QQH: Quant Signal Technology Fund

Summary

- The HCM Defender 100 is an innovative ETF that uses a proprietary quant signal to determine its allocation between equities and cash.

- The fund switches its allocation based on a proprietary trend signal, alternating between a 100% Nasdaq allocation and 100% in cash at the other extreme, with blended levels in-between.

- The fund is overweight in mega-cap tech stocks and has performed in line with the Nasdaq this year being up over 41%.

- QQH brings a hedge fund quant trading strategy to the ETF universe.

da-kuk

Thesis

The HCM Defender 100 (NYSEARCA:QQH) is an exchange traded fund. The vehicle focuses on equities and T-Bills, and seeks to provide investment results that correspond to the performance of the HCM Defender 100 Index.

We are going to discuss in detail the HCM Defender 100 Index in a section below, but in a nutshell, the index utilizes trend analysis and a proprietary quantitative program to decide between a pure technology equity allocation, a blended one with T-Bills or a pure cash one:

Quant Signals (Fund Fact Sheet)

This is a very innovative and interesting fund, through the perspective of active management driven by trend analysis. Usually a retail investor decides individually when market signals point towards risk-off environments, and usually scale into lower beta instruments. QQH does that for you via its structure.

In an environment with a 'Positive Quant Signal', the fund will be 100% in equities. That is the case with the fund at the moment. The fund will switch to a 70% equities / 30% cash position when the Nasdaq will close 3.5% below the HCM Buy-Line. If the market deteriorates further and the Nasdaq closes 6.5% below the HCM Buy-Line, the fund will further calibrate its holdings to contain 40% equities and 60% cash equivalents. The most conservative fund allocation occurs when the target index is 12% below the HCM Buy-Line, occurrence which triggers an 100% T-Bill allocation.

This is the beauty of a quantitative model, which has built in programs that signal allocations, rather than rely on hearsay and market news stories. Quantitative trading is a niche hedge fund strategy that can be extremely lucrative if executed correctly. QQH tries to bring this strategy to the exchange traded fund world.

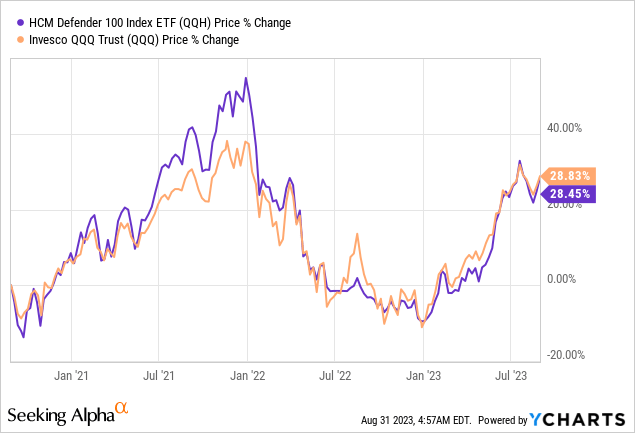

The fund aims to copy the Nasdaq when the market is in an up-trend, and subsequently move to a more conservative positioning via a higher cash allocation if the proprietary quantitative signals utilized turn bearish. The fund has performed in line with the Nasdaq in the past three years, with an outperformance during the 2021 period.

Analytics

- AUM: $0.35 billion.

- Sharpe Ratio: 0.59 (3-year).

- Standard Deviation: 25.16 (3-year).

- Annualized Volatility: 19.6

- Yield: 0%.

- Composition: Equities - Technology Large Cap

- Expense Ratio: 1.02%.

What does the HCM Defender 100 Index do?

As per its literature:

The HCM Defender 100 Index seeks to outperform the Solactive US Technology 100 Index, a proprietary methodology. The HCM Defender 100 Index is comprised of securities in the Solactive US Technology 100 Index, which are the largest and most liquid companies classified in the Technology sector, securities in the Solactive 1 - 3 month US TBill Index(“Treasury Sub - Index”), which are U.S.dollar denominated T - Bills with a time to maturity of 1 to 3 months, or a combination of both. The HCM Defender 100 Index alternates exposure among a full position of securities in the Tech Equity Sub - Index, a full position of securities in the Treasury Sub - Index, or a 50 / 50 position of securities in the Tech Equity Sub - Index / Treasury Sub - Index.

