Calibre Mining: Tracking Well Against Annual Guidance

Summary

- Calibre Mining Corp. reported another record quarter in Q2 with higher AISC margins and increased free cash flow despite elevated capital expenditures.

- Meanwhile, the company reported solid exploration results across its assets, and continues to have the balance sheet to support aggressive exploration and growth.

- In this update, we'll dig into Calibre Mining's Q2 results and see whether the stock is sitting near a low-risk buy zone after its ~20% correction.

Olivier Le Moal

The Q2 Earnings Season was a disappointing one for the gold sector, with the record average realized gold price being offset by inflationary pressures plus one-time headwinds for several producers. The result was that we saw minimal margin improvement for most companies, and FY2023 all-in sustaining cost margins should come in nearly 35% below peak levels enjoyed in Q3 2020 (~$600/oz vs. ~$860/oz), explaining the ~35% correction we've seen in the VanEck Gold Miners ETF (GDX) since Q3 2020, especially when factoring in heavy share dilution in the three-year period, negative impacts on NAV from inflationary pressures (higher LOM costs & sustaining capital), and the slide in free cash flow generation.

Fortunately, Calibre Mining Corp. (OTCQX:CXBMF) was an exception, reported another record quarter in Q2 and enjoying ~38% higher AISC margins on a year-over-year basis. Just as impressively, free cash flow was up despite elevated capital expenditures, and the company continues to have one of the best balance sheets sector-wide with minimal debt and ~$77 million in cash & cash equivalents. In this update, we'll dig into the quarter in a little more detail and see whether the stock is sitting near a low-risk buy zone after its ~20% correction.

Calibre Mining Operations - Company Website

All figures are in United States Dollars unless otherwise noted.

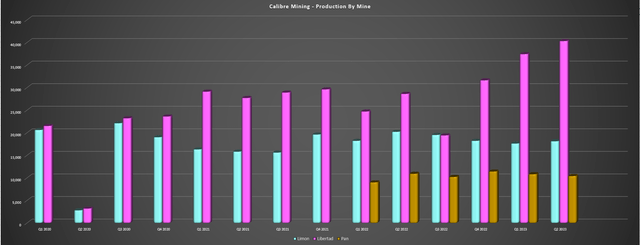

Q2 Production & Sales

Calibre Mining released its Q2 results last month, reporting quarterly production of ~68,800 ounces of gold, translating to another record quarter for this junior producer that's steadily working its way towards mid-tier (300,000+ ounce) status. This record quarter was a ~5% improvement over the previous record set in Q1 (~65,800 ounces), helped by higher production from Libertad, which more than offset marginal declines at its smaller Limon and Pan mines. Libertad's higher production can be attributed to a significant increase in throughput (~387,900 tonnes) at higher grades (3.71 grams per tonne of gold) compared to ~232,700 tonnes at 3.6 grams per tonne of gold in Q2 2022 by bringing new spokes online. The result was quarterly gold production of ~40,300 ounces, translating to over a 40% increase in output year-over-year when coupled with higher recovery rates.

Calibre Mining - Quarterly Production by Mine - Company Filings, Author's Chart

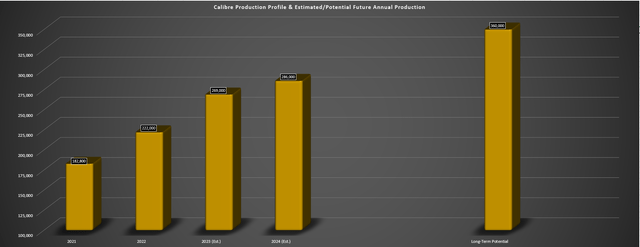

However, it's important to note that the record output at Libertad was achieved with its Libertad Plant running at just ~65% of its total capacity, suggesting the potential for this operation to run at a quarterly rate upwards of 60,000 ounces per annum, which would push Calibre's annual production well over 300,000 ounces. Importantly, this is separate from its development pipeline (Gold Rock), and there's the potential for further upside to its Nicaraguan Operations with its high-grade discovery at Panteon North, which continues to grow and looks to be much larger than the current reserve base. So, while this was another phenomenal quarter for the company, Calibre is still not operating at anywhere near its true potential (360,000+ ounces per annum), which could be realized post-2026.

