Petco Health and Wellness Company Q2: Hold On Tight For The Near-Term Price Cuts

Summary

- Petco's Q2 results exceeded expectations, but I think the market is focused on the near-term and uncertain about the impact of aggressive price cuts on margins.

- Sales of consumables and supplies are declining, and management's forecast for stabilization in the second half of the year is doubtful.

- The stock sentiment is unfavorable, and investors are likely to stay on the sidelines until there is a clear recovery in organic demand.

Marina Demidiuk/iStock via Getty Images

Summary

Readers may find my previous coverage from July via this link. My previous rating was a hold as I believed Petco Health and Wellness Company (NASDAQ:WOOF) growth recovery would continue to be pressured by the weak macro situation. I am reiterating my hold rating for WOOF as I am negative on the near-term performance, especially with a possible miss in guidance if management were to take a more aggressive price cut to drive demand.

Financials / Valuation

WOOF's revenue grew by 3.4% to $1.53 billion, surpassing the $1.53 billion consensus estimate thanks to an increase of 3.2% in comparable sales year over year. Sales of consumables were up 6.8% year-over-year and services and other were up 30.6%, while sales of supplies and pets were down 9.4%. The company's adjusted EPS of $0.06 was in line with expectations, and its operating income of $112.6 million was higher than expected ($109.3 million).

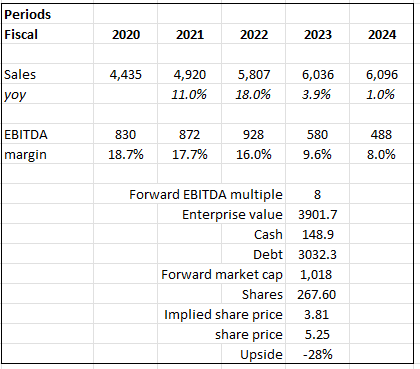

Based on author's own math

In terms of valuation, I believe the market has no intention to value WOOF on a long-term basis. The focus is on the near-term, and as such, I create a short-term model to estimate how much the stock is worth. Management is guiding for FY24 revenue of $6.21 billion, or 3% growth. I assumed that traffic does not come back as much as they expect, growth will fall short by 200bps (mimicking FY20 1% growth), and EBITDA margin will decrease as the price cuts reduce gross margin. I assumed the EBITDA margin to be slightly lower than the FY20 level as well. With these assumptions, WOOF would generate $488 million in EBITDA. I then compare WOOF to its peers in the pet industry, and I believe WOOF's valuation will continue to trade at a discount. WOOF peers include Rover Group, WAG! Group, and Chewy, which are all growing really fast (teens to 20+%), much faster than WOOF.

Comments

Even though Petco's 2Q23 top- and bottom-line results were both better than expected, I don't think the market is looking past the near future. First of all, I anticipate the aggressive pricing actions announced to put a strain on margin over the following few quarters. The reduction of price is rationalized as a means of stimulating demand in the pet supply and supply segments. Both of these segments were hit harder than expected, especially in food, which is feeling the effects of customers' trading down to more value-buys. Plans call for targeted price actions to close price gaps in key traffic-driving brands and SKUs. In my opinion, this announcement "forces" investors to stay on the sidelines because it is hard to model the effectiveness of this strategy. The expectation is that the reduced pricing will drive volume, thereby balancing or netting off the gross margin pressure. However, if volume does not recover, it would be a double whammy for WOOF's financials, and I believe this is something that investors are worried about. In addition to the aforementioned worry, WOOF's 2Q23 performance indicates weak volume ahead, as the company reported its sixth consecutive quarter of a negative HSD% drop in supplies and companion animal segment revenue. Even if we look over a longer period (over the past 2 years), the sales trend continues to see decelerating trends. Management's reduced forecast for the supplies category to stabilize in the 2H is the most glaring sign that demand is expected to remain weak.

This makes me skeptical that management will be able to hit the low end of its $6.15 billion to $6.275 billion sales target for FY23. Consumables and Supplies & Companion Animals are both experiencing slowing growth at the moment, and this trend does not appear to be reversing any time soon. Even though the service segment is booming, I fear that this will not be enough to counteract the slowdown of other segments given its revenue size as a percentage of the total business. Furthermore, if sales are lower, the risk to the adj EBITDA guidance could be even higher. Gross margin will be under increasing strain as Supplies and Pets continue to fall in sales, and management has given the impression that they may adopt a more aggressive pricing strategy in order to increase traffic.

All in all, I can see why the stock price tanked after the earnings release. I believe the stock sentiment is not favorable for any investors to enter today. I expect investors to stay on the sidelines until they see a constructive recovery in progress (i.e., an organic demand recovery that is not driven by aggressive price cuts).

Conclusion

My recommendation for WOOF remains a hold due to the uncertain near-term outlook driven by aggressive price cuts impacting margins. Despite better-than-expected Q2 results, I have concerns about WOOF margin performance over the next few quarters. Weakness in segments like supplies and companion animals persists, raising doubts about FY23 sales targets. While the service segment is performing well, its contribution may not offset slowdowns elsewhere. Investors are likely to remain cautious until clear signs of organic demand recovery emerge.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.