Realty Income Shares Have Plummeted: Buy, Hold, Or Sell?

Summary

- Realty Income Corporation is the most popular REIT on Seeking Alpha.

- But despite its popularity, it has recently crashed, and we have some growing concerns about the future of the company.

- Is now time to buy the dip or sell and run away?

- High Yield Landlord members get exclusive access to our real-world portfolio. See all our investments here »

iantfoto

Realty Income Corporation (NYSE:O) is by far the most popular real estate investment trust, or REIT, on Seeking Alpha. It has over 223,000 people following the company, with many new bullish articles come out every week.

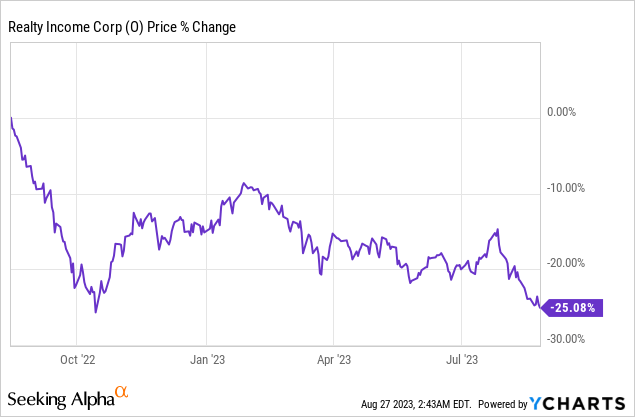

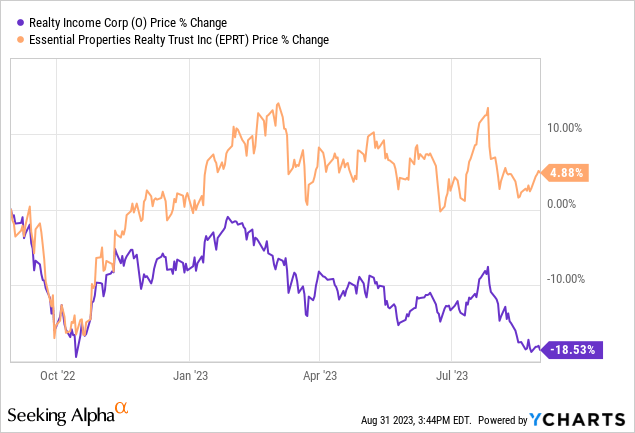

But despite this popularity, the company's share price has recently crashed and it is now priced at a historically low valuation:

Is this a historic buying opportunity?

Or should you sell before it suffers further losses?

I share my latest thoughts below. I discuss the company's fundamentals, its current valuation, and its latest news.

Realty Income: Q2 2023 Update - Buy or Sell?

Let's start by giving credit where it is due.

Realty Income is today very popular, and it deserves a lot of its praise.

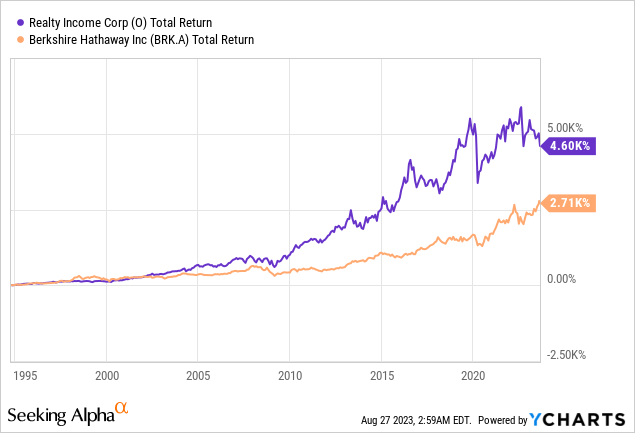

It has one of the best track records in the entire REIT market (VNQ), having managed to grow its dividend for nearly 30 years in a row, and having generated 15% average annual returns since going public in 1994.

That's an even better track record than that of Berkshire Hathaway (BRK.B), which is Warren Buffett's holding company:

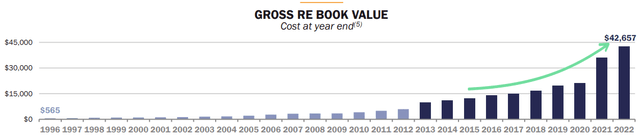

Moreover, if you look at the company's fundamentals, it really has a lot of things going for it.

It owns a huge $47 billion portfolio of defensive "class A" net lease properties that generate steadily rising rental income. In case you are not familiar with net lease properties, these are mainly service-oriented single-tenant properties such as Walmart (WMT) grocery stores and CVS pharmacies (CVS).

During my private equity days, these were some of my favorite real estate investments because:

- Their initial lease terms are very long at ~15 years, which results in highly predictable cash flow, even during recessions.

- The leases include automatic annual rent hikes of 1-2%, which may not seem high, but it really adds up over time.

- Finally, the tenant is responsible for all property expenses, including the maintenance of the property.

As a result, the risk-to-reward of net lease property investments is typically very compelling, especially when you are well-diversified like Realty Income.

Realty Income

Realty Income then combines this defensive business model with a sector-leading balance sheet that has low debt and long well-staggered debt maturities.

It is one of a few REITs that has an A- investment grade rating, which gives it access to cheap capital to keep acquiring more properties.

So to recap, Realty Income has a great portfolio, a scale advantage, and a fortress balance sheet with access to relatively cheaper capital.

That, combined with its track record, has earned it a cult-like following and a pristine reputation.

