Apple: Incredible Recovery Lifting Sentiments Ahead Of iPhone 15 Launch

Summary

- Apple dip buyers rushed in to lift buying sentiments this week as AAPL nearly regained its August losses, a stunning recovery.

- Upgraded estimates suggest Apple's iPhone 15 initial shipments could reach 86 million units, indicating strong holiday season sales.

- Institutional buyers were relatively underweight in AAPL based on a study released last week. This week's surge suggests buyers have returned robustly.

- Apple's use of 3D printers to manufacture steel chassis for upcoming Apple Watches demonstrates its commitment to improving production efficiency.

- I argue why my previous Sell rating is no longer defensible given the recent developments as Apple prepares to launch its iPhone 15. Upgrade to Hold.

- I do much more than just articles at Ultimate Growth Investing: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

Scott Olson

Apple Inc. (NASDAQ:AAPL) investors helped stage a remarkable revival this week since AAPL bottomed out in mid-August. The force of the recovery has stunned me, suggesting institutional buyers could be rotating back into the Cupertino company as it prepares to launch the iPhone 15 officially.

Keen AAPL investors are likely aware of the highly anticipated launch event of the company's most important hardware on September 12. Titled "Wonderlust," Apple aims to reinvigorate flagging smartphone sales in the US with its new launch, which is expected to include USB-C charging ports for all models.

Recent DIGITIMES estimates suggest a YoY decline of 5.1% for the smartphone market in 2023, given the macroeconomic headwinds and high inflation impacting consumer spending. However, it upgraded Apple's iPhone 15 initial shipment estimates to 86M units from 83M units previously. While it remains below last year's initial 90M units at the iPhone 14's launch, it suggests that Apple's holiday season sales could be more robust than anticipated.

Wedbush's Dan Ives also highlighted his optimism in a recent commentary previewing the Wonderlust launch event. The Apple Bull highlighted that the iPhone 15's base pricing sets up Apple well as a "phenomenal deal" compared to previous launches. Barron's recent calculation showed that when considering inflation, Apple's iPhone 15 base model could be cheaper than its earlier generations.

However, Apple was reported to face supply chain issues, which could lead to higher prices for its Pro series models. Recent updates by well-known Apple supply chain analyst Ming-Chi Kuo indicated that the Pro Max model suffered a "delayed start in its development, causing mass production of the high-end model to lag behind other iPhone models." As such, investors are urged to observe for unforeseen execution hiccups toward its launch. However, I don't expect these to be persistent challenges that could hamper Apple's holiday season sales efforts.

The Apple innovation engine is taking further steps to streamline its production processes. A recent report highlighted that Apple is "exploring the use of 3D printers to manufacture the steel chassis for certain models of its upcoming Apple Watches." It demonstrates Apple's ongoing approach to improving production efficiency mitigating supply chain challenges. Apple was reported to have been "quietly working on the 3D printing technique for approximately three years," suggesting the secrecy and importance behind its approach. In addition, Apple Watch users could expect new steel cases to accompany the upcoming Apple Watch Series 9 at Wonderlust.

As such, I assessed that the market's rotation back into AAPL seems timely, as AAPL has outperformed the S&P 500 (SPX) (SPY) since my previous update. Investors are likely anticipating a better-than-expected performance from the iPhone 15 series as Apple enters its most crucial calendar quarter.

The revised analyst estimates suggest that Apple's revenue growth could bottom out in the September quarter before inflecting with a 5.7% YoY increase in the December quarter. Notably, the positive growth dynamics are expected to follow through FY24, suggesting recent buyers are likely pricing in a robust recovery.

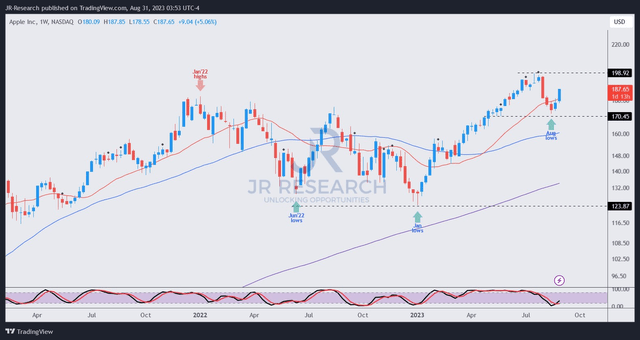

AAPL price chart (weekly) (TradingView)

AAPL's surge this week has brought it back to levels last seen in early August. The extent of the momentum spike likely suggests a sharp rotation into AAPL, as it consolidated robustly over the past two weeks.

Dip buyers likely capitalized in mid-August, astutely picking up the pieces from those who rushed out. AAPL's incredible strength has surprised me as it has recaptured most of the losses in August. As such, I believe my Sell thesis is increasingly tenuous as AAPL could resume its upward bias before attempting another re-test against its $200 resistance zone.

Therefore, I believe it's apt for me to move back to the sidelines from here as Apple prepares to launch its high-anticipated iPhone 15.

Rating: Upgraded to Hold. Please note that a Hold rating is equivalent to a Neutral or Market Perform rating.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn't? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA's bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!

This article was written by

Ultimate Growth Investing, led by founder JR Wang of JR Research, helps investors better understand a range of investment sectors with a focus on technology. JR specializes in growth investments, utilizing a price action-based approach backed by actionable fundamental analysis. With a powerful toolkit, JR also provides insights into market sentiments, generating actionable market-leading indicators. In addition to tech and growth, JR also offers general stock analysis across a wide range of sectors and industries, with short- to medium-term stock analysis that includes a combination of long and short setups. Join the community today to improve your investment strategy and start experiencing the quality of our service.

Seeking Alpha features JR Research as one of its Top Analysts to Follow for the Technology, Software, and the Internet category, as well as for the Growth and GARP categories.

JR Research was featured as one of Seeking Alpha's leading contributors in 2022.

About JR: He was previously an Executive Director with a global financial services corporation and led company-wide, award-winning wealth management teams consistently ranked among the best in the company. He graduated with an Economics Degree from Asia's top-ranked National University of Singapore (NUS). NUS is also ranked among the top ten universities globally. I currently hold the rank of Major as a Commissioned Officer (Reservist) with the Singapore Armed Forces.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (6)