Calibre Mining - Annual Production, Forward Estimates & Long-Term Potential - Company Filings, Author's Chart & Estimates

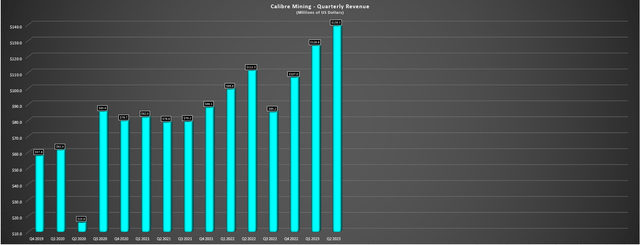

As for the company's financial results, Calibre reported record revenue of $139.3 million (+23% year-over-year), and record H1 revenue of ~$266.2 million, smashing its previous record of ~$213.6 million. The sharp increase was driven by higher gold sales and a record average realized gold price of $1,974/oz, and just as importantly, this production growth was not coupled with rising costs like we saw from Guanajuato Silver (OTCQX:GSVRF), who may have reported record production but saw a sharp increase in cash costs year-over-year. In fact, Calibre's cash costs and all-in sustaining costs [AISC] were down year-over-year and bucked the sector-wide trend, helping Calibre to report growth in operating cash flow and cash flow per share.

Calibre Mining - Quarterly Revenue - Company Filings, Author's Chart

Costs & Margins

Digging into the company's costs and margins a little closer, Calibre's cash costs came in at $977/oz (Q2 2022: $1,174/oz), while its AISC came in at $1,178/oz, an 8% improvement from the year-ago period. The company noted that the lower costs were driven by underground mining optimization improvements, higher open-pit ore tonnes, and lower diesel prices. And even more impressive, this lower AISC figure was despite a significant increase in sustaining capital year-over-year, which was a headwind for AISC. This was related to increased underground development at Jabali, expenses for Panteon development in the sustaining category, and deferred stripping costs at La Tigra. So, with lower AISC and the benefit of a higher average realized gold price, Calibre was one of the few companies able to report significantly higher AISC margins year-over-year, which increased to $796/oz in the most recent quarter vs. $577/oz in Q2 2022.

Calibre Mining - AISC & AISC Margins - Company Filings, Author's Chart

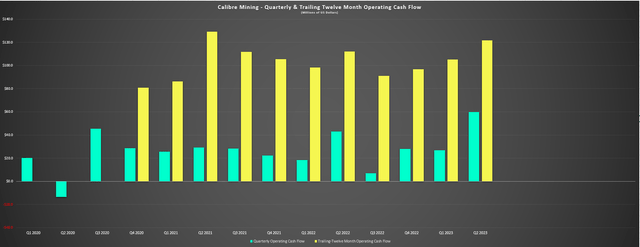

Given the higher sales at lower costs, Calibre Mining reported record operating cash flow of $59.8 million (+38% year-over-year) despite the continued impact of inflationary pressures sector-wide, and trailing twelve-month free cash flow also surged to ~$122 million. Meanwhile, even with elevated capital expenditures in the period ($43.9 million vs. $29.2 million) related to Eastern Borosi development, Dynamite Pit pre-strip (Pan), and land acquisitions and studies, Calibre reported higher free cash flow generation, which came in at $15.9 million in Q2 2023. This helped the company to finish the quarter with one of the strongest balance sheets among its peer group, sitting on ~$70 million in net cash. And given the exploration upside across its properties, this is certainly a great position to be in, with shareholders able to look forward to further growth in reserves, production and cash flow per share with aggressive and new mines able to be funded without external capital.

Calibre Mining - Quarterly & Trailing Twelve Month Operating Cash Flow - Company Filings, Author's Chart

Summary

Calibre Mining has continued to consistently over-deliver on its promises and is on track for another year of meeting or beating guidance, with production tracking at ~51% of its annual guidance with a strong H2 on deck. Meanwhile, the company has done just as impressive of a job keeping its costs under control, with it being one of the few miners to enjoy meaningful margin expansion year-over-year.

That said, while Calibre Mining Corp. continues to fire on all cylinders, I still don't see enough of a margin of safety relative to my fair value estimate of US$1.48. And while the stock could head higher given its ability to consistently beat guidance, the ideal buy zone comes in at US$0.90, which is well below current levels. So, while I see Calibre Mining as a solid buy-the-dip candidate, I continue to see more attractive bets elsewhere in the sector. One name that stands out is Marathon Gold (OTCQX:MGDPF), trading at less than 3x EV to FY2026 free cash flow estimates in a Tier-1 ranked jurisdiction.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MOZ:CA, MGDPF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: Taylor Dart is not a Registered Investment Advisor or Financial Planner. This writing is for informational purposes only. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Taylor Dart expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing. Given the volatility in the precious metals sector, position sizing is critical, so when buying small-cap precious metals stocks, position sizes should be limited to 5% or less of one's portfolio.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (4)

We all have our favorites and I am glad when I see Taylor long as well. Next few weeks w FED speak like today and before the meeting will be volatile so not really expecting much tbh. Bea

https://imgur.com/a/6fcWjD6Subscription Link:

buy.stripe.com/...