But before you rush to buy shares of the company, you need to also consider the flip side of the coin, because Realty Income also has its issues.

Realty Income's Hidden Issue

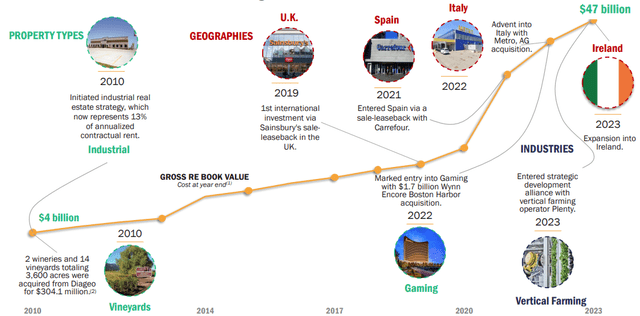

In recent months, I have pointed out that Realty Income is facing one main challenge: it is simply getting too big!

As a result, it has had to step out of its circle of competence into other property sectors and geographies:

But you cannot be a "jack of all trades," and that's really been my main criticism of the company so far.

I fear that the company is facing a dilemma: either it remains focused on its core competency and accepts a slower growth rate because of its huge size, or it steps out of it to grow faster, but it then increases risks and potentially dilutes the quality of its portfolio.

Realty Income has clearly chosen the second option, and to its credit, it has worked great so far. it has managed to keep growing at its ~5% annual targeted growth rate despite its large size.

But where's the limit?

Just recently, Realty Income announced yet another new type of investment. It is forming a Joint Venture with Blackstone (BX) and investing in the Bellagio in Las Vegas. Importantly, this investment includes a preferred equity component, which is something new for Realty Income. The CEO said the following on the deal:

"Credit Investments are a natural adjacency to our traditional business, allowing us to provide additional value to our clients while leveraging our core competencies in transaction sourcing and structuring, and real estate and credit underwriting and monitoring," said Realty Income President and CEO Sumit Roy.

So, once more, Realty Income is stepping into a new vertical.

Some of you may like this... Others may be worried about this new development.

The REIT market has historically rewarded companies for specializing in a specific property sector and becoming experts at it. This makes sense given that you cannot be an expert at everything and there are no benefits in diversification within a REIT given that investors can diversify themselves by holding a portfolio of REITs.

As a result, those REITs that own a diversified portfolio across many property sectors, also referred to as "diversified REITs," have historically traded at much lower valuation multiples than those REITs that specialize in one property sector.

Is Realty Income going to face permanent multiple compression as a result of its recent investments outside of its core circle of competence?

Only time will tell.

I would like to think that Realty Income is an exception and that the market won't punish it too much because of its reputation and cult-like following, which are truly exceptional for a REIT.

But in any case, growth will only become harder to achieve as Realty Income becomes larger and gradually loses its focus, and eventually, I would think that this will be reflected in its valuation.

This may perhaps explain why Realty Income has recently underperformed its smaller and more focused peers like Essential Properties Realty Trust (EPRT):

My Verdict

After reading this, you may now think that I am bearish on Realty Income, but that isn't the case. I actually own a small position as part of my Retirement Portfolio.

Following the recent crash, Realty Income's dividend yield is now at 5.5%, which is near its highest level since 2016. (The only time it yielded more was briefly following the pandemic crash in 2020.)

The company might be getting too big for its own good, and this will likely slow down its growth going forward, but this is now reflected in its lower valuation and higher yield, and not much growth is needed from here to reach attractive total returns.

Moreover, I think that interest rates will return to lower levels in the coming years and this will likely push Realty Income's valuation multiple, resulting in some upside.

I still think that some of its peers are even better investment opportunities in today's market, but if you are a conservative investor who needs safe monthly dividend income, then Realty Income isn't a bad pick at these levels.

It is not perfect, but no investment ever is. As long as you keep an eye on these risks and don't overpay, you should do well over time by owning shares of Realty Income.

If you want full access to our Portfolio and all our current Top Picks, feel free to join us at High Yield Landlord for a 2-week free trial

We are the largest and best-rated real estate investor community on Seeking Alpha with 2,500+ members on board and a perfect 5/5 rating from 500+ reviews:

You won't be charged a penny during the free trial, so you have nothing to lose and everything to gain.

Start Your 2-Week Free Trial Today!

This article was written by

Jussi Askola is a former private equity real estate investor with experience working for a +$250 million investment firm in Dallas, Texas; and performing property acquisition in Germany. Today, he is the author of "High Yield Landlord” - the #1 ranked real estate service on Seeking Alpha. Join us for a 2-week free trial and get access to all my highest conviction investment ideas. Click here to learn more!

Jussi is also the President of Leonberg Capital - a value-oriented investment boutique specializing in mispriced real estate securities often trading at high discounts to NAV and excessive yields. In addition to having passed all CFA exams, Jussi holds a BSc in Real Estate Finance from University Nürtingen-Geislingen (Germany) and a BSc in Property Management from University of South Wales (UK). He has authored award-winning academic papers on REIT investing, been featured on numerous financial media outlets, has over 50,000 followers on SeekingAlpha, and built relationships with many top REIT executives.

DISCLAIMER: Jussi Askola is not a Registered Investment Advisor or Financial Planner. The information in his articles and his comments on SeekingAlpha.com or elsewhere is provided for information purposes only. Do your own research or seek the advice of a qualified professional. You are responsible for your own investment decisions. High Yield Landlord is managed by Leonberg Capital.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of O; EPRT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)