Retirement Passive Income: W. P. Carey Stock Has Gotten Much Too Cheap

Summary

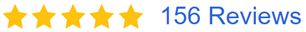

- W. P. Carey Inc. stock has taken a beating this year as interest rates have soared.

- We assess W. P. Carey's valuation, growth outlook, and risk profile.

- We believe that W. P. Carey stock is a very attractive buy for retirees looking for safe, growing, and attractive passive income.

- Looking for a portfolio of ideas like this one? Members of High Yield Investor get exclusive access to our subscriber-only portfolios. Learn More »

JamesBrey

W. P. Carey Inc. (NYSE:WPC) offers investors one of the lowest risk high yields available from common stocks in the market today. This is thanks to a brutal selloff since early February:

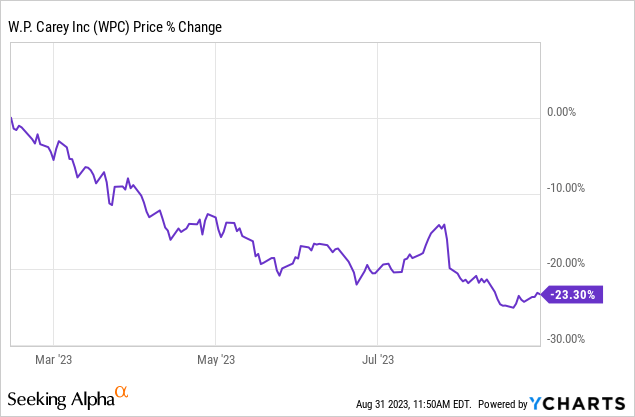

The yield has surpassed 6.5%, a level rarely breached over the past decade, and signals that the risk-reward is highly favorable for the stock right now:

In this article, we will share three reasons why WPC stock has gotten too cheap and is a compelling buy at these levels:

#1. WPC Stock's Valuation Is Near Historic Lows

First and foremost, WPC's valuation looks highly compelling right now relative to its historical levels. Its EV/EBITDA is 14.58x right now, well below its five-year average of 17.92x, its price to AFFO is 11.96x, well below its five-year average of 14.86x, its NTM dividend yield is 6.58%, well above its five-year average of 5.64%, and its price to NAV is 0.97x, well below its five-year average of 1.15x.

As a result, investors can buy WPC's underlying real estate at a ~3% discount to what they would pay to purchase it directly. Even better, buying WPC shares at its current price gets an investor its battle-tested business model, the benefit of instant liquidity and divisibility, significant diversification, and the attractive cost of capital that comes with its BBB+ credit rating for free when historically the market has charged a 15% premium to account for these benefits.

The discount to NAV is further accentuated by the fact that the NAV has been reduced to account for rising interest rates and cap rates in the triple net lease sector. As a result, if/when interest rates fall again, WPC's NAV should move higher, serving to further accelerate the capital gains that we expect WPC stock to experience.

#2. WPC Stock's Growth Is Improving

Another reason why WPC's selloff is overblown in our view is that its growth is improving, as evidenced by:

- Its robust growth pipeline. Year-to-date, the company has already made a total of $939 million in investments, putting them on track to continue their recent streak of making around $2 billion per year in growth investments.

- Strong same store rent growth of 4.3% in the first half of 2023.

- The completion of the exit from the asset management business, removing a major headwind to the bottom line.

- Cap rates on acquisitions rising to above 7%, with management reporting on their latest earnings call that their weighted average year-to-date cap rate is 7.3%. As a result, they are able to generate very attractive spreads on investments and lock in those higher yields for decades to come.

- Their recent upgrade to a BBB+ credit rating from S&P. While their cost of debt is increasing somewhat due to the rise in interest rates, the impact to their bottom line is blunted by the credit rating upgrade and their well-laddered maturities. This means that interest expense only increases by small amounts each year and management can opportunistically refinance debt whenever interest rates decline again. Meanwhile, their lease yields are being locked in at higher cap rates along with attractive rent escalator terms.

- Moreover, WPC continues to have a very competitive cost of capital thanks to having ~$385 million of remaining unsettled forward equity that was raised at a highly accretive average price over $83 per share.

- Finally, they expect to received substantial proceeds from planned asset sales (including potentially tapping into its ~$1.5 billion storage portfolio), a ~$400 million stake in a logistics company that is preparing to IPO in the future, and $1.8 billion on its revolving credit facility. As a result, they should have plenty of capital - including attractively priced equity - to finance its aforementioned robust growth pipeline.

#3. WPC Stock's Risk Profile Is Near Historic Lows

Last, but not least, WPC's risk profile is as low as it has looked in a long time. The company has a ~99% occupancy rate, is continuing to improve its portfolio mix by reducing its office exposure, progressing towards the sale of its non-core hotel portfolio, and aggressively increasing its allocation towards warehouse and industrial properties that do not suffer from e-commerce headwinds and tend to be highly resilient in the face of macroeconomic challenges.

Moreover, its recent credit rating upgrade to BBB+ further improves its risk profile as does its substantial liquidity.

Finally, its completed exit from the asset management business gives it the most stable and highest quality cash flow stream arguably in its history. As a result, we feel more confident than ever in its ability to sustain and continue to grow its dividend payout for years to come.

WPC Stock: The Bear Case

While WPC certainly looks like an attractive investment right now, the market is not stupid. Here are some of the reasons why the selloff is at least partially justified:

- Interest rates have risen sharply, driving up WPC's cost of capital and making its investment spreads somewhat less impressive. Moreover, it makes WPC's dividend yield less attractive relative to the risk-free interest rate on the 10-year treasury note.

- While WPC's office exposure has receded by nearly 50% over the past half decade, it still is not insignificant at 16%. That said, many of these properties are occupied by investment grade/government tenants and/or are located in geographies where office headwinds are less severe and the lease expirations are well-laddered, giving management time to navigate the current poor environment for the sector.

- Management expects the 4.3% same-store rental growth from the first half of this year to be "peak level" and expect it to fall to 4% and then 3% in the coming years as the sharp increase was driven by WPC's CPI-linked rent escalators. Of course, the counter to this is that these previous escalations are permanently locked into the rental rate and - should inflation sustainably decline - interest rates will likely follow inflation lower. As a result, WPC can easily offset this reduced growth's impact on the bottom line by reducing interest expense accordingly.

Investor Takeaway

W. P. Carey Inc.'s stock price decline has not been entirely without merit. However, given that its valuation is now at levels that are clearly below historical averages, its growth profile remains strong, and its risk profile continues to improve, we believe that WPC stock has gotten far too cheap.

For retirees looking for attractive, sustainable, and growing income, WPC stock is an excellent choice as part of a diversified portfolio and warrants a Strong Buy rating accordingly.

If you want full access to our Portfolio and all our current Top Picks, feel free to join us at High Yield Investor for a 2-week free trial

We are the #1-rated high-yield investor community on Seeking Alpha with 1,500+ members on board and a perfect 5/5 rating from 150+ reviews:

You won't be charged a penny during the free trial, so you have nothing to lose and everything to gain.

Start Your 2-Week Free Trial Today!

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of WPC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.