Hudson Technologies: Target Price Revision After Debt Repayment

Summary

- Hudson Technologies announces full repayment of outstanding term debt, resulting in over $10 million of annual savings on interest expenses.

- The company has reduced its debt by $100 million over the past 15 months, making it less risky and more credit-worthy.

- Hudson sports now a strong balance sheet which makes its bull-case even more clear.

designer491

Introduction

This is unplanned, yet very much welcomed. Hudson Technologies (NASDAQ:HDSN) doesn't stop to surprise its investors. After a solid quarter on top of two strong years, the company announced a few days ago significant news about its outstanding term debt.

This changes the way we need to look at its balance sheet and at its income statement.

Summary of previous coverage

Over the past year, I tried to share on SA my research as my understanding of the company improved. All throughout my coverage, I have maintained a buy rating and have been personally invested in the company. Here are the main factors that make up my bull-case:

First of all, I gave a full overview of its business model in June 2022, pointing out how thanks to its patented Zugibeast machine, the company is a US leader in refrigerant reclamation technology.

Secondly, in August 2022 I dealt with one of the strongest tailwinds the company has: the AIM ACT which mandates a phase down in HFC gases, reducing virgin supply and creating more demand for reclaimed HFCs. This pushes refrigerant prices upwards, helping the company increase its margins.

While the company sold off in March 2023, I explained why I doubled down, believe structural favorable macro-trends coupled with good management determined this pick for my portfolio.

A few months ago, I went over the proper way to look at how Hudson manages its inventory, since this is one of the major risks the company has.

Finally, I gave a full review of the latest earnings report.

Yet, the company surprised me with an announcement that is worthy of attention.

The Announcement

On August 21st, Hudson published a press release announcing

that the Company has repaid in full the remaining principal balance outstanding under its Credit Agreement with TCW Asset Management Company, LLC (“TCW”). In addition, on July 31, 2023 Hudson repaid in full its $15 million first-in-last-out (“FILO”) term loan. Over the last 15 months, the Company has paid down $100 million of term loan and FILO debt combined, resulting in over $10 million of annual savings on interest expense, inclusive of any prepayment fees.

Hudson’s current Asset Based Lending (“ABL”) facility with Wells Fargo Bank otherwise remains in place and will continue to be utilized primarily for working capital needs, including ensuring the maintenance of adequate inventory balances.

To put this news into context, the maturity date of Hudson's term loans was March 2nd, 2027.

But what exactly was the credit agreement the company had entered into?

On March 2, 2022, Hudson announced that it had entered into

a new $85 million term loan agreement with TCW Asset Management Company LLC. In addition, Hudson has amended its existing revolving credit facility to increase the overall facility to $90 million, with TCW participating in a first-in last-out (FILO) loan of $15 million, and Wells Fargo continuing to manage the facility and providing up to another $75 million in borrowing capacity.

Breakdown of the announcements

The original loan

Let's break down what the reported words mean, starting from the last one we just saw. When Hudson announced last year it was entering into a new loan agreement, it was saying the following things:

- Term Loan Agreement: this is a loan where a sum of money is borrowed and then repaid over time with interest. Hudson said it was gaining access to $85 million in funds.

- Revolving Credit Facility Amendment: a revolving credit facility is a financial operation where a company can borrow as much money as it needs within a set amount. The company only repays the amount borrowed, together with interest. In this case, Hudson was saying it increased its available funds to $90 million, which could be added at need to the $85 of the loan.

- FILO loan: as part of the revolving credit facility, TCW Asset Management gave a FILO loan of $15 million. This is a "first-in last-out" (FILO) type of loan, which means that, in case of a default, if will be repaid after the other loans are settled.

- Wells Fargo managed the facility and provided the remaining $75 million in borrowing capacity.

Overall, Hudson Technologies was announcing an infusion of funds to support the company's operations while managing the existing debt.

Full repayment

Within a little more than a year, Hudson announced the full repayment of the outstanding term debt. Let's break down the announcement as we just did, to understand what it is talking about:

Credit Agreement Repayment: Hudson has completely paid off the remaining amount it owed to TCW Asset Management Company. In the latest quarterly report, Hudson reported on its balance sheet $25 million of LT debt. We can assume this is the amount that has been paid completely off.

FILO Term Loan Repayment: Hudson also said it has paid back the entire outstanding balance of its $15 million "first-in-last-out" (FILO) term loan. This makes the company more credit-worthy in case of future loans.

Debt Reduction: We had already seen this trend, thanks to the strong cash flow generation. Over the past 15 months, Hudson has been laser focused on reducing its debt by a total of $100 million (including both term loan and FILO debt). This makes the company less risky.

Interest Expense Savings: Clearly, this debt reduction enables the company to save over $10 million annually in interest expenses and prepayment fees. We will thus see stronger earnings thanks to these savings. We have to consider that in these savings, the company is taking into account the prepayment fees.