In effect the HCM Defender 100 Index is a structured index that actively switches between 100% allocations to technology stocks and 100% allocation to cash via T-Bills. There are four levers utilized here, which are 100% stocks, 70/30 stocks-cash, 40/60 stocks-cash and 100% cash.

The index and implicitly the ETF, saw a heavy rotation along those levers in 2022, when the market was extremely volatile and we had several bear market rallies within the context of a full year down market.

For example, looking back at what the ETF did in 2022, we saw the name have a reduced equity exposure starting with the January end of month period, up to the end of March, when a prolonged rally in the Nasdaq triggered a recalibration that saw equites being brought back to 100% of the fund. The vehicle is going to have a dynamic allocation that will switch between its four levers as its proprietary signal advises.

Holdings

The fund contains 100 names, but is overweight the largest mega-cap tech stocks and a leveraged Nasdaq fund:

Holdings (Fund Website)

The top 10 holdings represent 65% of the fund's portfolio, and will account for most of the moves in the name. To note that QQH is up over 41% year to date, closely matching the Nasdaq performance.

Proshares UltraPro QQQ (TQQQ) is a 3x leveraged ETF that seeks to provide three times the daily performance of the Nasdaq. By layering in a high beta fund, QQH is basically taking a high beta position in the Nasdaq currently. Looking at its current collateral composition, the fund is 100% in equities at the moment, with no treasury positions.

Expect this allocation to pivot around as the quant signals change. If the underlying trend analysis starts flashing a more conservative allocation, the fund will liquidate TQQQ and move into treasuries.

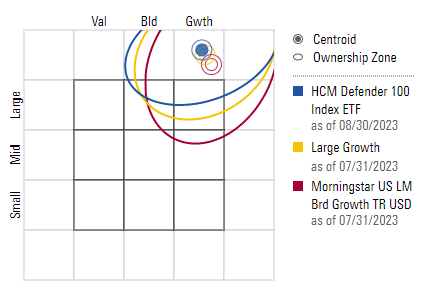

From a portfolio standpoint QQH is mainly a Large-Growth allocator:

Morningstar Allocation (Morningstar)

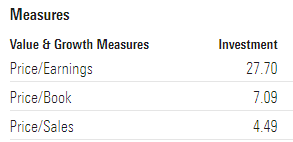

A retail investor will be exposed to the risk factors associated with this Morningstar bucket. To note we are currently experiencing an environment where valuations for Large-Cap Growth companies have ballooned to extremely stretched levels:

Valuation Metrics (Morningstar)

P/E levels are above 27x (whereas the S&P 500 is 'only' at 19x), while Price/Book levels are over 7x.

Performance

The fund has closely tracked the Nasdaq, with an outperformance during 2021 only:

We would have expected a better total return profile in 2022 when the market was in a significant overall down-trend, but the QQH vehicle only had brief periods of outperformance.

Conclusion

QQH is an exchange traded fund. The vehicle focuses on replicating or outperforming the Nasdaq during market up-cycles, while assuming a more conservative stance during downturns. The fund achieves this positioning by following the HCM Defender 100 Index. The index utilizes a proprietary quantitative program to decide between a pure technology equity allocation, a blended one with T-Bills or a pure cash one.

A retail investor who wants to go long technology equities is better served by a fund such as QQH since the vehicle utilizes proprietary signals to de-risk, thus taking off the table a difficult timing decision that individual investors often miss. Time and time again retail investors buy the top and sell the bottom, being driven by the fear of missing out or panic. QQH tends to eliminate those emotions through a quant driven algorithm. We are therefore of the opinion that QQH is presently a Buy over QQQ, since it provides an automatic, fund-embedded de-risking mechanism.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Short position through short-selling of the stock, or purchase of put options or similar derivatives in QQH over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (2)