highly dependent on factors largely out of its control, such as interest rates and market spreads. While it does employ strategies to mitigate some of these risks, the costs associated with these hedges can impact profitability. Therefore, DX is not a "buy and forget" investment but requires active monitoring and a willingness to adapt to changing market conditions.

I'd advise caution for retirees and risk-averse investors lured by DX's high dividend yield. The sustainability of this dividend is closely tied to interest rate fluctuations, and with the Fed planning two more rate hikes in 2023, I'd argue the yield's stability is uncertain. Moreover, while providing some safety, the company's hedging strategies come at a cost that can erode profitability.

Growth-oriented investors may find DX's focus on lower-yielding agency MBS less appealing, as this conservative strategy doesn't maximize long-term capital compounding either. While this approach ensures DX survives in the long run, I believe it doesn't compensate for the hedging costs. So, you have an investment vehicle that will survive over time, but will most likely continue to underperform.

Finally, I think the only ones who can benefit from DX are speculative and short-term investors. DX could serve as an easy-to-trade proxy for the MBS market. In the short term (i.e., less than one year), speculators could find DX suitable for its high dividend, which could be worthwhile during short periods. Also, it's a decent vehicle for betting on macroeconomic factors like interest rates and market spreads. However, as previously explained, I believe the longer they hold DX, the more likely they'll underperform.

Conclusion

While DX's high dividend yield is enticing, it comes with significant risks and uncertainties, notably the volatile interest rate environment and associated hedging costs. Moreover, the Fed's plan for more rate hikes in 2023 adds a layer of uncertainty, potentially jeopardizing DX's ability to maintain its attractive dividend.

Given these complexities, I think DX isn't suitable for retirees or risk-averse investors despite the allure of high dividends. Similarly, long-term value investors might find DX's conservative asset allocation less appealing, as it prioritizes its survivability over long-term capital compounding. In essence, DX is better suited for speculative, shorter-term investors who want to express a view on the MBS market and adapt to fluctuating interest rates. So, while DX does offer a high yield and some risk mitigation, it's not a one-size-fits-all investment solution.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (2)