In the last earnings call, Mr. Nat Krishnamurti, Hudson's CFO, had already highlighted the efforts the company was undertaking to tackle its debt and bring it down as much as possible. In fact, as I pointed out in previous articles, Hudson risked to go bankrupt between 2016 and 2018 because refrigerant prices suddenly dropped, making the company sell its inventory at a big loss. The lesson has been learned and the company is taking advantage of the current situation to generate strong free cash flow which is deployed to delever the balance sheet. Here are the words Mr. Krishnamurti spent, which I believe are important to understand even better what has just happened. Just a few weeks ago, he said:

During the second quarter of 2023, the company paid down an incremental $10 million of term loan debt resulting from improved performance and increased cash flow, reducing its leverage ratio from 0.32 to 1 for the trailing 12 months ended June 30, 2023. This represents a significant decline from a leverage ratio of 0.73 to 1 for the trailing 12 months ended June 30, 2022. The company reduced total outstanding debt by 31% from $46.8 million at December 31, 2022, to $32.5 million at June 30, 2023. As you know, interest rates have risen almost 500 basis points over the last year. So this debt reduction has provided significant savings for the company. In fact, since the refinancing in March 2022, the company has paid down approximately $67.5 million of term loan debt, resulting in $6.8 million of savings on interest, inclusive of any prepayment fees. Throughout this time, we have not needed to borrow against our revolver loan, which allows us even greater financial and operational flexibility. Stockholders' equity improved to $211 million at June 30, 2023, as compared to $175 million at December 31, 2022.

So, as of June this was the situation. In just a month and a half, Hudson finished to repay its outstanding term loan debt, resulting not in a leverage ratio of 0.

What does this mean? First of all, we will see big savings: $10 million per year from here until 2027. This means at least $40 million that will flow down to the bottom line. Secondly, we can be reassured refrigerant prices are high and the company is selling its inventory at a profit, thus generating enough free cash flow for such an aggressive move. Thirdly, Q3 is probably very strong, and we can expect an earnings report that could beat analysts' estimates.

What to look for going forward

As we see a company become stronger, we need to know, in any case, what we need to pay attention to monitor correctly its performance. First of all, in the next earnings call, special attention will go to the new balance sheet, to see if our estimates - given the announcement - are correct or need to be corrected. Secondly, it is always important to keep track of the reclaimed refrigerant price that Hudson's management reports during the call. It is the only way I have found so far to keep track of the price of this commodity. Sharp falls - though highly unlikely - may set a threat to the company. We can monitor this also by keeping track of inventory levels, as I explained in an article dedicated to this. Finally, if the hot season extends into Q4, with a warmer than expected October, we could expect an impact on the traditionally weak Q4 results. In any case, the real tailwind should start at the beginning of 2024 with the second step of the phase-down mandated by the Aim Act. That is why I am considering Hudson a position to hold for a few years.

New Valuation

This news has an impact on how we value Hudson. In fact, we know the company's balance sheet has changed, actually improving. In addition, we know future income and cash flow statements will be positively affected by the absence of interest expenses.

Hudson is now in better shape and can have greater flexibility.

Moreover, the confidence the company showed in aggressively paying down its remaining debt makes me think that the month of July must have been excessively strong with consistent free cash flow generation.

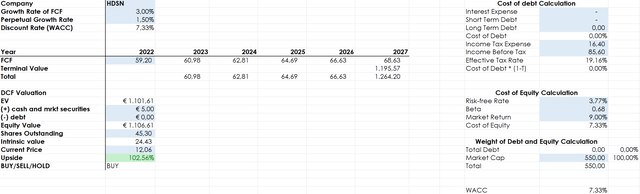

Now, if I run a new discounted cash flow model, I see that I need to move up my price target because the company has indeed become more appealing.

In my previous valuation, I shared a stock's target price around $20, which is about a 66% upside from the current price around $12.

However, with a better balance sheet, without changing my conservative FCF growth estimates (3% for the next 5 years and then 1.5% as the perpetual FCF growth rate), the company's valuation improves because it gains a stronger financial stability and creditworthiness. The main drivers are: a company's valuation goes up because its enterprise value increases. In fact, the enterprise value is calculated by adding to the market cap the total debt and then subtracting the value of a company's cash and cash equivalents.

At the end of June 2023, Hudson's EV was as follows:

market cap: $9.72*45,319,155=$440.5 million

+ total debt: -$29.3 million

- total cash: $11.4 million

=$422.4 million

Now, for the sake of this little explanation, let's keep the market cap the same.

Debt reduction clearly bumps up the enterprise value, which is now around $445-450 million, not counting the impact of the recent surge in price. If we factor that in, the current EV is around $555-560 million.

Going back to my DCF model, if we plug in the new numbers, we see that the intrinsic value of the company has gone up to around $24.50 a share, from my previous target that was just below $20. This is almost a 25% increase in value just by the fact that the company has paid its loan.

Author estimates based on recent data

Some investors may want to discount this price because of several factors: stock volatility, refrigerant price volatility, inventory management risk. Still, no matter how we factor in everything that needs to be discounted, we can reasonably assume the intrinsic value of each share is well above the current stock price. Therefore, I keep on rating Hudson as a buy, with even greater conviction than a month ago.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of HDSN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (2)